Summary:

- Amazon’s Q3 earnings beat expectations, with $158.88 billion in revenue and $1.43 GAAP EPS, driving shares up from $186 to $198.50.

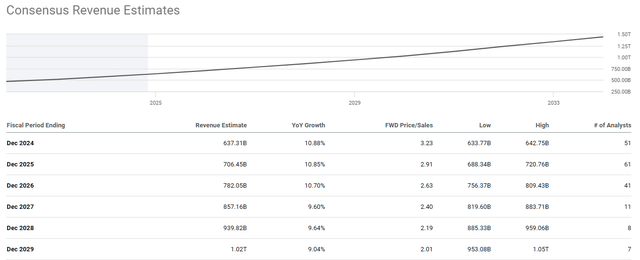

- Investments in CapEx are paying off, enhancing logistics and AWS growth, positioning AMZN for long-term growth and potential $1 trillion annualized revenue.

- Despite risks like low margins, competition, and regulatory scrutiny, Amazon’s improving operating margins and record cash from operations strengthen the bullish outlook.

- The macroeconomic environment, with declining interest rates and commodity prices, supports Amazon’s margin expansion and profitability, making it an attractive investment.

georgeclerk

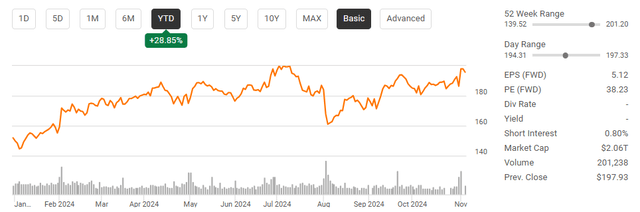

Unlike last quarter, when shares sold off after Amazon (NASDAQ:AMZN) released earnings, shares are holding most of their gains. AMZN generated $158.88 billion in revenue, which allowed them to produce $1.43 in GAAP EPS. AMZN beat the consensus estimates on revenue by $.16 billion and $0.29 for GAAP EPS. This caused shares to rally from around $186 to roughly $198.50 after the double beat. AMZN is currently hovering around $196, and I believe shares are going much higher.

In Q3, AMZN improved its operating margins to the highest levels since the pandemic while generating record amounts of cash from operations on a trailing twelve-month (TTM) basis. The investments in CapEx are clearly paying off as AMZN has created what is arguably the best logistical network behind the Department of Defense, and AWS continues to grow at double-digit percentages YoY. When I look at the growth rates and AMZN’s financials, this is a company that I still want to own more of, even as shares approach $200.

As the operating environment becomes more inclusive for business, I believe that AMZN will continue to drive value for shareholders, which will lead to further capital appreciation. I wouldn’t be surprised if shares climbed past $210 by the end of the year as AMZN has crossed over the $2 trillion market cap level. When I look at the Magnificent Seven, AMZN could be the best positioned for long-term growth as the road to $1 trillion in annualized revenue is getting closer each quarter.

Following up on my previous article about Amazon

When AMZN reported its Q2 earnings, shares declined by more than -10%. I was very vocal about how strong the quarter was despite many investors having mixed feelings about the results and speculating that guidance was weak. Shares had dropped to $154.21 when my last article was published (can be read here), and I discussed many data points that were being overlooked in the narrative that was forming. Since then, shares of AMZN have appreciated by 26.96%, while the S&P 500 only increased by 10.9%. I had taken the opportunity to add to my position after shares sold off, and I still want to own more AMZN. I am following up with a new article now that we have clearer economic data and AMZN delivered Q3 earnings. I believe that AMZN shares will continue to appreciate and that AMZN looks very attractive even though shares have been up over 25% since last quarter.

Risks to investing in Amazon

Just because I am bullish on AMZN or because they seem to have a large moat doesn’t mean that shares will continue to generate value for investors. There are many risk factors to consider before investing in AMZN. On a TTM basis, AMZN operates a low-margin business. While AMZN’s gross profit margins are 48.41% ($300.18 billion gross profit / $620.13 billion revenue), their operating expenses of $239.58 billion bring their operating margins down to 9.77% ($60.6 billion / $620.13 billion). If macroeconomic conditions become more restrictive and GDP growth slows, AMZN’s bottom line could be very negative. AMZN is running one of the largest companies in the world, and every dollar oil increases per barrel, and every 25bps that interest rates have increased impacts AMZN’s margins. If GDP growth starts to decline and unemployment rises, less capital will likely be spent on AMZN’s goods and services.

AMZN also faces increased levels of competition from Walmart (WMT) and Target (TGT) on a retail front and Microsoft (MSFT) and Alphabet (GOOGL) in cloud computing. AMZN has also been a target of the FTC, especially Lina Khan, who penned what has become a famous article titled Amazon’s Antitrust Paradox in The Yale Law Journal (can be read here). Depending on the political climate and the appetite to pursue cases against big tech, AMZN could find itself in the courtroom fighting a battle not to be broken up. I am still very bullish on AMZN and have been a long-term shareholder, but investors should consider these risk factors and others before allocating capital toward AMZN shares.

