Summary:

- Amazon’s AWS and Cloud Computing services are expected to benefit significantly from AI, with a wide range of AI solutions that are usually overlooked.

- AWS is the market leader in cloud computing, and its extensive suite of tools for AI developers positions it as a potentially major player in the AI landscape.

- The company’s valuation could reach $1.38 trillion, slightly higher than its current trading value, as it capitalizes on the growth in AI cloud and maintains its competitive edge.

- Overall, the expected growth for AI cloud computing and Amazon’s neutral, yet dominant position in this market could reignite AWS’ growth.

SeventyFour

Investment Thesis

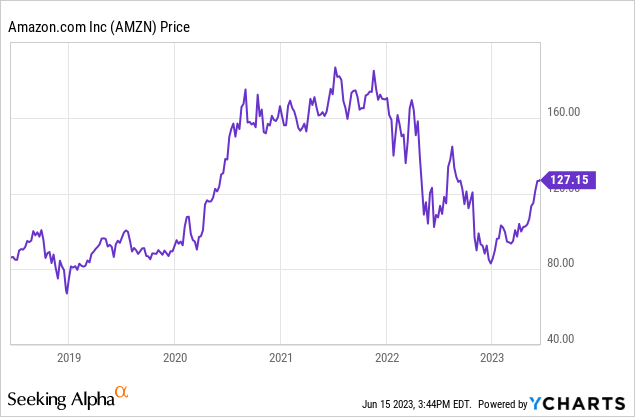

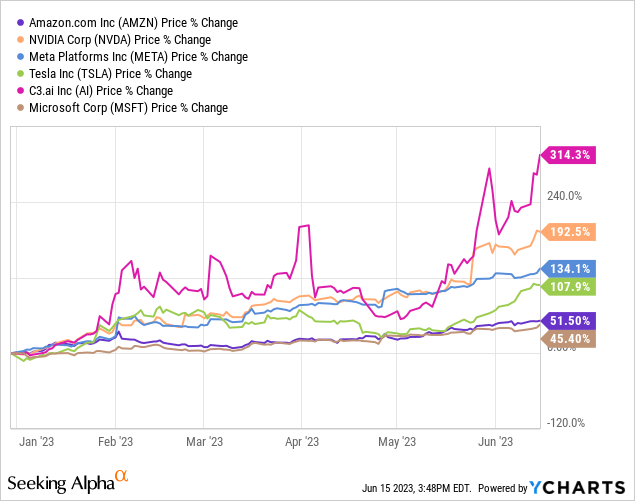

With the AI rally underway and companies like Nvidia (NVDA) posting a 195% return YTD, we believe that Amazon’s (NASDAQ:AMZN) AI/ Machine Learning capabilities are generally not being mentioned. Therefore, we have analyzed Amazon’s position in the AI landscape and believe that Amazon AWS / Cloud Computing has the potential to become one of the biggest winners in AI, with an extensive range of AI solutions and future capabilities, which we believe are not reflected in the current share price.

These solutions have already been adopted by companies in recent years and are currently being used for automation. We are currently raising our rating from “Hold” to “Buy” and note that Amazon is currently trading slightly below fair value, taking into account developments in the AI & Machine Learning environment.

From Compute To AI

Big changes are currently taking place in the cloud computing/datacenter space regarding the transition from traditional compute to companies now moving more to accelerated computing, as was highlighted in Nvidia’s latest earnings call. In particular, Nvidia management talking about this 10-year transition cycle in compute made us look at Amazon differently:

I think you’re starting — you’re seeing the beginning of call it a 10-year transition to basically recycle or reclaim the world’s data centers and build it out as accelerated computing. You’ll have a pretty dramatic shift in the spend of the data center from traditional computing, and to accelerated computing with smart NICs, smart switches, of course, GPUs, and the workload is going to be predominantly generative AI. (Nvidia Q1 Earnings Call)

