Summary:

- Despite Amazon’s strong performance and investment in AI, I maintain a “Hold” rating due to high valuation multiples and technical resistance levels.

- Amazon’s Q3/24 results show impressive growth with 11% revenue increase and 52.1% EPS growth, yet some segments are seeing decelerating growth rates.

- The broader market euphoria and Amazon’s inability to break past resistance levels suggest caution, as sentiment may be a contra-indicator.

- While Amazon is a great business investing heavily in AI and robotics, current stock prices do not justify long-term investment given potential recession risks.

georgeclerk

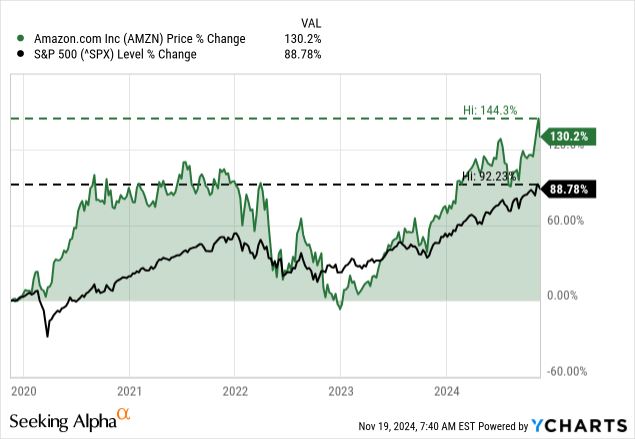

My last article about Amazon.com, Inc. (NASDAQ:AMZN) was published in mid-August 2024 and, similar to my previous articles, I rated Amazon as a “Hold”. However, in line with the euphoric stock markets in the United States, Amazon rallied as well and increased 18% in the last three months alone (the S&P 500 increased 8% in the same timeframe).

And Amazon is continuing to outperform the S&P 500, which already performed great in the last few years. It doesn’t matter what timeframe we consider – one year, three years, five years or ten years – Amazon is outperforming the broader market on every timeframe. Nevertheless, I will argue once again why I still don’t think it is the time to invest in Amazon for the long run – despite Amazon being a great business that is investing in the future. Let’s start by looking at the last quarterly results.

