Summary:

- Amazon is still the market leader both in e-commerce and cloud computing IaaS markets.

- A strong outperformance of Q1 estimates seems to have been deflated by a slight slowdown in AWS net sales growth.

- Robust product offerings and healthy organic growth is still being hampered by unfavorable macro conditions and FX rates.

- Long-term outlook remains unchanged, Amazon is still a BUY at current prices.

- Strong Buy will be earned around the $90 mark or if expected profitability shows positive surprise.

We Are

Investment Thesis

Amazon (NASDAQ:AMZN) is a hugely profitable mega-moat business which has just released an overall strong FY23 Q1 earnings report.

While operating margins, incomes and revenues have grown, a slowdown in growth rates for almost all of the company’s business segments has prevented shares from exhibiting any tangible breakout.

Long-term outlook seems to remain unchanged for the company as their core revenue streams and still solid and AMZN stock continues to offer value-oriented investors a tangible discount.

Company Background

Amazon is an American e-commerce and cloud/web service provider which dominates almost every market in which they operate. Their economic and social influence is realized across the globe through various business segments which give the company significant breadth and economic moat.

The bulk of Amazon’s revenues arise from their e-commerce sales with Amazon Web Services (AWS) being their second primary source of sales. Significant revenues are also realized through their Prime subscription service and through their offering of digital advertising solutions.

The immense scale on which Amazon operate has allowed the company to develop an ingrained presence in the lives of most Americans and Europeans. The breadth of services offered by the firm makes it almost impossible for the average person to live their life without benefitting from Amazon related products of services in one way or another.

The company’s recent Q1 earnings report has left many traders still holding bearish against the retail giant despite a significant outperformance of profit expectations due to a slowdown in AWS growth. This mixed set of signals from the company means an updated moat, financial situation and valuation analysis is required to deduce what value exists for potential investors.

Economic Moat – May 2023 Update

Amazon.com | FY23 Q1 Earnings Report

Amazon harbors a true mega-moat status as their breadth of services and product offerings create significant long-term value opportunities for the company.

I conducted a full in-depth analysis of Amazon’s economic moat back in January 2023 which I still believe is mostly valid, you can check it out by here: “Amazon: Long-Term Value Unaffected By Short-Term Headwinds”. And then, I covered Amazon in March, which you can read here: “Amazon: Long-Term Value Unaffected By Short-Term Headwinds“.

Nonetheless, some elements of their economic moat deserve a small update which I will cover here. Particularly, it is to do with their primary profit drivers: AWS and e-commerce.

Amazon.com | AWS

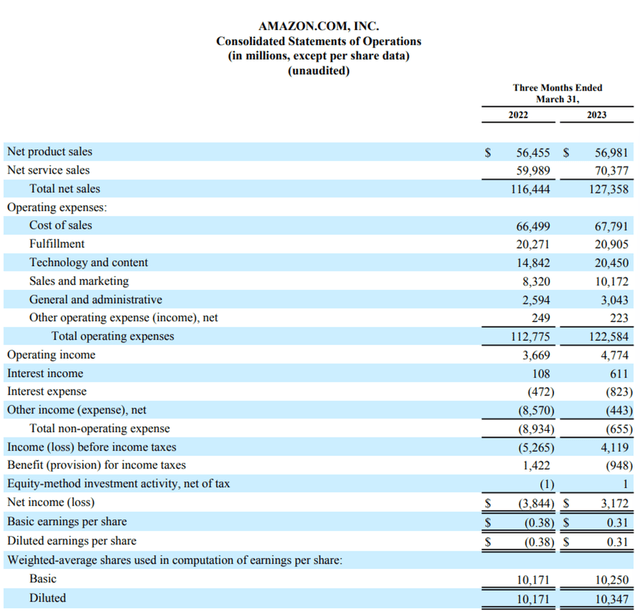

Regarding AWS, the previously souring sentiment towards Amazon’s IaaS cloud computing service seems to have been somewhat warranted given that sales grew by a meager 16% YoY. Many analysts suspected earlier this year that AWS is reaching a growth ceiling due to the increasing competition and market saturation occurring within the industry.

