Summary:

- Amazon’s aggressive AI and cloud expansion in 2024, including a $10 billion investment in Ohio, strengthens its long-term growth prospects.

- Financials show robust performance, with revenue up 11% to $158.9 billion and operating income up 56% to $17.4 billion.

- Valuation metrics indicate AMZN is significantly overvalued compared to both retail and tech sector peers, suggesting a “hold” stance.

- Technical analysis points to a potential pullback to $189, making it prudent to wait for a more attractive entry point.

hapabapa

Amazon (NASDAQ:AMZN) (NEOE:AMZN:CA) has continued its aggressive expansion into artificial intelligence and cloud technology throughout 2024. In addition, AMZN, which is also working to improve customer experience by using AI in e-commerce and retail, also looks to have very good financials. So why am I saying “hold” and not “buy”? I explain it in detail in this article.

What is AMZN?

AMZN is a multinational technology and e-commerce giant founded in 1994. Initially, it entered the industry with a retail mentality, but it has grown into a diversified company operating in sectors such as cloud computing and artificial intelligence (AI). Its flagship e-commerce platform offers a variety of products and services, while its cloud computing division, Amazon Web Services (AWS) is one of the global leaders in AI solutions. As many people experienced it, AMZN is known for its customer-centric approach. Right now, it started to become a major player in shaping the future of emerging AI-focused services.

Business Developments

AMZN continued to focus on artificial intelligence and machine learning in 2024. The company added new investments to its investments in artificial intelligence technologies. AMZN, which also developed integrations in addition to investments, integrated the Rufus shopping assistant and AI shopping guide into its shopping application. In this way, it is aimed to make customers’ shopping processes more personalized. AMZN’s sales are expected to increase with a personalized and interactive application.

I mentioned that AMZN continues to invest. One of the largest of these investments is an additional $10 billion investment in Ohio’s data center infrastructure to grow its AI and cloud footprint. With this expansion, AMZN aims to increase its data center capacity, create a major technology hub in Ohio and therefore hundreds of jobs. I believe that this move by AMZN will strengthen its position in the emerging AI sector and add value to its stock, especially in the medium and long term.

AMZN’s cloud computing service AWS in particular has seen very good growth in the third quarter of 2024. Revenue from AWS increased by 19.1% to $27.5 billion. This growth was actually an expected development. Because in this period when the AI sector is developing, there is nothing more natural than an increase in demand for cloud services like AWS. Therefore, we can say that as the AI sector grows and develops, the demand for AMZN’s products will also increase.

There have been improvements not only on the technology side, but also on the retail side, where AMZN originated. AMZN has expanded its offerings for Prime members to include unlimited grocery delivery and fuel savings. It has also improved delivery times by 25% annually on the retail side. These logistics capabilities will increase AMZN’s delivery times, improving customer satisfaction.

Speaking of delivery times, AMZN has optimized its delivery routes in the most efficient way by getting help from the AI sector. The company’s use of AI at every point seems to be significantly increasing business efficiency.

Financial Analysis

Revenue

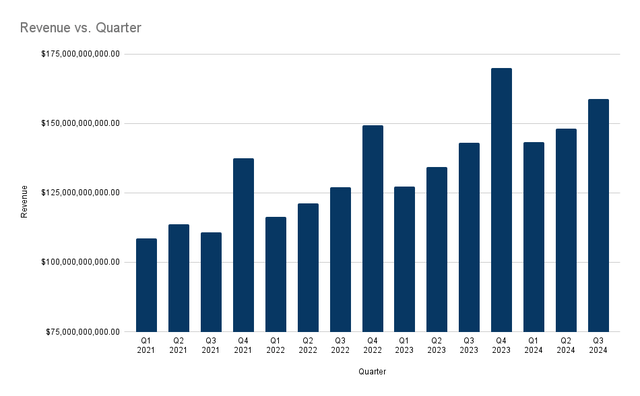

AMZN’s revenue increased to $158.9 billion in the latest quarter, an 11% increase compared to the same period last year. Breaking down this growth by segment provides more detailed information. North America segment sales increased 9% to $95.5 billion. International segment sales increased 12% to $35.9 billion. Finally, AWS segment sales increased as I told in earlier paragraphs 19% to $27.5 billion.