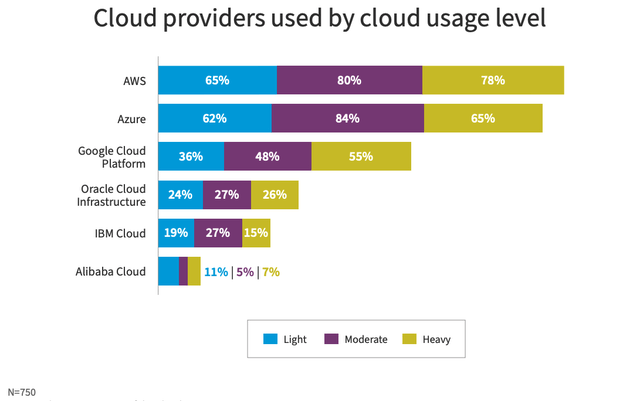

Looking at the current cloud computing landscape, AWS is still the market leader, although according to some of the latest cloud computing surveys, it may be starting to face more competitive pressure from Azure. In Q1, Amazon AWS still had a 32% market share versus Microsoft Azure’s 23%. Google Cloud also seems to be catching up and currently has an 11% market share.

Flexera, 2023 State Of Cloud Report

As for the move to accelerated computing, this change seems to have only just begun, with Nvidia pointing out that:

In the future, it’s fairly clear now with this — with generative AI becoming the primary workload of most of the world’s data centers generating information, it is very clear now that — and the fact that accelerated computing is so energy efficient, that the budget of the data center will shift very dramatically towards accelerated computing and you’re seeing that now. We’re going through that moment right now as we speak. (Nvidia Q1 Earnings Call)

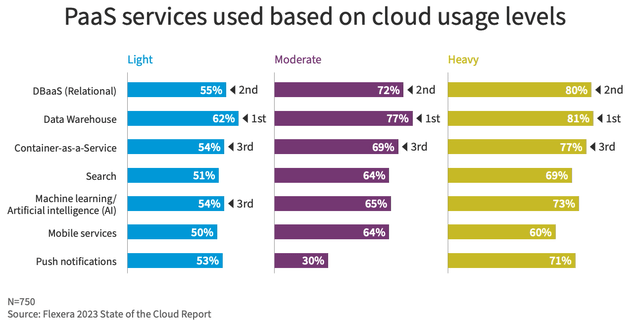

We also see confirmation of this in recent surveys, which indicate that Machine Learning (ML) and AI are currently, of all the utilities/services in the cloud, both most experimented with and planned to be used in the future, while only 36% of participants are currently using ML/ AI. In other words, we should soon start seeing the effects of ML/ AI adoption in companies that are bottoming out in terms of both top- and bottom-line results for Amazon AWS. Looking at the full cloud environment, Platform as a Service (PaaS), ML/ AI currently ranks 3rd for light cloud users, which is a good start.

Flexera, 2023 State Of Cloud Report

This is also where we believe other analysts have not yet addressed the full range of options available to AI/ ML developers, along with the importance Amazon has played in the AI landscape in recent years. We think Amazon’s services could even come close to competitors like Nvidia in terms of influence.

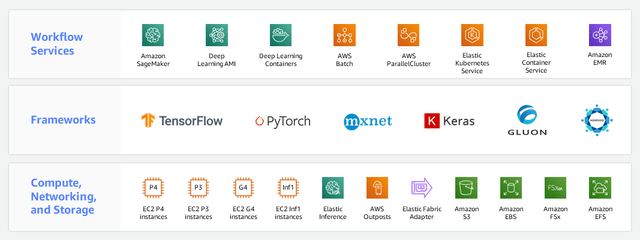

And they offer the whole suite when it comes to Machine Learning, from preparing data to building, training and deploying models to perform tasks. For example, Amazon was very early in labeling data and building models with Amazon Mechanical Turk and Amazon SageMaker, already widely used tools since the beginning of this AI growth period. What Amazon AWS also does not get enough credit for, in our opinion, is the fact that instead of taking sides, they still offer the full range of hardware for training models. This ranges from their own AWS Trainium chips designed for Deep Learning to Nvidia A100 GPUs. Yesterday, it was reported that Amazon is even weighing using AMD’s new AI chip. Also for Machine Learning deployments, customers can use Inference for models using Nvidia’s CUDA along with other libraries.

