Summary:

- In the coming weeks, I plan on boosting my position in Amazon by around 20%.

- Amazon’s net sales, diluted EPS, and operating cash flow each surged higher in Q2.

- The company’s net cash position increased again to close out the second quarter.

- Shares of Amazon appear to be trading 40% below fair value.

- The tech giant could realistically double by the end of 2026.

An Amazon delivery truck driver on their route.

400tmax/iStock Unreleased via Getty Images

Although I’m mostly a dividend growth investor, I’m not opposed to owning qualitative growth stocks, either. As I have recounted in the past, this is because I presumably have time on my side at 27 years of age.

To be sure, qualitative is a subjective term. My definition is a business that consistently grows its net sales/EPS/operating cash flow over time. A solidly investment-grade balance sheet also encompasses my definition. Preferably, this business should also be a clear industry leader.

On the growth side of the equation, I’m looking for companies with observable growth tailwinds on their side. That’s because such elements can keep pushing net sales/EPS/operating cash flow higher, which can drive outsized total returns. This is especially the case when the underlying stock of a business is a bargain.

This brings me to the focus of today’s article, Amazon (NASDAQ:AMZN). When I last covered the stock with a strong buy rating in July, I appreciated its numerous growth catalysts. I also liked the improvement in free cash flow and the strengthening balance sheet. Finally, shares appeared to be deeply discounted.

After Amazon’s second quarter results on Aug. 1st, I’m maintaining my strong buy rating. Even though the company’s results were mixed, it still performed quite well. Amazon also has adequate room for future growth. The company’s free cash flow and net cash/marketable securities position improved again. My slightly higher fair value estimate coupled with a lower share price means shares remain quite undervalued.

No End In Sight To Amazon’s Robust Growth

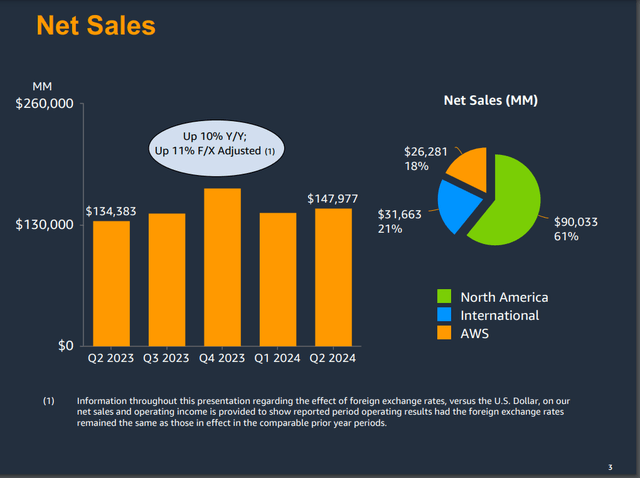

Amazon Q2 2024 Earnings Presentation

After five straight quarters of posting double-beats, Amazon fell just short on net sales for the second quarter. The company’s net sales jumped by 10.1% year-over-year to $148 billion in the quarter. Adjusting for unfavorable foreign currency translation, constant currency net sales were up 11% during the quarter. For context, this was $780 million less than Seeking Alpha’s analyst consensus for the quarter.

Still, Amazon is a business that’s executing exceptionally well. Each aspect of the company recorded healthy growth in the second quarter.

Unsurprisingly, the majority of Amazon’s topline growth was driven by its North America segment during the second quarter. Segment revenue rose by 9.1% over the year-ago period to top $90 billion for the quarter. Amazon’s focus on providing the best price, selection, and convenience for customers continued to pay dividends. That pushed unit sales, advertising sales, and subscription services sales higher in the quarter.

Adjusting for the 100 basis point benefit of Leap Day during the first quarter, net sales growth did moderately decelerate sequentially from approximately 11%. CEO Andy Jassy noted in his opening remarks during the Q2 2024 Earnings Call that Amazon’s higher ticket items are growing faster than the industry average. However, growth is slower than is typically observed in a more robust economy, per Jassy.

