Summary:

- Amazon is on the verge of joining the $2 Trillion Club, driven by a 4-percentage point acceleration in AWS to 17% YoY growth combined with strong 25% growth in advertising.

- E-commerce is what Amazon is famous for, however, it’s AWS and advertising that are the core growth engines. This past quarter, the two combined for $37 billion in high-margin revenue.

- Amazon is well positioned to capitalize on surging generative AI demand quickly, with a multi-billion dollar run rate in AWS from AI products already.

MarioGuti/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN) shares have climbed to fresh all-time highs following a double beat in the last earnings report. The company is on the verge of joining the $2 Trillion Club, driven by a 4-percentage point acceleration in AWS to 17% YoY growth combined with strong 25% growth in advertising revenue. AWS surpassed a $100 billion annualized run rate in the first quarter, with management noting that they “see more absolute dollar growth again quarter-over-quarter in AWS than we can see elsewhere.”

E-commerce is what Amazon is famous for, however, it’s AWS and advertising that are the core growth engines. This past quarter, the two combined for $37 billion in high-margin revenue. Analyst estimates point toward AWS and advertising exiting 2024 at a combined $160 billion revenue run rate. If this materializes, these segments will combine for one-quarter of Amazon’s total revenue while helping to drive 221% YoY growth in operating income.

The synergies from strong double-digit advertising growth, an AI-driven acceleration in AWS, and an increasing cash flow margin support Amazon’s push to all-time highs. Plus, there are hints that the acceleration could continue as more GPU supply comes online, and as Amazon Prime implements ads in Prime Video.

Q1 Recap

Revenue of $143.3 billion beat estimates by $0.8 billion, marking the fourth consecutive quarter of double-digit growth, as Amazon’s revenue growth rate accelerated 310 bp YoY to 12.5%. EPS increased 216% YoY to $0.98, as Amazon continued to realize gains from improved operating leverage, with gross profit rising more than 53% YoY and operating income surging 221% YoY to $15.3 billion.

Amazon’s North America segment and AWS both contributed to this operating income growth. North America operating income increased more than 500% to $5.0 billion, from $0.9 billion last year; AWS generated $9.4 billion in operating income, up 84% YoY (and a 37.6% margin). Put another way, AWS contributed more than 61% of Amazon’s total operating income in the quarter despite contributing less than 18% of Amazon’s revenue.

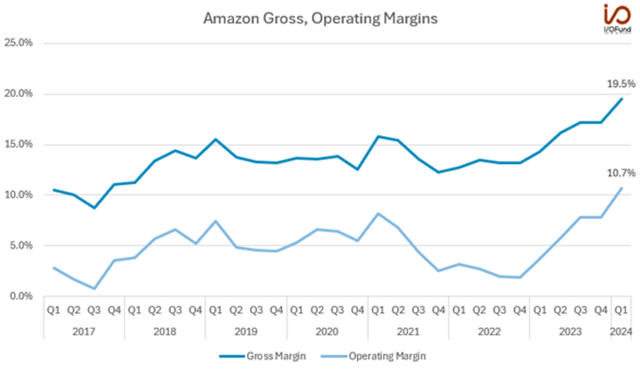

Not only is Amazon showing an ability to expand its gross margin from less than 15% towards 20% in four quarters, but it’s also driving more pronounced growth in operating margin, reaching double-digits for the first time.

Pictured Above: Amazon reaches double digit operating margin for the first time. (Tech Insider Network)

The tangible improvements to the bottom line are evident as the growth story unfolds. High-margin AWS and advertising revenues are also Amazon’s two fastest growing segments.

AWS Seeing AI-Powered Growth

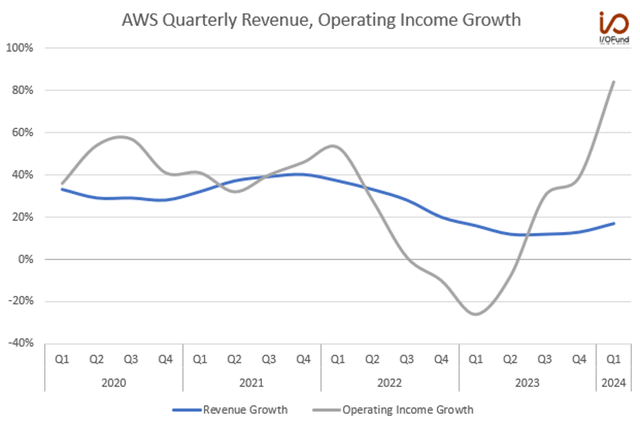

AWS re-accelerated 4 percentage points to 17% YoY growth in the quarter, as CEO Andy Jassy attributed it partly due to the “combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities.”

