Summary:

- Amazon delivers double digit top line revenue. However, valuation remains high due to low profitability.

- The company heavily reinvests into diverse industries and has a leading position that can deliver long-term growth.

- AMZN stock price has seen a major increase year to date, however investors should focus on the long-term initiatives, due to volatile history.

Kirk Fisher

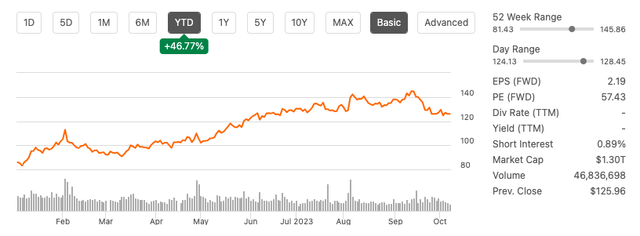

For those who made investing in Amazon.com, Inc. (NASDAQ:AMZN) part of their New Year’s activities, the year has indeed been an exhilarating one, with the stock value surging by an impressive 46.77% year to date. However, long-term followers of this stock are well-acquainted with its inherent volatility. They recognize that the current momentum is partly attributed to the AI hype and a year-over-year improvement in the e-commerce business. Nevertheless, it’s essential to acknowledge that this momentum could swiftly change course, particularly if there’s a negative impact stemming from a recent FDA announcement, even if it’s largely unrelated to the company’s core business operations.

Stock YTD trend (SeekingAlpha.com)

For many, Amazon remains a very frustrating stock to hold. While the company has a $1.3 trillion market cap, it does not provide dividends or share buyback programs; its valuations are extremely high, with a price-to-earnings ratio of 57.43 and FWD EPS of only $2.19. Furthermore, the company invests huge amounts back into the business, which results in low cash flow and relatively low profitability. However, the company’s stellar track record of successful investments speaks louder than its current valuation. While stock momentum and positive short-term updates are nice to have as an investor, investing in Amazon requires a long-term outlook and belief in its continued vision. Therefore, long-term investors may want to take a bullish stance on this stock.

Company overview

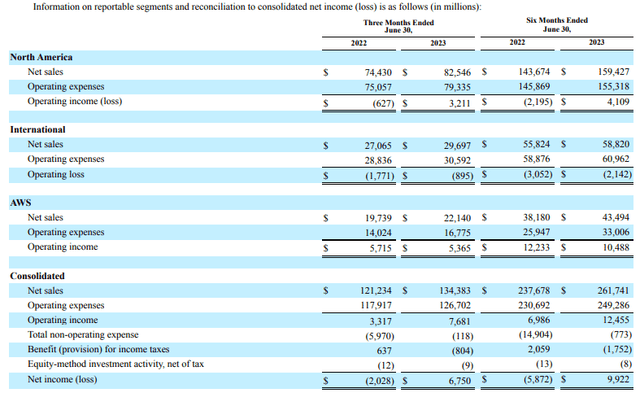

From a humble start as a US-only online bookstore with $15 million in 1996, Amazon has grown into a trillion-dollar giant dominating e-commerce and cloud computing worldwide. Investors benefit from its diverse industry presence, driven by a commanding e-commerce position, strong advertising, and efficient logistics. Amazon Web Services (AWS) is the profit powerhouse, contributing over 80% of operating income despite generating only 16% of revenue in the last year. Disappointing e-commerce results in 2022 were followed by a turnaround, with Q2 2023 delivering $3 billion in operating income compared to a $627 million loss the previous year. Amazon’s top-line revenue continues to surge, with expectations of strong upcoming earnings results. Amazon will hold its Q3 2023 Earnings Conference Call on October 26, 2023.

Sales and income by segment (Sec.gov)

Market dominance and long-term growth

While it’s undeniable that there are more appealing companies when it comes to current valuations, Amazon’s standing in e-commerce and its ongoing investments in cloud computing present a compelling case for investment. One of Amazon’s standout attributes is its leadership in the e-commerce sector across numerous countries. In the U.S., it commands a commanding 38% market share, with Walmart trailing at 6%. The industry is projected to maintain a CAGR of 11%, reaching a staggering $5.5 trillion by 2027. Given Amazon’s dominant position, it’s poised to benefit significantly from this market expansion.

In the realm of cloud computing, Amazon Web Services (AWS) boasts a substantial 30% market share, reinforcing its status as an industry leader. Moreover, Amazon is making noteworthy strides in the field of artificial intelligence [AI], indicating a promising trajectory for growth. The company’s advertising revenue has displayed robust growth, with a 23% year-over-year increase in Q4 2022 and an impressive 25% year-over-year growth overall for 2022, all based on a substantial $31 billion revenue base. These factors collectively paint a compelling picture of Amazon’s potential for investors.

