Summary:

- Amazon’s retail segment is showing signs of improvement, with positive operating income in North America and potential growth in international markets.

- AWS remains a strong revenue generator for the company, with projected growth in the cloud infrastructure market.

- Financially, AMZN is in a strong position, with manageable debt, and potential for improved efficiency and profitability.

Noah Berger

Investment Thesis

I wanted to take a deeper look at Amazon (NASDAQ:AMZN) to see if this high valuation is warranted and whether it is a decent time to start a position. Looking at the company’s outlook, recent performance, and improving financials, I rate Amazon Inc. a buy at these prices.

Outlook

Let’s look at the company’s revenue segments and how I think they will perform going forward. Let’s look at the retail first.

Retail

North America

I am encouraged by the fact that the retail segment is turning operating income positive, specifically the North American segment, which is showing a 3.9% operating margin as of Q2 ’23. The cost-cutting measures have been successful so far, and the company is going to continue to streamline its retail operations and keep improving margins across all its segments. The company is becoming much more efficient, which will hopefully continue to translate to more positive numbers in this sector that have been a money burner for many years, but it seems like all the investments into the segment are starting to bear fruit, and looks like a turnaround is afoot here. The easing of inflation is helping reduce fuel costs on all sorts of transportation Amazon employs to deliver the goods to consumers. I don’t think that there will be much revenue growth in this segment going forward as I believe the company has penetrated quite a lot of the market already.

International

The international segment isn’t doing very well just yet; however, I believe with the dollar weakening, I could see revenues grow at a faster pace because all the products will become cheaper. Let’s look at Mexico. In the last year, the USD lost around 16% in value against the Mexican peso, which is well below the currency pair’s average over the last 5 years. I know many Mexicans who are celebrating the fact that the dollar has depreciated so much in such a short period. The reason why they’re happy is because everything becomes cheaper to buy, which will lead to spending more on items from Amazon and other places.

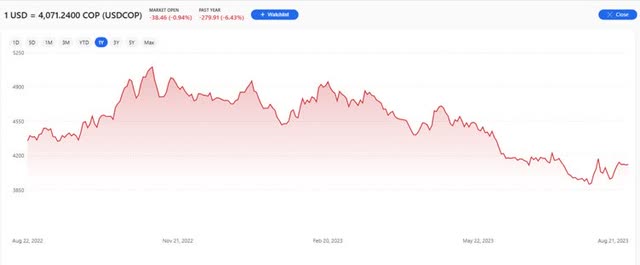

The same can be said about the Colombian Peso and to an extent Brazilian Real, which have both seen decent appreciation against the dollar that may turn into higher sales in those countries also.

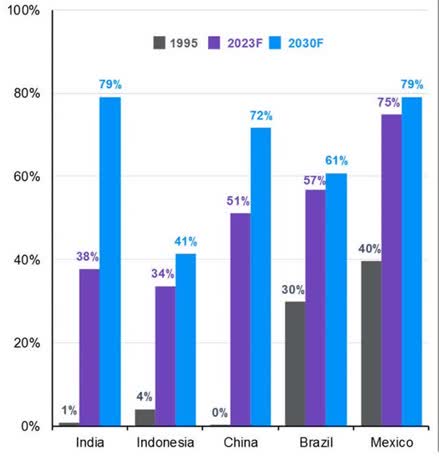

Another promising catalyst I see for the international segment is that Mexico and Brazil, along with a couple of other countries have seen an explosion in their middle class which is going to continue to expand further. Important to note that India is also predicted to see an explosion in the middle class by 2030, which no doubt will give the international segment a proper boost for years to come, especially if Amazon continues to expand into more territories over the next decade.

