Summary:

- Amazon Prime seems to be running at a loss, with far greater shipping costs compared to the earned subscription revenue.

- However, Amazon keeps on investing in building its Prime ecosystem.

- In this article, we will unlock the key that shows the true value of Amazon Prime.

Mazirama/iStock via Getty Images

Introduction

How is it possible for Amazon (NASDAQ:AMZN) to make money through Amazon Prime? In fact, the annual fee is $139 in the U.S. and a bit less in other countries around the world (UK: £95; Germany, €89.90; France, €69.90; Italy, €49). It is clear that a consumer who consistently buys on Amazon will receive a benefit in terms of free shipping far greater than the annual fee paid. So, what is the deal here?

The concept of value creation

If we look at Amazon Prime from a simple income statement perspective where we match revenue and costs, this business doesn’t seem to make sense. However, the way Amazon looks at Prime is a bit different. Jeff Bezos described it thoroughly in his last shareholder letter, when he explained how a successful business must create more than it consumes. This means a business needs to create value for every stakeholder.

To get an idea of how Bezos calculates the value Amazon creates, let’s read what he wrote in 2020 about value creation for consumers:

We offer low prices, vast selection, and fast delivery, but imagine we ignore all of that for the purpose of this estimate and value only one thing: we save customers time.

Customers complete 28% of purchases on Amazon in three minutes or less, and half of all purchases are finished in less than 15 minutes. Compare that to the typical shopping trip to a physical store – driving, parking, searching store aisles, waiting in the checkout line, finding your car, and driving home. Research suggests the typical physical store trip takes about an hour. If you assume that a typical Amazon purchase takes 15 minutes and that it saves you a couple of trips to a physical store a week, that’s more than 75 hours a year saved. That’s important. We’re all busy in the early 21st century.

So that we can get a dollar figure, let’s value the time savings at $10 per hour, which is conservative. Seventy-five hours multiplied by $10 an hour and subtracting the cost of Prime gives you value creation for each Prime member of about $630. We have 200 million Prime members, for a total in 2020 of $126 billion of value creation.

So, in 2020 a Prime member got a $630 value creation, net of annual Prime fees. At the same time, Amazon spent $58.52 billion on fulfillment, while earning only $25.2 billion from subscriptions. True, not every fulfillment expense is linked to a Prime subscription making it so that many consumers pay for their shipping. However, it is fair to assume there is a disproportion between the earned subscription revenue and the fulfillment expense which seems to make Prime unsustainable for Amazon.

In 2022, things don’t seem to be much better:

Subscription revenue: $35.3 billion.

Fulfillment expenses: $84.3 billion.

If this were to be a stand-alone income statement, we would be before a tremendous loss. In fact, besides fulfillment expenses we would need to add all the expenses linked to the whole Prime ecosystem. For example, we would need to add the expenses of Prime Video, both to create new content (i.e. The Rings of Power series) and to purchase broadcasting rights for events such as the Thursday Night Football. In 2022, just to get an idea, Amazon spent $16.6 billion on video and music. This adds up to the total value given to a Prime member; however, it just increases the net loss Amazon seems to be achieving.

However, the way Jeff Bezos looks at his company teaches us a very important lesson. What really matters is value creation for every stakeholder. Amazon Prime is creating value for its customers, both in terms of saved time and in terms of free shipping. So, how does Amazon create value even for itself if it seems to be running Amazon Prime at a loss?

In fact, Jeff Bezos, in the same letter we saw above, goes on explaining how

value creation is not a zero-sum game. It is not just moving money from one pocket to another. Draw the box big around all of society, and you’ll find that invention is the root of all real value creation. And value created is best thought of as a metric for innovation.

Of course, our relationship with these constituencies and the value we create isn’t exclusively dollars and cents. Money doesn’t tell the whole story.

True. But we also need to see where the money is.

Customer Lifetime Value

The answer is here in the sub-title. By giving out all this value to its members, Amazon locks them in, making sure each one of them will stick around the Prime ecosystem for a very long time. As a consequence, a Prime member has a really long lifetime value for Amazon. As a matter of fact, I don’t know anybody thinking that a Prime membership is just a treat for a year or two. I think it may not be an exaggeration to say that many Prime members don’t even know when their subscription expires for the very simple reason that it is out of the question whether to renew it or not. It is just too necessary.

If we look at the Q4 2022 earnings call, Brian Olsavsky, Amazon CFO, explained a bit of what Amazon wants to obtain through the creation of huge value for its members:

In general, if you step back, we had some very large video properties that we had launched last year, Thursday Night Football and Lord of the Rings: Rings of Power. Both of them had record sign-ups for Prime membership. And we know that, again, investments like that will help with not only a new member or new Prime member acquisition, but also retention. And we see a direct link between that type of engagement and higher purchases of everyday products on our Amazon website.

The last two sentences are key. Amazon wants to grow its member count and wants to increase its retention rate because the more a Prime member is engaged the higher the purchases on the website.

