Summary:

- AWS’s Trainium3 chips and Project Rainier supercomputer position Amazon as a major AI compute leader, challenging Nvidia while advancing Western AI leadership.

- Despite long-term AI-driven growth, Amazon’s current valuation reflects over-optimism. Near-term EV-to-EBITDA compression and moderate CAGR pose risks.

- AWS may eventually outpace Amazon’s e-commerce revenues, but volatility and AI investment risks warrant a Hold rating until valuation aligns with growth potential.

gremlin/E+ via Getty Images

In my last thesis on Amazon (NASDAQ:AMZN) stock, I cautioned investors that it was overvalued, yet it has rallied a further 10.5% since that article. I simply consider this further overvaluation—however, the increased positive sentiment indicates rational excitement (leading to an irrational price) surrounding certain new updates. The company’s Trainium3 and supercomputer initiatives are positioning AWS as a major player in the AI compute market—these product announcements are a key indicator of the company’s continued long-term shift into high-performance computing services and away from traditional e-commerce. Given the company’s rapid progress in and heavy focus on AI, I believe that, in a few decades’ time, AWS revenues may surpass Amazon’s traditional e-commerce revenues.

Trainium3 Chip & Macro Analysis

Amazon is being very shrewd by investing in Trainium, its AI chip family specifically designed to accelerate deep learning training and inference tasks. Trainium3 is projected to deliver four times the performance of its predecessor called Trainium2, leading to much faster large language model power scaling. AWS announced the product at re:Invent a couple of weeks ago. This is big news, and it represents a leap forward for both Amazon and the AI industry. AWS claims that Trainium3 has 40% better energy efficiency compared to Trainium2, far outpowering traditional GPUs like those from Nvidia (NVDA).

AWS is clearly attempting to diversify the AI compute market through its unique chips like Trainium3. Amazon, Meta (META), Google (GOOGL) (GOOG), Microsoft (MSFT) and others are making unique, bold steps toward their own distinct uses for artificial superintelligence. Moreover, we’re seeing a more interoperable and collaborative approach between Western Big Tech, including the open-source approach of Meta, the cross-model applicability of Amazon’s chips, and Microsoft’s partnerships with multiple firms helping to commercialize and broaden the scope of Western AI leadership. Indeed, it is fair to say that China, Russia, and Iran’s prominence in AI models is lagging the West’s technological advantage. However, data shows that from the end of 2023 China has at least 130 large language models, accounting for 40 percent of the global total and putting the country just behind the U.S.’s 50% share.

Zuckerburg has mentioned that he isn’t sure the large gap between the West and China in AI will last, but that instead the West can keep a slim advantage to establish global leadership and direction. I agree China may catch up, but we should ensure that China’s leadership of the Eastern axis is cooperative with the West’s global goals before giving too much free power away to the country related to AI, especially if China’s geopolitical interests conflict with Western democratic perspectives. The current military drills China is performing around Taiwan acts as evidence for why the West may be wise not to be too open-source related to AI access for China.

Amazon’s Trainium3 Neuron software development kit supports over 100,000 Hugging Face models, which includes Meta’s Llama family. However, AWS Trainium chips are currently not directly exported to China due to regulatory constraints. Even so, Chinese firms have been circumventing U.S. export restrictions by accessing advanced AI chips and models through cloud services. The AI arms race is at the center of global geopolitics with TSMC (TSM) in Taiwan, and one thing is for certain, the demand for AI does not appear to be slowing down and will likely be followed by more widespread, commercial robotics. This leaves me highly bullish on AWS for the long term, and Trainium3 is one big step closer to Western artificial superintelligence.

Project Rainier Supercomputer

Amazon has also recently outlined plans to build a supercomputer through Project Rainier, setting the stage for Amazon to house one of the largest AI compute clusters globally. It will utilize hundreds of thousands of Amazon’s custom Trainium chips. To do this, Amazon has partnered with AI startup Anthropic, investing $8 billion in the company to leverage this supercomputer for training advanced AI models. Through this initiative, Amazon is planning to compete with Nvidia by offering significant cost savings compared to traditional GPU-based solutions, positioning AWS as a competitive alternative in the AI chip market—this will likely reduce reliance on Nvidia for AI chips over time. And Amazon isn’t stopping there—it is developing Project Ceiba in partnership with Nvidia for a supercomputer utilizing over 20,000 Nvidia Blackwell GPUs to diversify its offerings and continue its collaboration with Western AI leaders.

