Summary:

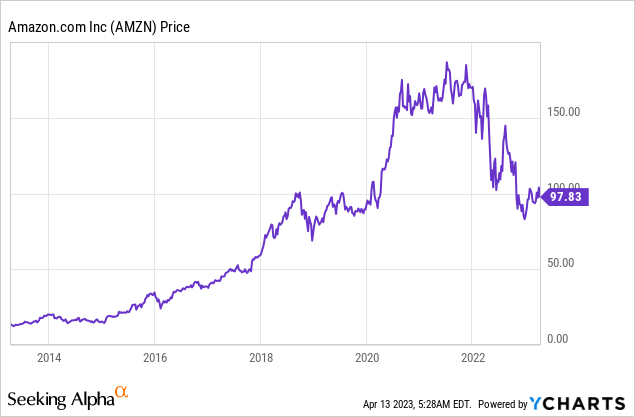

- After losing nearly a third of its value, Amazon looks more attractive than a year ago.

- Nevertheless, investors should be mindful of recency bias when evaluating Amazon’s share price attractiveness.

- The unique business model also poses some risks that should be considered regardless of one’s investment horizon.

Noah Berger

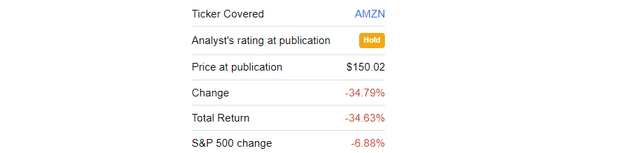

Exactly one year ago I warned investors of becoming too carried away by the exciting narrative by one of the most successful companies of our time – Amazon (NASDAQ:AMZN).

As one could guess, the thought of Amazon’s share price declining and underperforming the market was not well-received just as it was still trading near all-time highs.

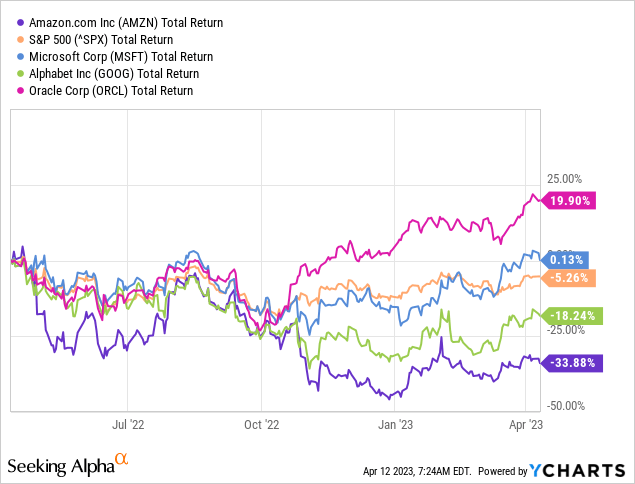

As it almost always happens, however, emotions and narratives are your worst enemy when it comes to investing. In just one year, Amazon lost more than a third of its value by declining nearly 35% at a time when the broader equity market fell by less than 7%.

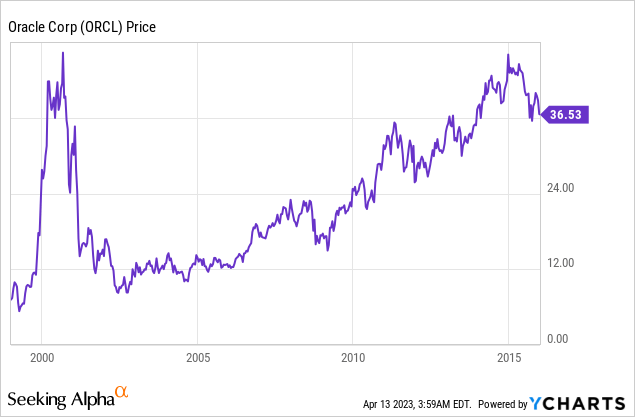

Things are even worse when we consider performance of other cloud names, such as Microsoft (MSFT), Alphabet (GOOG) and my favourite ugly duckling – Oracle (ORCL), which returned a positive 20% over the same period.

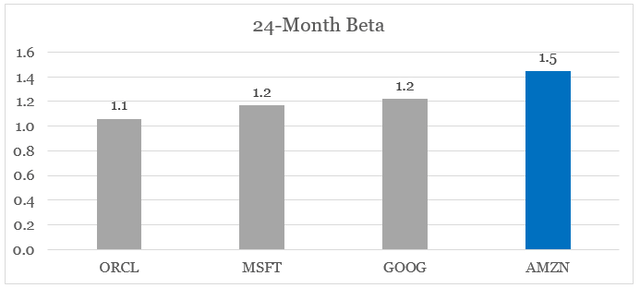

When judging share price performance, it is crucial to also consider the risks involved.

