Summary:

- Amazon seems finally ready to enter a formal film strategy centered on the multiplex first-window.

- This is an important development in becoming a true media conglomerate.

- By focusing on the multiplex, the company might be able to receive a higher valuation tied to its content division.

- The company should spend carefully and yield as much content per $1 billion spent.

- Amazon stock is a buy for patient investors willing to navigate the volatility; this is, in part, based on the price drop and historical PE.

Jeff Spicer/Getty Images Entertainment

Amazon (NASDAQ:AMZN) recently made news (back near the latter part of November 2022) for what appears to be a pivot in its studio strategy.

The company wants to make perhaps over a dozen films per calendar year dedicated to the multiplex as first window, according to this SA news item.

While that item indicated that theater stocks bounced at the time of a report discussing the strategy, my main concern is with Amazon itself, as I think this will definitely help the company create a more thriving entertainment ecosystem that will drive cross-promotional synergies with the company’s e-commerce, advertising and merchandising initiatives.

It also has a potential opportunity to increase subscriptions to Prime video simply for its own sake and not for the attached shipping product. To me, that’s a key point, as the Prime strategy as a whole will become very powerful if both services are valued both equally and very highly; right now, it seems as if consumers probably are mostly enamored by the shipping discounts as opposed to the filmed-entertainment benefits.

Going forward, Amazon’s entertainment assets, led by Amazon Studios, could become close in importance to the company’s web-services business. While there have been missteps in the evolution of this division -led by, most notably, a lack of a clear vision for the segment – I believe that a direct mandate to deliver completed film projects to theaters will pay dividends down the road. I will briefly discuss in this article thoughts on how that could happen, and some of the traps Amazon will need to avoid along the way.

For the stock – it is a long-term buy at these levels, but as I have been saying for other big names, no one can predict exactly how volatile the market will get, so an investor has to be willing to average in over time (and especially the next twelve months). I continue to add to my position currently.

The Importance Of Theatrical Projects

It’s a pretty simple rule in Hollywood: movies are a touchstone product, and theaters are touchstone gathering places. Industry site Deadline has been reiterating another rule that I’ve been paying attention to lately: no matter how small the box office returns, a movie that plays in a theater first will possess an intangible value that quantitatively increases the net present value of future ancillary exploitation.

I’m paraphrasing, of course, but what it boils down to is: always use theaters first, not streaming.

I’m not sure I agree with that always; certainly exclusives to streaming can enhance the branding aspect of a platform. And while theater operators may want windows that last a minimum of three months or more, with tentpoles, I would rather see collapsed windows that activate depending on when box-office grosses on a weekly basis plateau.

But I get it. And, with Amazon, it’s time for a true multiplex strategy to help get Prime to its next level of success. There are reportedly over 200 million members who receive the shipping product and have access to video. While Amazon probably knows the answer to this question (but isn’t telling), what I want to know is: how many people would be willing to subscribe to Prime Video just as a streaming service and not a full-fledged shipping/handling promotion? I’m assuming the latter is the main draw.

Amazon, though, has an opportunity with features whose first window is a premium auditorium screen to enhance its lot in Hollywood and become competitive with Netflix (NFLX) and Disney (DIS) on their own terms. Especially Netflix, since that company has yet to fully embrace the multiplex (it will get there, though; took a while for advertising, but the company eventually came around to that, keep in mind).

The key is for Amazon to look to make a profit on films in theaters first and not just as capital projects whose costs are amortized on the company’s digital platforms. Of course, most movies need to be amortized, especially tentpoles that might have huge profit participants attached (James Cameron and Tom Cruise don’t come cheap). But this should at least always be the goal, and it can set a proper corporate mindset: to be more than just a streaming service that operates on spreadsheet-adjusted risk; instead, make bets, take chances, on a diversified slate that has exposure to star talent, compelling concepts, and budgets of all levels, all at different percentages depending on the optimization needed.

