Summary:

- I’ve been cautious on Amazon for the past few years. There have been times when I’ve considered a PT, but in the end, I’ve never really gone there.

- This latest set of earnings crystallized my thesis and stance for Amazon – it’s a company that I, as a value investor, do not want to own.

- I present my reasons for it here and look forward to your feedback.

HJBC

Author’s Note: This article was published on iREIT on Alpha prior to publishing here on the free site

Dear readers/followers

I’ve touched on Amazon (NASDAQ:AMZN) a few times before without really giving the company a PT or an entry thesis. As a non-NA investor and capital allocator, I tend to look at things from the outside and in, rather than inside and out as many of the analysts following Amazon do. This is both, I believe, an advantage and a disadvantage.

A few months ago, we had a superb article written by the very knowledgeable author and former CEO of STORE Capital (STOR), where he applied his value equation to the company, resulting in a not-unexpected amount of feedback.

Some would say that the performance since that time has proven the Bears wrong. I would say that we’re only “waiting” at this time to see the next iteration of valuation materialize.

And that iteration isn’t going to be pleasant, as I see it.

Now, to be clear – this isn’t an iREIT article – this is my personal stance on Amazon, and why I do not own, nor will likely ever own a single share. While some of my reasons will echo what some other Amazon bears say, I will also bring my own focus to the table.

Let’s get going.

Amazon – It’s going to be problematic

Taking a non-bullish stance on Amazon is always going to be controversial. This is a company that has provided investors with massive growth. However, that’s also where the first fallacy/behavioral heuristic starts to really “fool” investors.

Amazon has delivered 5-year returns of 34.66%. I have done far better than this – most of you reading this have probably done far better than this.

While it’s a bit of a long shot calling Amazon a case of the availability or recency heuristic, meaning people giving too much weight to a previous event happening again, I do believe Amazon is one of these cases. People investing in Amazon usually have the expectation that the massive, triple-digit RoR that we’ve seen historically, is something they will see again. After all, the company does not, nor likely ever will pay a dividend – so growth is all that investors really have here.

The company traded above $180 in the last 5 years, and many investors are now saying this is a level the company can still deliver, under the right circumstances.

But the likelihood of those circumstances materializing is seeming smaller and smaller.

Why am I saying this?

First off, it’s no secret that Amazon has long had profitability problems. In terms of margins on the net income side, it saw a climb up to 2021, only in the recent fiscal to go negative.

The international segment has long been unprofitable and elusive for Amazon, and the company has even been pushed out of markets here, such as China. In Europe, Amazon alternatives are popping up on a national basis – including Allegro, CDiscount, Fnac, Otto, Rakuten PriceMinister, Real.de, Bol.com, Sparto, Zalando, and others. While many Amazon bulls may quickly discard these alternatives, many of them are catching up to Amazon in their respective markets – and more importantly, many of them are profitable.

If we view Amazon as a cyclical retailer, it trades alongside businesses like Alibaba (BABA), eBay (EBAY), JD, MercadoLibre and others mentioned above that are publicly traded, such as Allegro. In this peer group, Amazon is at best an average company, posting poor profitability indicators such as a 2022A gross margin of 13.16%, and OM of 2.38%, which is well below the leaders included in this segment such as eBay and Etsy, which are both above 15% in OM. Also, a cyclical retailer shouldn’t post consistently negative operating income – but that is exactly what Amazon has done on an international basis.

The company’s assets are growing at a faster pace than its revenues – it’s issuing new debt consistently, and the Rev/share is showing a real slowing down. The insiders are selling the stock and have been for years, not buying. More importantly to me, because this is a metric I look at often, comparing the company’s ROIC to its WACC gives us a negative result. ROIC gives us a sense of how well Amazon is using its capital to generate profit, and when comparing it to WACC we get an understanding of whether this capital is being used efficiently in terms of what the company is paying for it.

Amazon is not.