Image created by Yavuz Akbay with data from TradingView

While doing my quantitative analysis, the pattern in the revenue graph since 2021 caught my attention. When this pattern is observed, it is seen that the revenue in the 4th quarter of each year is much higher than the other quarters of the year. When the average of the first 3 quarters is taken and the deviation of the last quarter from this average is calculated, an average of 24.22% deviation occurs each year.

In addition, an average of 20.06% increase is detected in revenue from the 3rd quarter to the 4th quarter each year. Therefore, according to this pattern, I expect the revenue in the next quarter to be between $190 billion and $197 billion.

Profitability

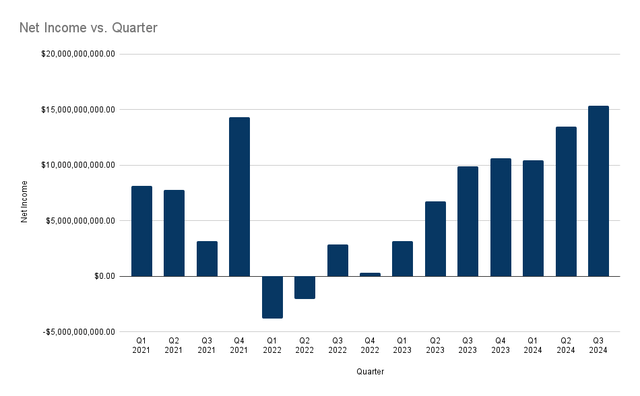

The company’s profitability also showed signs of significant improvement. Operating income was reported at $17.4 billion, representing excellent growth, up 56% from $11.2 billion in the same period in 2023. Net income was $15.3 billion in the last quarter. I would like to talk about net income in a little more detail.

Image created by Yavuz Akbay with data from TradingView

Net income had gone negative during the COVID period. After turning positive again in the 3rd quarter of 2022, it has caught a perfect upward trend, especially after 2023 and each quarter has always been higher than the previous quarter (except for the first quarter of 2024). Plus, the profit margin improved to 9.6% up from 6.9% in the same quarter last year, which is a really good sign for the stock. Therefore, I can say that AMZN manages its income and expenses perfectly.

In addition to the financials, AMZN’s advertising business also grew very well, generating 19% year-over-year growth on ad sales.

Valuation Ratios

AMZN is probably one of the most difficult companies to value. The biggest reason for this is that the company operates in both the retail and technology sectors. Therefore, especially in comparative analyses, a stock can be very expensive in one sector and very cheap in another. Now I will analyze this issue in depth.

Forward P/E Ratio

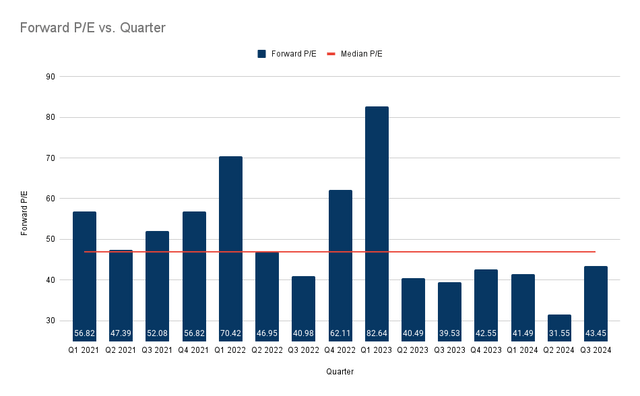

I will first analyze AMZN’s historical forward P/E ratio to gauge whether the company has been historically overpriced.

Image created by Yavuz Akbay with data from GuruFocus

When looking at AMZN’s forward P/E values historically, the median is calculated as 46.95. Since the historical high is 82.64 and the low is 31.55, the P/E has a range of 51.09 points. I think it is reasonable to consider deviations from the median above 10% of this range as significant. Considering that the current forward P/E value is 43.45, which is 8.06% below the median, no significant deviation is detected. Therefore, it is possible to say that AMZN is historically valued at a discount. So what is the situation compared to its substitutes?