Amazon blew earnings out of the water and set the stage for a lot of future growth at a reasonable valuation

AMZN produced a strong quarter in Q3, setting the stage for becoming the first company to hit $1 trillion in annualized revenue. AMZN delivered $158.9 billion in quarterly revenue and was able to generate $15.3 billion in pure profit. AMZN made roughly $5.1 billion in net income per month throughout Q3 and is firing on all cylinders. AMZN provided strong Q4 guidance as they believe revenue will be between $181.5 billion and $188.5 billion, which would be anywhere from a 7% – 11% YoY growth rate. The street is looking for $186.26 billion in revenue for Q4, so AMZN is positioned to beat the consensus estimates by more than $2 billion if they exceed their internal guidance.

AMZN has spent $64.96 billion on CapEx over the TTM, which is the most they have spent in their history on a TTM basis. This has allowed AMZN to launch new foundation models within AWS to support their AI infrastructure in addition to launching memory and compute-optimized EC2 instances based on AMZN’s Graviton4 processors. This allows AWS to deliver 75% additional memory bandwidth with 30% higher compute levels. AMZN has also been able to harness its internal AI infrastructure to enhance its shopping experience through several AI-powered features. AMZN is proving that its ability to spend on CapEx drives future growth across their business segments and makes it harder for their competitors to compete against them.

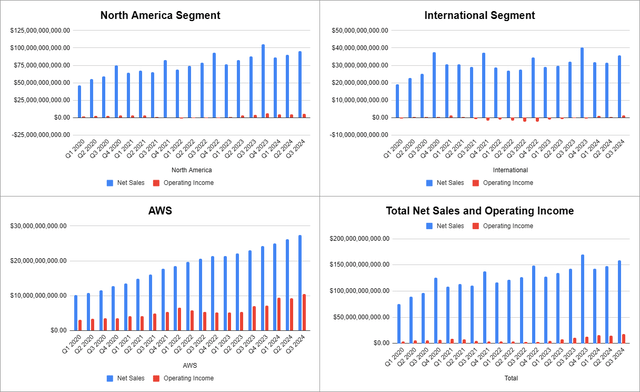

From a business perspective, Q3 was exciting and transformative. The North America segment grew revenue by $7.65 billion (8.7%) YoY. From Q4 2021 through Q4 2022, North America generated negative operating income, and in Q3, the operating income it generated grew by 31.48% ($1.36 billion) to $5.66 billion. International was a negative operating income producer from Q3 2021 through Q4 2023, and it has finally turned the corner this year. Compared to Q3 2023, the International segment has added $3.75 billion in revenue and $1.4 billion in operating income.

AWS is still the company’s growth engine. In Q3, AWS generated $27.45 billion in revenue, which was a YoY increase of $4.39 billion (19.05%). AWS’s operating income increased by 49.76% ($3.27 billion) YoY to $10.45 billion. When I look at the quarter wholistically, this was a pivotal quarter because the top and bottom lines both grew by double-digit percentages. AMZN was able to add $15.79 billion (11.04%) of revenue YoY and drove an additional 55.62% ($6.22 billion) of operating income from its operations throughout Q3.

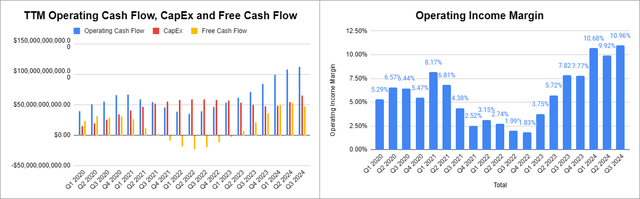

AMZN is operating at its highest margins since the pandemic and is generating record amounts of cash from operations. In Q4 2022, AMZN’s operating margin dropped to its multi-year lows of 1.83%. Over the next 7 quarters, AMZN has been able to exceed a double-digit margin while spending more than $80 billion on their cost of goods and $60 billion on total operating expenses. AMZN operated at a 10.96% operating margin throughout Q3 and on a TTM basis, driving in the most cash from operations in their history.

AMZN had previously topped out at $67.21 billion in cash from operations in Q1 2021 before watching the amount of cash they generated decline QoQ for 5 consecutive quarters to $35.74 billion. AMZN has been able to outspend its competitors on CapEx, which has allowed them to grow the amount of cash from operations generated on a TTM basis for 9 consecutive quarters to $112.71 billion. AMZN has spent $64.96 billion on CapEx in the TTM, which has allowed them to produce $47.75 billion in free cash flow (FCF). At some point, AMZN won’t need to spend this amount on CapEx, and their FCF could substantially increase.

