Summary:

- Amazon is reporting second quarter results and still growing at a solid pace – especially advertising revenue is increasing about 20% year-over-year.

- The stock is trading for 40 times earnings and free cash flow, and still seems a bit expensive.

- Right now, the looming recession might be the biggest risk to Amazon, and the stock still seems too expensive to account for that risk.

- Amazon remains a “Hold”.

MikeMareen/iStock Editorial via Getty Images

Amazon.com, Inc. (NASDAQ:AMZN) (NEOE:AMZN:CA) was a stock I have always been cautious about in the last few years – especially as the stock was too expensive in my opinion. And similar to previous articles, I rated Amazon as a “Hold” in my last article as well and argued that the price is still not fully justified. In my conclusion, I wrote:

I certainly could be wrong again at this point and my caution about Amazon might not be justified. After all, the company improved its bottom line and free cash flow in an impressive way, and we are still dealing with a great business that has a wide economic moat around its business (built on several sources of moat – including switching costs and cost advantages).

And Amazon also grew more and more into its valuation, but 43 times free cash flow is still rather expensive and certainly not a bargain. And considering that the stock reached its previous all-time highs I would be cautious at this point.

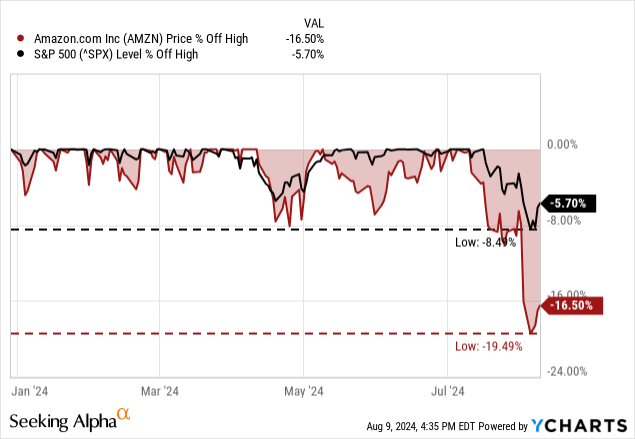

And it seems like my caution has been justified this time, as Amazon was declining a little more than 10% since my last article was published. Of course, we can argue that the decline was only due to the broader market sell-off, which affected Amazon as well. However, I don’t think it is justified to only explain a stock performance by looking at the performance of the broader market.

When looking at Amazon, there are several reasons to be optimistic as the business is still growing at a solid pace, and we see the business improving. Additionally, the stock seems to get more reasonably valued – at least when looking at valuation multiples. And as Amazon has lost about 20% from its previous all-time highs and almost entered bear market territory, we can also ask the question if Amazon is cheap enough already.

