Summary:

- The slowdown in AWS YoY growth rate was expected due to tough comps and macroeconomic situation.

- Improvement in macro environment and cost-cutting measures within the cloud unit should help in lifting sales and margin in the next few quarters.

- We can expect AWS YoY revenue growth rate to be between 10% to 25% and operating margin to be between 20% to 30% till the end of 2024.

- Even in the worst-case scenario, AWS would be producing operating income of $25 billion in 2025.

- Long-term investors can take advantage of near-term pessimism in AWS to gain better entry points.

4kodiak/iStock Unreleased via Getty Images

The slowdown in Amazon’s (NASDAQ:AMZN) AWS revenue growth rate was highly likely as the company was facing a number of challenges. In a previous article on 31st January, Amazon: all eyes on single number, it was mentioned that the near-term stock movement would completely depend on the sales and margin numbers reported within AWS. There was a high probability that AWS would report modest results in Q4 2022 and Q1 2023 which will result in negative sentiment towards the stock.

It is likely that once the macroeconomic environment improves, AWS growth rate should increase. The cost-cutting measures in this segment will also lead to improvement in margins within the next few quarters. AWS can still deliver YoY growth rate of 10% to 25% over the next few quarters with operating margin between 20% to 30%. Taking the worst-case scenario, it would still report over $25 billion in operating margin for 2025. This cash cow should allow other segments like advertising, subscription, and third-party services to increase their revenue share. As mentioned in a previous article, Amazon is playing a long game with its Prime business, and according to recent trends this business should reach $100 billion revenue rate by the end of this decade.

Even with modest results, the standalone valuation of AWS should be close to $1 trillion by 2025. Investors with longer-term horizons can take advantage of near-term swings in the stock to gain good entry points. Amazon stock is a buy despite near-term headwinds.

Overhype in one segment

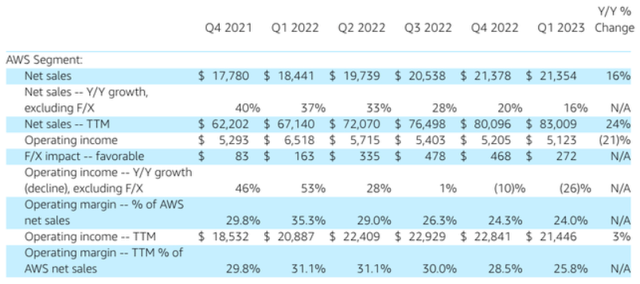

We have already seen a large number of analysts pointing to the end of growth period in AWS. There has been a rapid increase in Sell rating for the stock after the recent earnings report. AWS reported 16% YoY growth rate with operating margin of 24%. This was significantly lower than the earlier range of 30% to 40% growth rate and a margin of close to 30%. The slowdown in revenue growth rate and lower margins have caused a 26% dip in operating margin compared to year-ago quarter.

AWS reported operating margin of $5.1 billion in the recent quarter compared to $6.5 billion in the year-ago quarter. This trend was predicted in the previous article where it was mentioned that “AWS will likely face strong headwinds in Q4 2022 and Q1 2023 due to tough comps and slow demand growth. This can hurt the bullish sentiment toward Amazon stock in the near term.”

AWS delivers more than 100% of the total operating income for Amazon. In the recent quarter, Amazon reported $4.7 billion in consolidated operating income which was less than the $5.1 billion operating income contributed by AWS. Hence, it is inevitable that we might see pessimism towards the overall operations of Amazon once AWS growth diminishes.

Figure 1: Slowdown in revenue growth rate and lower margins in AWS. Source: Company Filings

However, the current challenges faced by AWS are likely to be temporary. The macroeconomic situation should improve in the next few quarters, which should be a tailwind for better revenue growth. Amazon is also undergoing massive cost-cutting which should help in improving the margins by end of this year. We have seen the impact of massive hiring on the margins of almost all big tech companies. The recent rounds of layoffs should allow AWS to bring its margin back to an earlier 30% level.

Worst case scenario for AWS is still rosy

The cloud industry has become an integral part of the tech space. Lower spending on cloud operations is likely to be temporary as inflation is tamed and we see an improvement in business sentiment. AWS was also facing tough comps in this quarter where operating income in the year-ago quarter increased by a whopping 53%. Easier comps and better macroeconomic situation should help the business in the next few quarters.