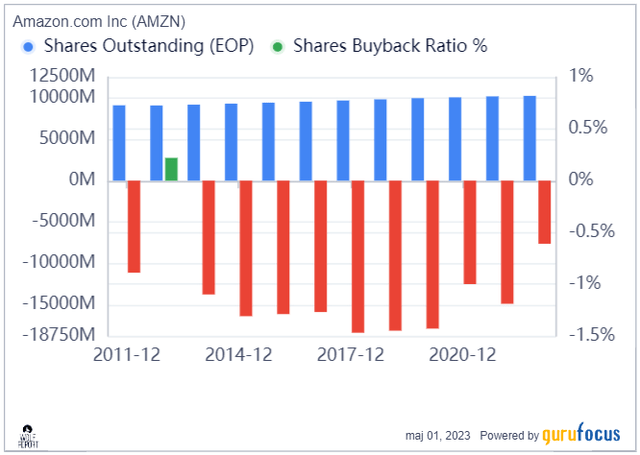

Furthermore, its constant issuing of new shares due to SBC makes certain that any investing shareholder is being diluted on a continual, annual basis, until now. It seems likely to continue going forward.

Amazon Shareholder Dilution (GuruFocus)

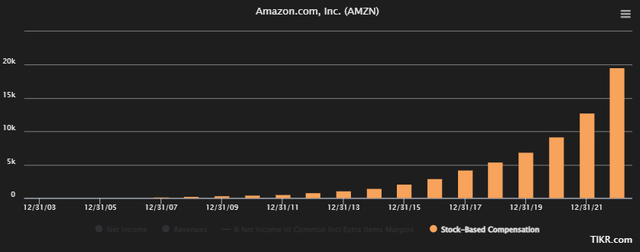

The chart you see below is not revenue or profit. It’s SBC – stock-based compensation.

Amazon SBC (TIKR.com)

Don’t you find it interesting that in the year they did one of their worst years in terms of net income, they also ratcheted up SBC to nearly $20B? This is material, no matter what stance you hold on the company. The SBC is now, as of 2022, inching close to 4% of total revenues. This is during a year where revenues only grew 9% – and revenue growth is after all one of the core arguments for a growth stock trading at over 70x P/E. This represents an SBC expense growth of over 50% in less than a year.

I don’t necessarily think SBC is an issue at Amazon yet – I’m pulling these facts because I want to showcase that the “brew” that is Amazon, is starting to bubble in ways that should give even long-term shareholders pause.

I fully expect Amazon to retain market dominance in the NA market in retail for years, even decades to come. I do not believe the company is going anywhere, and it has grown to a size where the company, even wanting to do so, has become very difficult to dislodge.

However, I do believe the decline in the international markets will continue. Amazon does not have the same customer loyalty, brand recognition, or same appeal it does in NA. Oftentimes, the company is far from the cheapest, its shipping is not the fastest, and other options with more local national sites are becoming equally or even more convenient. Amazon has tried multiple solutions for this – but EU customers simply aren’t as prime-focused as NA one. Its latest attempt is cutting EU distributors out and trying to source from brands directly to improve margins and SCM.

However, Amazon has been losing market share in key European geographies for years – such as France and Germany. Don’t get me wrong, Amazon is still by far the largest here, but it mirrors the trends we see on a global basis, and that trend is that Amazon is slowing down. And more importantly, let me say again, the company has never been profitable abroad.

Amazon’s sales mix and ambitions have long made certain that any headway gained by excellent investments has been clouded by failures and costs. Alexa, or Echo, is a recent example of this. The device has been around for about a decade, but has never succeeded in generating any sort of positive ongoing revenue stream – it doesn’t make money. This part of the company is part of the so-called “Worldwide Digital” segment of Amazon, and reports late last year were on track for this segment losing about $10B a year – most of that being due to Alexa. Reports are even Jeff Bezos lost interest in the project around 2020 (Source).

This sort of push has been characteristic of Amazon over the past few years – it’s a company that’s good at generating impressive revenues, but it’s even better at wasting staggering amounts of capital on projects that objectively, either due to reviews or sheer profitability, are failures.

This is probably part of the reason why I’ve never been that positive on Amazon as an investment. I’m extremely stringent in not viewing revenue as anything relevant without corresponding profit, not caring about potential total addressable markets, company “culture”, or other buzzwords that may be used to convince your typical PE investor at a pitch meeting that doesn’t necessarily handle his/her own money, but won’t convince me, who instead focuses on the question; “When am I getting my money back?”