Growth has cooled rather dramatically since early 2022, where AWS was reporting growth rates above 30%, but at a $100B+ scale, AWS is driving the largest absolute dollar growth across the entirety of Amazon’s businesses.

Amazon is not providing a distinct breakout of AI’s contribution like Microsoft Azure, yet CEO Jassy commented that AWS is seeing “considerable momentum on the AI front, where we’ve accumulated a multi-billion-dollar revenue run rate already.”

Tech Insider Network (AWS re-accelerated 4 percentage points to 17% YoY growth in the quarter, while operating income grew 84% YoY.)

In Q1, we saw evidence that AWS is benefiting from strong demand for generative AI offerings, with management optimistic that increased capex will continue to bear fruit in terms of growth. Interestingly, operating expenses for AWS declined YoY, from $16.2 billion to $15.6 billion, aiding this growth in operating income.

In addition, rival Microsoft explicitly pointed out that Azure does not have the GPU capacity to meet demand, Amazon also implied that demand is possibly higher than capacity of both third-party GPUs from Nvidia as well as for its custom silicon. Management noted that in the quarter, they “continued to meet growing demand for AWS Trainium and Inferentia chips,” and explained that a “meaningful” YoY increase in capex in 2024 is being driven by high generative AI demand.

One comment in particular hints at possible capacity constraints: “given the way the AWS business model works, [the capex increase] is a positive sign of the future growth. The more demand AWS has, the more we have to procure new data centers, power, and hardware.”

Reading between the lines here implies that Amazon is working to improve availability of its in-house Trainium and Inferentia chips while also expanding its data center infrastructure and purchasing more GPUs to continue to meet high-demand gen AI demand. The end result is that AWS will likely accelerate again in future quarters as supply comes online.

A Note on Capex

Amazon did not provide a full-year figure for capex, but management is anticipating a meaningful YoY increase this year, primarily to support AWS’ growth. Q1’s capex was $14 billion, which management expects will also “be the low quarter for the year.” This suggests 2024’s capex could easily top $60 billion, exiting the year in the mid-$60 billion range or higher, representing a YoY increase of at least 24%.

Advertising Revenue Growth Remains Strong

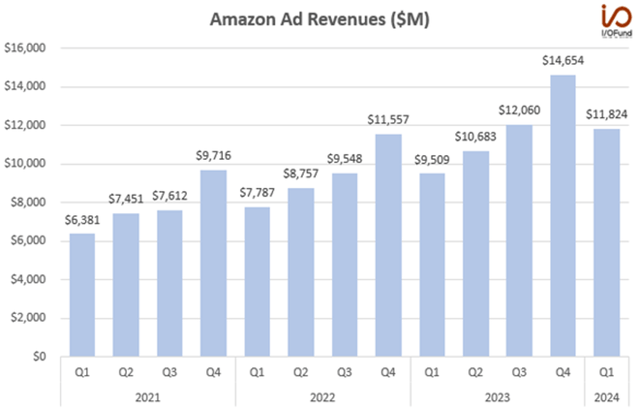

Advertising is Amazon’s fastest growing segment with 24% YoY growth to $11.8 billion in revenue in Q1, and it’s rapidly scaling. Amazon recorded its first $10B ad revenue quarter in Q4 2022, and now has reported four quarters in a row above $10B.

On a TTM basis, advertising revenue was just shy of $50 billion, a 51% increase from $32 billion just two years ago. At this rate, Amazon is set to exit 2024 with ad revenues approaching $58 billion annually. Though Amazon does not break out advertising’s operating income like it does other segments, it says it “remains an important contributor to profitability in North America and International segments.” This is primarily made from sponsored ads on Amazon’s e-commerce site and the recent addition of sponsored TV ads, including on Thursday Night Football.

It’s also worth noting that ad-tech typically has some of the best margins in the tech industry, exceeding cloud or e-commerce.

