Summary:

- Amazon’s Q1 2023 financial results show strong growth, with net sales increasing by 9% to $127.4 billion and AWS sales growing by 16% year over year.

- The company is investing heavily in projects such as healthcare, Project Kuiper, and Large Language Models (LLMs) Generative AI, which could drive future growth.

- However, global economic uncertainties, high inflation rates, and consumer debt levels may impact Amazon’s sales performance, leading to a hold rating for AMZN stock for now.

jetcityimage

Introduction

Analyzing Amazon’s (NASDAQ:AMZN) most recent quarter results, it is evident that they were solid and surpassed most financial results of the comparable quarter in 2022. For instance, Amazon Web Services exhibited a 16% year-over-year growth compared to the first quarter of 2022. However, it is important to consider the impact of worldwide economic slowdowns on people’s purchasing power and consequently, Amazon’s sales.

Financial outlook

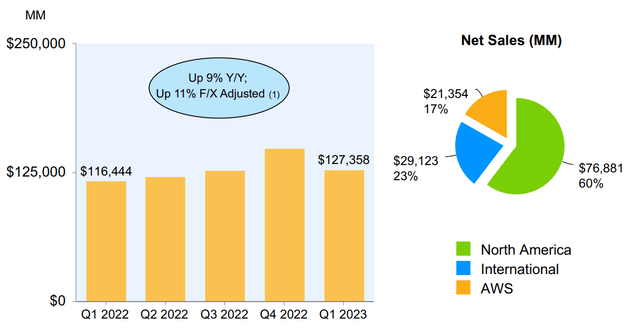

In the first quarter of 2023, Amazon posted impressive financial results compared to the same period in 2022. The company’s net sales increased by 9% to $127.4 billion, up from $116.4 billion in Q1 2022. This growth was largely driven by a 16% increase in sales from the Amazon Web Services (AWS) segment, which reached $21.4 billion year over year. Furthermore, Amazon’s income from operations rose to $4.8 billion in Q1, up from $3.7 billion in the same period last year. Also, it is worth highlighting that over the past year, Amazon’s North America segment has experienced a significant turnaround, going from an operating loss of $1.6 billion in Q1 2022 to an income of $0.9 billion in the most recent quarter. In terms of cash flow, Amazon saw a significant increase in cash flow from operations, rising by 38% to $54.3 billion in the trailing twelve months (TTM) compared to the previous record of $39.3 billion for the TTM ending March 31, 2022. However, despite this growth, their high capital expenditures resulted in negative free cash flow for yet another year. Nonetheless, the outflow of free cash flow was lower at $3.3 billion for the TTM than the outflow of $18.6 billion for the TTM ending March 31, 2022 (see Figure 1).

Figure 1 – Amazon’s net sales

Amazon’s first quarter presentation

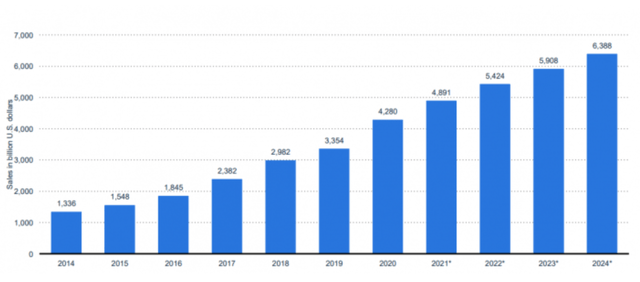

Amazon has been investing heavily in new projects such as healthcare and Project Kuiper, which have been their primary focus throughout 2023. Project Kuiper aims to bridge the digital divide by providing fast and affordable broadband to communities worldwide that are underserved or unserved by traditional technologies. To access Kuiper’s broadband, both residential and commercial customers will need to install a customer terminal outdoor antenna to establish communication with satellites in orbit. Amazon is currently developing two prototype satellites to test the entire end-to-end communications network, with plans to launch a beta version for commercial customers in this year and 2024. Despite a decrease in operating income for the Amazon Web Services segment from $6.5 billion in Q1 2022 to $5.1 billion in the recent quarter, AWS still holds significant potential for long-term profitability for the company. In spite of a cloudy outlook that predicts a slowdown in cloud computing, Amazon’s cloud business has significant growth potential. While customers have reduced their spending since April due to economic uncertainties, it is important to note that these macroeconomic slowdowns will eventually pass. Ultimately, Amazon’s cloud will drive impressive growth as businesses seek cost savings and improved responsiveness and service quality through cloud computing. Additionally, Amazon is well-positioned to capitalize on the growth in ecommerce retail sales in the coming years. In 2020, retail consumer goods ecommerce accounted for 18% of total global retail sales, and this figure is expected to grow by over 1% annually, reaching approximately 22% of total global retail sales by the end of 2024 (see Figure 2).