Amazon’s AWS segment was the next biggest growth contributor for the company for the second quarter. The segment posted $26.3 billion in net sales, which was an 18.7% year-over-year growth rate. That represented an acceleration sequentially versus the 17.2% growth rate logged in Q1.

Greater customer usage across both generative AI and non-generative AI workloads more than offset pricing charges via long-term customer contracts. According to Jassy, this was fueled by companies turning their attention to newer initiatives and restarting/accelerating existing migrations from on-premises to the cloud.

Lastly, International segment sales increased by 6.7% over the year-ago period to $31.7 billion in the second quarter. Like the North America segment, the International segment experienced a moderation in net sales growth from 9.7% in Q1. A more cautious global consumer environment partially offset the company’s value-creation efforts.

Moving to the bottom line, Amazon’s diluted EPS surged 93.8% higher during the second quarter to $1.26. This came in $0.24 better than Seeking Alpha’s analyst consensus for the quarter.

Thanks to disciplined cost management, Amazon’s total operating expenses increased by just 5.2% to $133.3 billion in the second quarter. That prompted a 410 basis point expansion in the net profit margin to 9.1%. This is how diluted EPS growth easily exceeded net sales growth during the quarter.

In the years ahead, Amazon’s outlook for perhaps its single most important metric is encouraging: Operating cash flow per share.

The fruits of the company’s capital spending in past years lead the FAST Graphs analyst consensus to predict 38.7% growth to $11.23 in 2024. For 2025, another 18.5% increase to $13.31 is expected. In 2026, an additional 25.5% rise to $16.70 is anticipated.

Amazon’s customer-centric approach to business is impressive enough. But what makes its future even brighter is the rising share of total global e-commerce sales to total global retail shares. In 2023, e-commerce made up 19% of global retail sales. By 2027, this will expand further to nearly a quarter of global retail sales per Statista.

The long-term outlook for AWS is just as encouraging. Just as I outlined in my previous article, the vast majority of global IT spending is still on-premises. As the global lead in cloud computing, AWS is the most obvious beneficiary of this ongoing trend. Throw in that Jassy believes generative AI is still in the very early days and the future is upbeat in this aspect, too (unless otherwise sourced or hyperlinked, all details in this subhead were according to Amazon’s Q2 2024 Earnings Press Release, Amazon’s Q2 2024 Earnings Presentation, and Amazon’s Q2 2024 10-Q Filing).

The Already Amazing Balance Sheet Gets Better Each Quarter

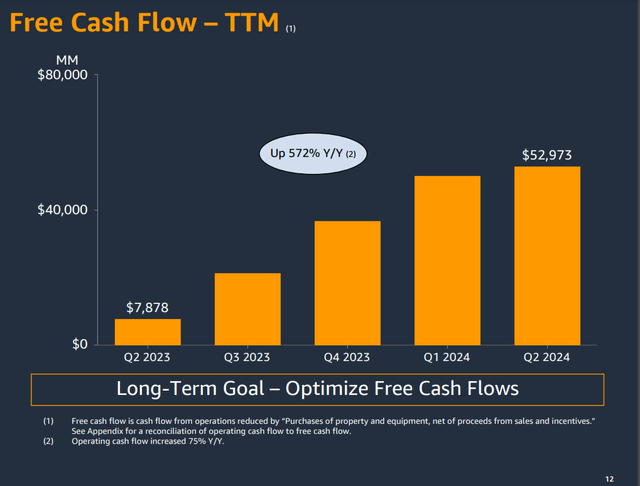

Amazon Q2 2024 Earnings Presentation

Amazon’s unbelievable uptick in its operating cash flow from its previous capex cycle is helping to push free cash flow higher. The company’s operating cash flow jumped by 74.6% year-over-year to $108 billion for the second quarter.

Along with relatively steady capex spending, this resulted in a staggering 572.4% growth rate in free cash flow to $53 billion in the second quarter.

That is also how the company’s net cash and cash equivalents/marketable securities balance improved to $34.2 billion during the quarter. Due to this net cash position, it’s also not a shock to learn that Amazon generated $940 million in net interest income through the first half of 2024.

