Summary:

- Amazon’s stock has rallied 47% since my first bullish article went live, by far outperforming the broader market.

- Recent quarterly earnings showed positive trends, including revenue growth, expanded margins, and positive leveraged free cash flow.

- Amazon’s dominance in cloud computing and e-commerce positions it well for long-term growth, with an expected 11% revenue CAGR.

- My valuation analysis suggests the stock is still substantially undervalued.

Alex Wong

Investment thesis

Amazon’s (NASDAQ:AMZN) stock has performed well since I wrote my first bullish article about it. The stock rallied about 47% and substantially outperformed the broader market. Today, I would like to reiterate my “Strong buy” rating. My updated valuation analysis shows that the stock is still attractively valued with almost a 25% upside potential. Recent developments look favorable for the company and give me a high level of conviction about the optimistic underlying assumptions for my valuation exercise. Amazon is still dominating in two very promising markets, including cloud computing and e-commerce which makes the company well-positioned to absorb the projected long-term growth of these industries.

Recent developments

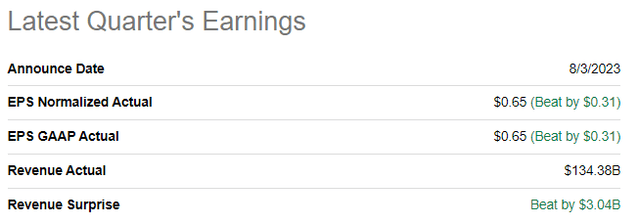

The company released its latest quarterly earnings on August 3, when the company topped consensus estimates. Revenue demonstrated a solid 11% YoY growth, and the adjusted EPS expanded significantly, from -$0.20 to $0.65.

Looking at the latest quarterly earnings, I see solid positive trends from the high-level perspective. The gross margin expanded from 45.2% to 48.4%, the highest level over the last couple of years. The operating margin also expanded from 2.7% to 5.7%. It is important to emphasize that a 5.7% level of the operating margin is the highest since the peak lockdown quarters of 2021, when people had no choice other than to use e-commerce to shop. As a result of expanding profitability, the quarterly levered free cash flow [FCF] was positive at $9.3 billion, compared to -$2.8 billion last year.

It is important that the revenue growth momentum is expected to remain in the near future. The upcoming quarter’s earnings release is scheduled for October 27. Quarterly revenue is expected by consensus at $141 billion, which indicates a slight YoY growth acceleration with an 11% YoY increase. The adjusted EPS is expected to follow the top line and double from $0.28 to $0.56.

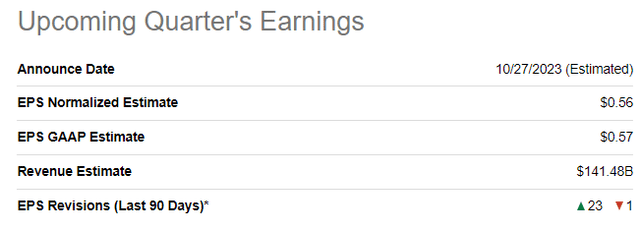

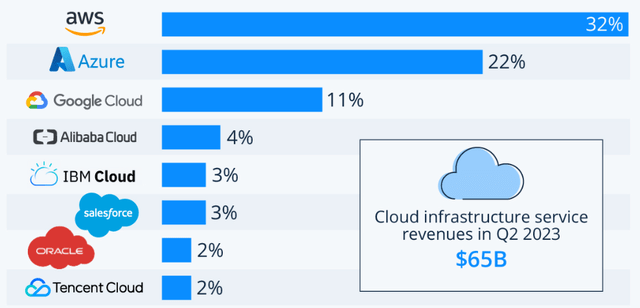

For the full year of 2023 and the next five years after, consensus estimates expect an 11% revenue CAGR, which looks impressive to me. AMZN bears might argue that these estimates are unrealistic since the cloud market shows signs of cooling down. But I firmly believe that the artificial intelligence [AI] boom will be a solid growth driver for Amazon’s infrastructure-as-a-service offerings. AWS has a massive customer base, cutting-edge technologies, and a solid brand, and that makes it well-positioned to absorb the tailwinds from the AI revolution. Let us also not forget that despite market growth decelerating recently, the global cloud computing market is still expected to compound at 20% yearly by the year 2030. That said, tailwinds in the cloud computing industry are solid. I would also like to remind readers that Amazon is still dominating the cloud market with about 32% market share, which almost equals the combined market share of Microsoft’s (MSFT) Azure and Alphabet’s (GOOG) Google Cloud.

