Summary:

- AMZN’s turnaround is almost complete, thanks to the expanded overall operating margins and promising FQ3’23 guidance.

- With the advertising and AWS segment also outperforming on a QoQ/YoY basis, we may see AMZN’s bottom line performance strengthen from here, as the global ad-spend returns.

- Investors may want to take note of its intensified capex efforts due to the doubled same-day fulfillment centers/regional facility expansions, potentially impacting its short-term FCF generation.

- However, we believe these investments will be highly strategic to AMZN’s long-term top/bottom line growth, with the uncertain macroeconomic outlook to lift by FY2025, if not FY2024.

- Combined with Andrew Jassy’s long-term cloud expertise and booming generative AI market, we believe AMZN’s tailwind remains robust here, with long-term PT of $244.69.

XiXinXing

The AWS Investment Thesis Is Still Highly Promising Here

We previously covered Amazon (NASDAQ:AMZN) in May 2023, discussing the management’s choice to temporarily compress AWS margins, in order to grow market share at that time of elongated sales cycle.

The AWS FQ1’23 revenues and operating margins had declined drastically on a QoQ/YoY basis, unsurprisingly triggering Mr. Market’s pessimism, since the segment had been largely responsible for AMZN’s profitability.

For now, AMZN has reported recovering AWS revenues of $22.1B (+3.5% QoQ/+12% YoY) and operating income of $5.4B in FQ2’23 (+5.4% QoQ/-5.4% YoY). Unfortunately, these numbers still imply impacted margins of 24.4% (+0.5% QoQ/-4.5% YoY), compared to FY2022 levels of 28.5% (-1.2 points YoY) and FY2019 levels of 26.2% (-2.2 points YoY).

Then again, this strategy has also resulted in expanding performance obligations (primarily related to AWS) of $132.1B (+8.2% QoQ/+31.9% YoY), with a weighted average remaining life of 3.6 years (-0.3 years QoQ/YoY).

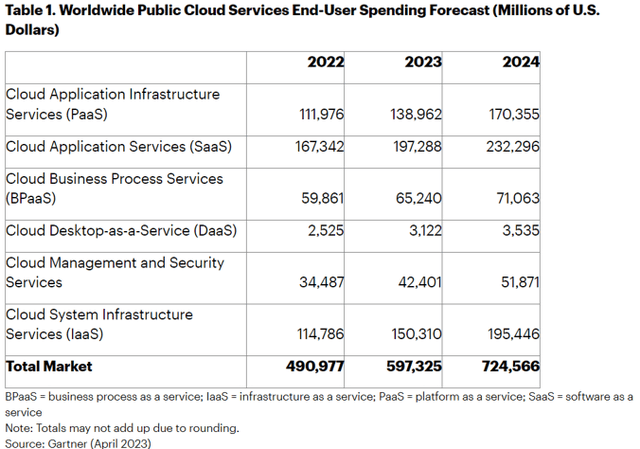

Gartner Worldwide Public Cloud Services End-User Spending Forecast

For now, Gartner expects the global cloud market size to grow tremendously to $724.56B in 2024 (+21.3% YoY), with SaaS and IaaS remaining the largest growth drivers thanks to the robust consumer demand for Generative AI and Metaverse.

As a result, AMZN may eventually be a long-term winner in the AI race, growing in strength together with Alphabet (GOOG) and Microsoft (MSFT), due to GOOG’s in-house DeepMind capability and MSFT’s growing integration with OpenAI.

Thanks to Andrew Jassy’s long-term cloud expertise as the AWS CEO between 2003 and 2021, the CEO has further highlighted the company’s expanding TAM in the cloud market, with the robust generative AI demand already attracting new consumers to AWS, while generating new workload deployments.

This is aided by the company’s customized AI chips, namely Trainium and Inferentia, as an “appealing price performance option” to Nvidia’s (NVDA) GPUs, while offering a wide range of AI tools for multiple applications.

Similar to the C3.ai (AI) management’s commentary in the recent FQ2’23 earnings call, AWS has been offering generative AI turnkey solutions that are bundled together as an AI-as-a-Service [AIaaS]. This is based on most consumers’ preference, since fully-customizable systems are generally overly complex and expensive.

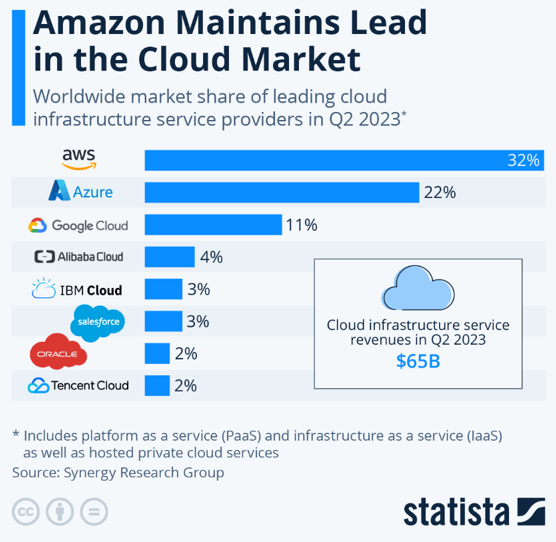

Amazon’s AWS Cloud Computing Market Share In Q2’23

Statista

As a result of AWS’ integrated cloud computing capabilities and the marketplace’s large offerings (including other large language models from multiple leading AI companies), we believe AMZN’s prospects in the booming generative AI market may be brighter than expected.

This may potentially boost its declining cloud infrastructure market share of 32% in Q2’23 (-2 points YoY), with more consumers temporarily flocking to MSFT and GOOG, contributing to the latter’s expanding market share of 22% (+1 points YoY) and 11% (+1 points YoY), respectively.