While this seems to be the case, it is important to remember that Amazon’s AWS solution is still the market leader in the sector. While competition is increasing both from Microsoft’s (MSFT) Azure and Google (GOOG) (GOOGL) Cloud, Amazon controls approximately 34% of the entire market.

The product of AWS pay-as-you-go cloud infrastructure presents companies with the opportunity to significantly reduce their own IT departments complexities. This incentivizes organizations to adopt AWS technologies.

Once incorporated in the AWS network, it would be almost prohibitively complex for a company to switch to a different product such as Azure by Microsoft or Google Cloud. Furthermore, firms with significant online media presence who rely on AWS would risk potential disruptions to consumer user experiences if issues were faced during a change in provider.

Even if Amazon is unable to attract significantly more customers into the AWS platform during 2023, the stability and profitability of their current AWS userbase is high. Therefore, I believe AWS still helps to increase the size of Amazon’s economic moat and remains an incredibly valuable asset to the company.

From the perspective of their e-commerce business, Amazon continues to be the undoubted market leader in online retail across the majority of developed western nations.

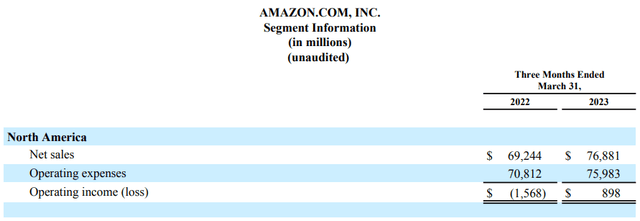

The company’s FY23 Q1 earnings report showed that their North America segment has finally become profitable again with operating incomes of $900M being achieved. Compared to the $1.6B loss in Q1 of FY22, this represents a huge turnaround and finally a much-awaited step towards pre-pandemic levels net margins.

Unfortunately, Amazon’s international sales were still loss producing garnering the company a $1.25B net expense for Q1 FY23 which while disappointing, is largely expected.

Given the unrelenting levels of inflation still plaguing Europe and Asia along with increasing labor issues in these geographic regions, I still believe it will take a couple years for the company to take a tangible step back towards profitability in these markets.

Amazon’s digital advertising business also continues to exhibit strong YoY growth at 23% through the first quarter of FY23. This lucrative industry could yield the company huge returns in the future as digital advertising tends to provide for larger operating margins thanks to the lower operating costs associated with the business.

Considering the above and my previous thoughts in the full in-depth analysis and March 2023 updated, I fully believe Amazon’s economic moat remains intact moving further into 2023. The strong operating margins in their e-commerce business combined with a still robust AWS business suggests Amazon is still well placed for future value generation.

Financial Situation – Q1/FY23 Update

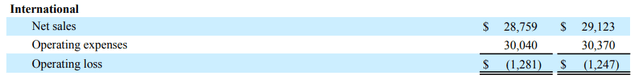

The first quarter for Amazon in FY23 was overall positive despite a couple hairs in their fiscal soup. Operating income increased almost 30% to $4.8 billion in Q1, compared with $3.7 billion in the same period during FY22.

This was largely due to the aforementioned $900M in operating incomes earnings from their strong North American market segment.

Net sales increased 9% YoY. This is including a $2.4B unfavorable FX impact caused by a worsening in foreign exchange rates throughout 2022 and early 2023. Once more Amazon’s North American market segment saw the strongest gains with an 11% YoY growth in net sales.

International markets grew a respectable 9% on a constant currency basis (1% adjusted for FX impacts) which illustrates that Amazon’s lack of profitability in this geographic segment is largely due to the FX rates and not any fundamental failure of their product offering.

