Summary:

- Amazon’s stock has outperformed the S&P 500 by 28.4% over the last five years, with strong financials and an innovative culture.

- The stock is currently in a strong upward trend, supported by technical indicators such as moving averages, MACD, RSI, and price rate of change.

- Amazon has impressive financial performance, with significant growth and profitability exceeding industry medians, making it an attractive investment choice.

Brett_Hondow

Investment Thesis

Amazon.com, Inc. (NASDAQ:AMZN) shares have soared by 110.38% over the last five years outperforming the S&P 500 by a margin of about 28.4%. This outstanding performance could be as a result of its strong and improving financials. I am bullish on this stock given its innovative culture which enables it to remain relevant to dynamic consumer needs as well as its commitment to improving customer experience. From a technical standpoint, the upward trajectory is strong and as a result, I rate this company as a buy.

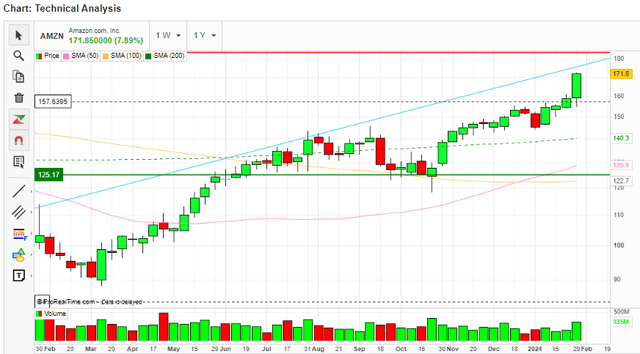

Let’s Begin Technically

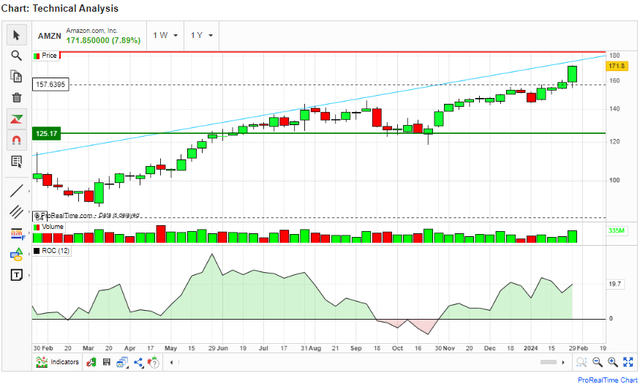

I find AMZN to be having two major zones within which its price have been trending. It has a strong support at around $80.46 and a strong resistance at around $187.62. Since January 2023, the stock bounced on the support zone and has been on a strong upward trajectory as indicated by the blue line. I expect this trend to continue until the price hits the resistance zone where a reversal is likely or where a breakout could occur depending on the growth catalysts and market sentiments.

To evaluate these price actions better, I am diving deeper to evaluate what technical indicators show. Firstly, the price is above its 50-day, 100-day, and 200-day MAs an indication that it is in a bullish trend. Further, the 50-day and 100-day exhibited a bullish crossover confirming that this trend is strong and likely to continue.

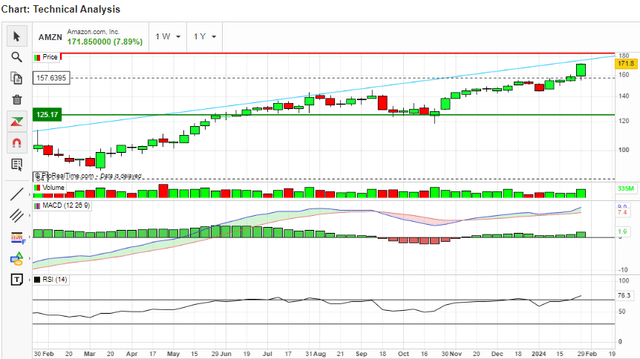

Additionally, the MACD and the RSI are pointing to a solid upward rally. The MACD is above and diverging with the signal line indicating a strong upward momentum which is confirmed by its histogram being above the zero line and growing. The RSI is at 76.3 and although this shows it is in the overbought region, it appears to be going upward and approaching the 100 level an indication that a reversal is not yet likely.

