Summary:

- AMZN’s cost optimization and resultant expansion in operating margins demonstrate that the management has once again embraced the company’s “Two-Pizza Teams.”

- At the same time, the intensified investments in cloud capex and generative AI capabilities are expected to be bottom-line accretive, similarly demonstrating the company’s “Day 1 Culture.”

- Despite the recent rally, we are maintaining our Buy rating, with AMZN still attractively valued amongst its Magnificent 7 peers, thanks to the profitable growth trend.

- Combined with the raised consensus forward estimates, growing balance sheet, and accelerating advertising opportunities, we believe that the company remains well-positioned for growth.

- Anyone hoping for dividend payouts may have been misguided after all, since the additional cash flow will be better utilized for “investing in growth initiatives, as part of its longtime business philosophy.”

Dicky Algofari

We previously covered Amazon.com, Inc. (NASDAQ:AMZN) in February 2024, discussing how it had outperformed expectations, with the strategic cost optimizations and moderated fulfillment/ warehouse locations already triggering notable expansions in its operating income margins and Free Cash Flow generation.

Combined with the long-term e-commerce tailwinds as the macroeconomy recovered and demand for generative AI SaaS/ cloud computing grew, we maintained our confidence that AMZN deserved its spot in the Magnificent Seven group.

Since then, AMZN has already rallied by +11.4%, well, outperforming the wider market at +3.3%. Despite so, we are maintaining our Buy rating, with the stock still cheaply valued amongst its Magnificent 7 peers, thanks to the robust profitable growth trend and the raised consensus forward estimates.

At the same time, with it already retesting the all-time resistance levels of $180s, interested readers may want to observe the stock movement for a little longer before adding upon a moderate retracement, preferably at its previous support levels of $170s for an improved margin of safety.

The AMZN Investment Thesis Remains Cheap, As The Management Delivers Profitable Growth

For now, AMZN has reported a promising FQ1’24 earnings call, with net sales of $143.31B (-15.6% QoQ/ +12.5% YoY) and operating incomes of $15.31B (+15.8% QoQ/ +220.7% YoY).

Much of its top-line tailwinds are attributed to the robust growth observed in AWS at $25.03B (+3.4% QoQ/ +17.2% YoY) and the North America segment at $86.34B (-18.1% QoQ/ +12.3% YoY), with a smaller extent observed in the International segment at $31.93B (-20.6% QoQ/ +9.6% YoY).

The bottom-line tailwinds are mostly attributed to AMZN’s consistent cost optimization thus far, with it reporting 1.521M of full-time and part-time employees as of FQ1’24 (-4M QoQ/ -20M from FQ4’22 peak levels of 1.541M).

This further underscores why it has been able to report impressive overall operating margins of 10.7% in the latest quarter (+2.9 points QoQ/ +7 YoY/ +5.5 from FY2019 levels of 5.2%).

This is significantly aided by AWS’ rapidly expanding operating margins of 37.6% (+8 points QoQ/ +13.7 YoY/ +11.4 from FY2019 levels of 26.2%), with the North American segment back in the black with margins of 5.7% (-0.4 points QoQ/ +4.6 YoY/ +1.6 from FY2019 levels of 4.1%).

With $85.07B of cash on balance sheet (-1.9% QoQ/ +32% YoY) and long-term debts of $57.63B (-1.1% QoQ/ -14% YoY), it is apparent that AMZN has also been generating robust cash flow, based on the resultant growth in its net cash to $27.44B in FQ1’24.

This is compared to $28.46B of net cash in FQ4’23, -$2.68B of net debts in FQ1’23, and $31.6B of net cash in FQ4’19.

Therefore, while AMZN may have also joined the ranks of Google (GOOG), Microsoft (MSFT), and Meta (META) in intensifying their cloud capex while investing in the generative AI capabilities, as observed in the former’s $14.92B of capex reported in FQ1’24 (+2.3% QoQ/ +5% YoY) and a guidance of “our overall capital expenditures to meaningfully increase YoY in 2024,” we are not concerned indeed.

This is particularly attributed to the rich net cash provided by (used in) operating activities at $18.98B (-55.2% QoQ/ +297% YoY) in FQ1’24, one that is typically the weakest quarter of AMZN’s fiscal year due to the seasonally higher accounts payable.

Assuming a similar cadence through the next three quarters, we may see AMZN achieve a record high in Free Cash Flow generation in FY2024, as similarly estimated by the consensus at $60.95B (+65.6% YoY), despite the higher capex.

If anything, we believe that these investments will eventually be bottom line accretive, seeing that the AWS continues to expand its profit margins as discussed above, while growing its multi-year backlog to $157.7B by FQ1’24 (+1.2% QoQ/ +29.2% YoY) with relatively stable cloud market share of 31% (inline QoQ/ -1 YoY).

As a result of these developments, we have the painful hyper-pandemic events (here and here) to thank for indeed.

This is especially since the AMZN management has once again embraced the company’s “Day 1 Culture,” with the “Two-Pizza Teams” concept demonstrating the laser focus in staying competitive by “relentlessly focusing on customers, creating long-term value over short-term corporate profit, and making many bold bets.”