Reinvestments

The company’s costliness is by design, as it commits to pouring vast sums back into its operations. Amazon takes investment in its business very seriously. The figures speak for themselves, with cash capital expenditures reaching $55.4 billion in 2021 and further increasing to $58.3 billion in 2022. These investments primarily focus on enhancing technology infrastructure, a significant portion of which supports the growth of the AWS business, and expanding capacity to bolster its fulfillment network.

Notably, Amazon consistently makes billion-dollar investment decisions, as exemplified by its $4 billion initiative, with an upfront investment of $1.25 billion, in the artificial intelligence company Anthropic. Additionally, in June, the company unveiled plans to deepen its involvement in the field of artificial intelligence by venturing into AI chip development. This demonstrates Amazon’s unwavering commitment to innovation and the future growth of its business.

Financials

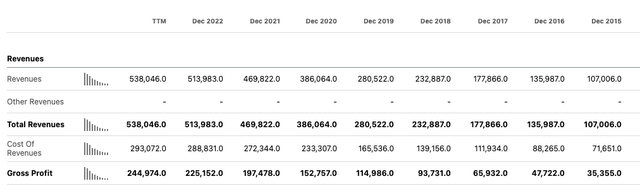

From a financial perspective, Amazon is an impressive revenue juggernaut, consistently achieving double-digit revenue growth and maintaining a robust ecosystem. However, its profitability metrics, including net income and free cash flow, appear relatively modest when compared to its substantial revenue. This is primarily attributable to the company’s ongoing investments and its commitment to expansion, which often takes precedence over immediate profitability.

Annual revenue (SeekingAlpha.com)

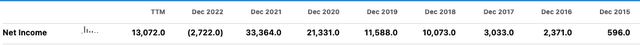

Amazon’s primary focus lies in expanding its business and building a substantial competitive advantage, rather than prioritising immediate profit generation. Notably, the TTM net income stands at $13 billion. While this figure is lower than the peak performance during the pandemic, it represents an improvement compared to the financial results of the fiscal year 2022. This underscores Amazon’s commitment to long-term growth and its willingness to invest in its future success.

Annual net income (SeekingAlpha.com)

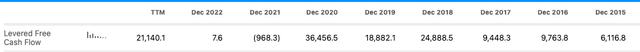

The company’s capital expenditure is indeed substantial, and this exerts a negative influence on its cash flow. However, it’s crucial to recognize that these investments represent a reinvestment into the business’s growth and development. Notably, the leveraged free cash flow remains positive at $21.14 billion, indicating an improvement from the previous fiscal year in 2022. This suggests that despite the significant investments, the company is still generating positive cash flow, which bodes well for its financial health and future prospects.

Levered free cash flow (SeekingAlpha.com)

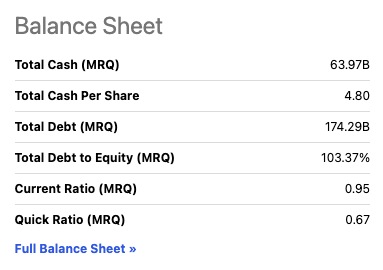

Examining the company’s balance sheet, we observe a total debt-to-equity ratio of 103.37%. This indicates a relatively high level of debt compared to equity. Additionally, if we consider the quick ratio, it stands at 0.67. This figure suggests that the company may face challenges in meeting its short-term obligations with its current liquid assets, signalling a potential liquidity concern.

Balance sheet (SeekingAlpha.com)