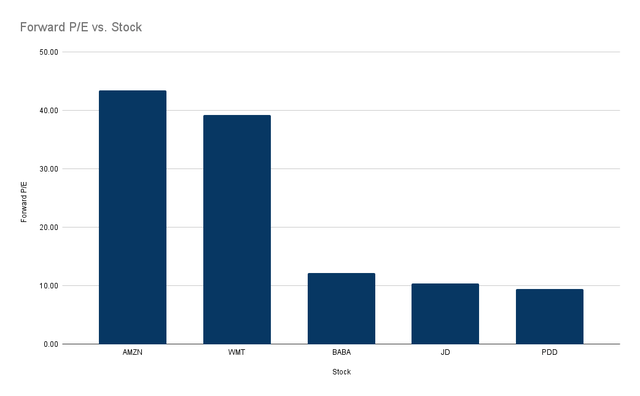

AMZN is an e-commerce and retail company by its establishment. Therefore, it is necessary to first interpret it by looking at its competitors in this sector. AMZN’s competitors in this sector were selected as Alibaba Group Holding (BABA), PDD Holdings (PDD), JD.com (JD) and Walmart (WMT).

Image created by Yavuz Akbay with data from Seeking Alpha

When the forward P/E average of AMZN’s substitutes is taken, the value is calculated as 17.79. We know that AMZN’s P/E ratio is 43.45. Therefore, as an e-commerce and retail company, AMZN has a P/E that is extraordinarily above the sector. To be exact, 144.23%. This means that AMZN is a seriously expensive stock in this sector.

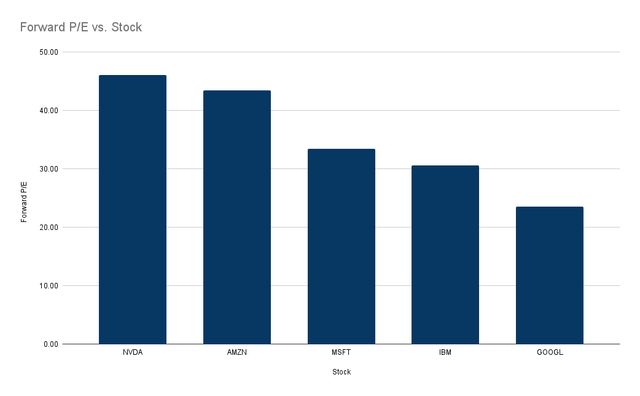

As I mentioned in the paragraph where I examined AMZN’s developments, the company is making very good developments in the field of technology. Therefore, describing this company as just a retail company can both lead to a wrong evaluation and investors opening the wrong position. Therefore, it is necessary to make a comparative analysis of AMZN with its competitors in the technology sector.

Image created by Yavuz Akbay with data from Seeking Alpha

AMZN’s industry competitors in the cloud and AI space are Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), NVIDIA Corporation (NVDA) and International Business Machines Corporation (IBM). When the average P/E of AMZN’s substitutes is calculated, the value is reached as 33.44. Considering that AMZN’s P/E value is 43.45, it is determined that AMZN is a stock that is 29.93% more expensive than its competitors in the technology sector.

As a result, when P/E analysis is done, AMZN is not a good buy as it is 144.23% more expensive than the retail sector and 29.93% more expensive than the technology sector.

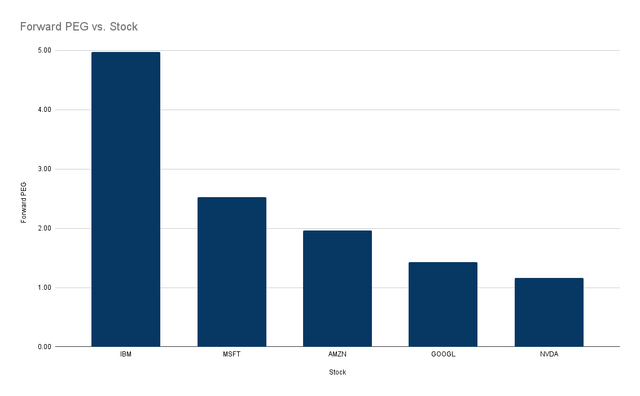

Forward PEG Ratio

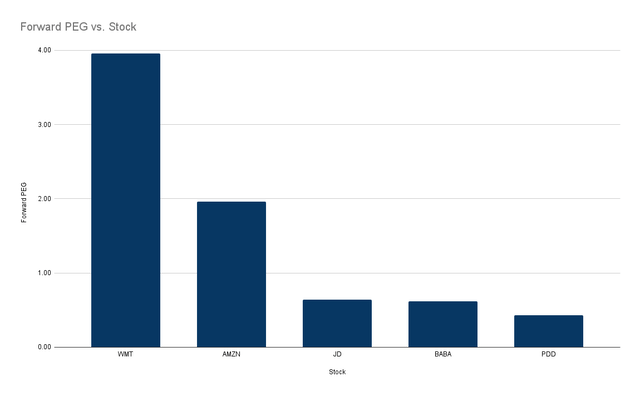

If there is a more advanced ratio than the P/E ratio, it is the PEG ratio. Since I think that the PEG ratio analysis, which also includes company growth, will give us a more comprehensive and accurate result, I want to do this analysis for AMZN and its substitutes.