Above all: always make projects as commercially-minded as possible. Take risks and experiment by all means, but don’t pace things too slowly or deviate too much from a mainstream cinematographic style. Go for hits, always, in other words.

The latter might seem obvious, but up until now, Amazon has taken a try-everything approach (well, it’s nickname is the everything store, I suppose) with its filmed-entertainment content division. It also has emphasized awards as a significant part of its model.

Now is the time to favor shareholder value over Academy statues. CEO Andy Jassy can utilize the reams of data at the company’s disposal to inform its moviemaking initiatives and to help reduce costs for marketing (we’re always hearing that data can do this…Amazon, come on and prove it, show that you’re truly a tech innovator; as an observer of this industry, I keep waiting to read that a $200 million tentpole production required only $50 million to market as opposed to $150 million and up). It’s time, therefore, to take a page from Disney and its forever CEO, Bob Iger, and try a focused strategy based on IP and franchise generation. It is definitely possible to incubate new IP, but exploiting the Metro-Goldwyn-Mayer library is the path of least resistance. However, Jassy will probably want to look for new acquisition targets as well that might come with attractive properties that could be put through a sequelization machine. Smaller comic-book companies might be an inexpensive route for such an endeavor (recall, as an e.g, that Netflix acquired Millarworld).

Just to give a few numbers to some of this perspective, let’s consider Disney’s studio segment from the 2019 annual report, page 37, so we can think about this before the second SARS virus began its trip around the globe. The top line in 2017 was roughly $8 billion…that jumped to $10 billion the following year, and finally to $11 billion in 2019. Segment profit during the same three years was a bit stagnant, basically going from $2 billion to $3 billion and then back down to $2.7 billion. Profit tends to be variable with entertainment (and in Disney’s case, integration with the Fox asset affected some of that trend), but the point of this exercise is to illustrate that a blockbuster strategy can lead to consistent surpluses. And we can’t forget the synergistic aspects – a thriving studio division can lead to higher merchandise/streaming revenue, with the latter being composed of advertising components as well as premium ones (Amazon is betting on advertising as a future growth engine, and although most of the talk centers around digital/online, I suspect we will see ads attached to content also significantly considered in the mix).

Those surpluses can come in handy for supplementation of investments made in Prime content. Amazon also has an advantage over Disney in a stealth sense, too: while the company, as I’ve suggested here, should want to replicate the Disney content-franchise model, since it is starting with a fresh theatrical strategy and is a decidedly different company than Disney, it doesn’t need to replicate every aspect and can, in fact, test out new, innovative approaches to keeping costs down.

That is the biggest trap in Hollywood – budgetary costs. Now that Wall Street is becoming impatient with platform red ink, Amazon would do well to consider carefully how it intends on compensating its star talent, or whether it should rely on casting science to a greater degree to find lesser-known talent that would not demand profligate packages. It’s a conundrum, to be sure, but Disney is locked in, it seems, to utilizing star talent in large part to generate ROI…mere spectacles of quality storytelling unfortunately don’t cut it in the blockbuster business model. This is a true risk for shareholders because while large investors may always consider the aura of Amazon’s web services before selling, they aren’t going to be impressed by escalating content costs and thus won’t go out of their way to give a multiple to filmed-entertainment in a sum-of-the-parts analysis. Whether it’s using cheaper talent or recasting roles, there is a distinct opportunity here.

Amazon also doesn’t want to fall into the trap of too much exclusivity since the streaming era has passed an inflection point on Wall Street – take theatrical movies and move them onto Prime, certainly, perhaps with a generous window, but then sell them on physical formats and make them available to rent/buy digitally on Amazon itself (and then on additional, competing platforms).