Quarterly Results

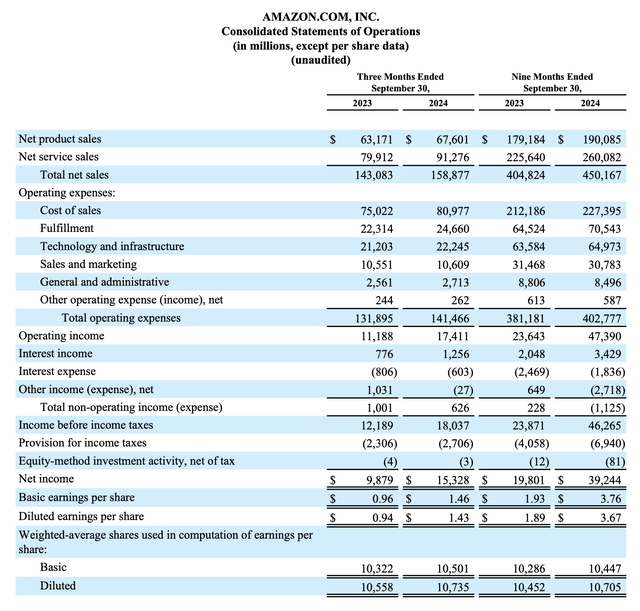

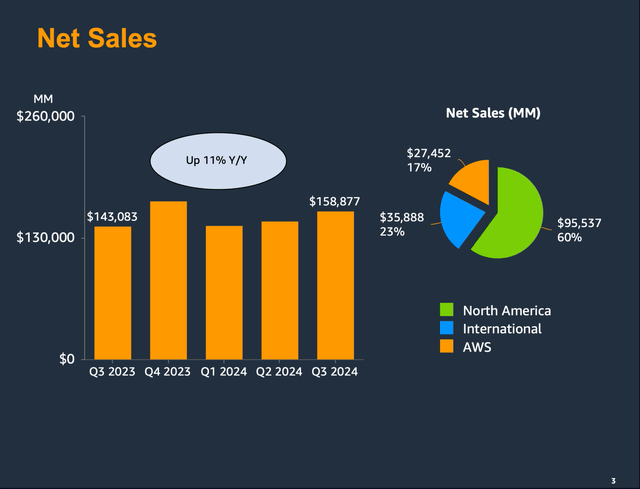

In the third quarter, Amazon is still reporting solid results. Total sales increased from $143,083 million in Q3/23 to $158,877 million in Q3/24 – resulting in 11.0% year-over-year top line growth. And while the top line grew already in the double-digits, operating income increased 55.6% year-over-year from $11,188 million in the same quarter last year to $17,411 million in this quarter. Diluted earnings per share increased from $0.94 in Q3/24 to $1.43 in Q3/24 – resulting in 52.1% year-over-year bottom line growth.

When looking at the top line in more detail, net product sales increased 7.0% year-over-year to $67,601 million and net service sales increased 14.2% year-over-year to $91,276 million. Additionally, all three segments contributed to revenue growth with sales in North America growing 8.7% year-over-year, International sales growing 11.6% year-over-year and AWS sales growing 19.1% year-over-year. Aside from all three segments contributing to top line growth, all three also contributed to operating income.

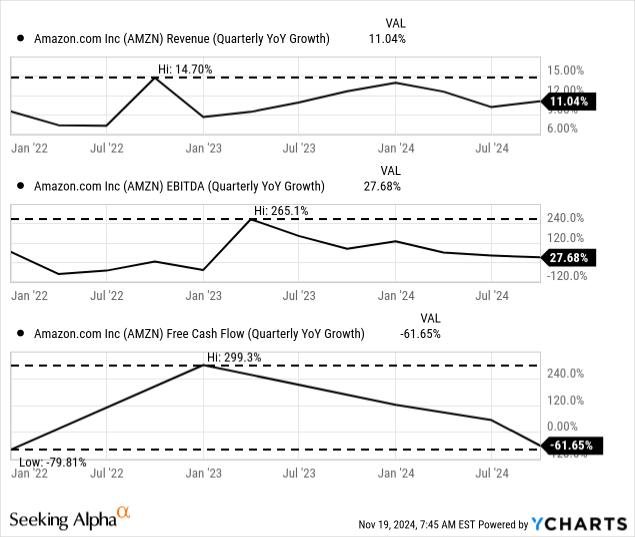

Quarterly results are certainly telling us a lot about a business, but to get a feeling for the performance of a company we certainly must look at longer timeframes. We should also look at results in more detail.

The Quarter in Context

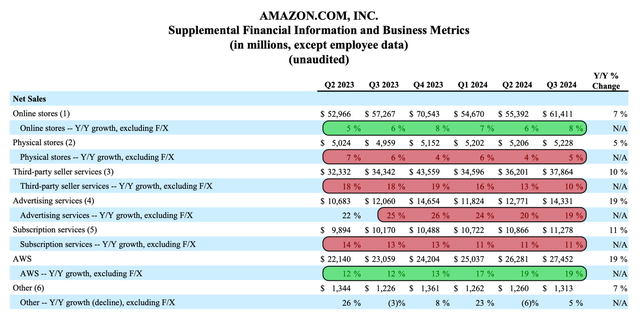

Amazon differentiates between product and service sales and organizes its reporting into three segments, but to really understand how Amazon is making money we have to look at the supplemental financial information and business metrics.

When splitting up Amazon’s revenue into the six subsegments, we see every single one contributing to growth. However, when looking at the growth dynamics, it is only AWS and online stores with accelerating growth rates. The other four segments still see growth – and often very high growth rates – but growth rates are slowing down over the last few quarters. Especially third-party seller services are seeing much lower growth rates than a year ago – only 10% growth in Q3/24 compared to almost 20% one year earlier.

