Summary:

- Amazon, one of our top BUYs for 2023, has flourished on a YTD basis, but we are now revising our rating to a HOLD.

- We pick out some of the important narratives that could weigh on AMZN stock’s movements.

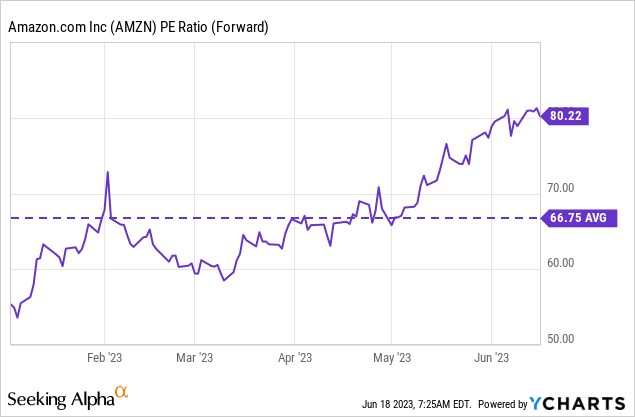

- The stock’s re-rating has been quite pronounced this year, with valuations now trading well above the historical average.

- We think the existing short-term trend could do with a pause and don’t believe the risk-reward is favorable for a long position at this juncture.

FinkAvenue

Introduction

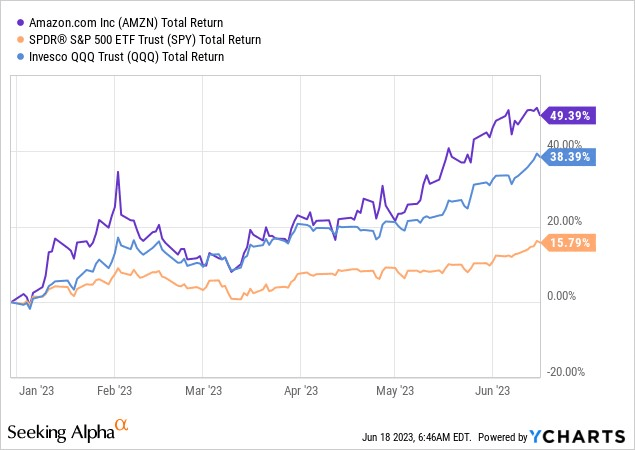

In Dec-2022, when the stock of Amazon (NASDAQ:AMZN) was going through a slump, we had crafted a long thesis, highlighting how the stock could be a rewarding pick for investors in 2023. Now, with almost half the year wrapped up, it’s fair to say that AMZN has proven to be one of the mega-cap stories of the year, notching up impressive gains of around 50% and comfortably outperforming both the key benchmarks, especially the S&P 500.

YCharts

Key Metrics, And What Should Investors Consider Going Forward?

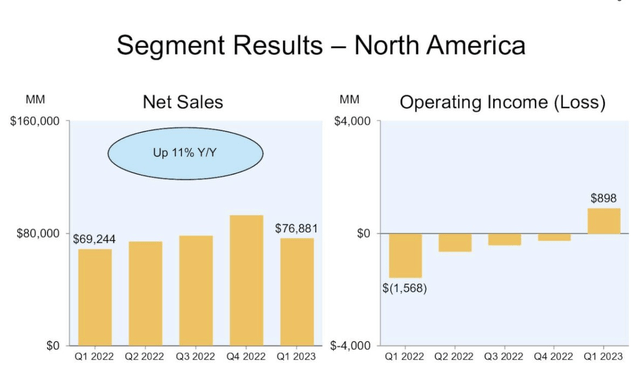

Whilst the excitement on the street has been primarily centered around Amazon’s AI linkages, it’s important to also not disregard underlying trends within the North American (NA) business which still accounts for the largest chunk of group revenue (~60%).

NA, which had been facing operating challenges since Q4-21, finally ended up delivering a positive operating margin within the low-single-digit terrain in Q1. Investors can expect further improvements on the operating margin front (there is ample runway here, as margins of this division are still well below the pre-pandemic range of 4-6%) as AMZN does a better job of leveraging the fixed costs associated with the existing fulfillment network, even as they go slow on network-related CAPEX.

