Summary:

- Amazon recently announced mixed earnings results, offering investors insights into how AI is impacting the entire business.

- Upside stock price movement could become difficult as a big fear could become reality, impacting one-third of AMZN’s revenue.

- While I am cautiously maintaining a ‘buy’ rating, all investors must consider the growing possibility of key competitors outpacing Amazon in this AI revolution.

Michael M. Santiago/Getty Images News

Amazon (NASDAQ:AMZN) (NEOE:AMZN:CA) recently announced mixed Q2 earnings results, with the slowdown in advertising revenue growth particularly disappointing investors. The stock was down almost 20% from its recent all-time high. Rivals Meta (META) and Google (GOOG) delivering much more encouraging ad revenue growth numbers, despite growing off of larger revenue bases, suggests that Amazon may be facing a company-specific issue, and could potentially also threaten its ‘Third-party seller services’ segment.

Bull case remains intact

In the previous article, we had discussed how the growing preference for open-source models among enterprises could give AWS a chance to fight back against the rise of Microsoft Azure and Google Cloud, as demand for closed-source models like OpenAI’s GPT series and Google’s Gemini are undermined by this trend. This may already be playing out, with Amazon impressing investors with a 19% top-line growth rate for AWS last quarter. Hence, the bull case remains intact.

Given the continued strength in its AWS cloud segment, which makes up the majority of the company’s profits (69% of operating income), I am maintaining a ‘buy’ rating on the stock.

Now let’s move on to the big risk facing Amazon’s e-commerce segment.

Amazon’s e-commerce segment in the generative AI era

Back in August 2023, we discussed in an article how the AI revolution poses serious threats to Amazon‘s ‘Advertising’ and ‘Third-party seller services’ segments, due to a conflict-of-interest issue potentially worsening.

Here is an excerpt from that article:

It is well-known that aside from selling goods from third-party sellers on its marketplace, Amazon also sells its own private labelled goods, including ‘Everyday Essentials’. In fact, the e-commerce giant has faced anti-trust litigation over using data about how shoppers interact with third-party sellers’ products to feed into its own product development processes, and subsequently undercut third-party merchants’ prices. Such unethical practices threaten third-party merchants’ business survival.

In fact, such practices are why I, personally, don’t own the stock, as small business owners reportedly miss out on sales opportunities as a result.

Moreover, while there were already reports of Amazon’s own products being given preferential treatment in the search results on Amazon.com, the evolution towards chatbots facilitating online shopping activities in this new AI era could further complicate the conflict-of-interest problem.

Last month, the e-commerce giant made its generative AI-powered shopping assistant ‘Rufus’ available to all U.S. customers through the Amazon app. The company also offered insights into how beta testers had been using the chatbot for purposes such as learning more about the specifications of a product, getting summarized customer reviews, getting advice about what type of product they should buy based on their intended purposes. As per an example provided by Amazon:

Customers often want to shop based on the latest products and trends, and Rufus is helping them keep up-to-date with questions like, “What are the most advanced electric pressure cookers?” and “What are denim trends for women?”

Amazon Rufus chat example (Amazon)

Now there is a risk of potentially exacerbating the conflict-of-interest issue here, in terms of which products to showcase in direct response to shoppers’ queries, Amazon’s private label goods or third-party sellers’ products.

Moreover, with Amazon in full control of the Rufus chatbot, the company will be gaining exclusive insights into customers’ specific preferences and requirements when making purchase decisions, which the e-commerce giant could use to feed into its own R&D efforts when designing private-label goods, while third-party sellers are unlikely to have access to this data. This could undermine the appeal for third-party sellers to sell their products through Amazon’s marketplace, or potentially even plant the seeds to future antitrust litigations.

In fact, in September 2023, the Federal Trade Commission sued Amazon alleging that:

Amazon is a monopolist that uses its power to hike prices on American shoppers and charge sky-high fees on hundreds of thousands of online sellers

As the company fights antitrust litigations, it is also not clear yet whether or how Amazon plans to incorporate ‘sponsored product’ ads, the company’s main source of advertising revenue, within Rufus responses. These ads typically appear at the top of search results when shoppers type in the product they are looking for. However, with product searches now initiating through a conversational assistant, Amazon will need to prove to advertisers (as well as shareholders) that it can still show relevant ads in response to user queries.

Amazon’s advertising revenue grew by 20% last quarter, while investors were expecting much faster growth given the upbeat results from chief rivals Google and Meta.

