Summary:

- AMZN stock could be considered a value thesis, with forward multiples indicating it is undervalued while offering growth at a reasonable/cheap price.

- Amazon’s impressive fundamentals, wide moats, and diversified revenue streams make it a compelling buy despite short-term economic risks and competition.

- The company’s strong growth in free cash flow and operational improvements highlight its potential for sustained growth and margin expansion.

Jaroslaw Kilian/iStock Editorial via Getty Images

Possibly, the best way to define Amazon’s (NASDAQ:AMZN) thesis is as a “GARP” – Growth at a Reasonable Price. However, the price of Amazon stock is at such an attractive level that it is possible to argue that it is also – at least partially – a value thesis.

Looking at its multiples, these are below historical levels, even though the fundamentals have advanced considerably. Looking at forward multiples and doing the math on a discounted cash flow, this also proves interesting, with Amazon stock even being characterized as undervalued.

This price factor, along with wide moats, great prospects, diversified revenue, and other characteristics that make Amazon unique, makes the stock a clear buy.

Amazon Stands Out As An Undervalued Opportunity

Looking at some recent periods, Amazon stands out with an interesting return. In the Year to Date the stock advanced by around 20%, above other mega caps such as Google (GOOGL), Apple (AAPL), and Microsoft (MSFT), in the LTM the same thing happened, Amazon rose more than those mentioned, with just over 40% return.

This comparison becomes a little more intriguing when we take it a step further. Of those mentioned and including Meta (META), Amazon is the worst performer in the 3-year window, with just 10%. In the 5-year window too, Amazon had a great performance of 110%, but the lowest when compared to these other 4 names.

This alone doesn’t say much. Amazon stock could have been mispriced, its fundamentals may have changed or performed below expectations, among many other factors. But I don’t see anything really negative happening. Of those mentioned, Amazon’s Free Cash Flow CAGR is among the highest, having recently reached 89.8% CAGR in the 3Y TTM.

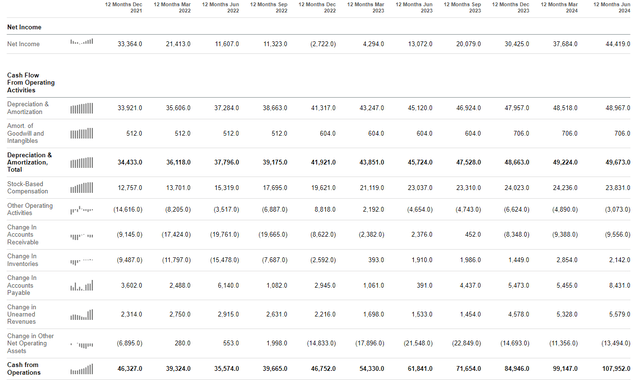

This growth resulted from excellent quarters and a job well done by the company (and here I’m not getting into the merits of which quarter was below or above expectations). Its revenue showed a high rate of growth, but what was most impressive was the improvement in margins, which meant that net income and cash from operations grew a lot. Note in the table below that the company recently achieved cash from operations of $107.9bn and Amazon today has a market cap of $1.92 trillion, resulting in a price-to-cash-flow of less than 20x.

For other companies, it could be argued that this would already be a high level, mainly because if we consider free cash flow, this multiple goes to almost 40x since CapEx is high. But here we must consider some factors, such as the quality of the company, which guarantees a premium valuation, and especially the continuity of this growth.

Just taking the consensus for the next 12 months, the EV-to-EBITDA multiple has already fallen to 14.5x, while the forward price-to-cash-flow is just under 16x. For these same indicators, Amazon’s average for the last 5 years is 20x and 20.4x, respectively. As the outlook for Amazon remains strong, I believe that these multiples should not deviate so much from the average.

Checking with some reasonable assumptions, Amazon would also have an upside of just over 20%, using a moderate growth for its financials, a discount rate of 7.8%, and a terminal growth of 4%.

In other words, looking at both the past and the future, Amazon continues to look like a compelling investment and one that manages to offer attractive value even with multiples that are above the market.

Amazon’s Moats and Prospects Point to Sustained Growth

AI has already become a secular trend, and it seems to me that Amazon will be one of the companies that will be able to benefit greatly from it, both in optimizations that favor the bottom line and in ramping up the top line. In addition, there are factors outside of technology that also increase confidence in Amazon’s growth prospects.