It seems to us that wherever AI is headed, Amazon is likely to be there as well. We think that compared to Microsoft and Alphabet, certain developers are more likely to stay with Amazon, which we see more as a neutral target, given the popularity of certain models currently being developed by OpenAI and internally at Google, which can be considered direct competitors for AI startups. In addition, there is demand for low-cost GPUs that are often used for Machine Learning, and AWS has delivered with their Trainium chipset:

AWS started investing years ago in these specialized chips for machine learning training and inference (inferences are the predictions or answers that a machine learning model provides). We delivered our first training chip in 2022 (“Trainium”); and for the most common machine learning models, Trainium-based instances are up to 140% faster than GPU-based instances at up to 70% lower cost. (Amazon Letter to Shareholders)

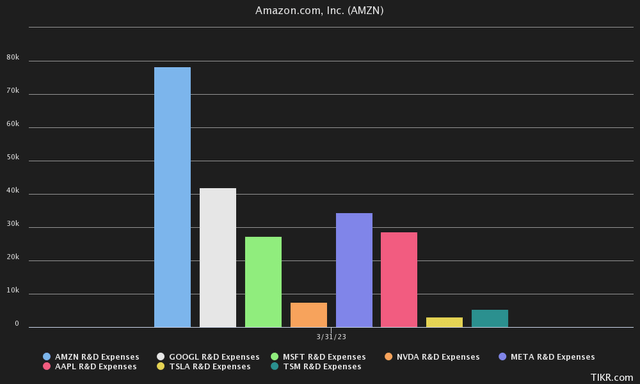

Since they also control most of the cloud market and are still in the lead, you could also say that Amazon has an internal data advantage over the other cloud providers in certain areas. Similarly, it might also be prudent to point out that Amazon is the largest R&D spender compared to other companies, with more than 8x Nvidia’s R&D spending in the past 12 months.

Now we understand that more R&D does not directly equate to more innovation, but for a tech company it does show how much human capital and infrastructure the company has built. We believe the immense operational efficiencies at Amazon over the past 20 years in both retail and cloud will eventually spill over to future AI/ AI cloud efforts, with Amazon remaining the market leader, just as it is now in the cloud with General Compute.

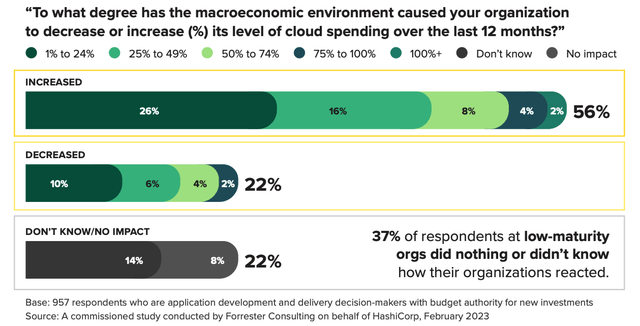

That said, there are still huge risks in terms of macroeconomic uncertainties overshadowing the cloud. However, the most recent survey of enterprise cloud users, released in May, shows that most companies are still increasing their spending on the cloud, with some actually increasing their spending on the cloud quite a bit. Despite the fact that the yield curve is still deeply inverted, and an economic recession is highly likely, only 22% of respondents are reducing their cloud spending, with most reducing less than 24% of spending.

Macro Squared

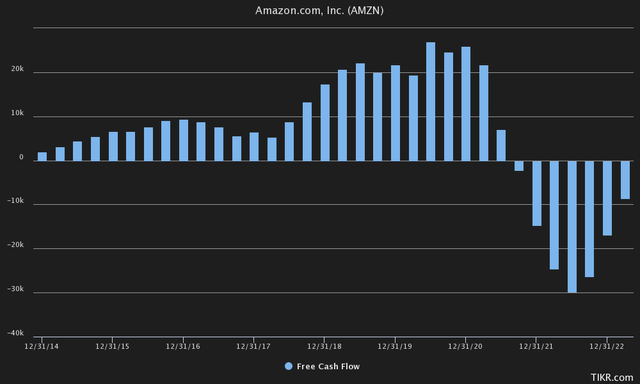

Taking all of the above perspectives into our valuation, we should also point out that Amazon is perhaps one of the most impacted companies when it comes to macroeconomics. Over the past 2 years, Amazon has been quite negatively impacted by problems ranging from supply chain issues to inventory overload and being caught up in boom-bust cycles.

The inventory problem seems to be getting resolved, with inventories peaking in Q2 2022 and now likely returning to normal. Given that Amazon has likely diverged from their previous trend line both on the upside and downside in this unfavorable macroeconomic environment, it is probably fair to say that the days of peak negative FCF margins are already behind us. Looking at Amazon’s FCF on a TTM basis, it appears to be returning to normal and should be FCF-positive again within a few quarters on a TTM basis.