Meta in particular impressed investors, with Meta CFO Susan Li sharing on the Q2 2024 Meta earnings call that:

Q2 Family of Apps ads revenue was $38.3 billion, up 22% or 23% on a constant currency basis. Within ad revenue, the online commerce vertical was the largest contributor to year-over-year growth

Keep in mind that Meta is growing off of a much larger revenue base, delivering $38.3 billion in ad revenue last quarter, while Amazon generated $12.7 billion in advertising revenue over the same period.

Furthermore, Meta’s executives also proclaimed how they are leveraging the power of generative AI to facilitate easier ad creations and greater ad spend returns for advertisers.

CEO Mark Zuckerberg:

we got to the point where our ad systems could better predict who would be interested than the advertisers could themselves…And in the coming years, AI will be able to generate creative for advertisers as well. And we’ll also be able to personalize it as people see it.

Over the long term, advertisers will basically just be able to tell us a business objective and a budget, and we’re going to go do the rest for them.

…

CFO Susan Li:

We’re also making it easier for advertisers to maximize ad performance and automate more of their campaign setup with our Advantage+ suite of solutions. We’re seeing these tools continue to unlock performance gains, with a study conducted this year demonstrating 22% higher return on ad spend for US advertisers after they adopted Advantage+ Shopping campaigns.

Hence, with rivals making such notable advancements through generative AI, merchants could increasingly decide to advertise through these alternative platforms over the Amazon Marketplace.

Facebook and Instagram are already becoming increasingly popular avenues for commerce, as covered in a previous article. Additionally, Google has also been making notable strides in facilitating e-commerce through its Search engine by making product listings free in the ‘Google Shopping‘ tab for merchants in April 2020. In early 2023, Google proclaimed that Google Shopping had 35 billion products listed on it.

Google also seems to be making encouraging progress with evolving its Search engine with generative AI-powered features. On the Q2 2024 Alphabet earnings call, CEO Sundar Pichai proclaimed that:

Search and other revenues grew 14% year-on-year, led by growth in the retail vertical

With both advertising rivals witnessing ad revenue growth that is driven by the e-commerce segment, it is certainly worrisome that Amazon delivered such slower growth for its own advertising segment, signaling that competitors may be racing past the e-commerce behemoth in the generative AI era.

And while one could argue that the advertising segment only made up 9% of total revenue last quarter, subduing the impact on overall stock performance, the potential worsening of conflict-of-interest issues between Amazon’s private label brands and third-party merchants’ products in the generative AI era could discourage these businesses from selling through the Amazon Marketplace over time.

Generative AI technology is expected to increasingly ease the process of online retailers setting up and running their own web stores and apps through software platforms like Shopify, which has close partnerships with major advertising platforms Google and Meta to help its merchants sell their products.

Unlike Amazon, Google and Meta don’t sell their own products that compete with their advertisers’ products, enabling merchants to be confident that any advantages from generative AI-powered advertising/ marketing tools will be deployed in their favor, with the platforms’ and advertisers’ interests better aligned.

With Google’s digital platforms (e.g. Google Search, YouTube, etc.) and Meta’s social media apps (e.g. Facebook, Instagram) becoming increasingly prominent commerce avenues, merchants could become less reliant on the Amazon Marketplace in the generative AI era. This would hurt the company’s ‘Third-party seller services’ revenue segment, which made up 24% of total revenue last quarter.

Hence, both the ‘Advertising’ segment (9%) and ‘Third-party seller services’ segment (24%) together make up 33% of Amazon’s revenue base, which could potentially struggle to deliver high growth in the AI era.

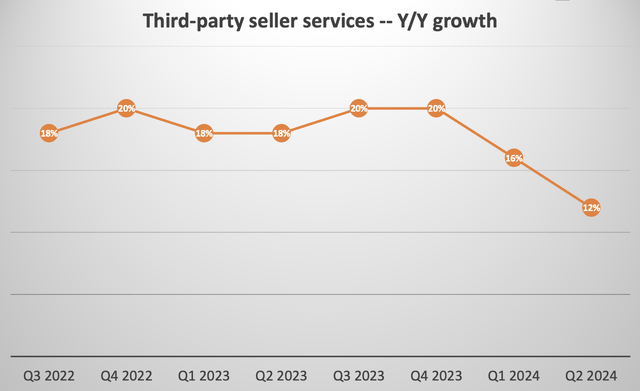

It is also worth noting that ‘Third-party seller services’ revenue growth on a year-over-year basis slowed to 12% last quarter.