When Amazon bulls are quite literally saying that “You shouldn’t read too much into Amazon’s recent results” my counter-argument is instead “yes, you most definitely should. It’s coming out of COVID-19 and ZIRP, these are the times you want to be looking at the results”.

As I said, I’m working under the assumption that NA retail dominance for Amazon will be a thing going forward. However, current trends and the numbers prove that Amazon is not a good retailer. It’s average, at best. An operating margin jumping between 0.2% and 4-5% at its highest, isn’t a good retailer margin. At worst, it’s abysmal, and at best it is average.

So, if it’s not a good retailer – what we have left is the cloud/AWS.

Granted, this is a very attractive segment with good profitability. However, the issue becomes that bulls and the market overall have been working off assumptions that AWS will be continuing to grow at the rate we’ve been seeing until now.

This has recently been disproven by the company’s own numbers – as well as the company’s own words.

As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter. And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1.

(Source: Amazon 1Q23 Earnings Call)

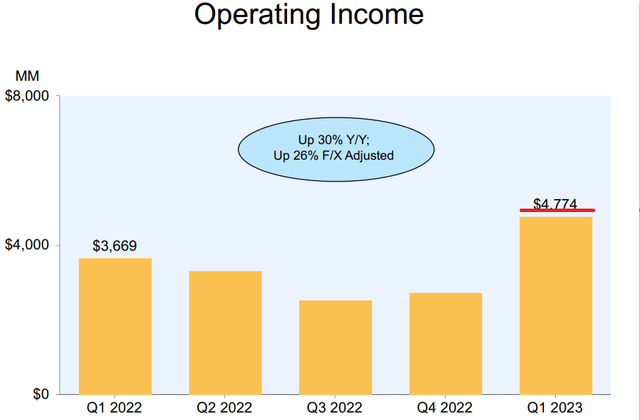

To translate that, not only are growth rates in AWS down for 1Q, they will/are expected to continue to drop into later quarters of the year. What’s more, Amazon is incredibly inefficient. Sales were up 16% in the AWS segment, but OpEx is increasing significantly despite a slower sales growth rate. What happens when you have massively increasing expenses without your expected sales increases is that less money can flow to the bottom line, resulting in an operating income drop. AWS has long been lauded as the golden child of Amazon, the segment where operating profit was delivering. Well, that operating profit is now from 35% down to less than 25%. That’s a significant drop.

Do you know why this should be especially worrying?

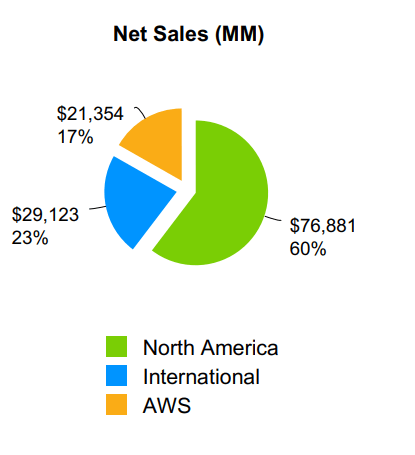

AWS is less than 20% of the company’s net sales.

But, it’s more than 100% of the …

Amazon IR (Amazon IR)

… company’s 1Q23 operating income at $5.123B.

Amazon Operating income (Amazon IR)

What this means is that for 1Q23, 83% of the company was profit-negative in terms of operating profit. If this growth engine is slowing down – not in sales, but in profit, where exactly will that end? Let me assure you, cutting expenses in a company without seeing negative results on the operating side is not easy.

Amazon bulls want to take these numbers with a few grains (or a shovel) of salt – me, I view them as absolutely horrifying on the level of the recent movie Evil Dead Rise.

(I highly recommend that one for horror fans, by the way)

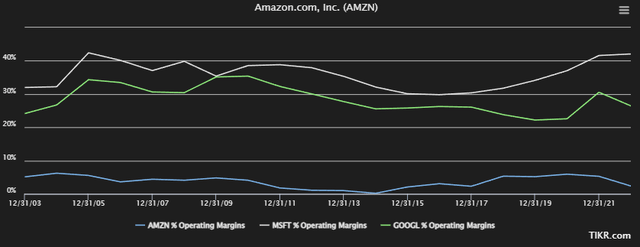

AWS is not without its competitors – and I don’t think you will argue with me that peers such as Microsoft (MSFT) and Google (GOOG) are equally well capitalized or better, they also have a far simpler sales mix without the weighing-down issues of Amazon’s retail and other operations.