To an extent we could ascribe this disappointing performance to Amazon’s higher exposure to market risk, which is measured below by its 2-year beta coefficient. During market downturns, such as last year, it is reasonable to expect higher beta companies to fall more than their lower beta counterparts.

prepared by the author, using data from Seeking Alpha

However, even the beta of 1.5 can’t explain the massive drop in Amazon share price, which underperformed the market by a factor of five.

In order to explain this massive drop in AMZN and evaluate what shareholders could expect in the long-run, we need to take into account two factors:

- first, is the company’s exposure to the recent liquidity flows that are now dissipating;

- second, we have to consider Amazon’s unique business model, which has both its strengths and weaknesses.

The Market Factor

When things go right, investors tend to pat themselves on the back that they have recognized a great company before the market did.

But when stock prices go in the other direction, it is usually the market which is irrational or the Federal Reserve is to blame – even though it was monetary policy in the first place that brought the shares to their all-time highs.

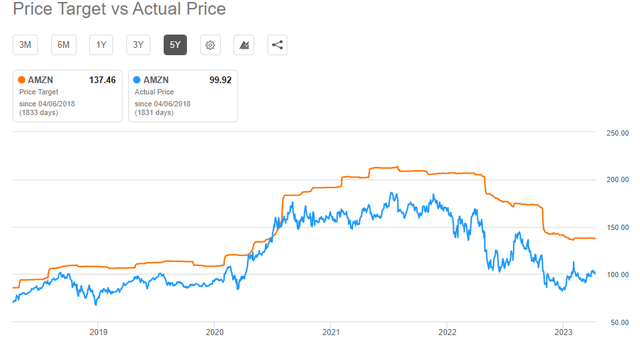

This is the first part applies to Amazon, when the stock was trading above $150 per share and the second one appears to be the case today with shares trading more than 30% off from their recent highs.

The levels reached during the 2020-21 period, however, are not indicative of the true value of the company. It is hardly a secret that the markets were flooded with liquidity during that time and now that things are finally normalizing, so are the prices.

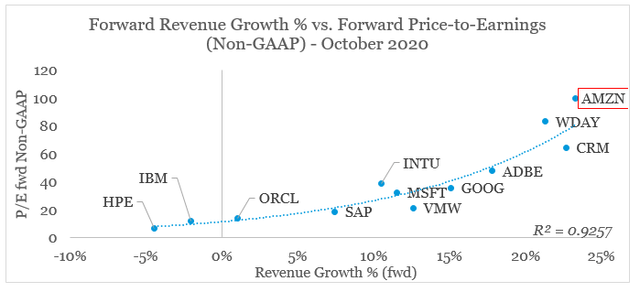

This could be illustrated perfectly by the chart below, which I did all the way back in October of 2020 and became one of the reasons why decided to stick with Oracle, instead of Amazon.

On the x-axis I have plotted the expected forward revenue growth as of October of 2022 and on the y-axis is the forward Non-GAAP P/E ratio at that time.

prepared by the author, using data from Seeking Alpha

What we could see is that companies, which were expected to grow the fastest were awarded with extremely high P/E ratios. On itself this sounds logical, however, the problem was that the premium P/E multiple for the companies on the very right became exponentially higher as a result of the excess liquidity pumped into the system.

The premium P/E of these companies is expected to remain as long as they could keep growing, but the main problem is that the level of this premium is subject to the monetary conditions at the time. In other words, when there is excess liquidity, the slope of the trend line tends to be steeper. Similarly, when liquidity is being withdrawn from the markets, the slope flattens.

If this still sounds confusing, you can take a closer look at a very detailed analysis for the cloud space I did back in November of 2021.

Another company that got caught by this dynamic was Salesforce (NASDAQ:CRM). The case of CRM was slightly different, as its management has recognized this and has doubled down on its strategy to achieve the highest topline growth possible through a frenzy of M&A deals.

Recently things have changed dramatically at Salesforce and I have turned more neutral on the share price due to the U-turn made in the company’s strategy. As a result of this strategy shift I have even added CRM my watch list of potentially attractive long-term investments. There are, however, certain issues that would need to be resolved before I consider it an attractive opportunity for my subscribers and myself.