Amazon is among the leading cloud providers, and with its 31% market share, it still has an advantage over Microsoft’s Azure and Google Cloud. Although there is a certain amount of uncertainty in the short and medium term as to what the margin in this segment will be for Amazon, as well as the high CapEx expenditures for infrastructure that put pressure on cash flow, it is still one of Amazon’s central pillars, which should continue to drive the company’s growth. If, on the one hand, the forecasts for an increase in data center spending should squeeze cash flow over the next few quarters or years, it should be positive in the long term, thinking not just about the next few quarters, but about the next few decades.

Not only that, but revenue should continue to benefit from similar trends in the coming years. AI, machine learning, big data, and the like should continue to advance at a pace that should further benefit the revenue of Amazon’s core business, which is retail. It is possible to cite, for example, the optimization of advertising and the algorithm for customers, facilitating sales and recurrence of user consumption. The ecosystem in general could become something that further facilitates cross-selling in categories where Amazon is weaker, not least because there is uncertainty as to whether Amazon can disrupt the business model of Hims & Hers (HIMS).

Continued international expansion is also something that could boost the top line. There are areas where the company still has lower penetration, and this requires time for the company to be able to invest and set up to achieve scale and logistical results to serve the customer as well as in other regions of the world.

Until a few quarters ago, International was a segment that reported operating losses, and in Q2 2024 this has already changed, with the segment achieving an operating margin of 0.86%, while in North America this margin is 5.63%. This shows that, as these regions mature, there is still a lot of margin to be captured.

It seems to me that this margin can be boosted even further in both segments. It’s no secret that Amazon has a strong robotics division, and this is also an excellent trend that if it materializes, Amazon is very likely to be one of the big beneficiaries. Robots, algorithms, and systems, which are becoming more and more precise for a segment where efficiency is very important and any margin gain matters, make a lot of difference and further reinforce the barrier to entry.

Combined, I think that over a long period of time, Amazon can unlock a lot of value both through revenue growth and a substantial increase in its margin, as well as a reduction in CapEx when the company reaches a greater stage of maturity, which also means greater value generation for the Amazon stock sharer. It’s worth remembering that reaching 3% in International means an increase of more than 200% in operating income. The same applies to retail North America, but to a lesser extent; achieving a two or three percentage points difference in operating margin already means robust growth.

Amazon Faces Risks Despite Its Strengths

Even though the moats are wide, and the prospects are generally very optimistic, there are risks to Amazon’s thesis. In the short and medium term, one of the main points that must be taken into account is the risk of an economic slowdown, which directly affects its business and could generate volatility in the stock. Even if this is mitigated by its price resilience and could make Amazon gain market share due to the deteriorating environment, its growth could be reduced, and its margin squeezed. In short, these bad periods of global economic cycles, especially in the United States, which may eventually occur, are a risk for the stock.

But for the long-term investor, there are some more important ones. In my opinion, the most latent is competition. Although there are strong barriers to entry in both the retail and cloud sectors, there are very good competitors. In retail, one of the best examples is MercadoLibre (MELI), which is very strong in Latin America and could somewhat overshadow Amazon’s growth in that region. There is still some doubt as to whether over the years, due to this unbridled competition, heavy investments in logistics and infrastructure, and gains in scale, the e-commerce sector will be a “winner takes it all”, but it is quite possible that it will be a “winner takes it most”, which could be a double-edged sword, guaranteeing more barriers to entry for Amazon in most of the regions where the company already has a relevant market share, but could become an obstacle in some countries.

As a global company, regulations and other legal factors are also an ever-present factor in Amazon’s thesis. Therefore, it is necessary to pay extra attention to regulations, lawsuits and the like that affect your business model, such as competition and labor issues.

Stock-based compensation is also something to monitor. In the last 12 months, the amount was $23.8bn, representing around 22% of cash from operations. This isn’t really a big problem, as long as income grows at a faster rate than SBC. Even so, it is necessary to bear in mind this additional dilution that affects per-share metrics and to monitor the growth of this indicator in relation to net and operating income.

The Bottom Line

The solid prospects for the evolution of financials and consequently the unlocking of shareholder value in the coming years for Amazon, together with strong barriers to entry and wide moats that guarantee the quality of the company, place it at a differentiated level and deserving of a premium valuation.

That’s why Amazon is trading at multiples below its average of the last 5 years and overall, a very reasonable level considering all future growth presents an opportunity even for value investors.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.