AMZN’s Advertising Segment May Be A Robust Bottom Line Driver Moving Forward

AMZN’s market leading share in the cloud and e-commerce markets may have also contributed to its accelerating advertising revenues to an annualized sum of $42.72B (+12.4% QoQ/+22% YoY) by the latest quarter. Insider Intelligence already expects its global digital ad market share to grow to 12.4% in 2023 (+0.7 points YoY), thanks to its multi-channel offerings.

While this number may still lag behind the advertising duopoly, GOOG at an annualized sum of $232.56B (+6.6% QoQ/+3.3% YoY) and Meta (META) at $125.96B (+12% QoQ/+11.8% YoY) in the latest quarter, the former’s high-growth cadence must not be ignored as well.

This is on top of the advertising segment likely being a bottom-line driver for AMZN, due to the higher margins commonly seen in the advertising market. For example, GOOG’s Google Services reported operating margin of 35.3% (+0.3 points QoQ/+0.9 YoY) and META’s Family of Apps at 41.3% (+1.7 points QoQ/+2 YoY) in FQ2’23.

There are also early signs of recovering ad-spend, with Oberlo and eMarketer expecting the global digital ad spend to further expand to $695.96B in 2024 (+11% YoY), while growing at a CAGR of +10.16% through FY2026 levels of $835.82B.

AMZN’s E-Commerce Transformation May Trigger A Temporal FCF Headwind

However, investors must also note that AMZN is looking to “double the number of the (same-day fulfillment centers/regional) facilities,” partly attributed to the improved cost efficiencies and optimized delivery speed, contributing to its overall top and bottom lines in H1’23.

Therefore, while the management’s effort in diversifying its national network to eight separate regions may have paid off, investors may also want to temper their near-term Free Cash Flow expectations due to the intensified capex.

The same has been observed in AMZN’s FQ2’23 Free Cash Flow margins of 3.7% (+11.1 points QoQ/+9.3 YoY) and LTM margins of 0.6% (+6.7 points sequentially), compared to its FY2019 levels of 7.7% (+0.3 points YoY).

Then again, we believe these are temporal headwinds since things may improve drastically in the intermediate term, based on the market analysts’ FY2025 FCF margin projection of 8.1%, with the macroeconomic outlook and capex likely already normalized then.

So, Is AMZN Stock A Buy, Sell, or Hold?

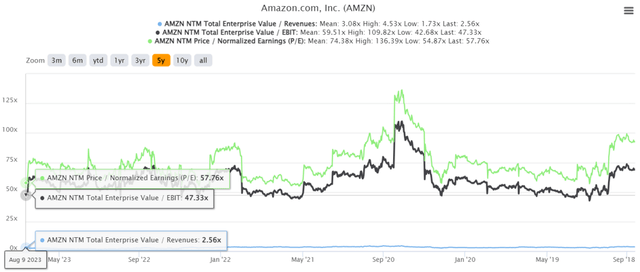

AMZN 5Y EV/Revenue, EV/EBIT, and P/E Valuations

For now, AMZN appears to be moderately valued based on its historical trend, at NTM EV/Revenues of 2.56x, NTM EV/EBIT of 47.33x, and NTM P/E of 57.76x, compared to its 1Y mean of 2.20x/58.36x/70.59x and pre-pandemic mean of 3.31x/52.76x/68.21x, respectively.

Based on its current valuations and the market analysts’ FY2025 adj EBIT per share of $5.17, we are looking at a long-term price target of $244.69, suggesting a more than excellent +76.5% upside potential from current levels.

These numbers are not overly bullish as well, since AMZN has guided excellent recovery in FQ3’23 revenues to $140.5B (+4.5% QoQ/+10.5% YoY) and operating income to $7B at the midpoint (-8.8% QoQ/+177.7% YoY), implying operating margins of 4.9% (-0.8 points QoQ/+2.9 YoY).

Based on these guidance and its H1’23 performance, we are looking at impressive preliminary numbers for the first three quarters of 2023, with revenues of $402.23B (+10.2% YoY), operating income of $19.63B (+102.7% YoY), and operating margins of 4.8% (+2.2 points YoY).

These are tremendous improvements indeed, bringing AMZN’s profitability nearer to 2019 comparable operating margin of 5.3% (inline YoY).

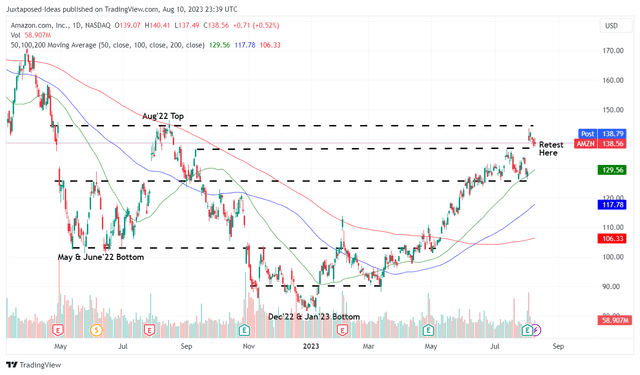

AMZN 1Y Stock Price

Therefore, it is unsurprising that the AMZN stock has also jumped post FQ2’23 earnings call, though unlikely to break out of the August 2022 top. Depending on the market sentiments over the next few weeks, we may see a moderate retracement to its previous support level of low $130s.

On the one hand, due to the excellent margin of safety to our long-term price target, we are cautiously rating the AMZN stock as a Buy, depending on individual investors’ dollar cost averages and risk tolerance.

On the other hand, we will not be adding to our portfolios since we are already fully invested at our previous buy-in point in the November 2022 bottom, with the stock already recording a tremendous rally of +52.19% since then.

Investors may want to weigh their portfolio accordingly.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOG, MSFT, NVDA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.