During the earnings call, management pointed out that more and more companies are spending energy on modernizing their infrastructure and moving from on-premises to the cloud. And of course, Amazon is also pointing out that these businesses are getting more productive. And according to Amazon’s management, it is difficult to be successful and competitive in generative AI if businesses don’t have their data in the cloud. Especially the Cloud AI business is growing at a high pace:

The AWS team continues to make rapid progress in delivering AI capabilities for customers in building a substantial AI business. In the last 18 months, AWS has released nearly twice as many machine learning and GenAI features as the other leading cloud providers combined. AWS’s AI business is a multibillion-dollar revenue run rate business that continues to grow at a triple-digit year-over-year percentage and is growing more than 3 times faster at this stage of its evolution as AWS itself grew, and we felt like AWS grew pretty quickly.

The advertising business is one of the subsegments with slightly decelerating growth rates. Nevertheless, revenue increased 19% year-over-year, which is an impressive growth rate as Alphabet Inc. (GOOGL) (GOOG) reported only 10.4% growth for its Google advertising business and Meta Platforms, Inc. (META) increased its advertising revenue also only 18.6%. Amazon’s management stated during the last earnings call:

In advertising, we remain pleased with our progress, generating $14.3 billion of revenue in the quarter, 18.8% year-over-year growth. Our expansive reach, ability to service relevant offers to our customers, opportunity to engage customers from the top of the funnel to point of purchase, and leading capabilities around measuring outcomes at every touch point provide all types of brands with full funnel advertising at scale.

With sponsored products, we’re seeing meaningful growth on a very large base, and we see further opportunity in driving even better performance for advertisers by further improving the relevancy of the ads we show and by providing additional optimization controls. At the same time, some of our newer offerings are in their very early days. We’re just entering our first broadcast season for Prime Video advertising, following a very strong showing at upfronts.”

And although revenue growth for subscription services is not accelerating, management pointed out during the last earnings call that Prime member growth was accelerating again.

Recession Or No Recession?

In the last few quarters, we see growth rates for Amazon slowing down. However, such a statement might be a bit misleading as revenue growth slowed down only a little bit and growth rates for free cash flow and operating income were so high in the past few quarters that growth rates had to slow down.

Overall, Amazon is performing well and even if the business is not able to grow at a similar pace as in previous years, we see no signs for a recession when looking at the company’s income statement. I mentioned the scenario of a recession quite often in several articles for several quarters now, but not only are the United States apparently not in a recession, the euphoric stock market in the last few months and the major indices running from all-time-high to all-time-high should make us question if the recession scenario is reasonable.

Additionally, we can look at several different early warning indicators and see a rather stable picture (at least many metrics are not getting worse, but that would be the pattern we are expecting in the months leading up to a recession). Housing permits, for example are fluctuating between 1.4 million and 1.6 million in the last two years.

Another warning indicator is the initial claims for unemployment insurance. However, when looking at the four-week moving average we see numbers improving a little bit in the last few months and especially in the last few weeks the numbers declined again. And with 221k initial claims on a four-week basis, we are still looking at extremely low numbers. As long as we are talking about unemployment numbers, we can also look at the Sahm Rule, which indicated a recession recently but is now below 0.5 again.