Tech Insider Network

Analysts are already quite optimistic about the revenue trajectory and potential for Prime Video ads, which launched in January of this year. For reference, Netflix reported 23 million monthly active users (MAUs) globally a little over one year after it launched. Amazon is taking a different approach to SVOD ads than Netflix, Disney and others – instead of offering a cheaper, ad-supported tier, Amazon is adding ads to all Prime Video members, and offering an ad-free plan for an additional $3/mo.

By putting ads directly in front of an estimated 150+ million viewers, Amazon can benefit both from ad revenue and incremental revenue from subscribers who pay the ad-free upcharge. Bank of America analysts estimate that Amazon could rake in $3 billion in advertising revenue this year from Prime Video, potentially up to $5 billion when including those users who pay the additional charge. Morgan Stanley is a bit more optimistic about Amazon’s new initiative forecasting $3.3 billion this year, $5.2 billion in 2025 and $7.1 billion in 2026, generating an additional $2.3 billion in EBITDA in 2024. We see a more conservative take from MoffetNathanson, which projects just $1.3 billion in ad revenue this year before rising to $2.3 billion in 2025, with ~$500 million from users paying the ad-free upcharge.

Unlocking Value via AWS, Ads

AWS and advertising are poised to exit 2024 at a combined $160 billion annualized run rate, or ~25% of Amazon’s estimated FY24 revenue. The two segments may help unlock more value for Amazon, given the gross and operating margin expansion the two segments are driving.

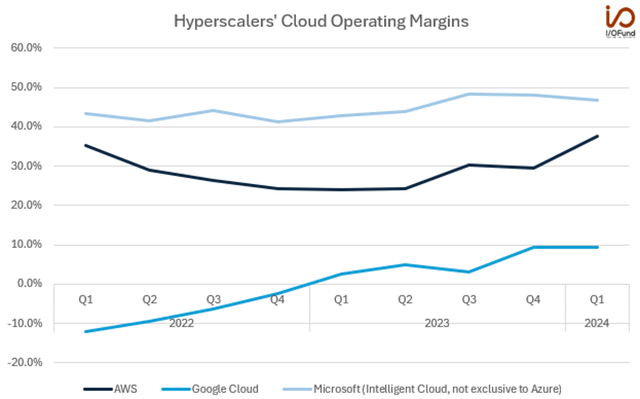

Take AWS – at $100 billion plus ARR, it’s the largest cloud provider compared to Azure at $76 billion ARR, Google Cloud at $38 billion and Oracle at $20 billion. Though AWS’ growth is lower at 17% versus +25% for rivals, it has one of the strongest margin profiles, with a 37.6% operating margin in Q1 and a 30.6% TTM operating margin.

AWS has one of the strongest margin profiles among rival hyperscalers, with a 37.6% operating margin in Q1 and a 30.6% TTM operating margin. (Tech Insider Network)

In a sum-of-the-parts view, AWS could be worth $900 billion: this assumes a fair ~9x sales multiple, or a 30x earnings multiple, given that AWS may potentially generate a ~50% YoY increase to ~$30 billion in net income on a 75% YoY increase in operating income towards $40 billion. These multiples are conservatively in-line with current market valuations in cloud and AI – Microsoft trades at 13x forward sales and 33x forward earnings for 17% company-wide growth, and Oracle at 6x forward sales and 21x forward earnings for single-digit growth.

Turning to ads, as the segment approaches a $60 billion run rate by the end of the year, it could fetch a $360 billion value in a similar sum-of-the-parts look. With growth likely remaining above 20%, this is again a conservatively fair market multiple of 6x forward sales, compared to a 7.6x forward sales multiple for Meta and a 6x forward sales multiple for Google.