Valuation

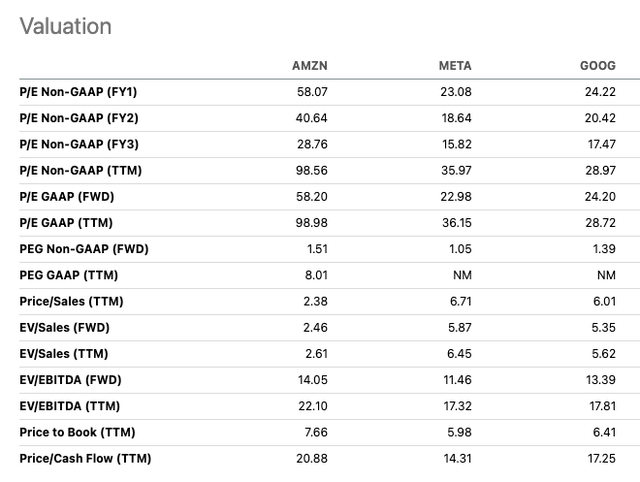

Regarding its valuation, Amazon’s stock price has experienced a significant surge, with a year-to-date increase of 46.77%, all while maintaining high valuation multiples. Investing in Amazon is a long-term endeavour. Despite the boost from the entrance of AI into the market, Amazon continues to allocate substantial capital expenditure. Moreover, even if the company were to triple its profits in the near term, the valuations still appear unattractive. This is a stock suitable for those who are not easily swayed by trending news but are rather focused on the company’s long-term potential. When comparing it to the world’s largest internet companies, such as Meta (META) and Google (GOOG), Amazon may seem less attractive unless you take into account its sales-related metrics, including a price-to-sales metric of 2.38 and an EV-to-sales ratio of 2.61.

Relative peer analysis (SeekingAlpha.com)

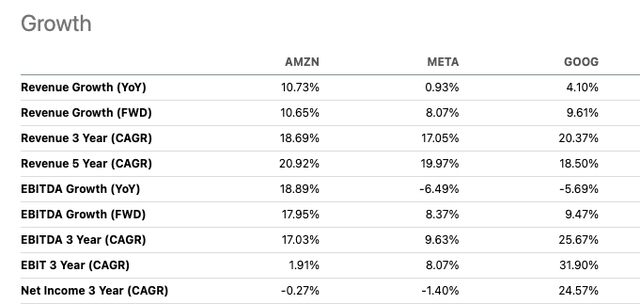

When we examine the company’s year-over-year (YoY) growth of 10.37%, Amazon outperforms both Meta and Google. Moreover, Amazon’s five-year CAGR of 20.92% surpasses that of its peers. Notably, its EBITDA growth YoY stands at an impressive 18.89%, in stark contrast to its peers who have reported negative earnings in this regard. However, it’s essential to acknowledge that Amazon’s net income shows the least appealing performance, with a three-year CAGR of negative 0.27%.

Growth compared to peers (SeekingAlpha.com)

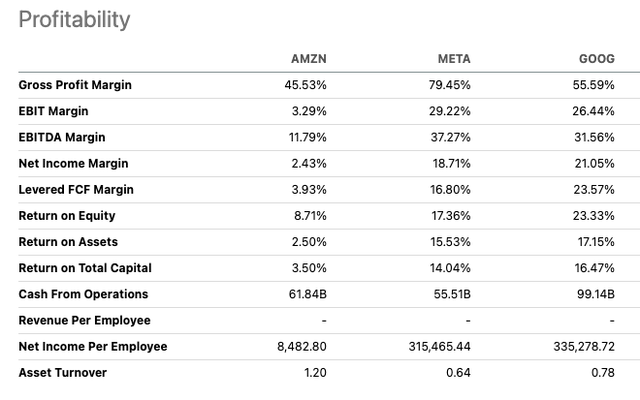

A continual source of worry for investors pertains to Amazon’s modest gross profit margin, standing at 45.53%. This figure falls short of what its industry peers achieve. Another cause for concern is the company’s EBITDA margin, which registers at a relatively low 11.79%. With intensifying competition, particularly in the e-commerce segment, there’s a heightened risk that these factors could exert further downward pressure on the company’s financial performance.

Profit versus peers (SeekingAlpha.com)

Risks

Amazon has recently garnered attention due to its substantial size and influence, which have raised concerns about its adverse effects on market competition and suspicions of monopolistic practices. While it’s improbable that the lawsuit will significantly affect the company’s operations, it’s wise to exercise caution in light of heightened regulatory scrutiny and antitrust apprehensions. Furthermore, Amazon’s rapid foray into diverse sectors has brought about heightened competition and the risk of potential overextension. Notably, tech giants like Microsoft and Alphabet have assumed significant roles in the AI industry, potentially affecting Amazon’s overall business performance and the returns on its investments.

Final thoughts

Amazon stands as a formidable presence in the realms of the internet, e-commerce, and retail. It perseveres in pouring substantial financial resources into its enterprise. We confront a company that commands one of the globe’s most substantial revenues, yet it is yet to furnish investors with gratifying bottom-line outcomes. I believe that a company eager to channel investments into its own growth rather than catering solely to short-term investor interests holds significant potential for long-term rewards. Hence, investors with a steadfast focus on the future may well consider adopting a bullish stance on this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.