Summary:

- Amazon finally sees its cash flows returning.

- The market has recognized the improvement and the stock rallied throughout the year.

- Amazon is still trading at historically cheap multiples, even after the 50% rally.

Daria Nipot

Amazon’s (NASDAQ:AMZN) stock performance has been a rollercoaster over the last five years. Driven by lockdown-induced euphoria, shares doubled quickly and had been on a decline until early 2023. In April 2023, I wrote my latest update on Amazon while the market was still pessimistic about the future. Since then, the stock has outperformed the market by 27% and has been on an overall 50% rally year to date. Let’s review what happened since then and if Amazon continues to be a compelling opportunity.

Amazon stock performance (Seeking Alpha)

Has the perfect storm subsided?

My last article had the headline A Compelling Buying Opportunity As The Perfect Storm Subsides. The perfect storm consisted of the following ingredients:

- US E-Commerce sales declining

- Large CapEx eating away cash flows

- Energy Costs as a headwind

- AWS slowing down

Let’s review these points:

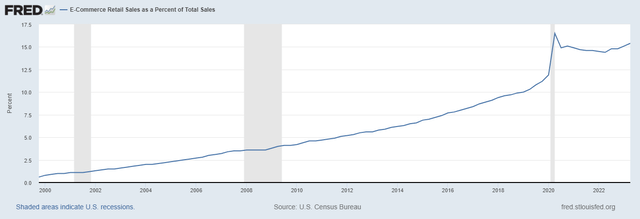

US E-Commerce sales declining

A big worry for Amazon has been the E-Commerce part of the business and the lacking profitability. Over the last two decades, we’ve seen a clear trend of increasing E-Commerce percentage of total retail sales. After it spiked in 2021, we saw the first decline ever in 2021. This situation has been returning to growth again. Since the bottom in Q2 2022 at 14.4%, we saw quarterly increases to 15.4% for Q2 2023.

US E-Commerce retail sales as a percentage of total retail (FRED)

The market was worried about Amazon’s declining margins, but as the table below shows, this worry is eroding now. The company is finally growing into its built-up capacity and is improving the efficiency and margins of its segments. Amazon can now show decent margins in its NA segment and international is close to breaking even. Sales also continue to grow in both segments.

| Operating margin | Q2 22 | Q3 22 | Q4 22 | Q1 23 | Q2 23 | Q3 23 |

| North America | -0.8% | -0.5% | -0.3% | 1.2% | 3.9% | 4.9% |

| International | -6.5% | -8.9% | -6.5% | -4.3% | -3% | -0.3% |

| AWS | 29% | 26.3% | 24.3% | 24% | 24.2% | 30.3% |

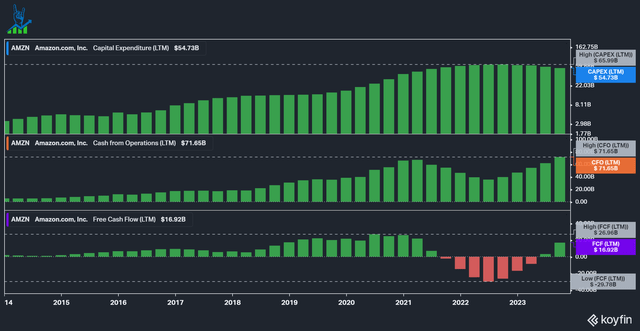

Large Capex eating away cash flows

Over the last quarters, Amazon continued to reduce CapEx further, from a high of $65.98 billion trailing in Q3 2022, down to $54.73 billion in Q3 2023. In the earnings call, it was also restated that the reduced Capex was in fulfillment and transportation and that AWS investments continue to ramp. At the same time, operating cash flows reached a new all-time high of $71.65 billion, compared to the previous peak in Q1 2021 at $67.21 billion. Free cash flows haven’t got a new ATH yet due to the significantly larger CapEx compared to 2021, but they are finally rebounding after seven quarters of negative FCF. This was a major worry for the market and Amazon finally can finance its investments with cash flows again.

For the full year 2023, we expect capital investments to be approximately $50 billion compared to $59 billion in 2022. We expect fulfillment and transportation CapEx to be down year-over-year, partially offset by increased infrastructure CapEx to support growth of our AWS business, including additional investments related to generative AI and large language model efforts.