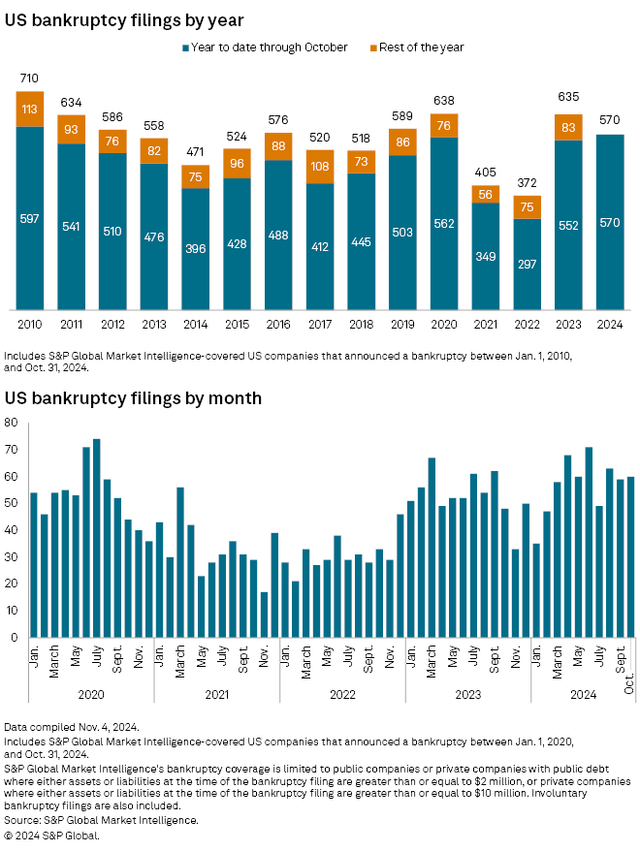

When looking at the bankruptcies, we see high numbers and 2024 is on track to become the worst year since 2010. However, when looking at the number from a different point of view, we can argue that monthly numbers are also stable in the last two years.

Although we can interpret the data of the last few months in a way that a recession was averted, my long-term view has not changed, and I see it in a very similar way to Avi Gilburt:

From an Elliott Wave perspective, and as I have outlined in several prior articles, we are coming to the conclusion of a multi-decade bull market, and are completing a final 5th wave of a long-term 5-wave structure which initially began in 1933 at the conclusion of the 1929 market crash. For those of you that are relatively proficient in math, you may realize that we are almost at the point of a 100-year long bull market off that low.

And in case of a recession, I still think that many of Amazon’s segments are at a huge risk of growth rates slowing down or sales even declining. Advertising revenue will take a hit, sales for online stores as well as physical stores might suffer, and third-party seller services might also decline.

Technical Picture

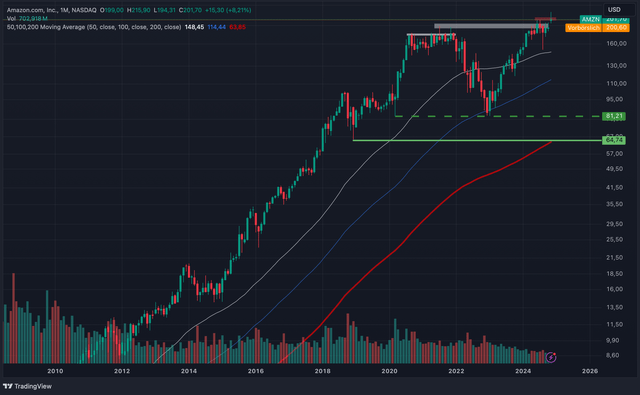

In case of Amazon there is another reason to remain cautious at this point – the monthly chart. When looking at the data, we see that Amazon was still not able to break out. While the S&P 500 is marching higher and higher and the Nasdaq-100 also exceeded its 2022 high, Amazon seems to be caught in a pattern that can be described as forming a market top. Since about four years, the stock is not really able to break above the highs of 2020 and 2021. The stock price is pushing against that resistance level but did not manage to go higher so far.

And as long as the Amazon does not break out, I think we should stay cautious. The risk for lower stock prices and Amazon forming a major, multi-year top should not be ignored. Considering the current euphoria in the market, most people would argue for higher stock prices in the coming months, but sentiment is usually a contra-indicator and sentiment alone is reason enough to be very cautious.

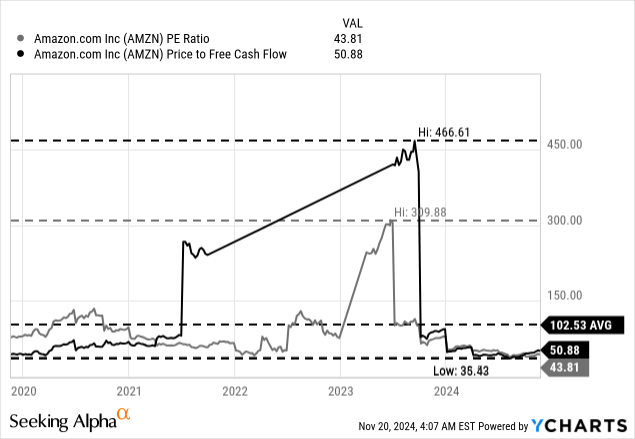

Intrinsic Value

Valuation multiples could be another reason to be cautious – aside from the technical picture. We all know that high valuation multiples are very weak warning signs, as a stock can remain overvalued for years (or maybe even a decade and longer). But in my opinion, a price-earnings ratio of 44 and a price-free-cash-flow ratio of 51 is not justified for Amazon.