In terms of competition, my comparative analysis shows three major rivals. Firstly, Nvidia’s collaboration with xAI has resulted in the Colossus supercomputer—this uses 100,000 Nvidia Hopper GPUs and is currently one of the largest AI supercomputers across the globe. Secondly, Microsoft and OpenAI are planning a $100 billion supercomputer known as Stargate, which aims to significantly exceed current capabilities by 2028. Thirdly, Meta is aiming for a compute power equivalent to 600,000 Nvidia H100 GPUs by the end of 2024. It’s a fair conclusion that the horses in this race are moving in tandem, momentarily superseding each other and then falling behind. My favored perspective is that the group is moving together, leading the West, and the world, to an AI age built on automation, robotics, and artificial superintelligence.

Valuation Update

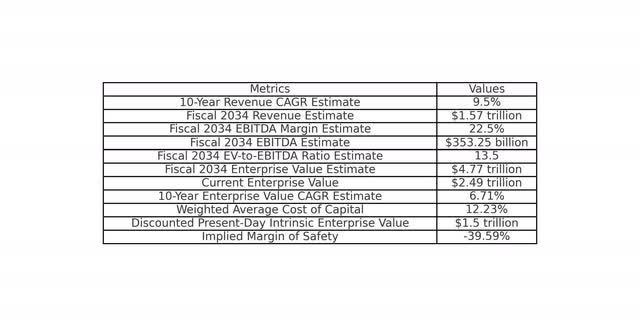

In my previous Amazon thesis, I outlined a comprehensive valuation model, which hasn’t much changed, though the stock has become further overvalued.

Amazon Valuation (Author’s Model)

The company has a historical 10-year annual revenue growth rate of 23.1%, a five-year annual revenue growth rate of 19.5%, and a one-year revenue growth rate of 8.9%, meaning my future 10-year annual revenue growth estimate of 9.5% is conservatively optimistic to give the company’s maturity.

The company has a five-year average EBITDA margin of 12.92% compared to a trailing 12-month EBITDA margin of 17.99%. I expect further margin expansion moving forward related to AI and automation efficiencies compounding.

As the company’s growth slows and EBITDA margin expands, the inevitable likelihood is a contracting EV-to-EBITDA ratio. The company’s current trailing 12-month EV-to-EBITDA ratio is 22.33 compared to 26.87 as a five-year average.

Amazon’s weighted average cost of capital is 12.23% with an equity weight of 94.71% and a debt weight of 5.29% (with equity costing 12.83% and debt at 1.57% after tax). This is what I have used for my discount rate.

Given the results of my model, I consider this a poor time to initiate a position on Amazon, despite the robust trajectory the company is on related to AI with its Trainium3 chip and Project Rainier supercomputer. This is the primary risk to be aware of as an Amazon investor at this time—near-term volatility due to overvaluation and moderate long-term CAGRs if buying at the present price.

Risks

While unlikely, a slowdown in the demand for AI or a moderation in the trend of AI adoption from both enterprises and individuals could lead to Amazon left with an over-investment which doesn’t yield the expected returns over the long term. Such a heavy focus on becoming an AI superpower could also lead to reduced returns from its e-commerce operations, for example if it loses focus on dominating in Latin America and competing with MercadoLibre (MELI) aggressively. That said, I do think AI is the bigger opportunity, and I am bullish on the long-term growth trend AWS is oriented for, but it will take ongoing sensitivity analysis from management to ensure that capital is being deployed effectively for returns. In addition, for most companies, AI investments are considered discretionary, which leads to cyclical dynamics in AWS’s revenues aligning with recessions and economic crises. As a result, investors should prepare for volatility as a common trait of Amazon’s stock experience (this can be capitalized on, as well as mitigated against, according to the valuation at the time).

Conclusion: Hold

I’m bullish on Amazon in general, but at the current valuation, investors will find better deals elsewhere. This is a company that will likely continue to be an AI pioneer, but it faces immense competition and must strike a delicate balance between investments in supercomputers and advanced chips and returns on these investments. Once the company’s valuation pulls back, I’ll be increasing my stake. I’m a confident Amazon investor based on the culture, the management, the board, the products, and the vision.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.