Nexus Research, data compiled from company filings

A key culprit for the slowing growth was the fact that Amazon cut the referral fees for third-party merchants selling clothing apparel on its marketplace, amid intensifying competition with Shein.

The bullish argument for Amazon’s e-commerce & advertising businesses

Now let’s consider the flip side.

This conflict-of-interest issue of Amazon selling its own products that compete directly with third-party products has been going on for years now, but this has not stopped third-party merchants from selling through the Amazon Marketplace.

Why? Because that is where the customers continue to come. As long as the e-commerce giant can sustain the shoppers’ traffic through Amazon.com, third-party sellers will remain incentivized to list their products and pay for ad space on the marketplace.

It is true that alternative avenues for e-commerce are on the rise, including through social media apps like Instagram, Facebook, YouTube and TikTok, as well as alternate e-commerce apps like Shein and Temu.

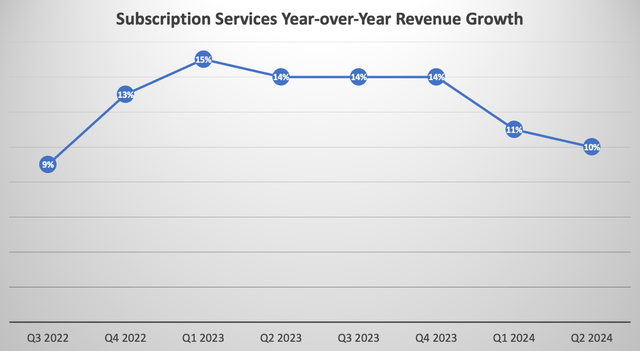

But at the same time, Amazon has continued to grow its base of Prime subscribers, with the Subscription services revenue (which “includes annual and monthly fees associated with Amazon Prime memberships, as well as digital video, audiobook, digital music, e-book”), growing another 10% last quarter.

Nexus Research, data compiled from company filings

The point is, Amazon’s growing and loyal customer base through Prime membership should continue to encourage third-party merchants to sell and advertise on the platform.

In fact, the allure of Prime membership continues to grow as well, with Amazon adding new services to the mix, such as cheaper medication delivery with the Pharmacy Rx pass, and the expanding availability of content through Amazon Prime Video.

Moreover, Amazon has found particular success with sports streaming through its platform. Amazon Prime Video was already building a sports-streaming audience through telecasting Thursday Night Football, and now it has also struck “an 11-year media rights agreement” with the NBA. Amazon was reportedly able to offer the NBA benefits that bidding rival Warner Bros. Discovery, Inc. (WBD) could not, testament to the power of its platform and balance sheet:

The NBA’s deal with Amazon included several provisions that Warner couldn’t match, say people familiar with the situation, including one spelling out the promotion of the NBA in Amazon’s NFL telecasts.

…

The league considered Amazon’s Thursday NFL telecasts an advantage, because they have helped build a sports-streaming audience that the NBA can benefit from.

…

Amazon also pledged to provide three years’ worth of payments for NBA rights into an escrow account that the league can draw down automatically. Warner provided a letter of credit, which the league deemed inferior

…

Amazon’s deal also stipulated that its reach in U.S. streaming won’t fall below 80 million households, a level it can easily clear but that wouldn’t be workable for Max, Warner’s streaming service.

Amazon is making impressive strides in enriching the content availability through Prime Video. Streaming popular sports leagues in particular can potentially bring scores of new subscribers. Now while Amazon offers Prime Video as a separate subscription for $8.99/month, the tech giant certainly has the opportunity to also encourage complete Prime membership for $14.99/month, such as by cross-selling sports league merchandise through the e-commerce marketplace, or other adjacent benefits.

The point is, more and more sports streaming through Prime Video could drive further growth in Prime memberships and potentially drive more traffic through Amazon.com, encouraging third-party sellers to continue selling through the marketplace.

In fact, Prime Video is also expected to become an important advertising surface, with CEO Andy Jassy proclaiming on the Q2 2024 Amazon earnings call:

Sponsored ads drive the majority of our advertising revenue today and we see further opportunity there. Even with this growth, it’s important to realize we’re at the very beginning of what’s possible in our video advertising.