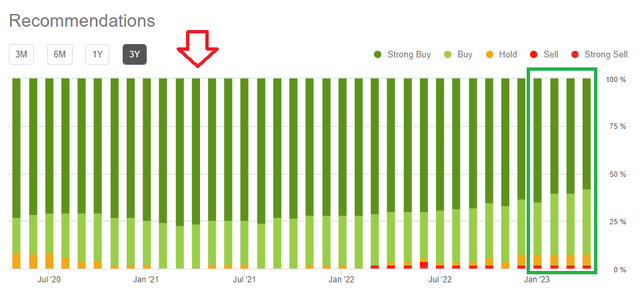

Back to Amazon, the company’s exuberant valuation was also supported by Wall Street Analysts, which usually follow such trends.

In the first half of 2021, just as AMZN reached its all-time highs, there was not a single analyst with a ‘sell’ or even ‘hold’ rating.

And surprisingly now that AMZN has fallen by more than 30%, and should be significantly more attractive, ‘sell’ ratings begin to surface.

Unfortunately, this trend-following is not unique to Wall Street Analysts and is a feature of the whole market, when liquidity is abundant and exciting narratives proliferate.

The good news for long-term holders of Amazon (and I mean true long-term holders) is that these deviations from fair value rarely change the fundamental strength of a business. In a similar fashion, Oracle was caught in the mania of early 2000s and its share price reached unsustainably high levels. It then took around 15-years, before the share price reached those highs again.

What this shows is that ultimately, AMZN could turn into a very successful investment, but that largely depends on your timing.

The Idiosyncratic Factor

Understandably, the explanation provided above rarely appeals to long-term shareholders, even though it is a crucial element for achieving above-market returns over the long run.

This leads us to the topic of Amazon’s unique business model and its strengths and weaknesses.

By far the strongest competitive advantage of Amazon is the ability of its founder and the team he has built around him to recognize long-term opportunities and pursue them no matter what the critics are saying. The Risky Bet that a well-known business magazine was describing back in 2006 was Amazon Web Services (AWS), which has made what Amazon is today. Without it, the company wouldn’t have been among the largest and most successful enterprises of our time.

As attractive as this sounds, shareholder returns are not always consistent and relying on recent history could be misleading.

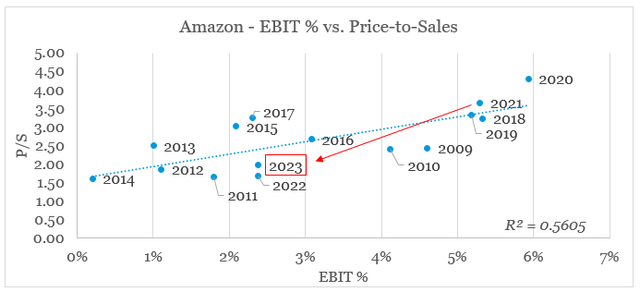

Over the long run, Amazon’s share price depends heavily on its margins. That is why we see a strong relationship between EBIT % and Price-to-Sales multiple on a time series basis.

prepared by the author, using data from SEC Filings and Seeking Alpha

Two more things stand out from the graph above:

- the first is that even during the pandemic, when the retail business was flourishing, Amazon’s margins were at mid-single digits;

- and the second is that the sharp drop from the 2021 highs was also driven by the falling margins.

The graph also clearly illustrates that the vast majority of Amazon shareholder value over the years was driven by scale. Since margins did not change materially over all these years, it was the size of the company that drove the spectacular returns over the recent years.

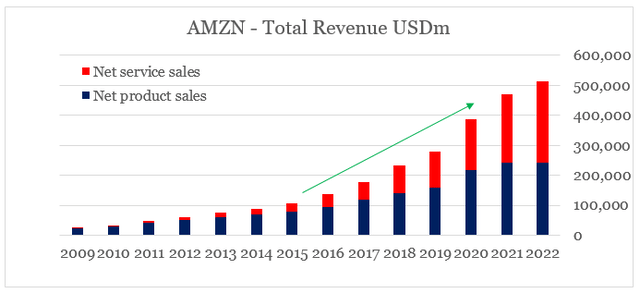

prepared by the author, using data from SEC Filings

The importance of the strategic shift of the business towards cloud, advertising, subscription and third-party seller services was paramount as growth in product sales slowly declined and during 2022 noted its first decline in a very long time.