Andy Jassy, Amazon CEO Q3 Earnings Call

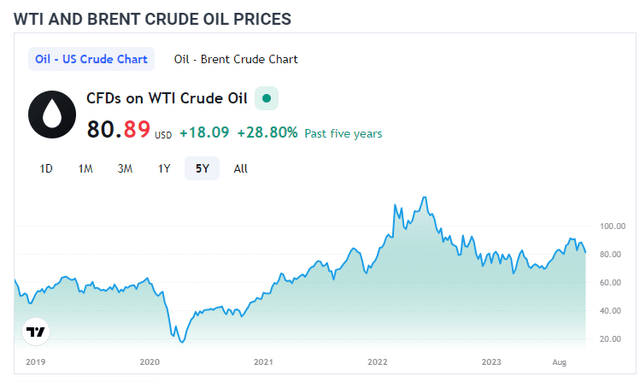

Energy Costs as a headwind

Not much changed with the energy cost for Amazon. Crude oil stayed at almost the exact same price as it was in my prior article ($80.32). Shipping costs have increased 9% for Amazon (below the 11% growth rate of NA and international segments) to $86.868 billion.

Historical oil price (DailyFX)

AWS slowing

AWS could have bottomed here after another quarter of 12% growth. The statement below discusses the increasing deal flow, which hasn’t reached the Q3 numbers. At a $92 billion annual run rate, AWS is a large business, but according to Andy Jassy, global IT spending is still 90% on-premise, presenting a gigantic remaining opportunity for AWS and the other big cloud players.

Companies have moved more slowly in an uncertain economy in 2023 to complete deals. But we’re seeing the pace and volume of closed deals pick up and we’re encouraged by the strong last couple of months of new deals signed. For perspective, we signed several new deals in September with an effective date in October that won’t show up in any GAAP reported number for Q3 but the collection of which is higher than our total reported deal volume for all of Q3.

Andy Jassy, Amazon CEO Q3 Earnings Call

Summary

To summarize: We have seen a rebound in the overall E-Commerce trend and a large improvement in Amazon’s cash generation (both on the CapEx and the operating cash flow side). AWS could have bottomed, but energy costs continue to increase and could be a tailwind if energy prices decline and the progress toward more electric delivery vehicles continues. Overall, Amazon has improved its business and the market has noticed that with a 50% surge in share price.

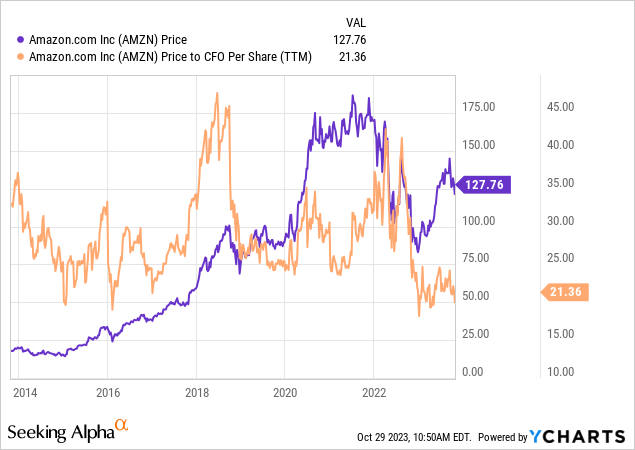

Amazon continues to be cheap

In my previous article, I valued Amazon based on its Price to Operating cash flow multiple. Below, you can see that the multiple stayed and even declined slightly from the 22 times during the last article. This has been due to the share recovery in operating cash flow and despite the rapid increase in share price. Amazon remains attractively valued based on its operating cash flows.

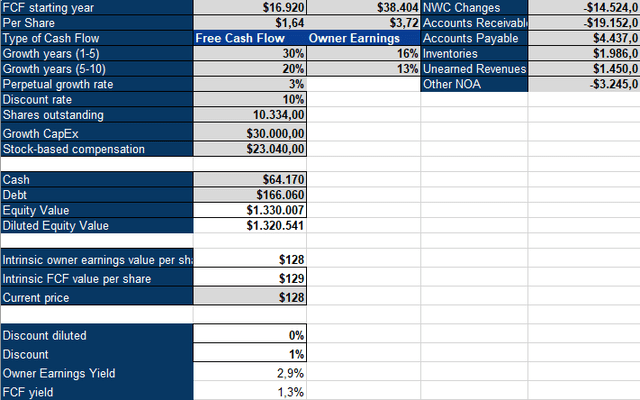

I also want to introduce my inverse DCF model for Amazon. Besides Free Cash Flow, I use Owner Earnings to account for growth Capex and the large stock-based compensation expense, as well as changes in Net Working Capital.

Based on Free Cash Flow, Amazon is still pretty expensive and would require 30% growth over the next five years. Using Owner Earnings, this required growth comes down to mid-teens. This is a reasonable assumption for Amazon based on its increasing focus on high-margin services and its impending operating leverage from growing into the growth capex of the last years. That being said, I am downgrading Amazon from a strong buy to a normal buy: A lot of the pessimistic sentiment of my previous article turned positive. While I still hold a large (9%) position in Amazon, I do not believe that the mispricing from earlier this year is still present. Amazon will continue to beat the market in my expectation.

Amazon Inverse DCF Model (Authors Model)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advise.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.