Valuation Multiples

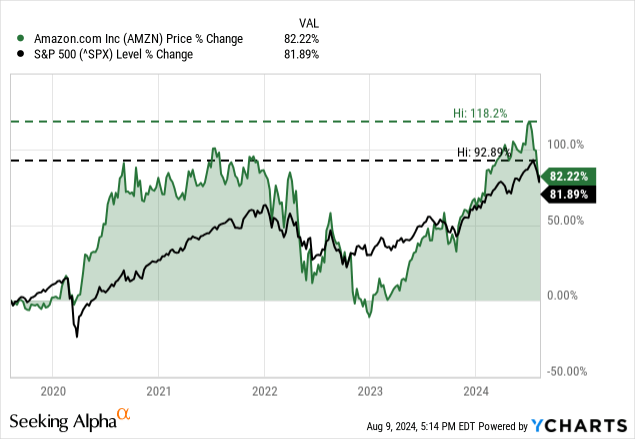

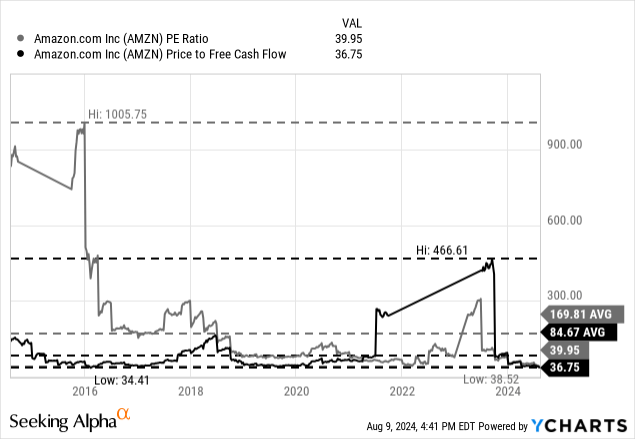

One of the major issues with Amazon was always the fact that the stock was trading for extremely high valuation multiples, and the stock was never really cheap. However, in the last few years the picture changed a little bit and when looking at a five-year timeframe, for example, Amazon was not able to outperform the S&P 500 (SPY) anymore.

And while the stock price still increased, but not with such a high pace as in the past, the fundamental business still improved (especially net income and free cash flow). And this led to a declining price-earnings ratio as well as a declining price-free-cash-flow ratio. Right now, Amazon is trading for 37 times free cash flow and for 40 times earnings per share.

These valuation multiples are close to the lowest valuation multiples Amazon has ever been trading for, but of course, 40 times earnings or almost 40 times free cash flow is still not cheap and can only be justified by a business growing with a high and especially stable pace. Now, let’s look at the last quarterly results.

Quarterly Results

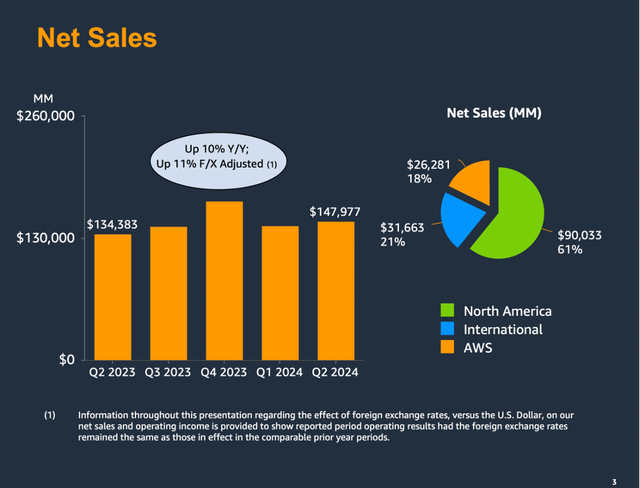

On August 01, 2024, Amazon reported second quarter results, and the results were solid once again. Top line is continuing to increase with a solid pace and total net sales increased from $134,383 million in Q2/23 to $147,977 million in Q2/24 resulting in 10.1% year-over-year growth. And while top line is growing with a solid pace, operating income almost doubled from $7,681 million in the same quarter last year to $14,672 million this quarter (91.0% year-over-year growth). Finally, diluted earnings per share also grew 93.8% year-over-year from $0.65 in Q2/23 to $1.26 in Q2/24.

And when looking at revenue in more detail, we see net product sales increasing 4.3% year-over-year from $59,032 million in the same quarter last year to $61,569 million this quarter. Growth was especially driven by net service sales, which increased from $75,351 million in Q2/23 to $86,408 million in Q2/24 – resulting in 14.7% year-over-year growth.

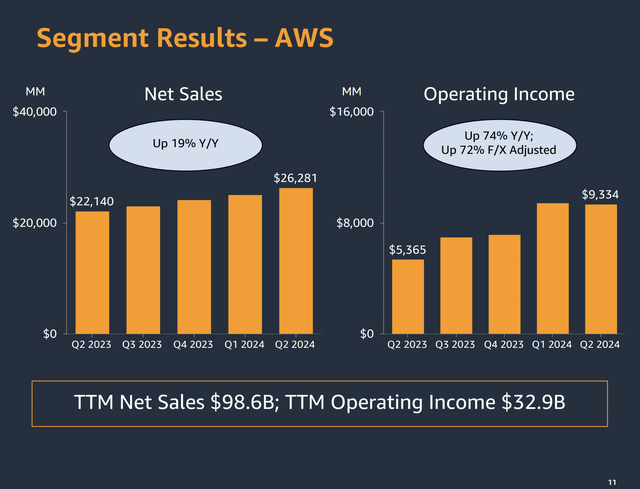

Additionally, we can look at the three main segments Amazon is reporting in. Let’s start with AWS, which is still responsible for the biggest part of operating income. While sales for the segment increased 18.7% year-over-year to $26,281 million, operating income also increased 18.1% year-over-year to $6,334 million. This results in an operating margin of 24.1% – the highest of all three segments, and it is also responsible for 34.5% of total operating income. And during the last earnings call, CEO Andy Jassy mentioned three macro trends driving AWS growth: companies having completed the majority of cost optimization efforts, companies spending their energy on modernizing their infrastructure and moving to the cloud and finally companies being excited about leveraging artificial intelligence.

