Summary:

- Amazon introduced a grocery delivery subscription for Prime members, aiming to monetize its 200 million Prime members and enhance Whole Foods’ competitive advantage.

- Expecting strong growth in AWS, driven by AI demands and digitalization transformation, with a forecasted 13.5% revenue growth in the near future.

- Downside risks include competition from Chinese e-commerce platforms like Temu and Shein, impacting Amazon’s e-commerce growth. Amazon launched a discount section to compete.

4kodiak/iStock Unreleased via Getty Images

I pointed out Amazon’s (NASDAQ:AMZN)(NEOE:AMZN:CA) double-digit revenue growth in third-party seller services and the notable potential for margin expansion, in my previous article published in April 2024. Amazon is set to schedule its Q2 result on August 1st after the bell. I believe the third-party seller service and AWS will continue to fuel Amazon’s growth in the coming years. I reiterate a ‘Strong Buy’ rating with a one-year price target of $240 per share.

Grocery Delivery Subscription

On April 23rd, Amazon launched a grocery delivery subscription benefit for Prime members and customers using Electronic Benefit Transfer in over 3,500 cities in the U.S.. Amazon has tested the market in three cities last year. With a $9.99 monthly subscription fee, Prime members can enjoy free delivery on orders over $35 across Amazon Fresh, Whole Foods Market and other grocery retailers.

I think the expansion into grocery delivery is quite important for Amazon for the following reasons:

- Amazon has more than 200 million Prime members. With the new subscription services, Amazon could further monetize its Prime members, contributing additional subscription revenue to the overall topline.

- The subscription provides one-hour delivery services at no extra costs where the service is available. This is highly convenient for Prime members. Additionally, customers can access a variety of retail stores.

- The subscription service could enhance Whole Foods’s competitive advantage, contributing to revenue growth for Whole Food.

- Amazon’s subscription fee is similar to other food delivery service providers. For instance, Instacart charges $3.99 for same-day orders over $35, or customers can subscribe Instacart+ services for $9.99 per month for unlimited free delivery on orders over $35. As Amazon scales its grocery delivery services, I anticipate Amazon could provide more benefits for its subscribers, leveraging its larger scale compared to other smaller players.

Expecting Strong Cloud Growth

As indicated in my previous articles, AWS has been a significant growth driver for Amazon over the past few years. AWS grew by 13% in Q4 FY23 followed by 17% year-over-year growth in Q1 FY24. Alphabet (GOOGL) reported 28.8% year-over-year growth in their cloud business in Q2 FY24, signaling strong cloud computing demand among enterprise customers.

Most cloud hyperscalers have noted that enterprise customers began optimizing their cloud infrastructure starting in early 2023. Over the past few quarters, these hyperscalers indicated that enterprise optimization activities were moderating. The strong growth in Google’s cloud business indicated a strong recovery in the cloud spending among enterprise customers, primarily driven by the continuing digitalization and AI initiatives.

Outlook and Valuation

For the near-term revenue growth, I am assessing the following growth pieces:

- AWS: As discussed previously, I anticipate AWS continuing to grow rapidly, propelled by AI demands and digitalization transformation. It is evident that all the hyperscalers, including Microsoft (MSFT), Amazon and Alphabet, will grow their cloud infrastructure business at 20%+ in the near future, in my opinion.

- North America Business: As discussed in my previous coverage, Amazon’s third-party services has become a major growth driver for Amazon’s e-commerce business. These services leverage Amazon’s comprehensive offerings for payment, logistics, inventory management, and customer services. Additionally, Amazon generate higher margins from their 3rd party services compared to its own e-commerce business. As such, the fast growth of 3rd party services will expand the operating margin for Amazon. I forecast North America business will grow at 12% annually.

- International Business: I assume the business will grow at 12% annually, aligned with the historical growth average.

Combining these factors, I forecast Amazon will deliver 13.5% revenue growth in the near future.

Amazon invested heavily in its infrastructure, including logistics and warehouses during the global pandemic period. In the post pandemic era, Amazon has begun to manage its operating expenses and drive its margins. The reported operating margin increased from 2.4% in FY22 to 6.4% in FY23. In the DCF model, I forecast 50bps annual margin expansion assuming:

- 10bps expansion from gross profits due to the increasing mix towards 3rd party services.

- 10bps operating leverage from fulfillment expenses

- 20bps leverage from R&D and content spending

- 10bps leverage from marketing expenses.

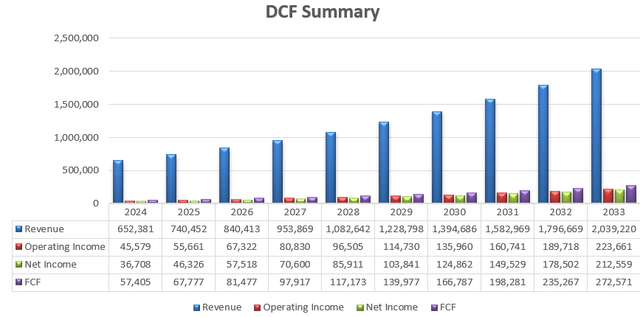

The DCF summary is as follows:

Amazon DCF – Author’s Calculations

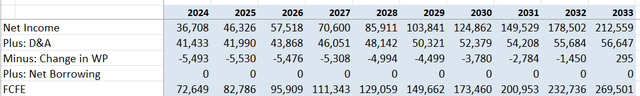

The free cash flow from equity is calculated as follows:

Amazon DCF – Author’s Calculations

The cost of equity is calculated to be 14.3% assuming: risk-free rate 4.2% ((US 10Y Treasury Yield)); beta 1.44 (SA); equity risk premium 7%. Discounting all the FCFE, I calculated the one-year price target to be $240 per share in my DCF model.

Downside Risks

Both Temu and Shein have been expanding their e-commerce businesses in the United States over the past few years. These e-commerce platforms provide direct-to-consumer. no-tariff shipments from China, offering lower costs for U.S. shoppers. Such low-cost e-commerce services could potentially impact Amazon’s e-commerce growth. According to Meta’s (META) past earning calls, these Chinese e-commerce players have been spending heavily on advertisement on the Facebook platform.

On June 26th, Amazon launched a discount section on its shopping site, shipping products directly from China to compete against these Chinese e-commerce platforms.

Amazon’s shareholders need to watch these Chinese e-commerce players closely, as well as any regulations stipulated by U.S. Customs and Border Protection.

End Notes

I favor Amazon’s strength in their 3rd party seller services and its cloud infrastructure business driven by AI workload. It is highly likely that both Amazon’s e-commerce and AWS businesses will grow rapidly in the near future. I reiterate a ‘Strong Buy’ rating with a one-year price target of $240 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.