Image created by Yavuz Akbay with data from Seeking Alpha

When the average PEG of AMZN’s peers in the retail sector is taken, the value is 1.41. Since AMZN’s PEG value is 1.96, which is 39% higher than this value, the PEG ratio positions AMZN as an expensive stock for the retail sector.

Image created by Yavuz Akbay with data from Seeking Alpha

Again, as in the P/E analysis, when the PEG average of AMZN’s competitors in the technology sector is taken, the value of 2.53 is reached. With 1.96, it is determined that AMZN has a PEG value of 22.52% lower than its competitors in the technology sector.

Therefore, with the PEG analysis, I determine that AMZN is an expensive company in the retail sector, as in the P/E analysis, but a discount compared to its substitutes in the technology sector.

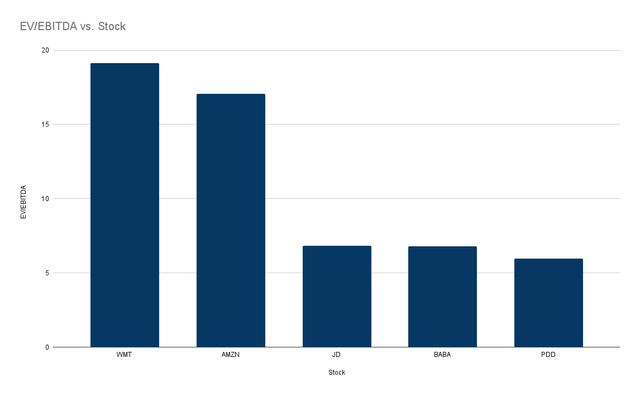

Forward EV/EBITDA

I would like to end the valuation section with the EV/EBITDA valuation.

Image created by Yavuz Akbay with data from Seeking Alpha

When the EV/EBITDA averages of AMZN’s competitors in the retail sector are calculated, the result is 9.70x. Considering that AMZN’s EV/EBITDA multiplier is 17.07x, it is clear that AMZN is a much more expensive stock than its competitors in the retail sector. Is this also the case in the technology sector?

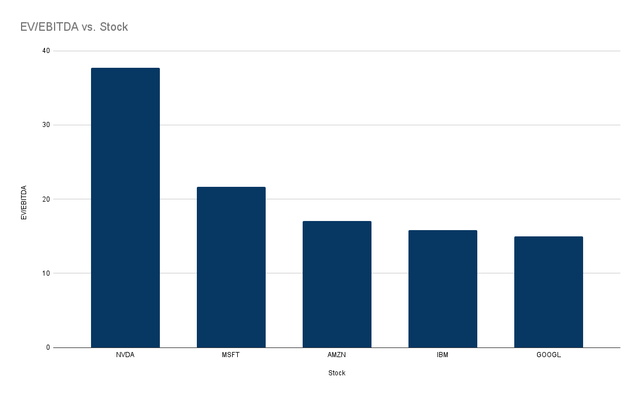

Image created by Yavuz Akbay with data from Seeking Alpha

When the EV/EBITDA averages of AMZN’s competitors in the technology sector are calculated, the value found is 22.56x. We know that it is ideal for companies to have an EV/EBITDA multiplier below 10x, but multipliers are generally this high in the technology sector. AMZN’s multiplier is 17.07x, which is well below this average. Therefore, AMZN’s position in the technology sector remains on the discounted side.

Valuation Conclusion

In the valuations, we see that AMZN is expensive on one hand and discounted on the other. So which one should we take into consideration to what extent? If you recall, I divided AMZN’s revenue into segments in the previous section. In this way, it is determined that 82.69% of AMZN’s total revenue comes from e-commerce and retail, and 17.30% from technology. By giving weights to each valuation method in this ratio, I determined the real values of the valuations.