The company’s by far the largest segment from the revenue point of view, e-commerce is also the dominating power in the U.S. with almost 38% market share. In this field, Amazon is also expected to enjoy solid industry tailwinds. Statista.com expects an 11% CAGR for the American e-commerce industry up to 2027. Being by far the most significant player in the U.S. e-commerce market with a vast network of merchants and an immense customer base makes Amazon firmly positioned to absorb or even outpace the e-commerce market growth.

Valuation update

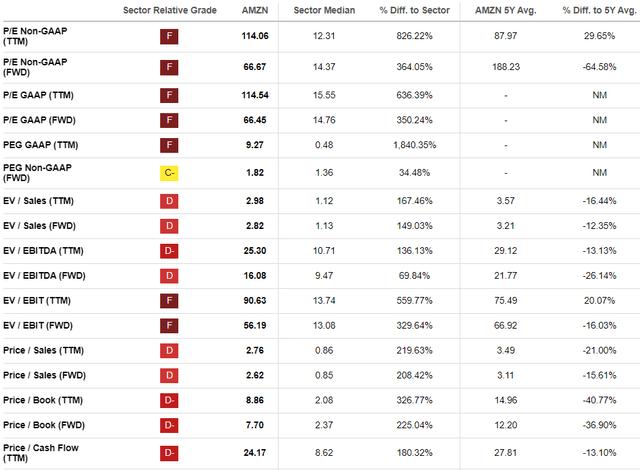

The stock rallied 69% year-to-date, significantly outperforming the broader U.S. market. Seeking Alpha Quant assigns AMZN the lowest possible “F” grade due to multiples substantially higher than the sector median. However, Amazon is a company with a unique scale and vast resources to fuel further growth, therefore, premium to the sector looks fair to me. I would better compare to historical averages, and current multiples are mostly notably lower.

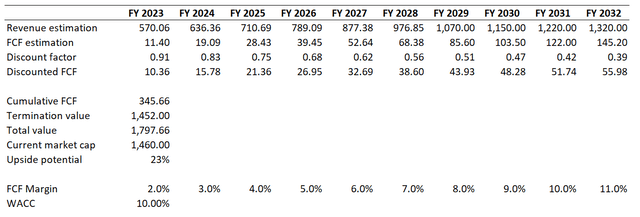

I also want to update my discounted cash flow [DCF] simulation since underlying assumptions have changed. I use a 10% WACC for discounting. Consensus revenue estimates project a 9.8% revenue CAGR for the next decade, which I consider fair. The TTM FCF margin ex-SBC is negative, so I use a modest 2% for my base year and expect a one percentage point yearly expansion.

According to my DCF simulation, the business’s fair value is almost $1.8 trillion, which indicates a 23% upside potential for AMZN. That said, my target price is roughly $180 per share.

Risks update

We are currently in a very uncertain macro environment, which weighs on the consumer’s confidence. This will ultimately lead to the softening of consumer spending, especially given the current environment of high-interest rates and the inflation still higher than historical averages. But I think that the cyclicality in the broader economy is normal and all these challenges are apparently temporary and not secular. Amazon has enough resources to weather the storm, but short-term volatility is inevitable in current uncertain times. Dollar averaging seems to be a good option to mitigate the volatility risk.

It is also important to emphasize that Amazon invests notable amounts in business expansion and these investments might also add pressure on the company’s profitability, which will ultimately pressure the stock price. For example, last year’s losses from investment in Rivian Automotive (RIVN) were a big reason why Amazon investors experienced a lot of pain last year. While Amazon had no notable acquisitions in 2023, the company is well-known for its aggressive growth strategy via acquisitions. That said, Amazon faces substantial acquisition and integration risks, which might drag down the company’s profitability.

Bottom line

To conclude, Amazon is still a “Strong buy”. Revenue growth demonstrates strong growth momentum despite a very uncertain and challenging macro environment. Last year’s problems with profitability seem to be far from the rearview window, as in the latest reportable quarter, the operating margin peaked close to levels of “full-lockdown” quarters in 2021. Amazon still by far dominates in two markets, which are expected to grow double digits in the long term. It is also crucial, that despite several bullish signs, the stock is still undervalued with about 23% upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.