Summary:

- Amazon has experienced a slowdown in retail growth as well as a sharp slowdown in AWS growth.

- That being said, the company is well diversified and has many opportunities ahead of it.

- We view the risk/reward to be attractive at these levels.

HJBC

Thesis

Some investors are concerned that Amazon’s (NASDAQ:AMZN) retail business is hitting a wall in growth and profitability. Despite their retail division being a large share of revenue, Amazon’s subscription, cloud, and advertising businesses will serve as the main value drivers of the business going forward. Their retail business is useful for data generation and has the potential for efficiency gains, but doesn’t need to meaningfully outperform expectations for Amazon to grow further.

The Big Picture

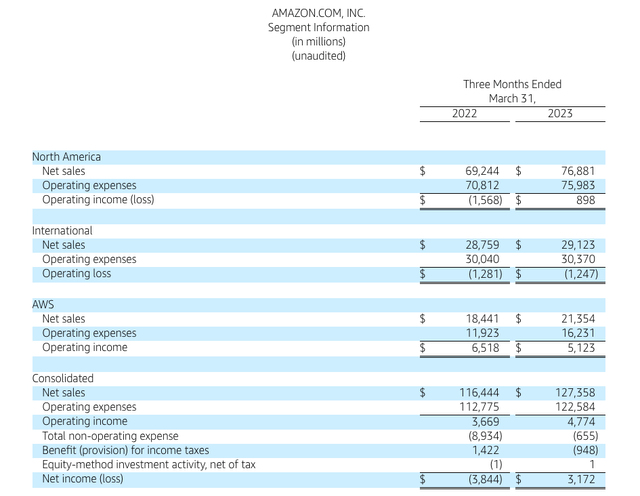

Amazon breaks out their segment operating income by “North America”, “International”, and “AWS”. International is still running at a loss, but North America returned to profitability compared to the year ago period. AWS operating margins declined meaningfully, from 35.3% to 24%. This could be evidence that competitors such as Microsoft (MSFT) and Google (GOOGL) are beginning to pressure AWS. The erosion in margins is more of a concern to us than the slowdown in AWS growth rates.

The profitability of the North America and International segments would likely be much worse if only retail was considered. These figures add in subscription and advertising revenues, which are likely much higher margin than retail. It’s possible that in the future, the company may decide to show the operating profitability of Advertising and Subscriptions as standalone units, similar to how they started breaking out AWS operating profitability. This could prove to be a catalyst for the stock, as investors may give more respect to those segments if they can see the underlying profitability.

Amazon.com First Quarter Earnings Release

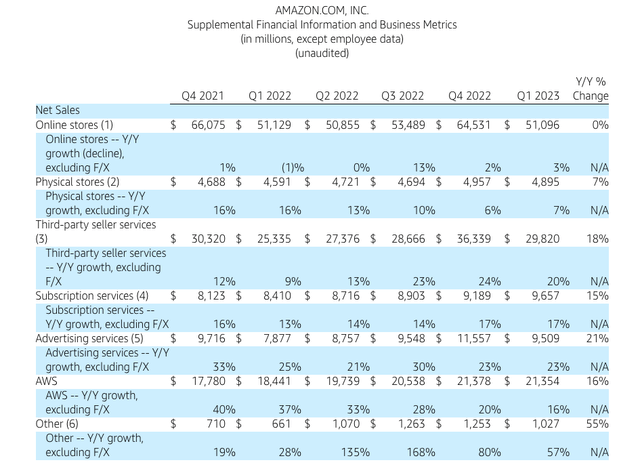

Amazon breaks out their revenue into seven segments. We can see that online stores revenue is essentially flat and physical stores revenue is marginally higher. The real points of interest are the other five segments. At this point, the subscription and advertising segments combined are almost as big as AWS, and could potentially be just as profitable.

Amazon.com First Quarter Earnings Release

Subscription

Amazon’s subscription revenue is consistent in nature but requires the company to continually provide more value, especially if they want to increase prices. The company may find it difficult to increase the number of subscribers in North America, but they still have room to grow in International Markets. Subscriptions revenue serves as a consistent profit engine for the company, similar to AWS. If the company is able to raise prices further, it would go straight to the bottom line, making this an area to watch. Management will likely adjust prices higher to try and gauge demand elasticity.

AWS

With the AI craze in full swing, companies are rushing to secure computing power. This is great news for all three of the biggest cloud providers in the US. In addition to the increase in cloud demand, Amazon may be able to make further advances in their semiconductor technology to improve the efficiency of their cloud computing services. Any improvement in server compute total cost of ownership will go straight to the bottom line and could be a way for Amazon to increase AWS profits faster than revenue.

Advertising

The power of Amazon’s advertising lies in the first party nature of it. Amazon is able to deliver advertisements to users who have demonstrated a high level of purchase intent. This means that advertising is more likely to lead to a conversion than generic search based advertising or brand advertising. What’s notable is how fast this segment is growing, in contrast to the slowdown faced by ad-based companies such as Google and Meta (META). This segment is likely highly profitable but that profitability is a bit skewed because it relies on the lower margin retail segment to generate the relevant data.