When looking at the other two segments, we also see stable growth – especially for the North America segment. Sales for the segment increased 9.1% year-over-year to $90,033 million. Operating income also increased 57.7% year-over-year from $3,211 million in the same quarter last year to $5,065 million this quarter. And the International segment also increased its sales 6.6% to $31,663 million. Instead of an operating loss of $895 million in the same quarter last year, the segment reported an operating income of $273 million this quarter.

Prime And Advertising

And the two segments – North America and International – consist of several “subsegments” and different business units, which are more interesting to look at. Let’s start by looking at the advertising business. Advertising revenue increased from $10,683 million in Q2/23 to $12,771 million in Q2/24 – resulting in 19.5% year-over-year growth and the advertising business reached $50 billion in annual revenue. Sponsored ads are driving most of Amazon’s advertising revenue and as pointed out during the earnings call, management is seeing further opportunity to grow.

In my previous article I argued that Amazon is continuing to take market shares from its two major rivals – Alphabet Inc. (GOOG) and Meta Platforms (META) – and when looking at the last quarter, Amazon is still outperforming Alphabet, which grew its Google advertising revenue about 11% year-over-year. Meta Platforms, however, grew advertising revenue almost 22% year-over-year and therefore with a slightly higher pace than Amazon.

Especially, advertisement on Prime Video continues to be a great opportunity for Amazon to grow its revenue. During the last earnings call, CEO Andy Jassy stated:

With ads and prime video, the exciting opportunity for brands is the ability to directly connect advertising that’s traditionally been focused on driving awareness, as is the case for TV, to a business outcome, like product sales or subscription signups. We’re able to do that through our measurement and ad tech, so brands can continually improve the relevance and performance of their ads. While ads have become the norm in streaming video, we aim to have meaningfully fewer ads than linear TV and other streaming TV providers. And of course, for customers preferring an ad-free experience, we offer that option for an additional $2.99 a month.

And Amazon is not only growing its advertising revenue. Subscription services also increased sales from $9,894 million in the same quarter last year to $10,886 million this quarter – resulting in 10.0% year-over-year growth. During the earnings call, management also pointed out that its storytelling is resonating with the hundreds of millions of monthly viewers worldwide, and it is also mentioning its 62 Emmy nominations the Amazon MGM Studios recently received.

Technical Picture

So far, Amazon seems like a good business to invest in as the different segments are growing with a stable pace. But when looking at the business and stock from different perspectives, we can also find some arguments making us rather cautious about an investment.

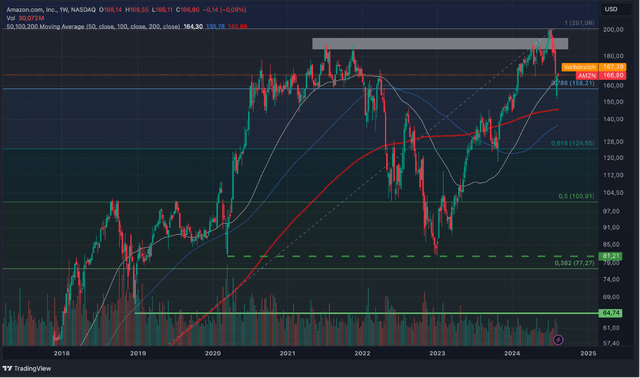

In my previous articles, I often looked at the chart and identified several resistance levels in the chart. But in the last few months, Amazon constantly moved higher, and it also reached the previous all-time high again, which the stock set in 2021. And recently, the stock also tried to break out above this level; however, the breakout failed and in the following weeks the stock declined rather steep.

