Summary:

- Amazon’s subscription business is showing strong growth despite earlier concerns about market saturation.

- Year-on-year growth in the recent quarter showed a jump of 17%, which was higher than the last four quarters.

- The recurring revenue base of subscriptions is a strong bullish trend for Amazon as it allows the company to introduce new services to its customers.

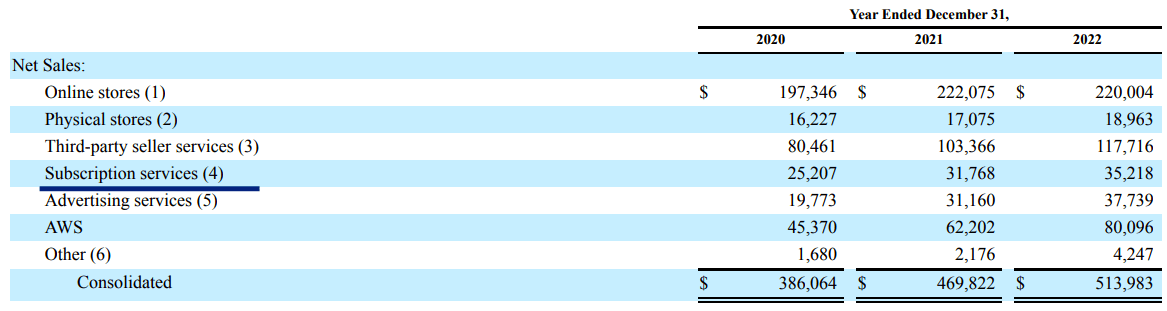

- The subscription revenue for fiscal year 2022 was $35.2 billion with a higher revenue share when compared to the overall revenue base.

- Even with a low teen growth rate, subscription revenue could hit $100 billion by the end of this decade, which makes this segment a key driver for future valuation growth.

4kodiak/iStock Unreleased via Getty Images

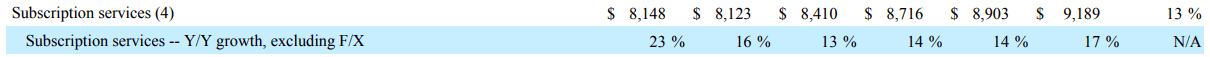

Amazon’s (NASDAQ:AMZN) investors should look closely at the steady growth rate delivered by the company’s subscription business. In the latest quarter, the company reported 17% YoY growth in the subscription business excluding F/X fluctuations. This is a faster growth rate compared to the previous four quarters. The subscription segment provides a recurring revenue base and the renewal rate for Prime membership is also quite high. This allows the company to invest in logistics, fulfillment, video streaming, and newer services.

The Subscription segment reported $35.2 billion in revenue for fiscal year 2022. Even at a low teen growth rate, this revenue base can reach $100 billion by 2030. The massive revenue base of subscription segment provides the company with a strong moat against other competitors and locks the customers within Amazon’s ecosystem of services. Comparing Amazon’s subscription business with other membership-based businesses like Costco (COST), Spotify (SPOT), and Netflix (NFLX) shows that this business will be a key growth driver for Amazon’s valuation.

Ideal business

The recurring revenue base of subscription business makes it one of the best segments for the company. There was strong doubt among analysts and investors over the impact of Prime membership hike on renewal rates. However, the recent growth numbers show that there has not been a significant negative impact on the renewal rate of Prime membership despite a big jump in fees.

Company report

Figure 1: YoY growth rates for subscription business in the last few quarters. Source: Company report

The growth numbers in recent quarters have shown that Prime membership base is quite loyal. The revenue base of this segment is over $35 billion. This allows the company to increase investment in logistics, delivery, video streaming, and other services.

Massive investment options

The subscription business provides Amazon with a virtuous cycle where a higher revenue base allows the company to increase investments which drives higher membership fees. If Amazon continues to deliver double-digit growth in this segment, we could see over half a trillion in combined revenue base in this decade. Most of this would be reinvested in building better logistics and delivery systems. It will help the company build a stronger moat around its ecommerce business and allow it to launch new services.

A large chunk would also be invested in video streaming. In the recent earnings report, the company mentioned that they have increased the video and music streaming investment to $16.6 billion in 2022 from $13 billion in 2021. With this increase, Amazon has spent 47% of its subscription revenue on streaming. Amazon is in a better position compared to other video streaming players like Netflix, Disney (DIS), Apple (AAPL), and others due to its ecommerce business which acts as an anchor service.