AMZN’s sector weightings show that its P/E ratio is 124.33% expensive, its PEG ratio is 28.24% expensive and its EV/EBITDA is 58.55% expensive. Therefore, while both business development and financials suggest that AMZN is a company that will grow very well in the long term, valuation ratios unfortunately indicate that AMZN is not a good buy at the moment.

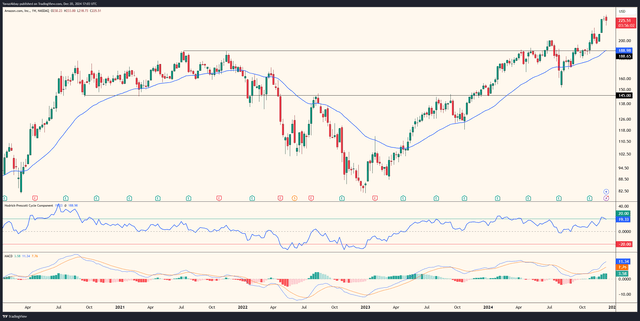

Technical Analysis

When analyzing AMZN technically, I try to use both the price action method and indicators. The price action method includes using support and resistance to determine investment points and using Fibonacci retracement to determine target. I generally use indicators to identify trend, overbought/oversold areas and momentum.

AMZN has been above the Hodrick-Prescott filter since the first quarter of 2023. AMZN continued its bull run by gaining support from this filter twice and rose to the current level of $225. In general, 20% positive and negative divergence is detected from the HP filter. After diverging to this extent, the stock tends to converge to the HP filter. Therefore, I currently expect AMZN to converge to the filter, which is at least at $189. This level is also the price action support level.

I can first support this expectation with the momentum decline in the MACD indicator. AMZN, whose momentum has started to decrease on a weekly basis, is prone to a death cross in the coming weeks according to the MACD indicator.

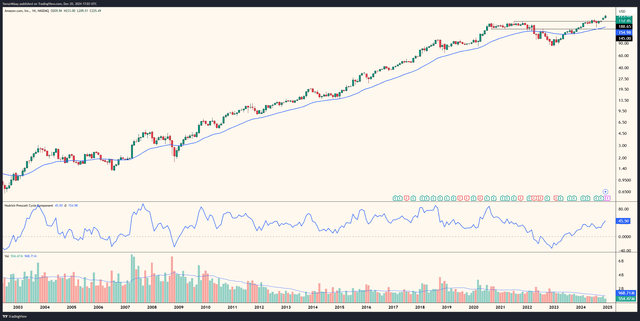

When analyzed over a longer period of time on a monthly basis, it is seen that AMZN has been above the HP filter since 2009 and has only fallen below this filter during the COVID period. It is also seen that the volume has decreased significantly during this time period. AMZN, which currently has a 20-month average trading volume of $968.71M, has never encountered such a low 20-month average in history. This is an indicator that supports AMZN’s potential for correction.

Therefore, AMZN technically has the potential for a correction to $189. If AMZN can hold on to this level after the correction, it will remain above the HP filter and continue its run. Since its business developments and financials are positive, I think it will maintain its upward trend in the long term.

Risks and Challenges

Most significant risk that could weaken my analysis is the unpredictability of macroeconomic conditions, which could reduce consumer spending and negatively impact Amazon’s e-commerce revenue. We have experienced this particularly recently due to the Fed’s statements. The macroeconomic environment could push AMZN below its expected support level, disrupting its medium- and long-term uptrend and causing it to decline. In addition, regulatory regulations due to various copyright violations in the nascent AI sector could reduce demand for AMZN’s cloud systems, threatening its profitability.

There are also risks that could push AMZN higher in the opposite direction. Although valuations show a very expensive AMZN, a higher than expected FED interest rate hike and a decrease in inflation projections, contrary to expectations, could cause indexes such as the Dow Jones or S&P500 to rise, which could also affect AMZN.

Conclusion

As a result, AMZN is showing strong growth prospects in terms of business development with its continued investments in cloud computing and operational efficiencies. The company’s financial performance is very solid, its profitability is improving quarter over quarter, and its technological advances are supporting the long-term growth of these financials. However, valuation metrics show that AMZN is significantly more expensive than its peers in the retail and technology sectors. Additionally, technical indicators that I trust point to a possible pullback to the $189 support level. Given these factors, I believe a “hold” stance is the most rational thing to do. AMZN’s long-term growth story remains. But waiting for a more attractive valuation or a confirmed technical rally would definitely provide a better entry point for investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.