Would you like to see, as a fun exercise, how the operating margins in these companies actually compare?

AWS peer operating margins (TIKR.com/S&P Global)

Even if we carve out AWS, AMZN is still the worst of the lot. I’m not saying AWS is bad, nor that it’s not going to grow or be profitable. AWS is the one operation in Amazon I would consider investing in if it was its own company/spin-off. I fully understand the arguments that some bulls have that Amazon needs to spin off AWS.

However, after the recent quarter, I would no longer pay even close to what I would consider paying prior to this slowdown. I expected a slowdown but did not expect this.

That’s not even mentioning that if Amazon were to spin off AWS, the legacy Amazon, the retail part of things, would quickly be clearly exposed as a potentially chronically unprofitable business – AWS is part of what is “holding the company up”, so to speak.

What this shows to me is that Amazon seems woefully underprepared for a slowdown in its cloud segment. It needs to get costs under control – pronto – and work to restructure not only AWS but other segments both in terms of manpower and in terms of expenses, for a slower-growth period.

And if Amazon is in less of a growth market….well, let’s just say I find it laughable to consider it worth 62x normalized P/E, 51x EBIT, and 38x FCF.

My Valuation/Amazon Thesis

You can simplify my thesis on Amazon into the following points.

- If viewed as a retailer, Amazon is objectively and based on margins and profitability inefficient and average/below-average retailer that’s losing market share outside NA, and has (almost) never been profitable in key markets, something that seems even more challenging now.

- I am not interested in investing in a below-average/average-at-best retailer without a yield and growth slowdown.

- If viewed as a cloud service provider, Amazon is after this quarter once again average or below average at best in terms of profitability. It still leads on size – over 30%, but others are catching up. Azure was over 20% back in 3Q22 (Source). However, I view AWS as problematic due to the segment’s failure to control its expenses.

- A 1/3rd drop in Operating margin is nothing to chalk off as a one-off, especially not in a slowing market. Going from gross to operating margin, that’s where you can control most of your costs – that’s operational costs. Moving from Operating to net income levels, we’re netting out things like D&A, interest, and other expenses. Common with these is that they are relatively inelastic/inflexible. They come in at or about the same level regardless of whether you want it or not, and there is very little Amazon can do to change them, even if they wanted to.

I would not call Amazon a bad company. Any company with the sort of market dominance it has isn’t a bad company. However, this also leads to investors, especially new investors, being blinded by the fact that they’re investing in something like Amazon, which “has to be good”/”safe”.

When I invest money in a company, I do so as an active participant in the growing revenues and more importantly, income that the company will generate. I want to invest at a cheap price in order to make sure that the growing profit of that company will result in a growth in the share price, which allows me to generate either a combination of attractive capital appreciation and a dividend income, a dividend income with stability, or significant capital appreciation.

Based on where Amazon currently is, and what is forecasted, I do not see much logical reason for the company to experience significant growth here. Income on the retail side is likely to be negative, and with the cloud slowing down, I don’t see much potential for outperformance here. At least not potential that isn’t solely driven by sentiment – and I don’t invest in sentiment-based investments.

In taking a stance that is not bullish, but borderline bearish, I’m going against almost every analyst I follow, every service I subscribe to, and every data service I use for analysis – I want to be clear about that. I know I am the “vocal minority” here.

Many of my colleagues are positive about Amazon. I share their views on many stocks, but not on this one.

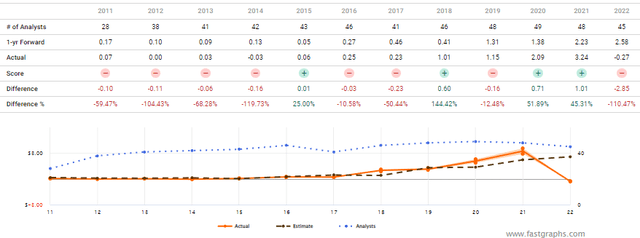

While the company does indeed have the distinction of being called “undervalued” by almost anyone following it here on the sell-side of things, I call your attention to the complete inaccuracy of analysts forecasting this company. Analysts have consistently failed to properly forecast earnings declines in Amazon. In fact, on a 1-year basis with a 10% margin of error, FactSet analysts have not once accurately forecasted Adj. EPS in the last 10 years.