…

With ads and prime video, the exciting opportunity for brands is the ability to directly connect advertising that’s traditionally been focused on driving awareness, as is the case for TV, to a business outcome, like product sales or subscription signups. We’re able to do that through our measurement and ad tech, so brands can continually improve the relevance and performance of their ads.

Furthermore, Amazon has the opportunity to leverage the rich database it holds on its e-commerce shoppers to show them the most relevant ads in Prime Video that drive optimal conversion. And vice versa can hold value as well, whereby users’ content preferences can feed into Amazon’s algorithm to show them more relevant product ads on the marketplace side of the platform.

Nonetheless, CEO Andy Jassy also went on to say that:

While ads have become the norm in streaming video, we aim to have meaningfully fewer ads than linear TV and other streaming TV providers. And of course, for customers preferring an ad-free experience, we offer that option for an additional $2.99 a month.

This remark is in direct response to users’ averseness towards seeing ads, having gotten used to the ad-free experience. Amazon needing to show fewer ads in Prime Video to avoid undermining the streaming experience too much is in contrast to Meta’s strategy of focusing on short-form content, namely Reels, as it creates more advertising opportunities in between videos.

On the company’s last earnings call, Meta CFO Susan Li highlighted how this would benefit the social media giant’s ad revenue growth prospects:

On Instagram, we expect Reels to continue to drive growth, while on Facebook, we expect to grow overall video time, while increasing the mix of short-form video, which creates more impression growth opportunities.

In fact, not only can Meta show more ads with this video-streaming strategy, but it could also offer a better ad experience than Amazon Prime Video, as it is much less intrusive to see short-form ads in between Reels, than it is to see ads in the middle of long-form content such as movies and TV shows.

As a result, consumers may also be more likely to take actions (e.g. clicking through to learn more about a product, or even purchase the product) based on ads they see while viewing short Reels, as opposed to ads in the middle of movies and TV shows.

These are factors to keep in mind as Amazon’s executives strive to convince investors that they can continue growing ad revenue through Prime Video.

Amazon Financial Performance and Valuation

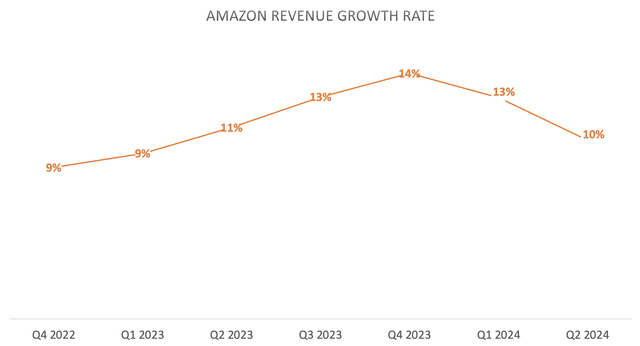

Amazon’s total revenue grew by 10% last quarter, as the slowing advertising revenue growth and cut in fees charged to third-party sellers subdues overall top-line growth.

Nexus Research, data compiled from company filings

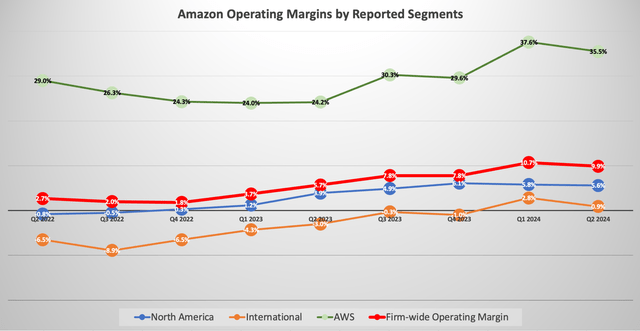

Despite the slowing revenue growth, AMZN remains a profit margin expansion story, with CFO Brian Olsavsky highlighting on the earnings call that:

We saw improvements in our cost to serve, driven by our efforts to place inventory more regionally, closer to where our customers are. This resulted in more consolidated shipments, with higher units per box shipped. We also saw packages traveling shorter distances to customers, and this also led to better on-road productivity in our transportation network.

Moreover, while the regionalization of fulfillment centers has already been expanding profit margins for the company, CEO Andy Jassy guided that they are only getting started with their cost-cutting strategies:

And I think one thing to remember about that is that while it’s had even bigger impact than maybe we theorized when we first architected it, we’re still not done fully honing it. There’s a lot of ways that we continue to optimize that U.S. regionalization that we think will continue to bear lower cost to serve. But at the same time, we found a number of other areas where we believe we can take our cost down while also improving the customer experience.