Perhaps most notable is that Amazon is reportedly considering what a couple observers labelled a surprisingly small amount of capital to prime the theatrical engine: $1 billion is what the initial slate of a dozen or so projects is supposed to cost. While for a company like Amazon this amount may seem lacking, there might be a good reason to remain conservative at the moment: cash flow has been challenged for the retailer, as this article mentions, with free cash after other obligations (less equipment finance leases, etc.) being firmly negative. Plus, the company will want to be cautious as it seeks over time a high valuation for its film business since, as I mentioned, investors are expecting higher returns from ecosystems that have streaming units attached (and that describes all your media conglomerates, of course).

Besides, a billion bucks can still buy a prosperous initial slate of potential IP-incubators. The trick is to yield as much content per billion dollars invested.

Clearly, if the company caps the spend at that amount (for now), a variety of budgets and genres will be utilized to create a diverse slate, and that’s usually the best approach overall, although the concentration should be on mainstream tentpoles and lower-budget films in the horror genre. One might figure on two/three tentpoles (maybe $250 million/$300 million) per billion, as well as a cartoon or two (kids’ projects tend to sell merchandise, remember). If the company could lower the budgets per project, I’d even go for $1 billion all-in, with marketing spend as well as filming costs. Create a set marketing budget (say $100 million to $200 million) and use the rest to make the slate. That would be tough, and it is perhaps even crazy to contemplate such a low figure, but as I alluded to before, Amazon’s electronic-retail platform (and thus its implied direct-marketing efficiencies) certainly could make up for a lot of television-ad buys. And sacrificing top-line revenue in favor of profits (and the eventual move to streaming on a forty-five-day window basis) would be a worthy experiment.

Amazon: The Stock

Now, let’s consider the stock itself.

The company is currently navigating a recession threat that will impact consumers. Add to that price declines based on valuations using bear-market discount rates and lack of free cash flow and you’ve got a tough equity to hold.

SA gives the stock a very low rating on valuation, and the cash-flow metrics in particular hurt. However, I think The Value Corner brings up a solid point that on a historical basis, you’ve got to look at this company – a leader in the online-retailing space – as trading at a relatively attractive price point.

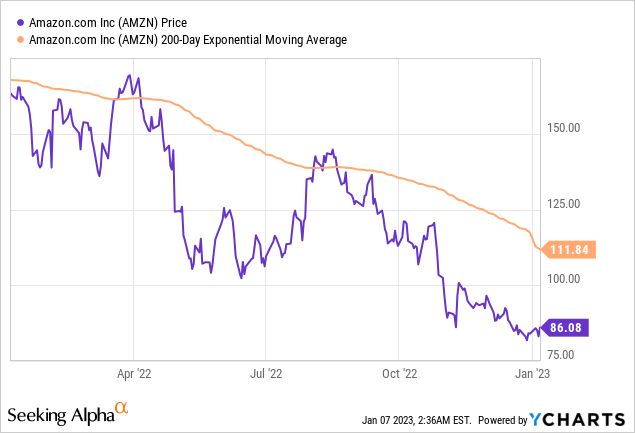

Let me bring up a one-year chart:

Such a chart shows that the market is expecting more pain ahead, so long-term investors building up a position should be aware that multiple purchases will be necessary to improve cost basis. It might very well be worth it for a company like Amazon (shorter-term traders will have to exercise more caution or look for a technical turnaround before making any move here).

Conclusion

A multiplex strategy for Amazon Studios is overdue. It will strengthen the filmed-entertainment division and Prime Video, and by doing that, the company’s IP/storytelling/streaming assets can build itself up to be another hedge against the commerce business model.

Again, the risk here is falling into the traps of Hollywood, where outside tech money is oftentimes seen as a profligate spigot from which to greedily imbibe.

If Jassy is careful not to overpay talent and focuses instead on concept over celebrity, even if that means box-office records remain unbroken as far as Amazon is concerned, then he’ll have a winner on his hands in Amazon Studios as it builds up a library of original content that hits theaters first.

Disclosure: I/we have a beneficial long position in the shares of AMZN, DIS, NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.