FCF improved to an outflow of $3.3B for the TTM compared to an outflow of $18.6B for the TTM ended March 31, 2022. Operating cash flows increased a healthy 38% for the TTM compared to the same period ended March 31, 2022.

Amazon’s total operating expenses grew another 9% in Q1 totaling over $122.5B compared to $112B in Q1 of FY22. This was once more due to the sticky rates of inflation affecting economies and business across the globe leading to increased transportation, labor and packaging costs.

The main factor from this Q1 earnings report that seems to have stopped Amazon’s shares from breaking out is the slowdown seen in their AWS growth. The drop to just 16% YoY net sales growth for the business appears to have set off alarm bells for many analysts which I simply cannot understand.

AWS is beginning to be a maturing business for Amazon as cloud computing IaaS solutions have become significantly more mainstream within the business world. Furthermore, competition from Microsoft and Google has left the market saturated with product offerings which undoubtedly has contributed to Amazon’s AWS slowdown.

However, the rapidly increasing rates of AI adoption and integration into the IaaS offerings could yield Amazon significant growth in the future. While Microsoft seems to have taken a head start in this new world of AI products offerings, Amazon’s AWS system is still perfectly placed to benefit from such technological innovations.

This could help further spur AWS growth in the future. Regardless of this, AWS is an incredibly profitable and robust business segment which should not be underestimated by investors.

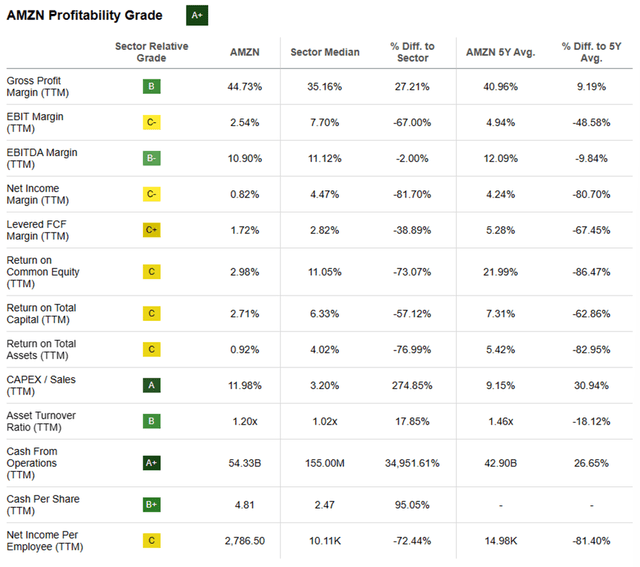

Seeking Alpha | AMZN | Profitability

Seeking Alpha’s quant continues to rate Amazon with an “A+” profitability metric which I believe still accurately represents the company’s profit generating prowess.

While short-term headwinds could result in weaker than anticipated 2023 results, I believe the company’s continued march towards pre-pandemic margins combined with strong North American segment results offset the slight slowdown in AWS earnings.

Valuation

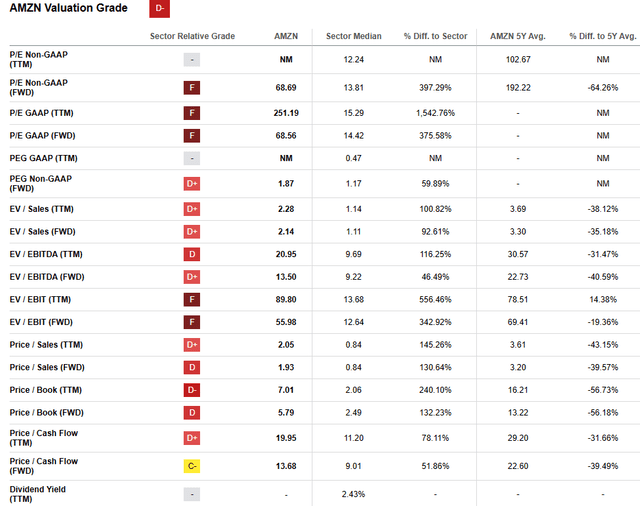

Seeking Alpha | AMZN | Valuation

Seeking Alpha’s quant has downgraded its “D” valuation rating for Amazon seen in early March 2023 to a “D-“ here in early May.