Author Analysis On MarketScreener

Of great interest to me is the price rate of change in this stock. While the other indicators have pointed out that the upward rally is on, it is critical to evaluate how strong this momentum is. Since October 2023, the ROC has been rising consistently an indication that the upward swing is very strong and likely to be sustained.

Author Analysis On MarketScreener

In conclusion, it is very apparent that AMZN has a strong upward momentum with no signs of a reversal. For this reason, I believe this stock is a good investment opportunity for momentum investors. However, they should keep a close eye on the indicators so as to spot the right exit points, perhaps when the price hits the resistance zone and the ROC starts trending downwards and the MACD histogram starts constricting or even falls below the zero line.

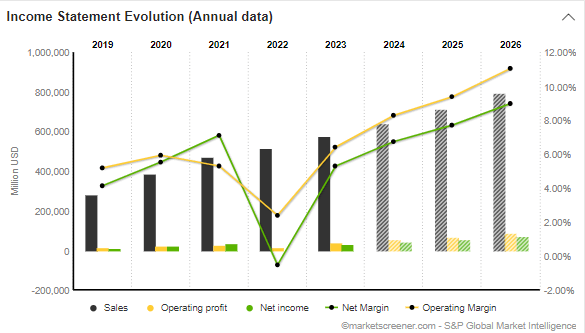

Financials: Nothing But Impressive

For about a decade, Amazon has not had any challenges generating revenues but turning the sales into profit was a challenge. This prompted the founder to focus on growth initiatives and eventually profits began being realized with 2017 being the breakeven point. However, 2022 was a tough year which saw the company’s net income declining to about $2.7 billion. However, since then, the company appears to be on a good course both in its top and bottom line as shown below.

MarketScreener

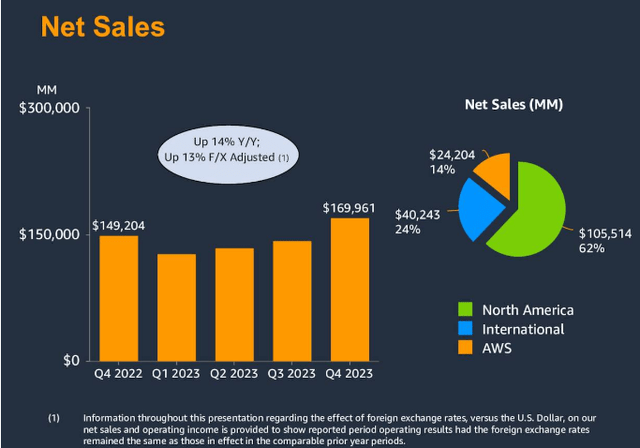

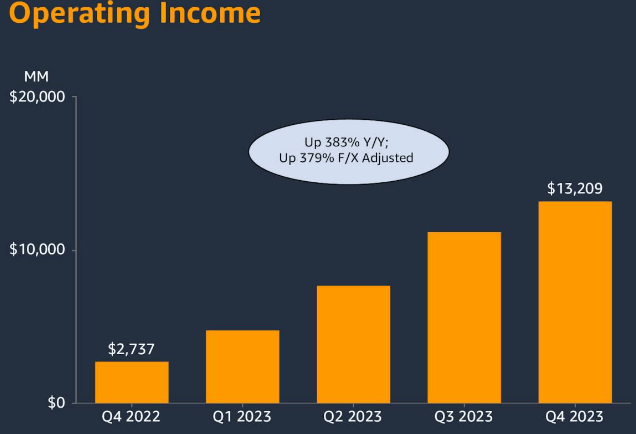

Allow me to draw your attention to the MRQ performance so as to demonstrate how best this company is doing in the front. Net sales came in at $169.96 billion14% YoY.

Its operating income was $13.2 billion a 383% growth YoY.