Advertising could become Amazon’s “next AWS” and will continue to grow larger as retail sales volumes increase. Amazon could also find ways to further improve the effectiveness of their advertisement delivery, increasing their segment margins and strengthening their competitive positioning against the other ad titans.

Potential for Retail Efficiency Gains

The retail division has the potential to capture efficiency gains in the future, mainly from the further integration of robotics and autonomy. The company will likely continue to increase the amount of robots they own and will likely decrease the total number of retail employees they have. Over time an Amazon warehouse will eventually function more like an automated facility as robotics technology improves. The closest example of this idea that currently exists is an Ocado automated facility. These efficiency gains will extend to autonomous driving and delivery when that technology becomes commercially viable. While these improvements are incremental and in some cases far out into the future, it’s a nice call option on the retail and fulfillment operations. Even a small amount of margin expansion would meaningfully boost profits.

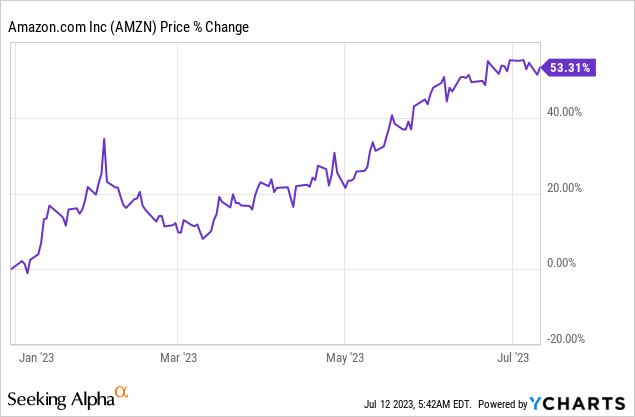

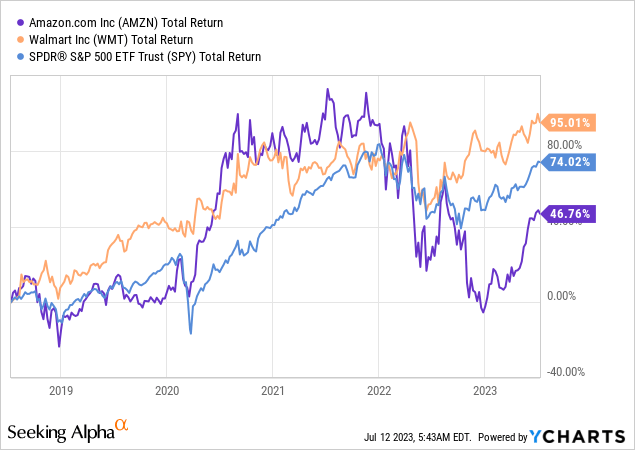

Price Action

Amazon has had a blistering rally YTD, but when the chart is zoomed out, the returns over the past five years look less than impressive. It might surprise some readers that Amazon has not only lagged the S&P 500 over the past five years, it has also lagged Walmart! In order for Amazon to continue rallying, the company will likely need to justify their elevated valuation by improving profitability and showing the benefits of their decade-plus retail and fulfillment investment cycle.

Valuation

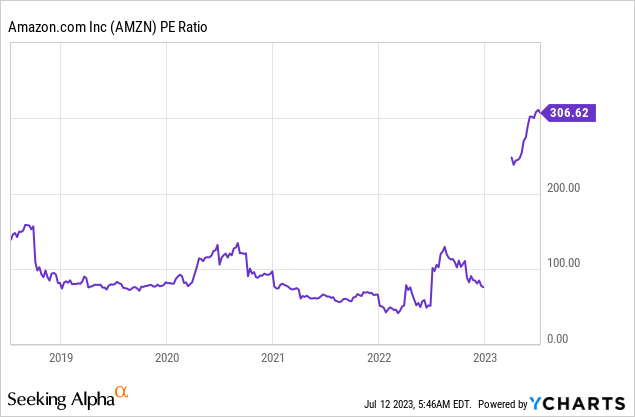

Amazon looks highly extended on a PE basis. Some of this is due to non-operating losses regarding their Rivian stake. Amazon has generally traded at what many would consider to be an elevated valuation, and the market has been willing to give the company credit for the investments they have made into growth. At some point these investments will need to meaningfully boost profitably, and for now the market believes that they will.

We view the current valuation as being reasonable and believe that the company will be able to capitalize on the opportunities in front of them. Our reason for owning the business mainly revolves around AWS, advertising, subscription, and third party seller services. We believe that these segments will serve as the growth drivers of the business going forward. We also believe that these segments will see margin expansion over time as the company reaps the benefits of the massive growth investments they are making today.

Risks

Amazon has a few risks. The ones we are most concerned with are the potential for increased regulatory scrutiny and the potential for them to fail at expanding internationally. Another significant risk is the potential for the company to fail at improving their profitability while also being unable to resume top line growth. This would likely result in a sharp valuation correction.

Key Takeaway

The slowdown in retail doesn’t concern us as Amazon has many opportunities for growth. We view the overall risk/reward to be attractive at these levels and believe that the company can effectively monetize their growth investments.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to AMZN, GOOG, GOOGL, MSFT, and META.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.