Nexus Research, data compiled from company filings

As Amazon continues to expand profit margins on the e-commerce side of the business, AWS profit margins have also been expanding year-over-year, which continues to have the largest weighting on the company’s profitability, making up 69% of the tech giant’s operating profit last quarter.

So while the concerns around Amazon’s advertising and third-party seller segments are definitely worth taking into consideration when making investment decisions, I feel that the solid growth and profit margin expansion on the AWS side, which is one of the picks and shovels of this AI revolution, should buy Amazon some time to figure out how they will strike the right balance between their private label business and third-party seller services, and sustain their flourishing ad business through the Rufus shopping assistant.

Over the near-term, Amazon’s stock price should continue rallying higher, driven by growth in AWS.

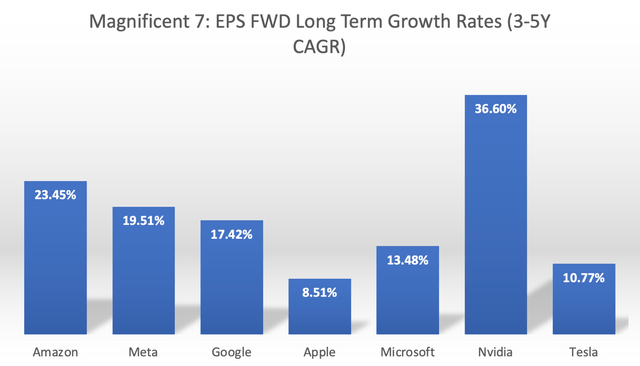

Now, in terms of the valuation of AMZN, the stock trades at a Forward PE multiple of just over 35x. Although, a more comprehensive valuation measure would the Forward Price-Earnings-Growth [PEG] ratio, which adjusts the Forward PE multiple by the expected EPS growth rate going forward. The idea being that companies with higher earnings growth rates should be allowed to trade at higher Forward PE multiples.

Nexus Research, data compiled from Seeking Alpha

Note: Anticipated growth rates range from 3- to 5-year periods across the companies, which may subdue the comparability somewhat.

Out of the Magnificent 7 stocks, Amazon has the second-highest projected EPS growth rate, behind only Nvidia. Though while Nvidia’s EPS growth is likely to be mainly driven by top-line revenue growth, Amazon’s anticipated EPS growth rate reflects market’s expectations that the company will continue making its e-commerce side of the business more efficient.

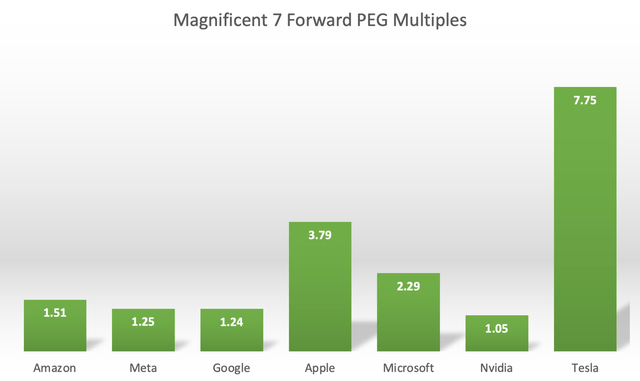

Now adjusting each stock’s Forward PE multiples by the EPS FWD Long-Term Growth Rates (3-5Y CAGR) to derive at the Forward PEG multiples reveals AMZN trades at a 50% premium to fair value. For context, a Forward PEG ratio of 1 is considered fair value, though it is not unusual for popular tech stocks to trade at a premium to fair value.

Nexus Research, data compiled from Seeking Alpha

Despite both Google and Meta delivering much stronger ad revenue growth, and making notable progress in facilitating commerce activities through their platforms, they continue to trade at cheaper valuations relative to Amazon. Though keep in mind that Amazon also benefits largely from the fact that it runs the largest cloud service provider, AWS, which is delivering impressive growth amid the AI revolution, and thus the market assigning it a higher valuation multiple.

That being said, if the ‘Advertising’ and ‘Third-party Seller Services’ revenue growth rates continue to underwhelm amid the intensifying competition, it could weigh on stock performance going forward. Amazon will need to prove to investors that it can sustain its e-commerce moat in the generative AI era. But for now, the stock remains a ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.