Summary:

- Amazon’s shares earned 34.4% annually from 2011 to 2021.

- Amazon invented and scaled an entirely phenomenal new business from an underutilized asset base.

- The 1.6 trillion-dollar question is: What margin level does Amazon’s array of businesses collectively earn?

David Ryder

The following segment was excerpted from this fund letter.

Amazon (NASDAQ:AMZN)

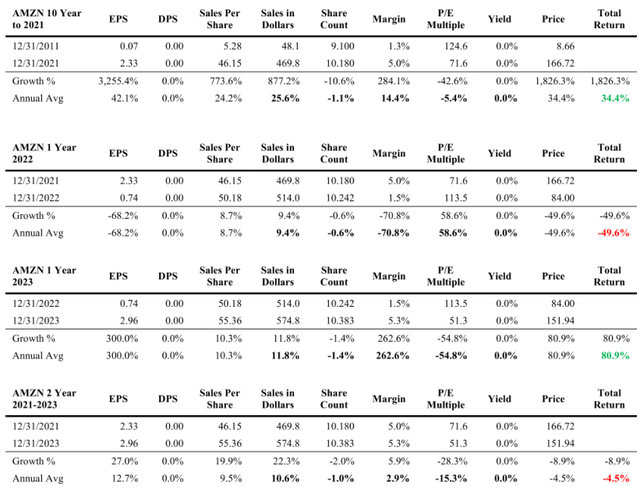

Amazon’s shares earned 34.4% annually from 2011 to 2021. Revenue growth at 25.6% was nearly a tenfold increase, albeit from a small base.

The analyst must dig into the component businesses within Amazon to develop a framework to determine where growth and profitability will be derived, overlaid on where the capital in the business resides and will be spent.

The stock ended 2021 at 71.6x earnings, reflective of expectations for ongoing rapid sales growth and margin expansion to perhaps 9% or 10% from 5.0% in 2021. Glance at the multiple paid for 2011’s slight 1.3% margin. It was priced like a really fast-growing distributor with huge volumes and rapid inventory turnover. Somewhat not far off the mark for its original retail business where it owns inventory.

Understanding the business requires understanding its third-party retail operation and also their cloud business. The creation of AWS and its success are incredible. Amazon invented and scaled an entirely phenomenal new business from an underutilized asset base. If the blend of businesses ultimately reaches a 10% net margin, then the stock really didn’t trade for 124.6x in 2011 or 71.6x in 2021. Doubling the assumed margin halves the multiple.

Investors clearly didn’t like what transpired in 2022 when the margin collapsed to 1.5% from 5.0%, sending the multiple back over 100x. Dollar sales growth of 9.4% and a bit of dilution combines to send the stock down 50%.

Turning the page by a year, investors applauded the margin recovering and exceeding 2021’s 5.0%.

The extremes of how our five factors work together are on full display with Amazon. An 80.9% total return in 2023 was bolstered by 262.6% growth in the margin, a 54.8% loss from the multiple moving back down to 51.3x from over 100x. Dollar sales continued to race ahead by 11.8% and the business continues to spend capital and increase shares, costing investors 1.4%.

Math being math, a 50% decline and subsequent 80.9% gain leaves you down 8.9% total, or 4.5% per year from 2021 to 2023.

The 1.6 trillion-dollar question is: What margin level does Amazon’s array of businesses collectively earn? I have an idea and don’t think the stock’s 113.5x multiple was out of line a year ago.

|

SEC-registered investment advisory firms are now required to disclose 1-, 5- and 10-year returns, or the time period since performance composite or portfolio inception, if shorter. The new rule seeks to prevent “advertisers” from cherry-picking time periods that make returns appear more favorable. As short- and intermediate-term returns change frequently due to beginning and endpoint sensitivity, we have chosen to disclose all yearly intervals from the current 1-year return all the way back to inception. Intra-year periods will likewise be shown annually back to inception. Better, in our opinion, to provide more data than less. We are augmenting the mandated disclosure with the full data set – not to confuse – but if we must provide a few defined numbers, to the extent anybody uses them in decision making, we want you to have the information we’d want if our roles were reversed. The yearly return intervals are italicized and shaded in blue. Information presented herein was obtained from sources believed to be reliable, but accuracy, completeness and opinions based on this information are not guaranteed. Under no circumstances is this an offer or a solicitation to buy securities suggested herein. The reader may judge the possibility and existence of bias on our part. The information we believe was accurate as of the date of the writing. As of the date of the writing a position may be held in stocks specifically identified in either client portfolios or investment manager accounts or both. Rule 204-3 under the Investment Advisers Act of 1940, commonly referred to as the “brochure rule”, requires every SEC-registered investment adviser to offer to deliver a brochure to existing clients, on an annual basis, without charge. If you would like to receive a brochure, please contact us at (303) 893-1214 or send an email to csc@semperaugustus.com. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.