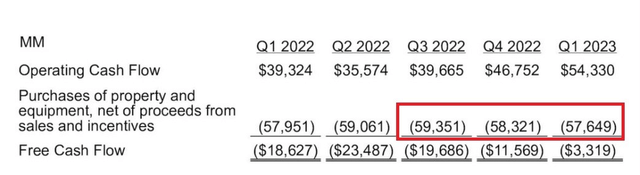

On a TTM (Trailing-twelve-month) basis note that group CAPEX trends have been drifting lower (despite some uplift in investments in large language models and generative AI) since Q3-22, and by the end of FY23, the overall CAPEX figure will likely be lower than last year’s spend of$59bn.

In recent months, Amazon has also been tilting its fulfillment network footprint from a national to a regional one (these 8 inter-connected regional centers will still be able to ship all over the nation if required). With a pro-regional network approach, fulfillment distances will likely be shorter, resulting in lower costs of services and better speeds.

One other underappreciated contributor to not just North America, but the International division’s prospects as well, is the advertising side of the business, where Amazon offers ad services via video ads, sponsored ads, etc. Prima facie, given a subdued macro-economic environment, one would ordinarily think that advertising may not be too compelling a proposition in attracting ample dollars. However, note that for two quarters running, AMZN has been able to consistently grow this business at 23% YoY!

AMZN’s ad business will have a lot of takers, unlike the ad offerings of traditional retailers, as the former is better positioned to leverage its machine learning algorithms and ensure more effective conversions from your standard customer search. The level of reach and the eyeballs you could attract is also a lot more on an online e-commerce platform. What’s also key is that there are still quite a few untapped levers (beyond e-commerce) through which this advertising business could expand. As things stand, avenues such as video, Amazon Fresh, Amazon Music, etc. are yet to be meaningfully used to place ads.

Needless to say, a greater chunk of advertising in Amazon’s overall sales mix, will also do a world of good for the company’s FCF trends, as this is inherently not a CAPEX-heavy business.

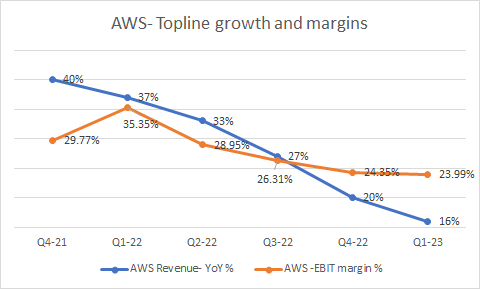

Then AWS (Amazon Web Services), the cardinal driver of AMZN’s operating profit will likely continue to witness short-term challenges, as cloud optimization trends continue to afflict the industry, and the company continues to make investments to beef its capabilities in this space.

Earnings presentations

We’ve already seen the run-rate on the AWS topline sliding for six straight quarters now, and we wouldn’t be surprised to see it persist in Q2 as well. AMZN management already noted that April’s topline was 0.5% weaker than Q1, and considering the relatively steep base effect of Q2-22 where AWS witnessed 33% annual growth, we think it would be something of a challenge to arrest the declining trend in revenue growth.

What could perhaps negate, or even reverse the declining revenue trends for AWS, is the growing appetite for low-cost machine learning (ML) training infrastructure in a parsimonious tech budget environment as we have now. Over the years, AMZN has been making investments in developing its own brand of specialized chips and currently has some rather competitive offerings both for the training phase (Trainium), as well as the inference phase (Inferentia). Trainium-based instances reportedly generate 1.4x the speed of other GPU-based instances, and crucially do so at just 0.7x the cost! Meanwhile, the latest version of the Inferentia chip offers latency levels that are 10x lower than the version launched in 2019 (and 4x higher throughput).

Is Amazon Overvalued Now?

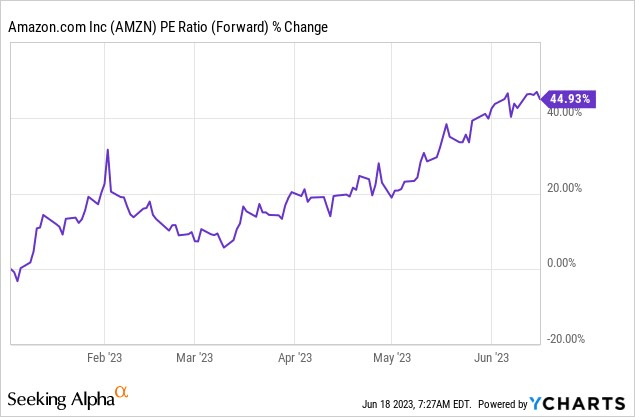

One of the reasons why we liked Amazon back in December was the attractive forward valuation differential that one could capitalize on, relative to its historical range;, back then, the stock was priced at around 50x forward P/E, a 75% discount over its long-term average.

