Summary:

- Amazon’s subscription business is showing steady growth, with no signs of saturation.

- Recently Amazon has also added another incentive for Prime members by reducing the cost of One Medical service by $100 which could help close to 1 million members.

- Amazon has already announced that it will run ads on Prime Video, or charge an additional $3 per month for an ad-free option.

- Even at a modest 10-12% CAGR growth in subscription, the revenue base of this segment could reach $100 billion by 2030.

- Amazon’s subscription business provides a flywheel effect for new services, improving the monetization of the customer base, and gives the company a long term growth runway.

4kodiak/iStock Unreleased via Getty Images

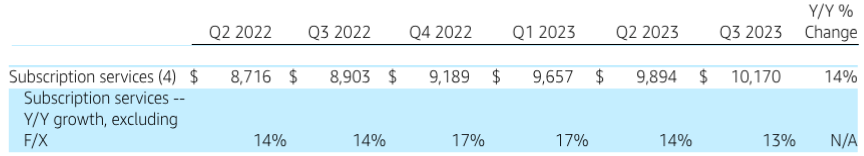

Amazon’s (NASDAQ:AMZN) recent earnings were a mixed result with strong growth in advertising and a slowdown in cloud growth. However, one of the key segments to look at is the subscription business. This segment reported 13% YoY growth with trailing twelve month revenue of close to $40 billion. Many analysts have pointed out that the Prime revenue growth will slow down as the company reaches closer to saturating its addressable market. This has not been the case in the past few quarters. This segment has absorbed the price increase announced last year really well and is still showing double-digit growth. It was mentioned in a previous article that AWS will continue to face some challenges. This will increase the importance of subscriptions and other segments to drive future growth.

Amazon has recently announced another incentive for Prime members by giving a $100 per year discount for One Medical membership. There were close to a million members using One Medical membership in the last announcement. If there is a strong overlap between the usage of Prime and One Membership, then this incentive can be very attractive for customers. Healthcare is a rapidly growing industry due to an aging population. Cheaper access to healthcare options for Prime members can increase customer loyalty and provide Amazon with a better growth trajectory.

Amazon has already mentioned that it will have ads on Prime Video from next year with an ad-free option costing an additional $3 per month. This should provide a good jump in YoY growth over the next few quarters. Even with a modest 10%-12% CAGR growth in subscription revenue over the next few years, this segment should reach close to $100 billion mark by 2030. The strong recurring revenue base of subscription segment will make it the key driver for future valuation growth in Amazon stock.

Building a stronger flywheel

Amazon has announced good results within the Subscription segment. The YoY revenue growth is 13% and the quarterly revenue was $10.17 billion. There has been no signs of a saturation or slowdown in this segment. Despite a big price hike last year, the customer loyalty in this segment seems to be quite strong. This is promising for the company as it can allow the management to maintain the trend of announcing a price hike every four years.

Company Filings

Figure: Subscription revenue growth in the last few quarters. Source: Company Filings

Amazon has announced another incentive for Prime members which will allow the members to subscribe to its subsidiary, One Medical, at $99 per year. This reduces the annual membership for One Medical by $100. Healthcare is a major industry and all the big tech giants are trying to increase their footprint in it. Amazon acquired One Medical for $3.9 billion when the membership for this startup was close to 1 million. The massive discount offered to Prime members could be a win-win for the company and the customers. Amazon would gain a stronger loyalty for Prime membership and customers looking for cheaper healthcare options will get a massive discount.

Earlier this year, Amazon took another step by launching RxPass which provides generic medications to Prime members. Amazon is trying to improve healthcare coverage and affordability by giving incremental incentives to Prime members. There have been regulatory concerns for Amazon in the past few quarters. The recent healthcare incentives could give the company bonus points while putting its case in front of regulators and legislators.

Growth in the next few quarters

Amazon had announced that it will start charging customers an additional $3 per month for ad-free Prime Video streaming or customers can opt for the current fees with advertisements. If customers opt for the $3 per month hike, it will increase the annual Prime membership cost by 26%. Netflix (NFLX) has recently reported that it has 15 million customers on ad-supported tier which means over 90% of customers choose to pay higher fees for ad-free content. If Amazon sees a similar trend, it will give a strong boost to the subscription revenue in the next few quarters. It is highly likely that we could see YoY subscription revenue growth of over 20% in the next few quarters as more Prime members opt for ad-free option.

The long-term growth potential of this segment is also quite strong. The last two price hikes increased the price of Prime membership from $99 to $139 giving a 4% CAGR in eight years. We could see another two price hikes by 2030 if the company maintains its previous trend. Steady launch of new services for Prime members should also improve the growth trajectory. Even at a modest annualized growth rate of 12%, the subscription revenue should reach $100 billion by 2030. This would be a strong moat for Amazon as it builds a regular revenue stream with high customer loyalty.