Figure 2 – Global retail ecommerce sales worldwide from 2014 to 2024

International Trade Administration

Impact of macroeconomic outlook on Amazon

While Amazon’s financial outlook remains strong, it is important to consider the potential impact of broader economic conditions on consumer purchasing power and, consequently, Amazon’s sales performance. The current economic outlook is uncertain due to factors such as high inflation rates, ongoing geopolitical tensions resulting from Russia’s invasion of Ukraine, and the lingering effects of the COVID-19 pandemic. According to forecasts from the International Monetary Fund (IMF), global economic growth is expected to experience a bumpy recovery, with growth rates projected to fall from 3.4% in 2022 to 2.8% in 2023 before rebounding to 3.0% by the end of 2024. However, if financial sector stress persists, global growth could drop even further to around 2.5% in 2023. Meanwhile, global inflation rates are predicted to decline from 8.7% in 2022 to 7.0% in 2023 due to lower commodity prices; however, without significant economic slack, inflation is expected to recover more slowly and may not return to target levels until at least 2025.

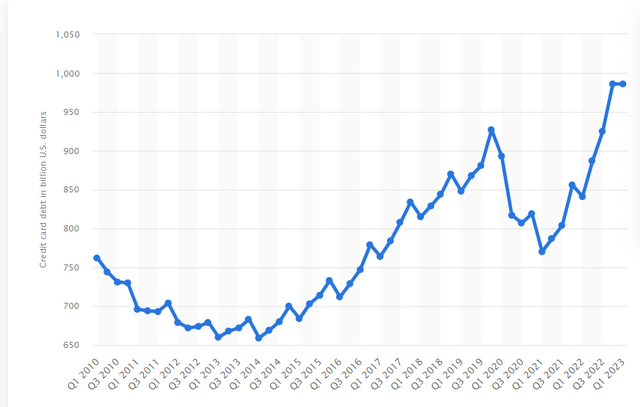

According to Andy Jassy, the CEO of the company, Amazon is investing heavily in Large Language Models (LLMs) Generative AI, as the company expects LLMs and Generative AI to be a big deal for customers and shareholders. As a result of these investments, and the global expansion of LLMs and Generative AI, which have gained the attention of investors nowadays, and various market researches (for example you can see here and here ) that are trying to explain the broad impact of LLMs and Generative AI on E-commerce and marketing one might argue that Amazon’s financial results might improve significantly in the following years. I don’t want to argue against Amazon’s huge investments in LLMs and Generative AI. In fact, these investments are necessary for the company to stay strong in the E-commerce business, and continue growing. Also, I agree with those who say that Amazon’s investments in LLMs and Generative AI might help the company to improve its sales in a significant way. But, at first, there must be more potential customers that might choose to buy Amazon’s products and services. For this to happen, interest rates must decrease, and inflation rates must get back to around 2.0%. The United States’ inflation rates decreased significantly in the past year. However, it is still high (U.S. annual inflation rate in April 2023 was 4.9%) and Federal Reserve must continue its tight monetary policy to reach its inflation target. Due to high inflation rates, the purchasing power of the consumer dollar in the United States dropped in the past year, and as World Bank estimates the U.S. real GDP growth in 2023 and 2024 to be 1.1% and 0.8% (compared to 2.1% in 2022 and 5.9% in 2021), It seems that it would be a relatively low amount of money available in the hands of U.S. consumers to purchase the goods and services from Amazon. Also, it is important to know that from 1Q 2021 to 1Q 2023, credit card debt in the United States increased from $770 billion to $986 billion, up $216 billion (see Figure 3). More specifically, the interest rates are key elements of determination of the sustainability of public debt. Thus, U.S. consumers must pay their relatively high debts to the banks, which might leave a limited amount of money to buy from Amazon. That might be the reason to see a shift in consumer spending towards lower-price items, which was declared by CFO Brian Olsavsky in the last earnings call:

“We saw moderated spending on discretionary categories as well as shifts to lower-priced items and healthy demand in everyday essentials, such as consumables and beauty. Third-party sellers, including businesses who elect to utilize Fulfillment by Amazon for their storage and shipping services are a key contributor to the selection offered to customers.”

Figure 3 – Credit card debt in the United States (in billions U.S. dollars)

Statista.com

Conclusion

In this comprehensive analysis, we have examined Amazon’s financial performance and significant initiatives over the years. While Amazon has demonstrated strong financials, its future results are subject to various factors such as fluctuations in foreign exchange rates, changes in global economic and geopolitical conditions, consumer spending patterns impacted by debt levels and purchasing power, inflation, interest rates, growth rate of online commerce and cloud services, among others. Our detailed investigation reveals that Amazon’s AWS has significant potential for profitability and sales growth but may not see immediate improvement due to the current economic slowdown. According to IMF projections, global economic conditions are unlikely to recover by the end of 2024. In conclusion, we recommend a hold rating for AMZN stock for now despite its long-term growth potential.

We welcome your thoughts on this assessment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.