Q4 2023 Presentation

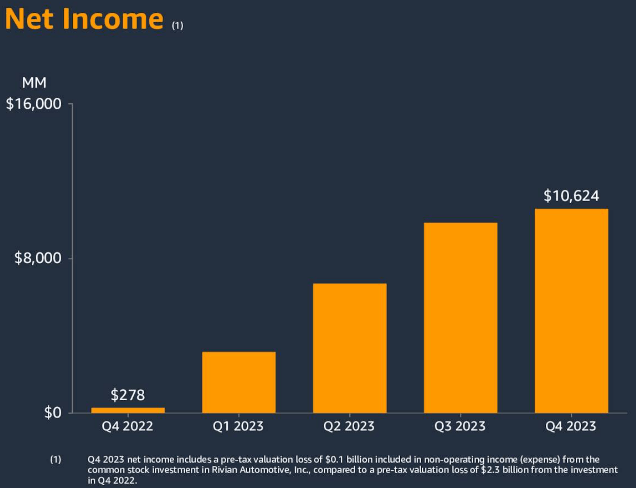

The company’s net income also registered impressive growth from $278 million in Q4 2022 to $10.6 billion in Q4 2023.

Q4 2023 Presentation

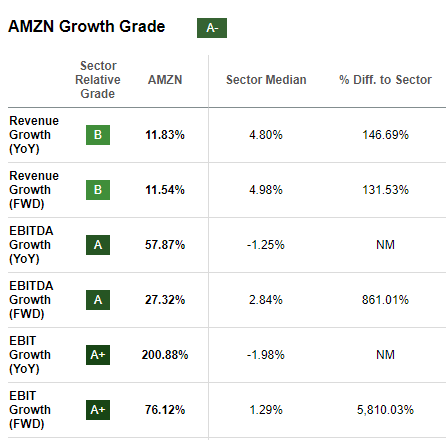

While this performance looks amazing in absolute terms, I believe it is more attractive when looked at comparatively. To do this, I draw your attention to the company’s growth and profitability metrics relative to industry medians. Beginning with growth, AMZN is ahead of the industry medians by more than 100% in all metrics making this company a good growth choice comparatively.

Seeking Alpha

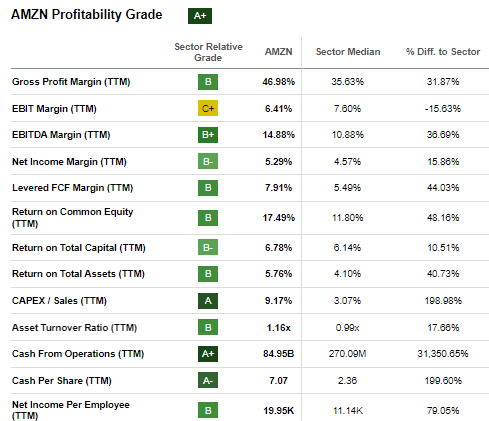

Moving to profitability, the company has also beaten the sector medians significantly in almost all measures making it a top dog in the profitability race as confirmed by the overall grade “A+” in profitability according to Seeking Alpha.

Seeking Alpha

In summary, AMZN has had a very impressive performance having turned around its profitability woes around. At the moment, the company has very attractive growth and profitability both in absolute and relative terms making it a good investment choice for growth and profit oriented investors.

Given this outstanding performance, the most critical part is to evaluate what this company has been doing to achieve such a performance because that is what can assure us that the company can sustain it in the long run. In my opinion, Amazon’s stellar performance has been realized because of its innovations which have helped them stay relevant with dynamic consumers’ needs as well as its focus on improving customer services. I will cover these aspects in the sections that follow.

Innovating To Meet Dynamic Customer Needs

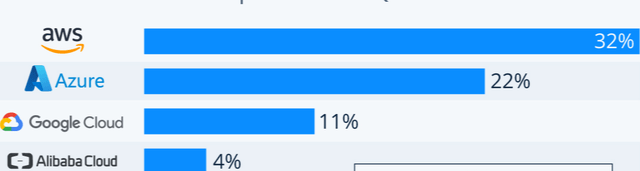

Although I agree with most analysts that Amazon has achieved its strong growth and performance due to its excellent Amazon web service characterized by a dominant market share and its e-commerce dominance, being the world’s leading online retailer with over 300 million users, I would like to evaluate what has led to such leading positions in these major spheres.