Now, the valuation dynamics have reversed completely and one does wonder if investors will get ample bang for buck at these multiples, even if one accounts for the burgeoning AI theme, which no-doubt recently stimulated some degree of re-rating in the stock.

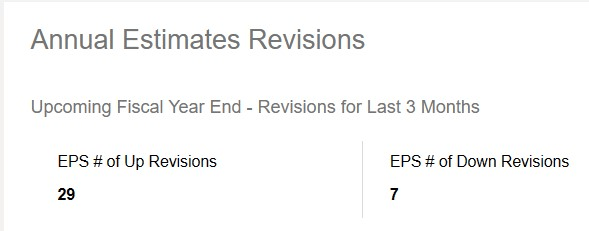

We believe it would be useful to track sell-side positioning as these guys play a key role in driving fund flows towards and away from stock (see SOFI’s volatile performance off late). When it comes to AMZN, it’s worth noting that these guys haven’t been sitting still, and a large chunk of the sell-side club has already lifted estimates for the coming year.

For context, there are 48 analysts who provide number estimates on the AMZN stock, and over the last 3 months, 36 of those analysts have changed their estimates for the current year. Interestingly enough, over 80% of those 36 changes were upward revisions, and only 20% were to the downside.

Seeking Alpha

Typically, a boost in the forward EPS ought to have made the forward P/E look more attractive, but such has been the strength in AMZN’s uptrend this year, that we’re now faced with an unappealing valuation backdrop with the forward P/E re-rating by over 45% on a YTD basis.

YCharts

All in all, there’s little doubt that AMZN is priced exorbitantly, trading at 80x forward P/E, a 20% premium over its long-term average multiple.

YCharts

Closing Thoughts – Is The AMZN Stock Likely To Go Higher?

Firstly, it’s worth pondering if the Amazon stock could benefit from any rotation momentum for those seeking value opportunities within either the internet space or the retail space. Well, both the charts below suggest that is unlikely to be the case with AMZN trading above the mid-point of its range, relative to flagship ETFs from the Internet and Retail avenues.

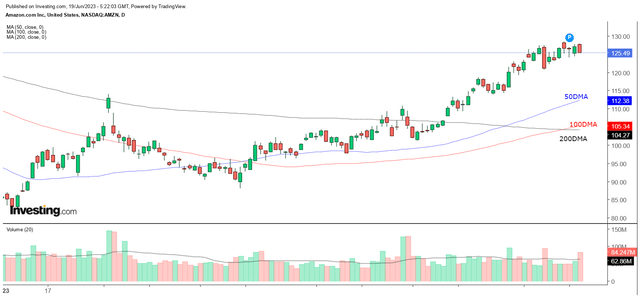

Admittedly, momentum-based investors will no doubt be enthused to discover the bullish hues of the Amazon stock, as it currently trades well above its 3 key moving averages (50,100, and 200).

However, we would also urge investors to consider the dynamics in play within the larger time frame weekly chart, which may prompt some caution at this juncture.

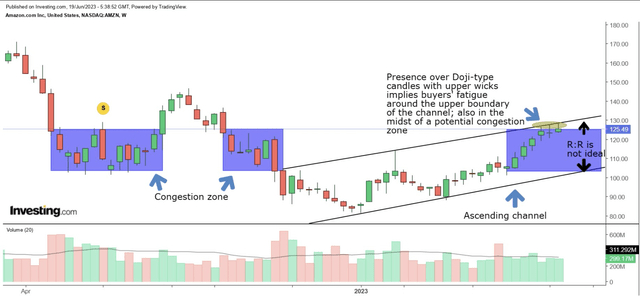

What we can see is that the stock has recently been trending up within an ascending channel, and over the last three weeks it has been struggling to break past the upper boundary of this channel. Notice also the doji-type candles (area highlighted in yellow) over the last 3 weeks, indicating some degree of indecision and fatigue amongst the buyers.

If you dial the clock back to May-July 2022 (area highlighted in purple), or Sep-Oct 2022, you’ll find that this current sub $125 zone has previously proved to be an area of congestion where the stock typically chops around, rather than move fluently in one direction.

Given that we’ve seen 7 straight weeks of green bodies candles, it’s difficult to expect further upside in the short-term until the stock takes a pause and consolidates; or better still, indulges in a pullback to lower levels within the congestion zone (or perhaps even drift closer to the lower boundary of the channel). The stock may also well break past the upper boundary of the channel, but we think investors would be better served by getting in at lower levels as the short-term risk-reward is currently not too favorable.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.