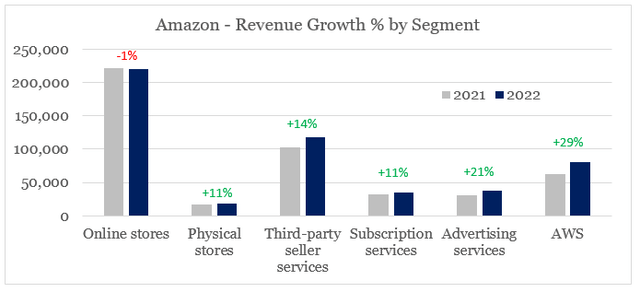

prepared by the author, using data from SEC Filings

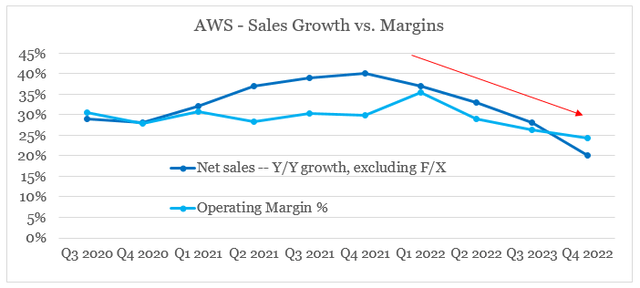

Investors are now relying on these service lines to take up the torch from online stores and elevate Amazon’s scale to new highs. However, the cloud space is getting extremely competitive and after the strong push towards digitalization following the pandemic it is now likely to grow at lower rates.

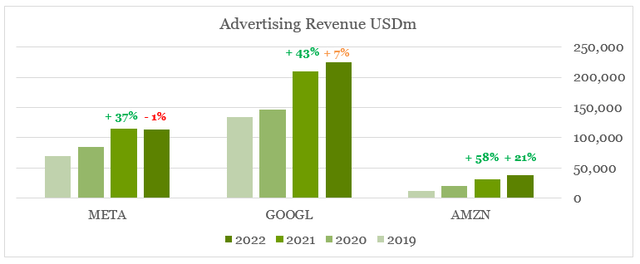

The advertising business is still relatively small to those of Meta (META) and Alphabet (GOOGL), but it appears that a significant slowdown in the segment is in traction as more and more enterprises cut advertising budgets in anticipation of an economic slowdown and rising costs.

prepared by the author, using data from SEC Filings

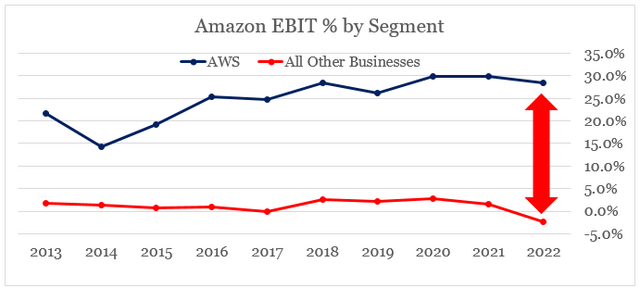

At the same time, Amazon would need to rely on its AWS profitability driver more than ever as losses in all other businesses are mounting.

prepared by the author, using data from SEC Filings

Given the recent developments in the cloud space, however, it is highly likely that AWS’ margins have already peaked in 2021.

prepared by the author, using data from SEC Filings and Investor Presentations

All that would continue to put tremendous pressure on Amazon share price in the coming year, especially in an event of a recession by the end of 2023 which now appears a highly likely scenario.

Investor Takeaway

Given the current environment of normalizing monetary conditions and the risk of an economic slowdown, growth stocks valuations are likely to experience more pressure in the coming months. These conditions could be exacerbated by Amazon’s unique business model, which has served the company well during the past decade but could now put its business at a disadvantage.

Contrary to the worsening outlook by Wall Street Analysts, such a scenario could be an excellent buying opportunity for anyone with long-term investment horizon and willingness to endure pain over the short to medium term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

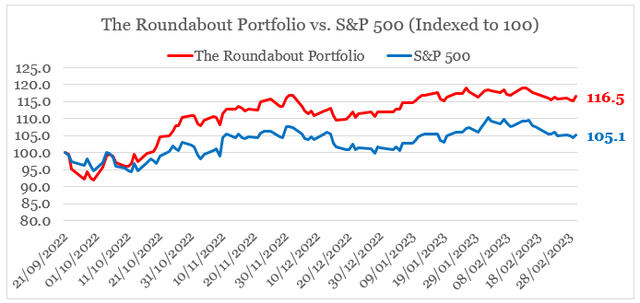

Looking for better positioned high quality businesses across different sectors?

You can gain access to my highest conviction ideas by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.