Andrew Jassy seems to have learned well the lesson from Jeff Bezos, as he felt necessary to add to what Mr. Olsavsky said, these words which really match Bezos’ last shareholder letter:

Just to add really one piece here, which is just, if you step back and think about a lot of subscription programs, there are a number of them that are $14, $15 a month really for entertainment content, which is more than what Prime is today. If you think about the value of Prime, which is less than what I just mentioned, where you get the entertainment content on the Prime Video side and you get the shipping benefit, the fast shipping benefit you can’t find elsewhere and you get the music benefit, you get the Prime Gaming benefit and you get the photos benefit and you get the Buy with Prime capability, use your Prime subscription on websites beyond just Amazon and some of the grocery benefits that we provide, and RxPass like we just launched to get a number of medications people take regularly for $5 a month unlimited, that is remarkable value that you just don’t find elsewhere. And we will continue to add things to Prime and continue to experiment with lots of different features and benefits.

It is clear that a customer receives a lot of value through this subscription. It is also clear that Amazon has its returns through high retention rates. Therefore, the question then becomes: how much is a Prime member worth for Amazon?

Unfortunately, Amazon doesn’t disclose a yearly update of its Prime members count. However, we know that at the end of 2021 there were more than 200 million members, as written in the first shareholder letter from Andre Jassy.

We are trying to figure out the value of a Prime subscription for Amazon. The key is to discover the real value a Prime member has. In 2022, a survey reached the results that in 2021 a Prime member spent on average $1,400 on Amazon, versus the $700 spent by non-Prime members. Let’s assume that in 2022 these numbers have increased a bit and that a Prime membership leads to $1,500 of average spending. At the same time, let’s consider the average spending of a non-Prime to be around $750 a year. These numbers may be a little conservative, given inflation and salary raises. However, since we are making a lot of assumptions, we need to stay as conservative as possible.

The math is easy: Amazon earns its annual fee plus an extra $750 in spending that will be deployed during the year. However, a Prime member is very likely to be around for some time. According to statista.com, Amazon’s Prime member retention rate after 1 year is 93%. On the second year after the subscription, the rate goes up then 98% of the members who renewed after 1 year renew for a second year. This means that, for every 100 new members, Amazon will still have 91 subscriptions after two years, which are then likely to become loyal Prime members. Since a Prime member is likely to stick around and spend, the value of such a customer is more than $750.

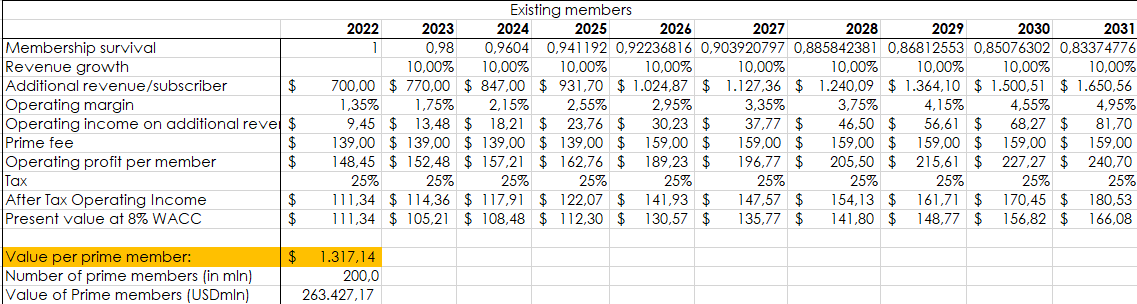

In a past article on the value of the Lord of the Rings series for Amazon, I shared some calculations about the value an existing member has for the company that I would like to share once again, since it is still pretty accurate.

Author

I assumed a membership survival rate of 0.98 and a revenue growth of 10%, which I think is sustainable given the expansion of online retail. Regarding the operating margin, though it seems like Amazon ran at a loss last year due to huge capex, I assumed a value that is more in line with standard operating conditions and I took 1.35%. Assuming capex will slow down in the next few years, I slowly increased the operating margin by 40 bps per year.

The result is that a Prime member has a lifetime value of around $1,317. If we update the additional revenue per subscriber to $750, the value of a prime member moves barely up to $1,324.

Overall, this leads to a total value of the 2022 Prime member ecosystem of $263 billion. This is very conservative because it assumes there will be no new Prime member acquisition over the next decade.

If we consider that Amazon has around 40 million members around the U.S., we can easily grasp how the company has lots of room to grow. Using the same table to calculate the value of a new prime member, we reach a lower number: $930. In fact, we must factor in the acquisition cost. However, assuming Amazon is able to add around 20 million new members per year, we can calculate that in the next ten years Amazon will gain another $190 billion in value from its new members. Staggering numbers.

In other words, it is fair to assume that the Amazon Prime ecosystem currently has a value of almost $450 billion, considering its present size and a reasonable forecast of achievable growth. A market cap of $1 trillion for a company that, in addition to Amazon Prime has higher margin businesses such as advertising and AWS, is to me quite low, making me consider Amazon one of the best buys I currently see.

Conclusion

The more I study Amazon, the more I understand it is not a company like many others because it thinks about its operations in a very different way. As a matter of fact, it is one-of-a-kind in terms of long-term thinking. Therefore, since its horizon clashes with short-term expectations from Wall Street, the stock has been sold off because of weak free cash flow generation and high capex for its fulfillment network. However, Amazon has proven more than once that every time it is able to create something that offers real value to every stakeholder, it will invest heavily into it knowing that it will generate huge amount of profits down the road. Amazon Prime is such a gold mine and it is one of the most important reasons why I am invested in the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.