And although valuation multiples can’t be used to determine when a stock is reaching its top or bottom (in this case, sentiment is playing a major role), it is still telling us if a stock is rather a good investment or not.

Using a discount cash flow to determine an intrinsic value for the stock is also indicating an overvaluation of Amazon. When calculating with a free cash flow of $42,950 million as basis (the trailing twelve-month amount), a 10% discount rate and 10,735 million shares outstanding, Amazon has to grow its free cash flow a little more than 20% annually in the next ten years. I am using a 4% growth rate until perpetuity, and of course, we can argue if Amazon won’t grow with a high pace. Nevertheless, the necessary growth rates are high, and I don’t know if Amazon will achieve 20% annual growth in the next ten years.

Great Business and Investing In The Future

I am skeptic about Amazon as an investment – not about the business. This is often assumed when writing against a stock, but Amazon is without doubt a great business. And with its massive investments in artificial intelligence as well as robotics, we can assume the company is well positioned for the future.

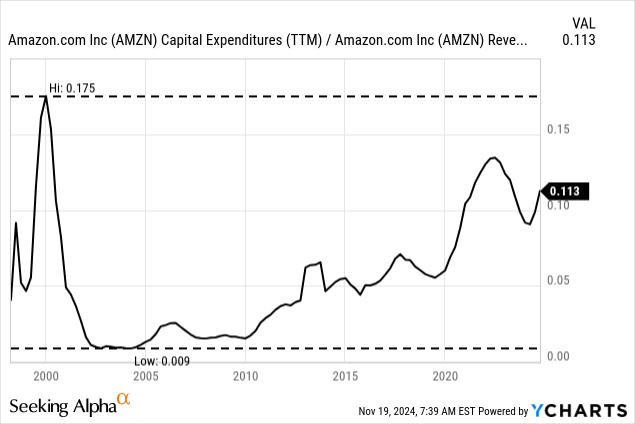

Amazon is continuing to spend high amounts to expand its AI capabilities and in fiscal 2024, management is expecting to spend about $75 billion. And for fiscal 2025, management is expecting capital expenditures to be higher once again. Of course, a business with constantly higher revenue and operating income will also report higher capital expenditures over the years on an absolute basis. But Amazon is also constantly increasing its capital expenditures as a percent of revenue. In the years following the Dotcom bubble, capital expenditures were less than 1% of revenue and constantly increased over the last 20 years to 11.3% of revenue right now.

And the AI business is already a multi-billion dollar business (Amazon has not disclosed numbers, but reports triple-digit year-over-year growth). Jassy pointed out that Gen AI is growing much faster than AWS at a similar stage.

Aside from spending on AI capabilities, Amazon is also trying to make its warehouses more effective by using robots. CEO Andy Jassy explained how Amazon is innovating in robotics to speed delivery and lower costs in the fulfillment center:

We recently launched our 12th-generation fulfillment center design with the first building launching in Shreveport, Louisiana. This is the first facility that incorporates our newest robotics inventions that simplify stowing, picking, packing, and shipping processes. Thus far, this new design reduces fulfillment processing time by up to 25%, increases the number of items we can offer for same-day or next-day delivery and is expected to drive a 25% improvement in our cost to serve during peak within this next generation facility.

Amazon is also continuing to move into the pharmaceutical market and is especially trying to put its competitors under pressure by much faster delivery. The plan is to launch operations in 20 cities in the next year, so nearly half of the United States will have the ability to get medication delivered within hours.

Conclusion

The numbers Amazon and the economy are reporting are not really indicating a recession and based on these numbers we should question if we were too pessimistic. However, I see these numbers as the calm before the storm and continue to see Amazon only as a “Hold”. The stock is not a great investment right now, but for a more reasonable price, Amazon can be a great long-term investment – especially as the business is investing in AI capabilities and its logistics and fulfillment centers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.