Summary:

- Amazon’s performance in 2023 and potential catalysts discussed.

- Financials show steady revenue growth, margin improvements, and strong profitability metrics.

- Outlook focuses on North American, International, and AWS segments, with valuation suggesting caution in adding or starting a position.

- Downgrading to Hold until I get better growth numbers for AWS.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

I wanted to revisit Amazon, Inc. (NASDAQ:AMZN) to see how it performed throughout 2023 and talk a little about potential catalysts of the company that can help it perform well. AWS has the most potential to lift the company; however, I would like to see its growth rates accelerate once again, while the retail segments start showing that the future looks better than a year ago; therefore, I am downgrading to a hold rating and suggest being patient in this volatile environment.

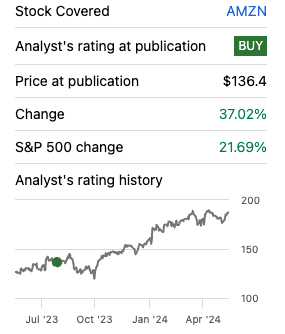

Since the first time I covered AMZN back in August ’23, the company performed better than the overall market by a decent margin, and I said it was a good time to add it to your portfolio. The same bullish thesis remains, however, if I don’t see improvements in the overall growth, I don’t think it’s a good time to add to your position and a pullback would be ideal.

Seeking Alpha

Briefly on Financials

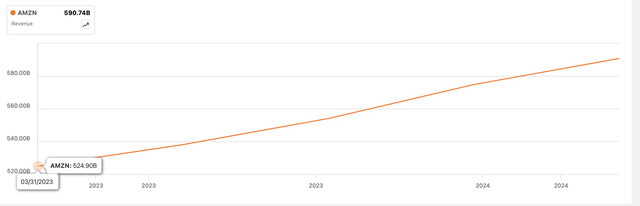

The company’s revenue steadily increased over the last year, with an average percentage y/y increase of slightly over 11%. It is still amazing how such a big company grows in low-double-digits still.

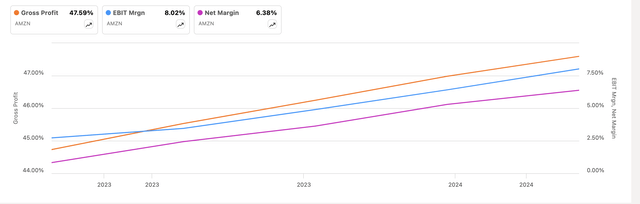

Over the last year, the company saw meaningful improvements across the board when it comes to margins, especially in the company’s retail business side. The North American and International segments have been notoriously bad at holding positive margins over the last while; however, we have seen a massive improvement overall in the latest quarter. The NA segment saw an improvement of 560bps y/y, while international saw an even larger improvement of 710bps y/y. However, the International segment still accounts for very little of the total operating income compared to the NA one ($903m vs $4,983m). These improvements can be attributed to lower transportation rates, improvements in cost to serve, and regionalization of operations.

The company’s largest contributor to the total operating income (around 61% in Q1 ’24), saw its operating margin improve by over 1300bps, or 13% y/y. The NA segment coupled with AWS helped the company achieve over $10B in net income.

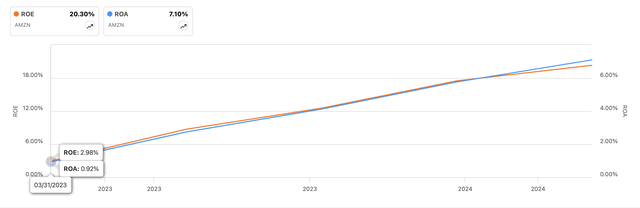

Unsurprisingly, the company’s other efficiency and profitability metrics saw a huge improvement over the last year also, with ROA and ROE seeing a steady uptrend as of the latest quarter.

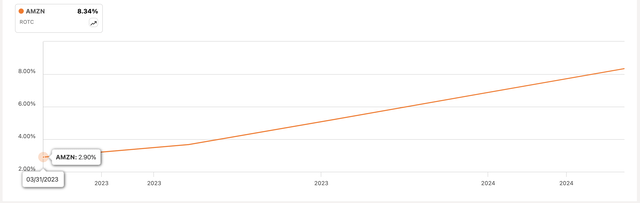

Continuing with efficiency and profitability, I like the trajectory of the company’s return on total capital, or ROTC. I like looking at this metric because it shows how efficiently it uses its capital available (debt and equity) to generate profits. We can see that over the last year, the company’s ability to generate profits increased over three-fold. This comes down to the factors mentioned, like improved cost management across the board.

