Summary:

- Amazon stock saw a massive correction post-earnings, but many strong metrics were overlooked by Wall Street.

- The company missed consensus revenue estimates by a small margin, but it is still in the upper range of its own revenue guidance.

- The advertising business reached a milestone of over $50 billion ttm revenue, which could put the standalone valuation of this segment close to $900 billion when we do peer comparison.

- There has been an acceleration in AWS revenue growth and margin expansion, which has almost doubled the operating income from this segment compared to the year-ago quarter.

- Investors can still enter AMZN stock while it trades at 25 times the forward PE estimates for 2025, which is cheaper than other peers.

4kodiak/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN) continues to show strong fundamentals despite a modest earnings result. Amazon’s GAAP EPS came at $1.26, beating estimates by a massive $0.23. On the other hand, the revenue missed by $780 million. Some of the analysts have called it a mixed bag earnings and this explains the immediate correction in the stock after the earnings. However, for a company the size of Amazon, it is important to dig deeper into various segments to find how the overall performance has been and the possible EPS trajectory in the next few quarters. In a previous article, it was mentioned that Amazon is unlikely to join other big tech peers in giving dividends and rewarding investors. This puts greater pressure on core business to improve the EPS trajectory.

Amazon’s advertising segment has hit a milestone by reaching over $50 billion in trailing twelve months revenue. Even at this massive scale, the advertising segment has shown a good pace of 20% YoY revenue growth. Meta (META) reached $50 billion in ttm revenue in 2018 when its market cap hit over $600 billion. Google’s (GOOG) advertising revenue reached over $50 billion in 2015 when its market cap reached $500 billion. Ideally, Amazon’s advertising business should have a standalone valuation more than Meta and Google at the $50 billion revenue base. The main reason is that Amazon has a massive flywheel effect, and it can invest the profits from advertising in building better logistics, streaming video, autonomous delivery, and many other initiatives. On the other hand, both Meta and Google have been spending heavily on buybacks as they have fewer options to invest excess cash.

Amazon’s AWS has also performed very well. The operating income in this segment increased from $5.3 billion in the year-ago quarter to $9.3 billion in the recent quarter. This equates to 72% YoY growth in operating income. AWS remains a key driver for Amazon’s valuation, and good results in this segment should end up improving the sentiment towards the stock in the near term. The EPS estimate for fiscal year 2025 is $5.8 which gives the stock a forward PE ratio of 27. For fiscal year 2026, the forward PE ratio is only 21. This is lower than many other big tech peers like Apple (AAPL). The revenue growth in Amazon is still quite strong and as the revenue share of high-growth segments like advertising, AWS, and subscription increase, we should see better margins and profitability. This should help the stock regain bullish sentiment in the near term.

Missing the consensus estimate

It seems that Wall Street was already in a cautious mode when Amazon’s earnings were released. As the headline numbers showed a revenue miss, Wall Street went into a bearish momentum for the stock. It is unlikely that adequate attention was paid to the individual segments, which are the key to Amazon’s valuation. Amazon had given a revenue guidance of $144 billion to $149 billion for Q2 2024. At $147.98 billion, the quarterly revenue of Amazon was close to the upper range of its revenue guidance. However, this was still $780 million short of the consensus estimate, which has been taken as a negative sign showing a slowdown in the company.

The reality is quite different, as Amazon has shown very strong growth in important segments like AWS and advertising. A minor slowdown in online store sales is not going to hurt the long-term growth potential of the company. This might even help the overall margins as the revenue share of AWS and advertising increases at a faster pace, pushing the company-wide margins higher over the next few quarters.

Advertising segment is undervalued

Amazon reached a milestone number in its advertising segment. The company reported $51 billion trailing twelve-month revenue from the advertising segment and had a YoY revenue growth of 20%. Amazon’s advertising business has broken the duopoly of Meta and Google in digital marketing. It is also important to compare the market cap and revenue growth of both Meta and Google, when their advertising revenue reached close to $50 billion. Meta reached $50 billion in advertising revenue in 2018 while Google reached this milestone in 2015.

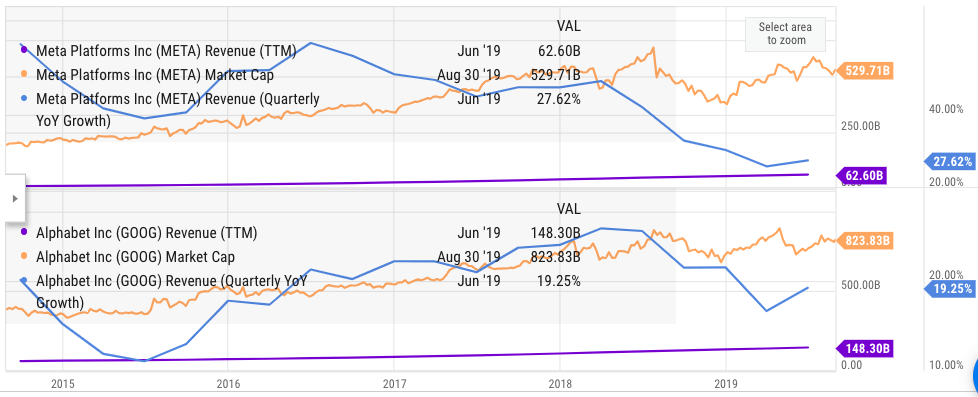

YCharts

Figure: Market cap and revenue growth of Meta and Google between 2014 and 2019.