I still find this to be rather pessimistic. Their current P/E GAAP FWD ratio of just 68.7 combined with an equally low (relatively speaking) P/CF FWD of 13.7 suggest the company may not be as overvalued as the quant believes.

Seeking Alpha | AMZN | Summary

From an absolute perspective, Amazon shares are still incredibly cheap. While shares have risen by 23% YTD due to the early 2023 bull rally that seems to have swept across a majority of markets and industries, Amazon last traded for $105 back in April 2020.

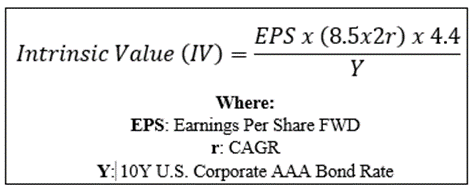

By accomplishing a simple financial valuation based on the calculation below and using the estimated 2024 EPS of $2.54 a realistic r value of 0.20 (20%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive a base-case IV for Amazon of $121.

The Value Corner

When using this reasonably realistic CAGR value for r, Amazon still appears to be undervalued by a substantial 13%. Even when using an incredibly conservative CAGR value of 0.16 (16%), shares are valued at around the $100 mark, meaning the firm would still be fairly valued.

Therefore, I believe Amazon as a historically growth-oriented company is currently sitting somewhere between fairly valued and modestly undervalued. I believe the ability to enter into a position in a growth stock at even a modest discount is truly attractive, even to the most deep-value oriented investor.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. Much depends on the prevailing macroeconomic conditions and the severity of the expected economic slowdown in 2023.

Luckily for long-term value investors, any short-term drop will most likely be due to negative investor sentiment rather than sound fiscal reasoning. Any decrease in share prices would only increase the possibility for a value-oriented position to be initiated.

In the long term (2-4 years) I fully expect their position as a leader in the industry to become even stronger. Their unique industry knowledge combined with the potential for significant future growth places little doubt in my mind over the almost undoubtable returns the company should be able to provide to shareholders.

From a pure value perspective, it is absolutely possible to argue an undervaluation is present in Amazon. The negative sentiment currently present in the marketplace is largely unfounded and rooted in outdated information and speculation.

If shares drop closer towards the low $90 mark, a true deep-value proposition could be made for Amazon shares.

Risks Facing Amazon

The primary risks facing Amazon remain largely unchanged compared to my January and March 2023 analysis.

The risk of failed execution of future innovations and development strategies remains a threat along with the potential for a recession in 2023 to particularly hurt their e-commerce sales.

From an ESG perspective, Amazon must continue to ensure their employees are better protected moving into the future to avoid negative social sentiment towards the company. Recent allegations of worker mistreatment and poor employment conditions have placed the company in hot waters with pro-union social groups.

AWS also harbors some more unique risks for Amazon due to the incredible amounts of data their servers process both on individual shoppers and their commercial customers. Ensuring the possibility of a cyber-security breach is mitigated should remain a top priority for the firm.

I do not particularly see a slowdown in AWS growth as a risk, given that the business is fundamentally sound even at its current scale.

Summary

While the last year has been less than impressive for the company, their robust business fundamentals, huge economic moat and significant scale still remain significant drivers for future economic growth.

In the short-term Amazon may continue to see stagnating operating profits along with softening retail sales. Nonetheless, their undeniable position as the market leader in the e-commerce market combined with strong AWS growth should position the company for a much awaited comeback as we move closer to 2024.

Current share prices have left the company trading at a relative undervaluation to the company’s past and expected future value. The promise of strong cashflow generation combined with a diversified revenue generation portfolio should mean significant returns are on the horizon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.