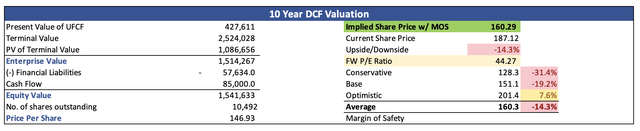

In terms of the company’s overall financial position, as of Q1 ’24, which was filed on April 30th, AMZN had around $85B in cash and marketable securities, against around $57.6B in long-term debt. This debt for a company that is pushing a $2T market cap is pocket change. The company’s interest coverage ratio stood at around 25x, meaning its operating income can easily cover annual interest expenses on debt. Furthermore, the company receives more in interest income than it pays out in interest expense, therefore, that amount of debt is not an issue.

Overall, the company saw a decent year in 2023. Efficiency improvements and a steady increase in top-line have helped its share price outpace the S&P500 by a decent margin (48% vs 25.5%) and is smack in the middle of the Magnificent 7 performance YTD, only behind Alphabet (GOOG), Meta (META), and Nvidia (NVDA).

Comments on the Outlook

The North American Segment

Let’s start with the largest revenue contributor, the retail NA segment. This segment, as I mentioned earlier, experienced quite a rejuvenation in the most recent quarter, fueled by operational efficiencies and overall macroeconomic improvements like lower transportation costs. Over the last three years, this segment saw around 14% growth on average, which has been on a downtrend slightly. The latest quarter showed around 12% increase y/y, which aligns with the recent average. In terms of the top-line improvement going forward, it is tough to predict, but as long as the company maintains this sort of growth in the long run, I am happy. It may not be possible given how big this business already is, however, if the company continues to expand its reach across the US, it is possible.

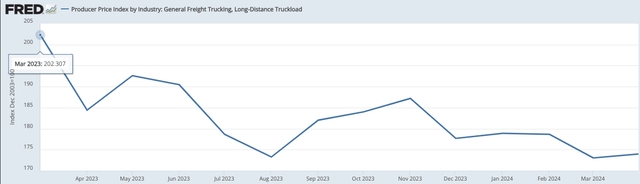

What will play the largest improvement in this segment is the continuing improvements in transportation costs and other operational efficiencies that lower the delivery distances. We saw how much of an improvement the company experienced this quarter compared to the same quarter last year due to the reasons mentioned above. The improvements align with the PPI dropping around 14% over the last year.

I don’t think this segment is going to be the one to push the company’s profitability further, however, if it can continue to adjust its operations to become more efficient while the macroeconomic outlook continues to improve, a steady operating income is good enough for me.

The International Segment

Over the last year, this segment has been the troubled child of the bunch in terms of cash burn. It has been losing billions of dollars, and finally, in the latest quarter reported, this segment turned positive with $903m in operating income, compared to $-1,247m just a year ago. The company’s efforts are starting to pay off internationally, which was also helped by improved macroeconomic conditions, no doubt; however, that is not the only reason I believe this segment finally turned profitable. CFO Brian Olsavsky mentioned in the latest quarter that the company “saw good progress in our emerging countries as they expand their customer offerings and make strides on their respective journeys to profitability”. He also mentioned that the more established countries were the main drivers for the segment; however, I still believe emerging countries will play a crucial role going forward due to many countries like Mexico, Brazil, India, and China are expected to see an expansion in their middle class, so, if AMZN continues to put effort into these countries, efficiencies will eventually come through and margins will see a reasonable improvement in the long run. However, let’s not forget that there is a lot of competition for AMZN in those regions from MercadoLibre (MELI), Flipkart, Reliance Industries, Alibaba (BABA), JD (JD), Tokopedia, and Shopee (SE).

AWS

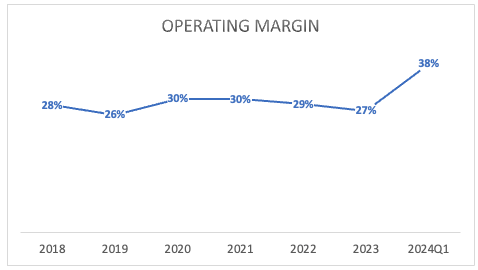

This segment remains to be the strongest catalyst that may propel the company’s profitability to new heights over the long term. Over the last while the company saw operating margins hovering around 26% to 30%. This last quarter, the segment saw a massive improvement over 1300bps, or 13%. Given that this segment is the main contributor to operating income, I have no doubt the company will do whatever it takes to keep it that way. Should we expect this new operating margin to persist? In the long run, I’m sure that will be the case; however, the management did mention that the profitability of this segment will see quite massive fluctuations because of the company’s increased spending, which I view as a very positive in the long run. I don’t mind when companies increase spending if they see there is a good opportunity for growth, and that is exactly what AMZN is seeing right now in terms of cloud applications and the demand for AWS. The main focus is on the AI revolution that has been doing the rounds for the last 2 years or so. The company sees strong growth coming from AWS with AI functionality at the top of the priority list, citing; “we’re seeing strong AWS demand in both generative AI and our non-generative AI workloads, with customers signing up for longer deals, making bigger commitments. Still relatively early days in generative AI and more broadly, the cloud space, and we see a sizable opportunity for growth.”