Middle Class forecasts (JPMorgan)

AWS and Advertising

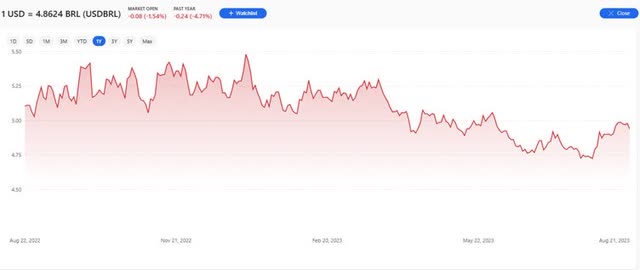

The moneymaker of the company. I believe the AWS segment is going to continue its strong growth for many years to come because the cloud is still projected to grow at a 14.1% CAGR over the next 7 years. With the massive cash flow the company is able to generate, I could see the company continuing to be the leader in the cloud infrastructure as shown in the graph below. According to Statista, AWS is still a leader in the segment by what looks like a huge lead, however, it has lost two percentage points from a year ago August, losing to Microsoft’s (MSFT) Azure and Alphabet’s (GOOG) Google Cloud. Nevertheless, AWS is a clear leader, that has about a third of the total market share and is still poised to grow at very respectable rates for the next 7 years.

The AI boom is going to help boost the segment’s revenues, however, since we are still in the very early stages of it, it is hard to predict what kind of potential it holds but it will not be a negative one. Advertising is getting a nice boost also, going up 22% y-o-y, which tells us that the company can utilize advanced tech like AI and ML to better target consumers and I could see how this will continue to improve even more as time goes by.

The demand for cloud infrastructure will remain high as more and more companies are transforming how they operate, and digital transformation is at the top of most, if not all companies these days. Being the leader in the sector, Amazon is positioned very well to meet its customers’ demands for transformation.

Risks

Inflation may linger for much longer, which may bring prices of fuel back up once again and that will hurt the company in the short to medium term. For now, we see that the prices have more or less stabilized and are well off the peaks, but that is still a concern with the war continuing to rage on in Ukraine.

The dollar may reverse in the medium term and become stronger against the mentioned currencies, which may translate to lackluster revenues from the international segment before the company manages to control the expenses and continue losing money. The company may overspend on cost-cutting measures only in the end to see that these measures weren’t as effective as predicted.

The bright spot in the company, AWS, may continue losing market share to other major players mentioned above. Azure may become a real threat if Amazon isn’t careful. Both companies are making so much money, which means both companies will be able to dump billions into their cloud offering and I believe it’ll be a fierce battle for the next decade. Google may surprise us also.

Financials

Just to note, all the graphs below will be as of FY22 because I would like to look at full-year numbers for a better picture of the company. I will include some numbers from the most recent report if I think they are relevant for extra color and will also add some estimates for ’23 and ’24 in some cases.

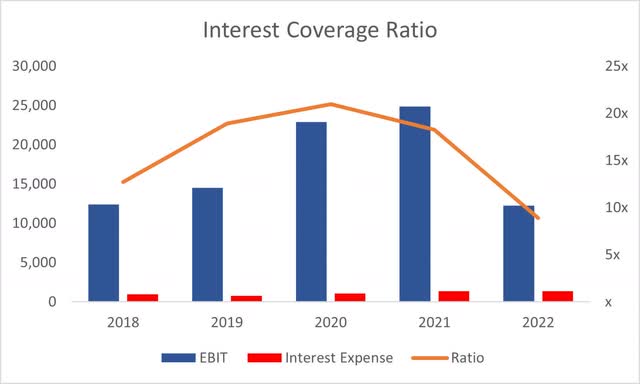

As of Q2 ’23, the company had around $64B in cash and marketable securities, against around $76B in long-term debt. Seems like a lot, however, the company’s market cap is over $1.3T which makes the debt number seem insignificant. The company’s net interest income was $-1.4B in FY22, which means its interest coverage ratio was around 9x, meaning EBIT was able to cover interest 9 times over. For reference, many analysts consider a coverage ratio of 2 to be healthy. Safe to say, AMZN is at no risk of insolvency.

Interest Coverage Ratio (Author)

The company’s current asset ratio is below what I like to see, however, in the past, the ratio was over 1, which is the bare minimum. I would prefer a ratio to be in the range of 1.5 -2.0 but as long as the company gets back up to 1, I’m fine with it, since AMZN has been operating like this for years and it had no impact. 2022 was a tough year for many companies, including AMZN, so I think it’ll be back above 1 in FY23.