Increase in revenue share

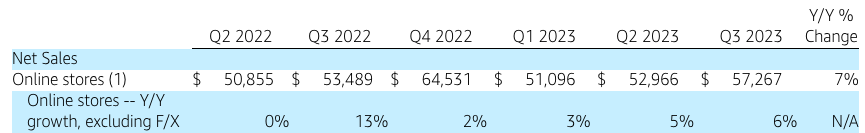

The e-commerce segment has reported low single-digit growth in the last few quarters. One of the reasons is the tougher comps in this segment due to pandemic-related growth in 2020 and 2021. However, this trend has led to a higher revenue share of services compared to e-commerce sales.

Company Filings

Figure: Slower growth rate in the online store segment of Amazon. Source: Company Filings

The margins in the online store are wafer-thin. It requires massive investment in logistics and is very labor intensive. This has led the management to focus more on increasing the growth rate within services like subscription, AWS, and advertising. It is likely that we will see a continuation of this trend which will increase the revenue share of services within the overall pie. Faster growth rate in services should also help in increasing the overall growth rate of the company.

According to earnings reports, these three main services of subscription, AWS, and advertising contributed $45 billion out of $143 billion in total sales or 31% of the overall revenue. Prior to the pandemic, in Q3 2019, the contribution of the three services was $17.5 billion out of net sales of $70 billion or 25%. Hence, we can see that there has been a significant increase in revenue share of services which should help in improving the long term growth trend and margins for the company.

Impact on Amazon stock

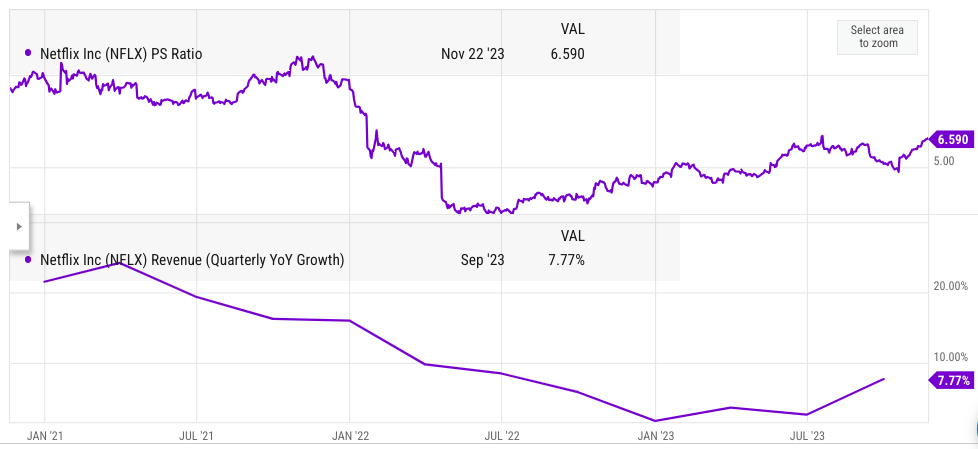

There is no direct comparison of Amazon’s subscription business. However, we can take a look at some of the other competitors in related industries. Amazon spent $17 billion on video streaming in 2022 which equates to over 45% of its subscription revenue. Hence, we can compare it to Netflix. Currently, Netflix is trading at PS ratio of 6.6.

Ycharts

Figure: Comparison of PS ratio and YoY revenue growth rate of Netflix. Source: Ycharts

It should be noted that Amazon’s subscription business has reported significantly higher YoY revenue growth rate than Netflix for the last few quarters. Amazon has subscription growth in the range of 13% to 17% for the last six quarters. Netflix had YoY revenue growth of only 2% to 9% in the last six quarters.

Amazon also has an advantage of the halo effect created by Prime membership. It has been reported that Prime members buy more on Amazon’s e-commerce platform. They also create a ready addressable market for new services launched by Amazon. Hence, Amazon’s subscription segment should get a higher PS ratio compared to Netflix. A reasonable PS ratio could be in the range of 10-12. At the current annualized revenue base of $40 billion, Amazon’s subscription business should already have a standalone valuation close to half a trillion dollars. The future growth potential and strong flywheel effect makes the subscription segment a key growth driver for Amazon stock in the next few years.

Investor Takeaway

Amazon has reported good YoY revenue growth numbers in the Prime segment. Earlier fears of big cancellation in Prime membership due to price hikes have been proved wrong. Launch of new services also increases the growth runway for the subscription business. We should see a big growth jump in subscription revenue in the next few quarters as Amazon launches paid ad-free option for Prime Video streaming.

The long term growth potential of this segment is quite strong due to regular price hikes in the core Prime membership. Netflix stock is trading at a PS ratio of 6.6 and Amazon would likely get a higher valuation multiple due to better monetization capability of its subscription business and the launch of new services. Even at a modest PS multiple, Amazon subscription is already a key growth driver for the company and should improve the stock trajectory over the next few years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.