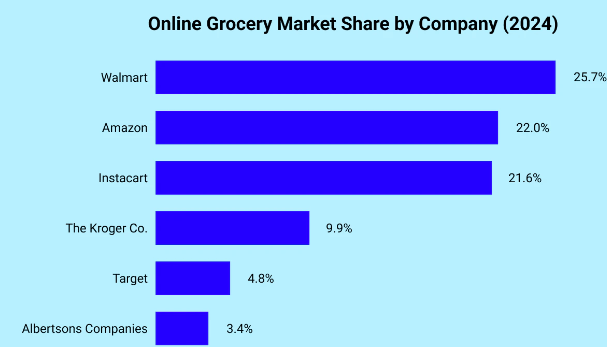

The first aspect that I believe has driven AMZN to these heights is its investment in innovation especially in the emerging customer trends. To support this assertion, I will discuss three of its innovations. The first one is its online grocery. This is one of the fastest growing market segments in the e-commerce as consumers seek convenience. According to Statista, the online grocery segment is projected to grow by a CAGR of 12.74% by 2028. This shows that this company is investing in fast growing segments which bode well for its future growth. Currently, Amazon is the second in terms of online grocery market share slightly behind Walmart, an indication that its venture commands a significant presence in the market.

Oberlo

The other innovation is the Amazon One which is a biometric payment system. This product enables users to verify payment through scanning their palms something which is in compliance with the contactless payment trends since the Covid 19. The contactless payment market size according to the Precedence Research report is expected to grow by a CAGR of 16.1% between 2023 and 2032 further showing how Amazon is investing in high growth market segments.

Lastly, Amazon has invented Lambda which is a serverless computing service and supports multiple programming languages. Among its benefits is its ability to run codes without managing serves. The global serverless market share is projected to grow by a CAGR of 22.24% by 2027.

Following these innovations in high growth segments, it is apparent that AMZN is investing in response to emerging consumer demands as well as responding to emerging trends which makes this company stay relevant to the dynamic consumer needs. In my view, this will not only act as a major competitive advantage but also go a long way in improving the company’s customer satisfaction.

Committed To Improving Customer Experience

It is very appealing to see a company innovate to meet dynamic and emerging consumers’ needs but I believe it is even interesting to see the company striving to improve its customer experience. This is all present in Amazon. To support my assertion, I will just discuss two examples of how this company is striving to enhance its customer’s experiences.

To begin with, the company improved its delivery time significantly in 2023 making it the fastest ever in the world. It delivered more than 7 billion units in the same or the next day at most. This marked an improvement of about 65% YoY in the fourth quarter of 2023. In my view, this fast delivery improves its reliability and convenience translating to improved customer satisfaction.

Secondly, the company has considered improving the health of its prime members through announcing that they can add healthcare from one medical for $9/month and add up to five family members for $6 each. These would translate to an individual saving of about $100 from the conventional membership rates and a family saving of about $133.

These are just two examples of the many initiatives Amazon is adopting to serve its customers better. For these reasons, it is evident that this company is prioritizing its customers something which will go a long way in enhancing its customer satisfaction. This will also improve its reputation as an organization acting as a MOAT and hence sustainable long-term growth.

Investment Takeaway

From a technical perspective, this stock is in a strong upward momentum supported by strong financial growth and profitability. The company’s innovative culture and commitment to enhancing customer experience bodes well for the company’s sustainable long-term performance. As a result, I recommend this stock to momentum, growth, and profit-oriented investors.

However, investors should be aware of the major risk of investing in this stock which is the increasing competition from other e-commerce companies. For example, Amazon is lagging Walmart in the online grocery business whereby it is projected that Walmart is opening the competitive gap on this front. While I believe Amazon’s diversity may offset such occurrences, it is important for investors to keep a close eye on how this company is responding to the increasing competition.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.