If we take a possible range of YoY revenue growth in AWS of 10% to 25% for the next few quarters, this segment should have annualized revenue of $120 billion to $150 billion by end of 2025. Cost-cutting measures should help in better margins and we should see operating margins of AWS in the range of 20% to 30% in the near term. Even in the worst case scenario of 10% YoY sales growth and 20% operating margin, AWS would be reporting operating income of $25 billion by the end of 2025. This cash cow should give enough time for other high-margin segments to improve their revenue share and increase their contribution to Amazon’s bottom line.

Advertising, subscription, and third-party services

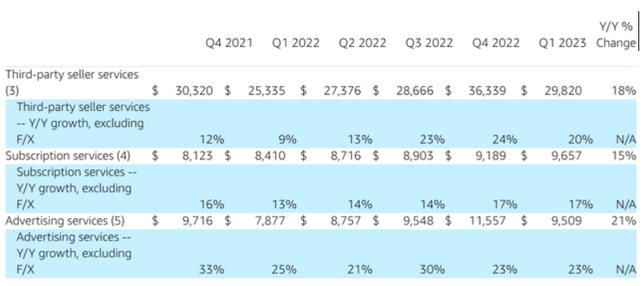

Amazon’s advertising segment reported $9.5 billion in net sales with 23% YoY growth while subscription services reported 17% YoY growth with $9.6 billion in net sales. Together, advertising and subscription revenue base is $19 billion which is close to the $21 billion net sales generated by AWS. It is highly likely that these two important segments will overtake AWS in net sales by end of this year. Amazon’s focus on third-party services is also showing results with 20% YoY growth in this segment.

Figure 2: Good growth rate in advertising, subscription and third-party services. Source: Company Filings

Importance of these segments will increase significantly as their revenue share improves and their contribution to Amazon’s margin gains more attention. Wall Street can focus on AWS in the near term due to its role within the growth story of Amazon, but the longer-term growth and margins will depend on other segments like advertising, subscription and third-party services.

Near and long-term trends in Amazon stock

The cost-cutting measures announced by the company would take some time to reflect in quarterly results. However, by the end of 2023 we should see AWS regain some of the lost margins and reach closer to 30% level. Improvement in macro situation should also help in increasing the YoY growth metrics to above 20%. In the near term, we would continue to see bearish sentiment and Amazon stock can also get some lower price revisions.

But the long term growth story of Amazon is still good. Investors can gain good entry points due to near term swings in Amazon stock. As pointed out above, even in the worst-case scenario for AWS, it will still be able to report $25 billion in operating margin by 2025. With a PE multiple of 20 to 30 times, AWS could still have a standalone valuation of close to $1 trillion in average scenario by 2025.

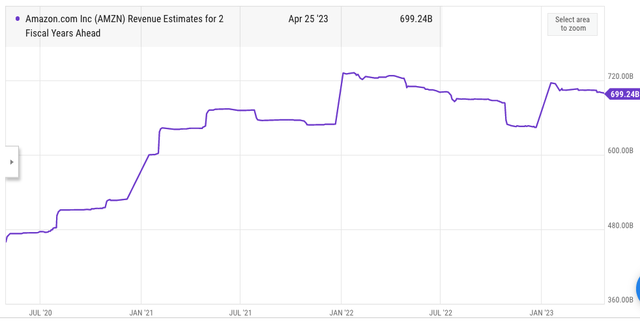

Figure 3: Increase in Amazon’s forward revenue estimates. Source: YCharts

The average estimates for Amazon’s future revenue are quite good. Most of the growth would come from more lucrative segments like advertising, subscription and third-party services which should help in improving the margins for the company. The revenue base of these three segments is already close to $50 billion which is equal to 40% revenue share in the recent quarter. AWS contributes another 18% to Amazon’s revenue. An increase in revenue share from high growth, high margin segments should improve the sentiment towards Amazon stock in the medium to long term.

Investor Takeaway

The slowdown in AWS is overhyped and it was already priced in as the company was facing difficult macroeconomic situation and tough comps. Even with modest growth rate and margin, AWS should still report over $25 billion in operating margin for 2025 which can give this segment a standalone valuation of close to $1 trillion. Amazon’s other profitable segments are increasing their revenue share which should help in improving the overall revenue growth rate and margins for the company. Despite the recent numbers reported in AWS, Amazon stock is a buy due to long term growth potential in key segments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.