Amazon Analyst accuracy (F.A.S.T graphs)

The same goes for S&P Global and more local analysts in Europe. They have typically assigned massive premia to this stock. Back in early 2022, the PT was $205 on an average basis coming from 48 analysts. That is the most analysts following a stock I have ever seen, and the lowest target at the time was $140/share and the highest nearly at $300/share.

Remind me where Amazon is trading today?

Even today, 47 analysts come in at an average of $138/share, and 30 of the 47 have a straight “BUY” rating, with only 1 at “SELL” and 3 at “HOLD”. The difference is, the lowest PT here is now $90/share.

I view this as still being far too high.

If called to evaluate Amazon and give you my PT on the stock, which I’ve most often declined to do, I would do it as follows. I would not as some, value Amazon as a straight retailer at a 0.4-0.7x sales multiple, which would imply a PT of somewhere between $30-$43/share on normalized results. However, I would not give it the benefit of the doubt of evaluating AWS as too high either. The mix of the two segments is problematic, but I would average it out at about a 0.85x sales multiple. This comes to/around $47.50/share.

I believe pretending that Amazon is going to grow the same way it did in the pandemic or post-GFC is wishful thinking. I realize such a PT may cause many of you to laugh – but understand that even at that PT, I’m still allowing for quite a bit, given the amount of unprofitable retail that’s in the mix here. Because how is the company’s retail going to become more profitable?

Raise prices? it can’t – competitors both in the US and outside are already as cheap, or close to it. If Amazon raises prices, it will lose market share.

Expand? The expansion potential is outside of the US, given NA’s market dominance. But Amazon has already proven it lacks the ability to profitably expand into new markets – it’s actually losing ground, not gaining it. It recently shut down wholesale distribution in India. It obviously also failed in China, and any current operations are not profitable.

Even if Amazon did become break-even or slightly profitable internationally, it would still lag competitors which often are profitable in those markets.

I have, over the year, made several attempts at evaluating Amazon and its growth potential. Most often, the problem has come down to that company disclosures have not been consistent over the history of the company due to growth. Many of the segments we have today were not separately disclosed or carved out less than 8 years ago.

Many authors have drawn attention to the company’s declining NA profitability in legacy, with more or less no growth since 2018. In his article, Christopher Volk forecasted the 2022 results to look even worse – which they did.

In this article, I’ve mostly focused on high-level basic things – I have not even touched on pending risks such as litigation in the US, which for Amazon has been on the rise the past few years. I’ve not considered the recession risk either – I do not believe it to be necessary to showcase that Amazon is not the growth potential it once was.

In the end, Amazon is not a company I want to “BUY”.

Amazon is a company I’m fine buying FROM. Oftentimes, they have good prices and decent return policies. I do not mind shopping certain items from them – but Amazon only represents 5-10% of my online shopping, and that is with Sweden getting its “own market” about a year back.

I see many dangers lurking ahead, and I view Amazon as a very unstable and potentially negative investment. It may go up based on sentiment alone – I am not taking a “SELL” stance here. But I am taking a cautious “HOLD” stance – I do not believe you should “BUY” the company here.

Want cloud services?

Buy Microsoft. That’s what I’m considering. The retail side of Amazon is not a positive – it’s a ball-and-chain.

Thesis

- Stripping away buzz and expectations, Amazon is a combination of a below-average retailer in everything but size, and the least profitable of the top-3 cloud providers around. Its failure to control expenses and generate consistent profit will, eventually, cause the stock to drop. That is how I see the future of Amazon in the longer term.

- I do not invest in unprofitable businesses or companies where I see a problem with the business model – and Amazon’s mix is not something I’d want to be in. Here, I would prefer to invest in Microsoft.

- My PT for Amazon, the price I would consider adding shares, would be below $50/share, specifically at around $47.50 – but I hold no illusions that the company could easily drop to that.

- I’m at a “HOLD”.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I debated even calling it fundamentally safe, but I do believe there to be well-run parts of Amazon – so the company simply doesn’t fulfill all of my other criteria.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend witholding taxes and ways to mitigate these.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.