The Dividend Kings’ Zen Research Terminal

This is why Amazon enjoys an AA credit rating from S&P on a stable outlook per The Dividend Kings’ Zen Research Terminal. That vigorous corporate credit rating implies just a half percent chance of the company filing for bankruptcy in the next 30 years.

100%+ Upside Could Be Justified Through 2026

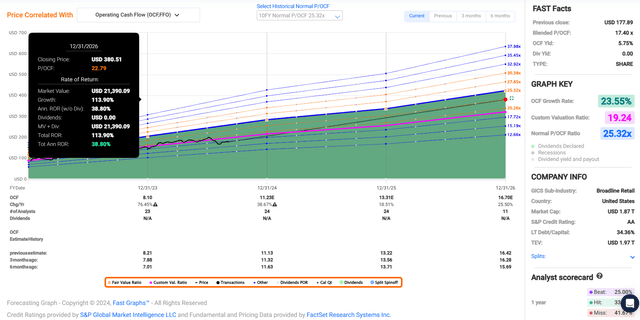

FAST Graphs, FactSet

Backed up by the fundamentals, a look at Amazon’s FAST Graphs chart reveals that its valuation is quite interesting here. The company’s current-year P/OCF ratio is 15.4, which is well below the 10-year average P/OCF ratio of 25.3.

This is even though Amazon’s 23.6% annual forward OCF per share growth outlook is comparable to its 10-year average compound annual growth rate of 29.5%. That type of growth would be formidable for even a much smaller company, which is what makes it so marvelous.

This is why I continue to believe that a reasonable P/OCF multiple remains one standard deviation under the 10-year average. That is equivalent to a 22.8 P/OCF ratio.

As things stand, the current calendar year is about 69% complete. This suggests that another 31% of 2024 and 69% of 2025 is yet to come in the next 12 months. Thus, I arrive at a forward 12-month OCF per share input of $12.68.

Using my fair value multiple, I compute a fair value of $289 a share. Compared to the $173 share price (as of September 6th, 2024), this is a 40% discount to fair value.

If Amazon matches the growth consensus and reverts to my fair value P/OCF multiple, it could have a blistering 114% upside ahead by the end of 2026. Put another way, Amazon could compound at 39% annually through 2026, and it would be 100% supported by the fundamentals.

Risks To Consider

Amazon is a world-beating business of the utmost quality. However, it still has risks to the investment thesis that should be watched over time.

Amazon continues to deliver for its clients and this is helping it to retain a 30%+ share of the global cloud market each quarter. In the second quarter, the company’s market share came in at an estimated 32%, per CRN.

The long-term risk is that AWS could fail to maintain its tremendous value proposition over time. If this happened in as competitive of an industry environment as global cloud computing, competitors could swipe share away from Amazon. That could result in a deterioration of the company’s growth prospects.

Additionally, as I highlighted in my prior article, Amazon arguably has the most customer info of any company on the planet. This positions it as the business perhaps most targeted by would-be cyber hackers.

If any major cyber breaches materialized, this could jeopardize the security of its vast databases. That could undermine customer trust in Amazon and result in sizable legal settlements against the company.

Inventory risk is one additional risk that the business faces as the world’s largest e-commerce retailer. If Amazon can’t maintain appropriate inventory levels, this could weigh on the company’s operating results. Understocking items could also hurt Amazon’s brand reputation among consumers.

Summary: Buying And Holding My Amazon Position For The Long Haul

Amazon is a top-notch company. It has catalyst after catalyst working in its favor. The company is also executing and possesses an admirable growth trajectory. Amazon’s AA-rated balance sheet is one of the best in the world, and it’s only getting stronger every quarter. The icing on the strong buy case cake is that shares look to be 40% undervalued. This could translate into shares doubling in the next two and a half years.

That’s why I hold a 2.5% stake in Amazon, and could realistically see this weight double in the next year or two. That journey to a 4% to 5% weighting on Amazon will begin with a 20% bump in my stake with additional capital deployment on my end within the next few weeks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.