Future growth projection

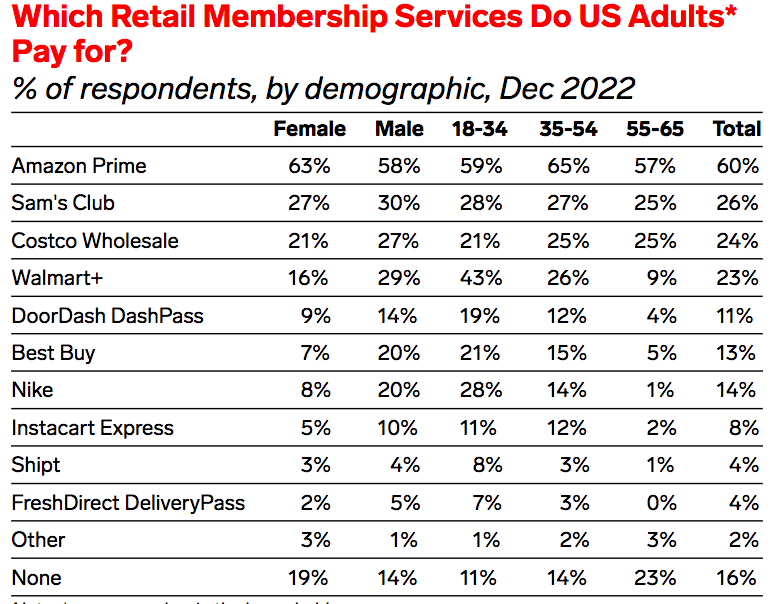

There is a lot of talk about market saturation for Prime membership. Financial Times and Insider Intelligence have mentioned that more than 60% US households already have a Prime membership. There is a very low remaining addressable market available within US. However, the company is rapidly expanding its Prime membership in international regions. It is also frontloading these benefits which allows customers to gain similar Prime services at competitive prices.

eMarketer

Figure 2: Amazon Prime membership compared with other services used by US households. Source: eMarketer

None of the competitors have a membership plan which includes video streaming, music streaming, ecommerce, and other delivery options in a single subscription. This gives Amazon a significant advantage against other companies. As mentioned above, Amazon is spending close to 50% of its subscription revenue on video and music streaming. This should allow the company to ramp up investment and spend more than other streaming players including Netflix.

Company report

Figure 3: Growth in subscription revenue in the last two years. Source: Company report

Even if the company is able to deliver low teen growth rate of 13%-15% in subscription business over the next few years, the annualized revenue should hit the $100 billion level by 2030. This is a massive number which should give the company an excellent moat and a strong valuation.

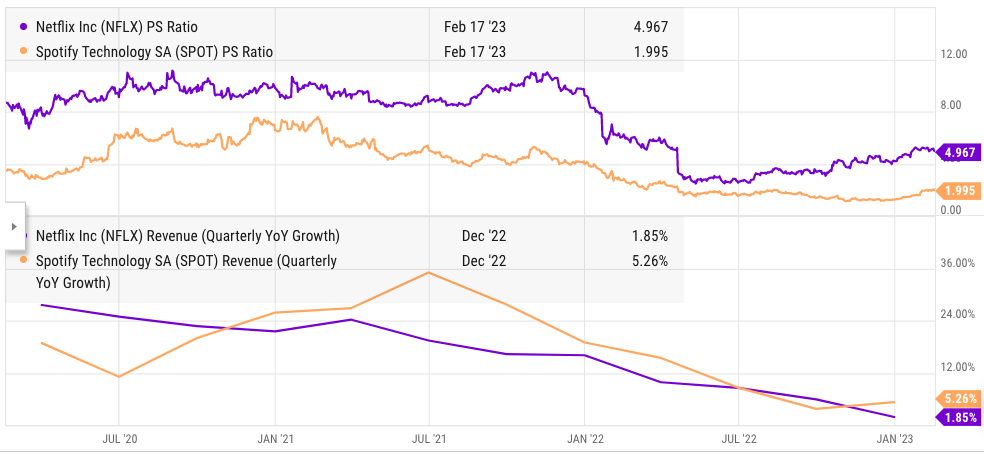

Impact on Amazon stock

There are no peers in the subscription business which offer ecommerce as well as streaming services. If we look individually at streaming companies, Netflix is trading at P/S ratio of 5 while Spotify is trading at 2. Taking a middle value of 3.5, Amazon’s $35 billion in subscription revenue should be valued at over $100 billion.

YCharts

Figure 4: PS ratio and YoY revenue growth of Netflix and Spotify. Source: YCharts

However, Amazon also has a strong ecommerce business and a flywheel effect which should allow the company to get a higher valuation multiple for its subscription business. Amazon’s subscription business has shown consistent revenue growth compared to Netflix and Spotify, both of which have seen a rapid decline in YoY revenue growth and a stock price correction in the last year.

If Amazon’s subscription revenue reaches $100 billion level by 2030, Wall Street could give this business a good standalone valuation. Prior to the stock correction, Netflix was trading at a PS ratio of 10. Amazon’s subscription business could certainly get a similar valuation multiple when we look at the halo effect, Prime retention rates, and market leadership.

At this level, Amazon’s subscription business could have a standalone valuation of $1 trillion by 2030 on a revenue base of $100 billion. The future trajectory of subscription business looks very strong and this segment can become one of the key drivers for Amazon’s valuation growth.

Investor Takeaway

Amazon’s subscription business reported 17% YoY revenue growth which is the highest rate in the last four quarters. There has not been any big decline in retention rate of Prime membership despite a big hike in fees. This segment has reported over $35 billion in revenue in fiscal 2022. At a modest growth rate of 13%-15%, the subscription business could reach $100 billion level by 2030.

This business provides a strong halo effect for new services offered by the company. It is a steady and recurring revenue base that is valued at a higher multiple compared to wafer-thin business of ecommerce. The growth rate, retention rate, and flywheel effect for Amazon’s subscription business are much higher than Netflix or Spotify. At a PS ratio of 10, Amazon’s subscription business could be valued at close to $1 trillion by 2030 which makes it one of the key drivers for future stock growth.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.