In 2018, Meta had a market cap of $600 billion, while its YoY revenue growth was slowing rapidly. Google’s advertising revenue reached $50 billion in 2015 when its market cap was $500 billion and the company was showing advertising revenue growth of 10%-20%.

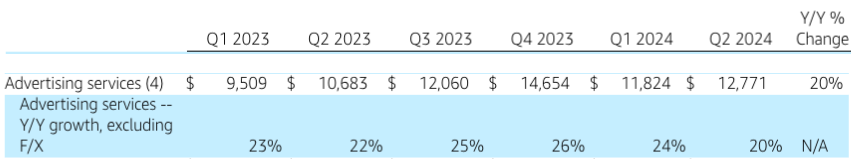

Amazon Filings

Figure: Recent revenue and growth rates of Amazon’s advertising business.

If we give a similar valuation multiple to Amazon’s advertising business, its valuation could be close to $600 billion. However, I believe the standalone valuation of Amazon’s advertising business should be higher compared to Meta and Google when they were at this revenue base. A key reason is the flywheel effect of Amazon. The company can invest the profits from this segment in many other growth options. We have already seen massive investment by Amazon in its logistics and streaming video business. This strengthens the overall ecosystem of the company. The YoY growth trajectory of Amazon’s advertising segment is also stronger compared to what it was when Meta and Google were at $50 billion revenue rate. If we give Amazon’s advertising business a 50% premium valuation compared to Meta and Google when they were at $50 billion revenue base, the standalone valuation of this business would be $900 billion or more than 50% of the total market cap of Amazon.

On the other hand, both Meta and Google have had relatively fewer options to invest heavily in new businesses. Meta has been investing in Reality Labs, but it is losing massively in this segment, and it will take some more time before it gains good customer traction. Google has invested in its Cloud business and autonomy. The cloud business has reached profitability, and this reduces the options to effectively invest cash from advertising business. Both Meta and Google have been investing heavily in buybacks, while Amazon is the only big tech company that has avoided buybacks and dividends.

Future EPS trajectory

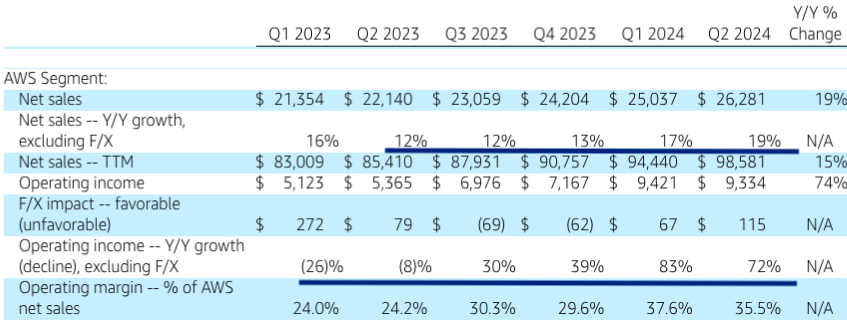

AWS is still one of the biggest contributors to Amazon’s operating income. It contributed $9.3 billion in operating income out of consolidated operating income of $14.6 billion in the recent quarter. Hence, AWS contributed close to two-thirds of the overall operating income. This segment has seen a massive improvement in operating income in the last few quarters. There was 72% YoY growth in operating income in the recent quarter. The YoY revenue growth has accelerated to 19% in the recent quarter and the operating margin has also expanded to 35.5% from 24.2% in the year-ago quarter.

Amazon Filings

Figure: Improvement in AWS performance in the last few quarters

This growth trajectory has led to higher EPS estimates in the next few quarters and also reduced the forward PE ratio at which the stock is trading.

Seeking Alpha

Figure: EPS estimates and forward PE ratio of Amazon

For the fiscal year ending Dec 2025, the consensus EPS estimate is of $5.8, and the forward PE ratio of 27. For the fiscal year ending Dec 2026, the EPS estimate is of $7.4, and the forward PE ratio of only 21. On the other hand, Apple has a forward PE ratio of 25 for the fiscal year ending 2026. For Microsoft, the forward PE ratio is 26 for the fiscal year ending 2026.

This makes Amazon stock quite cheap when compared to other big tech peers. It is also likely that we will see another upward revision in EPS estimate for Amazon as the revenue share of advertising increases, which should help in further expansion of margins.

This makes Amazon a good option for investors looking to hold the stock for the longer-term, and short-term dips similar to post-earnings correction could give a good entry point.

Investor Takeaway

Amazon missed the revenue estimates in the recent quarterly report, but it still reached close to the upper end of its own revenue guidance. The advertising business has reached a milestone of over $50 billion ttm revenue and is still showing over 20% YoY revenue growth. The standalone valuation of this segment could be close to $900 billion or more than 50% of the current market cap of Amazon.

Amazon’s AWS is showing strong operating income growth, which is helping the expansion of overall margins. We should see more upward revisions in EPS over the next few quarters as the revenue share of AWS and advertising increases. The forward PE ratio of Amazon for fiscal year 2026 is more than 20% cheaper than Apple and Microsoft, which shows that the stock is relatively cheap and makes it a good buy at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.