Now, we can argue that the decline was just going hand-in-hand with the overall stock market decline in the United States (and many other countries around the world). However, when comparing Amazon to the S&P 500, we see Amazon declining much steeper than the index. And it is not untypical for technology stocks (especially those trading for rather higher valuation multiples) to decline rather steep. Nevertheless, we should take the false breakout seriously, as it could be a warning sign for much lower stock prices in the coming months. From a technical point of view, I would not buy Amazon at this point as the chart is not looking so bullish.

Author’s work created with TradingView

And I also don’t care that analysts – here on Seeking Alpha as well as on Wall Street – are extremely bullish about Amazon. While it is not surprising that Wall Street is rather bullish (Wall Street is mostly bullish), I would pay more attention to the opinions presented here on Seeking Alpha.

Nevertheless, in my view, we should be extremely cautious about the stock and company for one reason in particular – the looming recession.

Talking about Recession

One of the most important aspects we should talk about right now and keep in mind is the looming recession that could have a huge impact on thousands of companies around the world, including Amazon. During the last earnings call, management already mentioned that customers are already getting price-sensitive:

In our stores business, we saw growth of 9% year-over-year in the North America segment and 10% year-over-year in the international segment. A few notes on our North America revenue growth rate. First, last quarter’s leap day added about 100 basis points of year-over-year growth. Second, we’re seeing lower average selling prices, or ASPs, right now because customers continue to trade down on price when they can. More discretionary higher ticket items, like computers or electronics or TVs, are growing faster for us than what we see elsewhere in the industry, but more slowly than we see in a more robust economy.

Amazon already seems to feel the pressure a little bit of customers trying to spend less. Nevertheless, I assume that pressure will get a lot worse during a potential recession. While Amazon does seem diversified, it has several business segments which are far from recession resilient. Its whole e-commerce business (including third-party sellers) is not recession resilient as these are mostly not essential, everyday items, and advertising revenue is usually also taking a hit during a recession. And when looking at revenue from physical stores (which is mostly Whole Foods) we should also be a little cautious. The business is selling mostly essentials, but we should not ignore that Whole Foods is rather expensive and sells high-priced items. In case of a recession and customers getting even more price sensitive as they are already, they might switch to cheaper alternatives and Whole Foods might be forced to lower prices.

In the case of Amazon, we don’t really have data on how the business will perform during a recession, as the 2020 recession was rather an exception and Amazon profiting due to lockdowns. And in 2008, Amazon was still growing at a high pace. Hence, we should not assume the performance during the next recession being similar as during the last two recessions.

Recession Signs

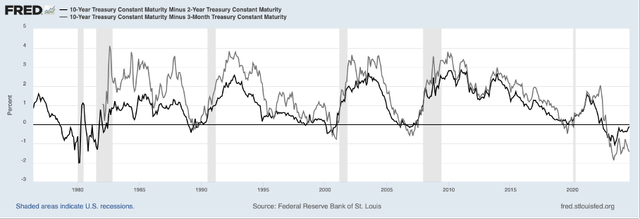

And while other investors might disagree, I still see the United States being close to a recession. I articulated this point of view, especially since the yield curve inverted back in 2022, and I admit it has been a very long time since that first warning sign and as far as we know, the United States is still not in a recession.

According to official data, we are still not in a recession, but it seems like we are very close to the next warning sign going. There are many “events” usually occurring before a recession and the re-inverting yield curve is one of these signals. And right now, the 10-year vs. 2-year treasury yield is close to zero again indicating that the yield curve, which is still inverted, will go back to “normal”.

Aside from interest rates reacting to economic data and indicating a recession, the FED is usually also reacting to the economy struggling and is starting to lower interest rates to stimulate the economy. The so-called FED Pivot (the FED switching from increasing interest rates to lower interest rates again) is another step usually happening before a recession. And for September 2024, analysts and market participants seem to be 100% certain a rate cut will occur. And when looking at data from the CME Group, interest rates are expected to be lowered several times in the coming months and not only by 25 basis points.

I often point out that the initial claims for unemployment insurance can be another warning sign – but a rather weak one. Nevertheless, the numbers are increasing constantly since January 2024 (I am looking at the 4-week average to level out fluctuations).