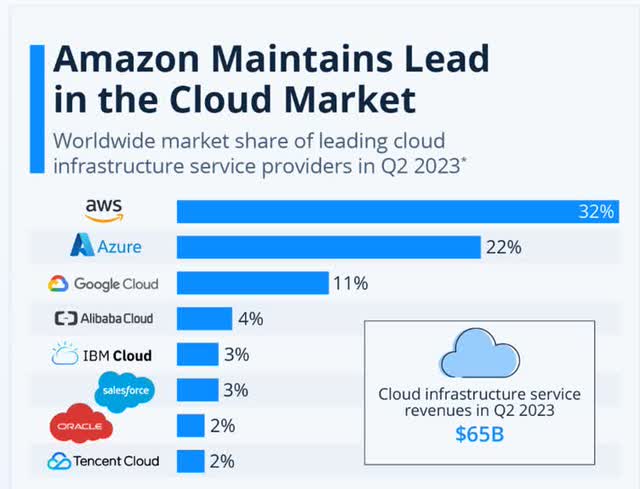

In terms of efficiency and profitability, AMZN’s ROA and ROE have seen a big hit in FY22, which is an anomaly because of the bad year. I see these becoming positive once again in the near future and could look at something like the graph below, which I think are conservative assumptions. In the past, it seems like AMZN was very efficient in using its assets and shareholder capital.

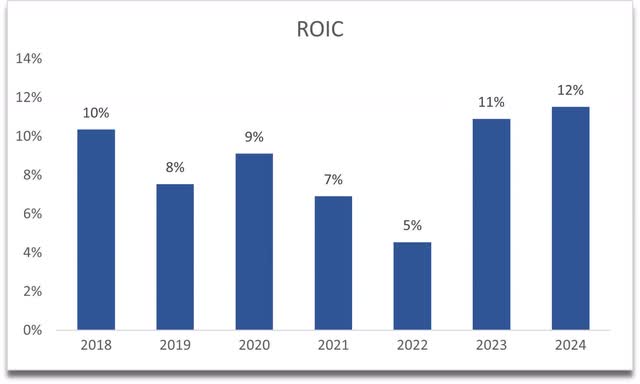

A similar story can be said about return on invested capital, or ROIC. I predict the company will return to over 10% in the next couple of years, which means the company will maintain a good competitive edge and a strong moat that seemed to have been lost in FY22 but as I said that year is an anomaly, and not a fault in company’s management.

Overall, the company seems very strong financially. I know it may look like the company’s financial situation is not the best, however, looking at quarterly reports we see a completely different story already compared to FY22, so I do not doubt that AMZN will return to at least the historical metrics going forward.

Valuation

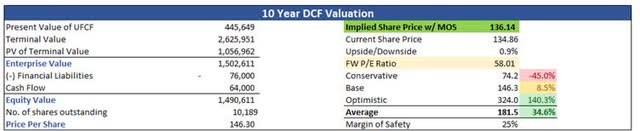

For my revenue assumptions, I’ve separated the three segments as I believe AWS and International will see higher growth numbers over the next decade than the NA segment. Take these calculations with a grain of salt because a decade is a long time, and many things can change that may affect the revenue potential of these segments.

For the base case, I went with 10.5% CAGR in NA segment, 12.3% in International, and 19.5% in AWS. I believe these are achievable, seeing that the NA segment grew over 20% in the last 5 years, International 17%, and AWS 33%.

For the optimistic case, I added 4% to every segment in the base case, while for the conservative case, I took away 2% from the base case in every revenue segment to give myself a possible range of outcomes.

For the margins, I decided to improve these by around 700bps or 7% over the next decade, which will bring net margins from around 4% in FY23 to around 10.5% by FY32.

On top of these assumptions, I will add a 25% margin of safety to give myself some breathing room. With that said, Amazon’s intrinsic value calculation is $136.14, implying the company is priced fairly.

Closing Comments

The company’s high investments back into itself are starting to pay off handsomely and I believe we will see the company performing well over the next decade, according to my calculations it is not a bad time to start a position at this price. There may be volatility ahead still, however, I would treat it as an opportunity to add to the long position.

Many people look at AMZN and see the company’s high PE ratio and may stay away because of it. I think the number is justified given the potential ahead. I will be looking at opening a position very soon as I believe the risk/reward is very enticing here. Please do further due diligence to see if this is a company you would like to have in your portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.