This alone implied AMZN’s promising prospects as an e-commerce and cloud provider giant, further aided by the accelerating advertising growth opportunity with FQ1’24 annualized net sales of $47.28B (+24.4% YoY/ +274.6% from FY2019 levels of $12.62B).

With advertising typically commanding high profit margins, as similarly reported by GOOG and META, AMZN may be a force to be reckoned with indeed, especially due to the well-diversified offerings across shopping, entertainment, healthcare, and grocery available to Prime members.

This has resulted in an estimated 230M in global Prime subscribers as of February 2024 with an impressive 99% 2Y renewal rate in the US, further underscoring AMZN’s extremely sticky offerings, one that is highly valuable to advertisers looking to optimize their ad returns.

The Consensus Forward Estimates

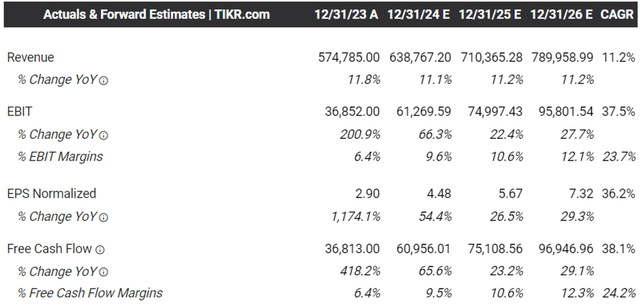

As a result of these developments, it is also understandable why the consensus have raised their forward estimates, with AMZN expected to generate an accelerated top/ bottom-line expansion at a CAGR of +11.2%/ +36.2% between FY2023 and FY2026.

This is compared to the late 2023 estimates of +10.9%/ +16.9%, naturally highlighting the market’s conviction about its ability to deliver profitable growth ahead.

AMZN Valuations

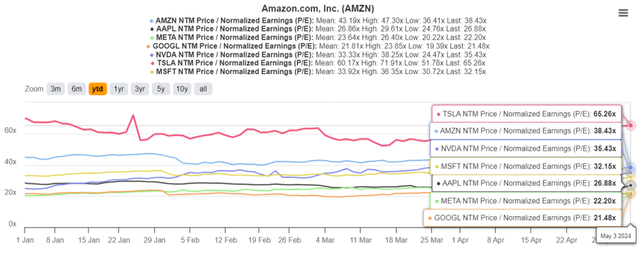

As a result of its raised growth prospects, we maintain our belief that AMZN remains reasonable at FWD P/E valuation of 38.43x, compared to its 5Y mean of 70.28x.

When compared against its Magnificent Seven peers, such as Google (GOOG) at 21.48x, Meta (META) at 22.20x, Apple (AAPL) at 26.88x, Nvidia (NVDA) at 35.43x, and Tesla (TSLA) at 65.26x, it is undeniable that the e-commerce giant is attractive at current levels.

So, Is AMZN Stock A Buy, Sell, or Hold?

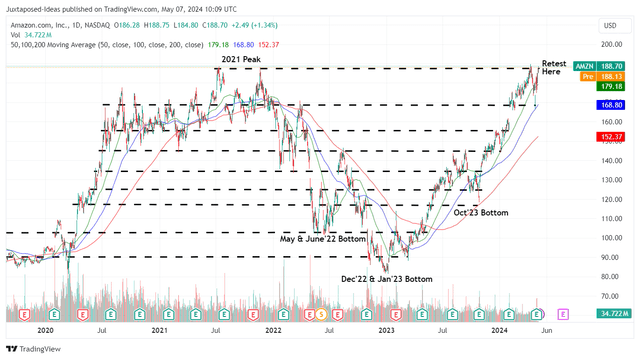

AMZN 4Y Stock Price

For now, thanks to the excellent FQ1’24 earnings call, AMZN has recovered from the recent slump and is currently retesting its 2021 peak levels of $180s while trading above its 50/ 100/ 200 day moving averages.

Based on the FQ1’24 annualized adj EPS of $4.52 and the FWD P/E valuations of 38.43x, it is apparent that the stock is trading near to our fair value estimates of $173.70

Based on the consensus raised FY2026 adj EPS from the previous estimates of $6.95 to $7.32, there remains an excellent upside potential of +49% to our long-term price target of $281.30.

With AMZN still offering an impressive growth prospect, we believe that anyone hoping for dividend payouts may have been misguided after all, especially since the additional cash flow will be better utilized for “investing in growth initiatives, as part of its longtime business philosophy.”

As a result, we maintain our Buy rating, though with no specific entry point since it depends on an individual investor’s dollar cost average and risk appetite.

For now, with AMZN already retesting its all-time resistance levels of $180s, interested readers may want to observe the stock’s movement for a little longer before adding upon a moderate retracement, preferably at its previous support levels of $170s for an improved margin of safety.

Even so, with AMZN consistently generating alpha for long-term shareholders, we believe that the stock is a great Buy at every dip.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, GOOG, MSFT, TSLA, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.