AMZN’s cash from operations increased on a TTM basis by $41.05 billion (57.29%), while FCF increased by $26.31 billion (122.76%) YoY. Based on the current trajectory AMZN is in a position where their cash from operations and FCF can continue to grow while allocating more toward CapEx. AMZN also has a large lever that they can pull by reducing the amount of capital allocated toward CapEx. If AMZN decided next year to drop their CapEx to $50 billion while cash from operations continues to grow, they would instantly generate an additional $15 billion in FCF without factoring in the cash from operations growth rate. AMZN is generating record amounts of operating income and net income on a TTM basis, which will make the bull case very strong going forward.

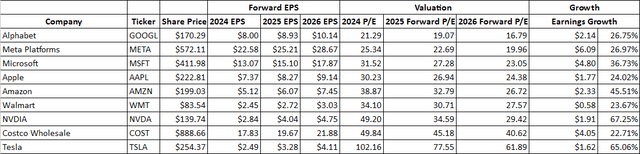

From an operating standpoint, AMZN is increasing their profitability and growing all of their business lines. This is also related to the forward valuation, and AMZN looks cheaper than it has in recent years. When I look at the Magnificent Seven and add in Walmart (WMT) and Costco (COST) you have all of AMZN’s main competitors in one group. AMZN competes with Meta Platforms (META) and Alphabet (GOOGL) in advertising, GOOGL and Microsoft (MSFT) in the cloud, and WMT and COST in retail.

AMZN now trades at 38.9 times 2024 earnings and 26.73 times 2026 earnings. AMZN is expected to grow its EPS by 45.51% over the next 2 years. The combination of all these companies has an average of trading at 42.54 times 2024 earnings and 30.07 times 2026 earnings. The average company will experience 35.84% in EPS growth over the next 2 years. AMZN trades at a lower valuation than the peer group average, with more growth on the horizon. When I look at WMT and COST, they trade at 27.61 times and 40.66 times 2026 earnings with less than 25% EPS growth over the next 2 years. I think AMZN is finally looking cheap compared to other big tech and retail companies, and it could continue to look cheaper as 2025 progresses.

Steven Fiorillo, Seeking Alpha

Why I believe Amazon will continue to grow and expand margins

The macroeconomic environment is setting up well for AMZN as GDP growth continues to expand while commodity pricing and interest rates decline. The United States has generated 10 consecutive quarters of GDP growth, which is strong for AMZN as it sells goods and services across the country to businesses and individuals. Unemployment has dropped to 4.1%, which means that more people are working, and we are seeing that disposable personal income is reaching pandemic levels when stimulus checks were being printed. The Fed will meet on Thursday, and CME Group is projecting that there is a 98.9% chance that rates will be reduced by 25 bps. On the commodities side oil is down 11.87% this year while natural gas has declined -21.23% and gasoline has fallen -7.52%. When I look at the data, it’s not a surprise that AMZN is increasing revenue while improving its margins. Input costs are declining, and the demand for goods and services is expanding. This is a combination that works well for AMZN, and it’s showing up in the numbers.

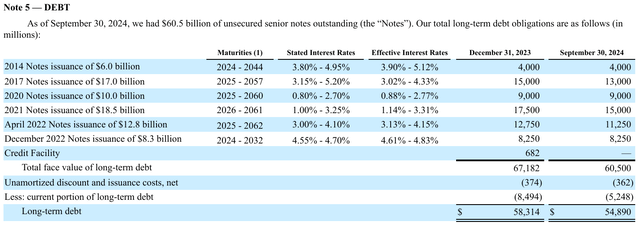

The reduction in interest rates is also critical for AMZN for 2 reasons. When rates decline, servicing debt becomes more affordable, and businesses are more likely to tap the debt markets to expand. When businesses expand, they need additional goods and services to facilitate their growth from cloud computing to office supplies. The Fed is expected to take rates to 3.5% by the end of 2025 and around 3% by the end of 2026. As this occurs, it could lead to greater business expansion and more revenue for AMZN.

Lower interest rates also help AMZN’s margins as they have $60.5 billion in long-term debt. The combined weighted average of AMZN’s notes is 13.1 years, and there are tranches of debt that reach an interest rate of 5.12%. Over the TTM, AMZN has allocated $2.55 billion toward interest expenses, and over the next several years, they could be in a position to refinance at least half of their debt at a lower rate if they don’t eliminate it with their increased levels of profitability. I believe that AMZN’s top and bottom lines will grow over the next several years, and the combination of a better business environment and lower interest rates will be critical for improving their margins.

Conclusion

Amazon is expected to be the first company to reach $1 trillion in annualized revenue as they are projected to grow their top-line by around 10% YoY for the next 5 years. As AMZN’s top line expands and margins improve, they should generate increased levels of EPS, and the valuation could look inexpensive as shares appreciate. AMZN should be in a position to follow in META and META’s footsteps by implementing a dividend program while increasing the $10 billion share repurchase program that was put into place in 2022 by a significant amount. AMZN’s growth isn’t stopping, and their margins are improving, which can be seen in their forward projections. I think AMZN trading at 26.74 times 2026 earnings is cheap and that we will have much more capital appreciation on the road to AMZN becoming the first company to achieve $1 trillion in annualized revenue.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, GOOGL, AAPL, TSLA, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.