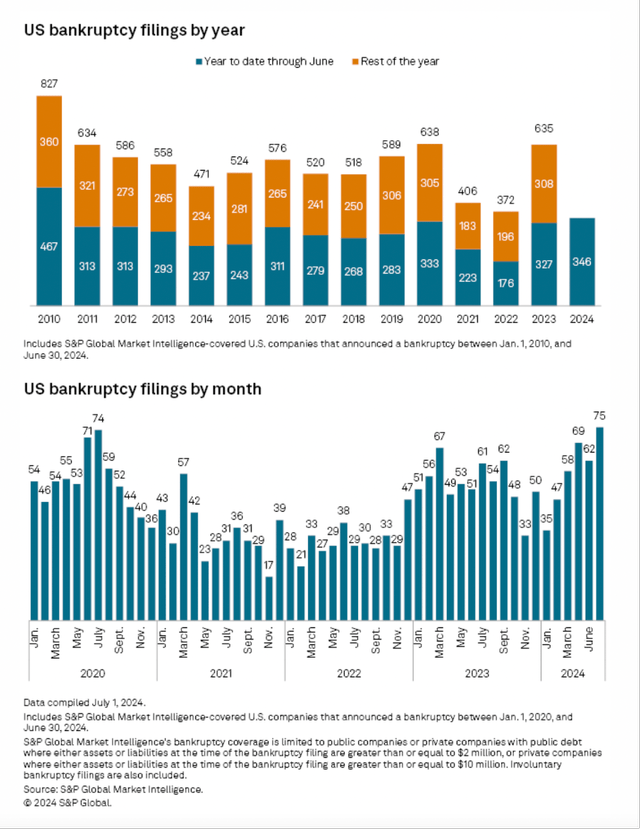

And the increasing unemployment claims might go hand-in-hand with the increasing number of bankruptcies. A high number of businesses going bankrupt will lead to difficulties for some people to find a new job right away.

And when looking at the year to date through June data by S&P Global, we see the highest number of bankruptcies since 2010 and the last monthly data from June 2024 is also the highest (75 bankruptcies) since 2020.

All in all, I see us at the eve of a potential global recession, and Amazon is certainly not the best pick in such an environment.

Intrinsic Value Calculation

Finally, we are calculating an intrinsic value once again to determine if Amazon is a good investment or not. And I still find it very difficult to determine an intrinsic value for Amazon, as I find it difficult to make reasonable estimates for free cash flow and growth in the years to come. While it seems obvious that growth rates are slowing down, estimating the growth rates for the years to come seems rather difficult – especially as we have to estimate how Amazon might perform during a recession (and as mentioned above, we don’t have historic data we can use as it might not be comparable).

As basis for such a calculation we can take the free cash flow of the last four quarters, which was $52,973 million, the last reported number of diluted outstanding shares (10,708 million) as well as a 10% discount rate. We could calculate with 11% growth for the next ten years (according to analysts’ expectations for earnings per share between fiscal 2024 and fiscal 2033). Following the next ten years, we can calculate with a 6% growth till perpetuity, and this leads to an intrinsic value of $176.15 and Amazon would be slightly undervalued at this point.

And we must also keep in mind that 6% growth till perpetuity is a high growth rate. A business growing at such a rate till perpetuity would constantly grow (at least) at twice the pace of the overall economy in the United States. History has shown us several examples of companies outpacing GDP growth for several decades, and I think Amazon could also be one of these companies. But we can also make the argument that we should not calculate with more than 3% growth till perpetuity. When calculating with these growth rates, we get an intrinsic value of $118.65 and should be rather cautious about buying Amazon right now.

Of course, we also must question if 11% growth is reasonable for the next few years if the United States should fall into a recession. But on the other hand, Amazon grew earnings per share with a CAGR of 23.56% in the last five years, and we could also make the argument for higher growth rates again. And in such a scenario of being rather uncertain, I would lean towards the side of caution and the right move would be to stay on the sidelines.

Conclusion

Amazon is growing slowly into its previously high valuation multiple, with the stock stagnating a bit and the fundamental business still growing at a solid pace. However, I still see the stock as being too expensive at this point – especially with the risk of a looming recession and huge parts of Amazon’s business being not really recession resilient.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.