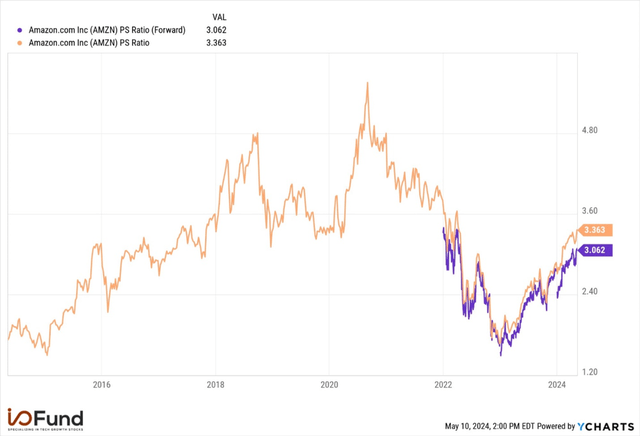

Combined, Amazon’s two fastest growing segments could be viewed as worth at least $1.26 trillion, while also driving significant gross margin and operating margin expansion. When combined with Amazon’s remaining e-commerce and subscription businesses, which could be worth $1.2 trillion at a 2.5x multiple (a 30% discount to Amazon’s 5-year average 3.3x multiple) on an estimated ~$480 billion in revenue in 2024, there is room for Amazon’s valuation to expand towards the $2.5 trillion threshold. However, this outlook is reliant on AWS maintaining this revenue acceleration, as well as ads & AWS driving continual margin expansion.

Valuation Intact, Strong Cash Flow Growth

Amazon’s valuation is not at peak levels, with shares trading far below historical highs, unlike Microsoft which is trading at ‘Mount Everest’ valuations in regard to historical valuation multiples.

Amazon currently trades in line with its 5-year average PS ratio of nearly 3.4x, and at about 3.1x forward PS — although this is a significant increase from the 1.6x multiples at the start of 2023, Amazon’s forward PS ratio is 10% lower than early 2022.

YCharts

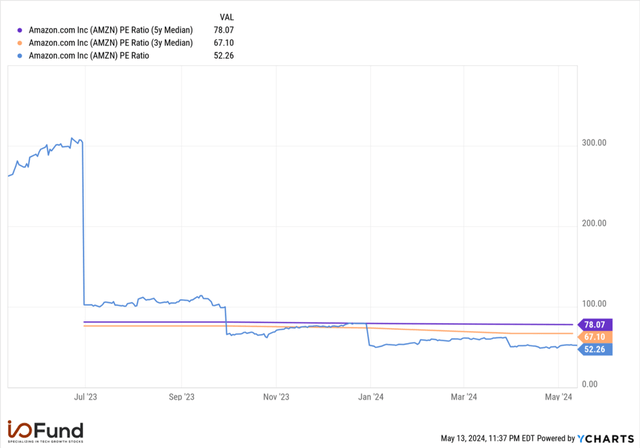

Due to strong growth on the bottom line, Amazon is cheap on a PE basis for this stock. The current PE Ratio of 52 is one of the lowest we’ve seen in the past few years, and is comfortably below the 3-year median of 67 and the 5-year median of 78. In fact, Amazon is cheaper now than it was in October 2023, despite a nearly 60% rally in shares since then.

Due to strong growth on the bottom line, Amazon is cheap on a PE basis for this stock (YCharts)

Earnings growth and operating cash flow growth are both expected to be strong in 2024 and extend into 2025. Amazon is estimated to report more than 56% growth in EPS this year to $4.52 before rising another 27% to $5.74 in 2025. Operating cash flow is projected to increase 45.5% to $123.6 billion in 2024 before rising another 19% to $147.4 billion in 2025.

Conclusion

In a 2022 webinar entitled “The New Kings of Tech,” our firm discussed that the first wave of AI gains will be realized in the enterprise space. We also recently debated on Real Vision that Big Tech has an undeniable advantage in AI due to possessing the capital to make the required hardware investments, and having an immediate product-market fit with their current in-house segments. Meanwhile, mid-cap companies and small startups have to find customers for their AI products, and those SMB customers must be willing to absorb the high costs of AI. Meanwhile, Amazon is well positioned to capitalize on surging generative AI demand quickly, with a multi-billion dollar run rate in AWS from AI products already. Combined with advertising, the two are driving strong margin expansion and aiding in both top and bottom-line growth; and in turn, this growth is creating an attractive valuation on the bottom line.

Recommended Reading:

- Investing In AI with Beth Kindig: 1-Hour Video Interview

- Semiconductor Stocks Q4 Overview: AI Gains Heat Up

- Arm Stock: AI Chip Favorite Is Overpriced

- Big Tech Q1 Earnings: AI Capex Increases As AI-Related Gains Continue

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services include an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.