Summary:

- Bullish but cautious on Amazon with earnings on deck.

- Consumer disposable income is dropping which could lead to headwinds despite the dovish fed announcement.

- This option play can profit no matter which way price action moves.

4kodiak/iStock Unreleased via Getty Images

Happy earnings week everyone! I don’t know about you, but I am ready for this bear market cycle to ease up. The Fed meeting this week seemed to put the market in good spirits sending the S&P 500 and most major tickers up a percent or two. With this week’s Fed meeting in the books and the next one scheduled for March 21-22, I am working on a strategy to profit on Amazon’s (NASDAQ:AMZN) move to its next consolidation zone. The fed meeting points to a move up, but earnings still have to be announced and the market could still be digesting the news over the next few trading days. Things are looking up but I still want to have some downside protection since of course, anything can happen.

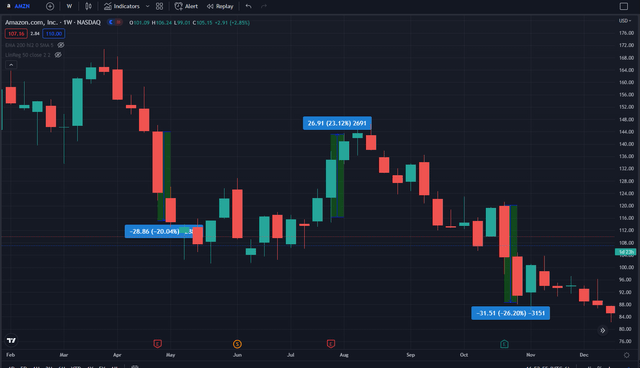

Amazon’s weekly chart shows the clear downtrend experienced by the majority of big tech. We have seen a nice rejection multiple times from going lower than $82-85 and being on the right side of the $100 price area is a positive sign. Price is currently entering a strong resistance zone but there is still a chance to run through it with a good earnings report. Being in a support/resistance zone with a news announcement on deck, provides a good opportunity to launch an option strategy that profits in either direction.

The fed meeting has provided the first catalyst and now earnings need to deliver as well. Price action has previously chopped in the current $105-112 area for weeks at a time, but this entry has a chance to be different with the earnings event to drive it through or to send it back down. I have identified two key zones price action could be heading. Looking at past earnings announcements, we can expect a 20-25% move during earning week and the week after. Stock price has already moved ~7% this week, but we still have plenty of room for more.

The low $120’s will be hard to breach even with a blowout report. That 200 period exponential moving average will act as a floating resistance line and other rallies have stalled out at this point. Also, while Amazon is a lot more than just an e-commerce giant thanks to their juggernaut AWS platform, consumer sentiment can still weigh on stock price and disposable income has reached its lowest level since the Great Depression. With 2/3s of the GDP coming from consumer spending and debt still expensive to come by, I am not ready to take risk off and go long only on any trade. That is where the options market comes in handy.

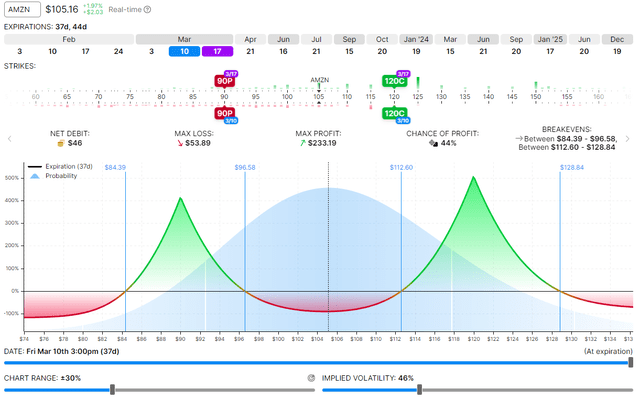

Identifying two likely zones is a good set-up for a double calendar spread. Right now, Amazon’s weekly options expiries go through March 17th which is good timing since the next fed meeting is set for March 21-22 and the trade needs to finish before another catalyst can potentially move it too far through one of our key zones. Calendar spreads are a lower risk options play since you are covered if your short options are in the money and get assigned and typically, the most you can lose is your initial debit amount, which is small thanks to the short portion of the option reducing theta effects and offsetting the long option cost. As it stands now, the double calendar spread +/- 15% from current stock price is ~$46 with a max profit of $233!

Trade Idea

Buy to Open: 90P and 120C 3/17/23 expiration

Sell to Open: 90P and 120C 3/10/23 expiration

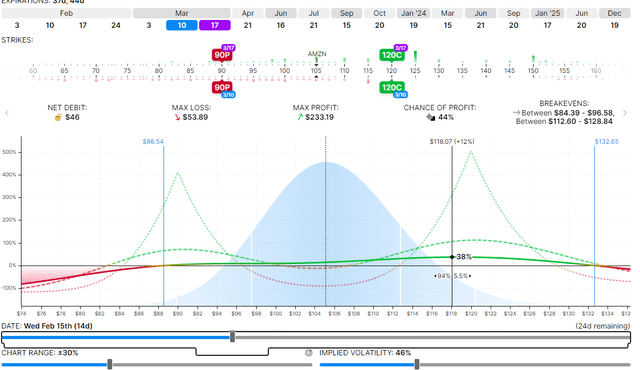

OptionStrat runs a great platform but always take options calculators with a grain of salt since there are numerous factors and market conditions that can affect premiums especially right now since implied volatility is high with the announcement on deck. Still, it is a useful illustration of how the debit spread could increase or decrease as time and stock price moves. The above shows at expiration of the short option on March 10th, but you don’t have to hold until then to profit! Amazon typically moves well for a week or so after earnings announcements as highlighted earlier and the below shows what the potential profit could be if we move to one of our zones more quickly than expected. This is a bit idealistic but I still like the double calendar spread play to catch some profits with a move in either direction.

The fed meeting and earnings in the same week has the potential to lead to a strong move for Amazon’s stock. I like the company and have long shares in my retirement account, but for my active trading account, I am remaining short term cautious and am not going long without downside coverage. The average person’s disposable income greatly declining has me worried that commerce stocks could face some headwinds so for now, I’m going to enter small trades that can profit on a move in either direction. Since Amazon has historically moved well the week following its earnings announcement, I am going to let implied volatility come down some and enter this trade after the announcement. I also will not be holding until expiry most likely and will close if price moves past either the $90 or $120 strike.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.