Author

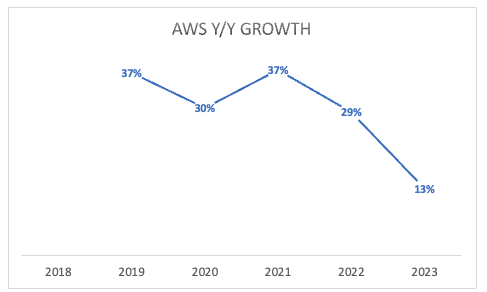

This provides me some comfort, although, I’m not going to get carried away since the comments are rather vague. The segment has been slowing down much quicker than anyone anticipated, so if the comments above talk about the rejuvenation of the segment, I welcome such comments, however, I will not be too optimistic because I would like to have some concrete evidence that shows that AWS is indeed returning to the growth it has seen in the previous years.

Author

In summary, the company has plenty of opportunities to continue to improve its profitability. The NA segment I continue to believe has been more or less at full penetration, and any incremental improvements don’t think will make too much difference going forward. However, we still don’t know how much the streamlining initiatives will make a difference in the long run, but any is better than none. The International segment is starting to bear fruit, and I am excited to see how the company will continue to improve this segment in the long run, but it is looking much better than just a year ago. AWS needs to return to the robust growth it saw in the previous years, and I believe it can do that considering the AI revolution has just begun, and there will be plenty of opportunity to make bank, as long as the company doesn’t drop the ball, which it looks like it knows what it’s doing and where it needs to go. I need to see some more numbers because the latest quarter showed around 17% growth, which is only slightly better than FY23. There is still a huge opportunity ahead for AWS.

Valuation

So, let’s look at an updated DCF model to see what the company is worth right now, and whether it is undervalued or not.

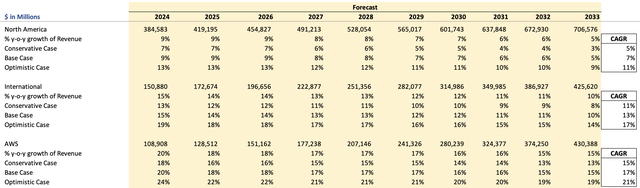

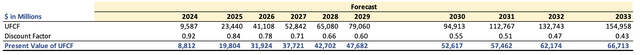

For revenues, my assumptions changed slightly now that we have seen a rather big slowdown in AWS. Nevertheless, I am still modeling around 17% CAGR for AWS over the next decade, which, I think, is achievable if the comments above remain true. I also think these numbers are not outlandish and too optimistic. For the NA segment, I don’t want to be too optimistic also because as I said, the company has penetrated a lot of the market there, so I am having a hard time believing it could see growth in the low double-digits. This way, I am getting some margin of safety if I remain more conservative; therefore, I am modeling around 7% CAGR over the next decade. For international, I do think this segment will perform much better than the NA given the potential outlined above; therefore, I went with around 13% CAGR for the next decade. For AWS, as I mentioned, I have some reservations right now due to the falling growth in the last three years, so I am going to assign a more conservative growth than before. Nevertheless, I do believe that AWS will return to higher growth numbers in the near future, with the potential of AI applications boosting it considerably. I went with around 17% CAGR. I also modeled more optimistic outcomes and more conservative ones. Below are those estimates, with their respective CAGRs.

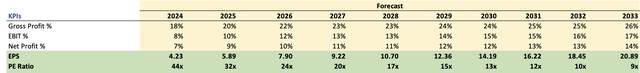

For margins, I am modeling more improvements overall due to how well AWS has performed in terms of profitability, and given that it accounts for most of the operating income, I am confident that the company will become much more profitable. Additionally, further streamlining efforts of the retail segments in terms of logistic improvements and strategic warehouse placement should translate to improved margins. Below are those estimates.

For the DCF analysis, I went with the company’s WACC of 8.8% and a 2.5% terminal growth rate. These estimates help me derive the company’s unlevered free cash flow or UFCF for the DCF analysis.

With all the inputs above, we get an intrinsic value of $160 a share for AMZN, which means it may not be the best time to add to a position or start one, in my opinion.

Closing Comments

The company is going nowhere and will be dominating the markets it’s in for many years to come, as long as it doesn’t drop the ball, however, given the estimates above, if the company cannot grow its AWS segment at a higher pace, or any segments for that matter, AMZN right now may not be the best choice to add to your existing position, and I think patience is key in this situation. The markets are very volatile right now due to the interest rate uncertainty, so, I expect some fluctuations in the markets overall, which may bring down AMZN to a more reasonable price. To be honest, if you are in it for the long haul, 14% isn’t going to make a huge difference in the end; however, I am fine with setting a price alert and seeing how the markets develop over time and how the company’s operations perform over the next couple of quarters; therefore, I am downgrading to hold for now, and suggest not altering your current position.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.