So in our valuation this time we try to take out these unfavorable macroeconomic effects and try to value Amazon as if the company were operating again in normal economic times. In other words, we are valuing Amazon’s international retail business on a P/S multiple and Amazon’s AWS business on a Price to Earnings to Growth multiple (PEG).

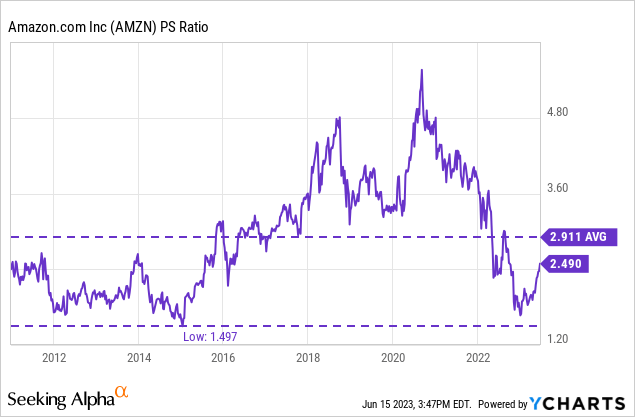

Amazon’s North American and international retail operations brought in $441.9BN in revenue on a TTM basis, of which $323.5BN came from North America and $118.4BN came from international retail. If we look at NYU Stern’s average P/S ratio for the total U.S. market without financials, it is 1.93x revenue. If we were to value Amazon’s retail business at the average market multiple, we believe this segment would represent a fair value of approximately $852.87BN. Based on a historical 10-year average P/S ratio, Amazon currently appears to be trading more toward the lower end of this range.

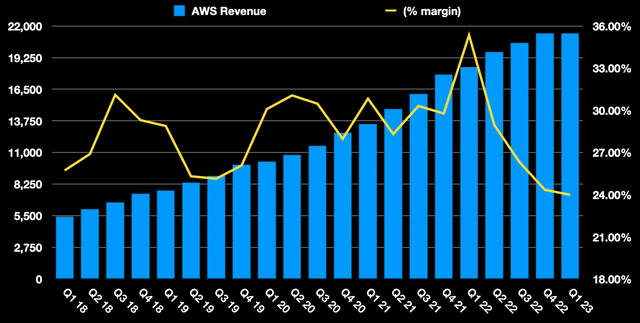

Turning to the cloud/ AWS segment, Amazon achieved $83.01BN in revenue on a TTM basis. Excluding the unfavorable macroeconomic environment and getting closer to AWS’ average margins, we apply the average operating margins for AWS between 2018 and 2023, which is 28.39%.

In other words, we believe AWS should be able to generate $23.57BN in EBIT on a trailing 12-month basis. However, taking into account AWS’ growth and valuing the company on a PEG ratio basis, we believe a PEG ratio of 1 represents a fair/attractive valuation. In terms of growth, taking into account previous assumptions, we believe AWS’ segment is close to the projected growth for the AI cloud market, which many market research firms believe is close to a CAGR of 22.4%. If we put all this data into a PEG ratio calculator, AWS should be worth about $527.88BN.

However, this is only if the company is able to maintain its growth thanks to advances in AI and can maintain its margins thanks to its operational efficiency and remain competitive.

Accounting for both segments, in our eyes Amazon’s fair value could be estimated at $1381BN, or $1.38T, which is still slightly higher than the $1.30T the company is currently trading at. Taking into account the 10.26 billion shares outstanding, we would arrive at an equivalent of $134.58 per share.

Aside from the previously mentioned risks related to growth remaining below expectations or macroeconomic pressures persisting, the only other signal we currently see that we don’t like is the fact that Warren Buffett sold 1.08% of his shares last quarter, when the stock was trading between $84 and $114. As a side note, it may also be important to point out that Amazon is still an antitrust target, as are most major tech stocks, such as Alphabet and Apple, these days.

The Bottom Line

As we look at the developments in the AI/ ML landscape, we think Amazon may be overlooked in terms of their potential and may be one of the few companies that is currently not being discussed in this AI rally. We raise our rating from “Hold” to “Buy.”

In addition, their developments of dedicated chips for Machine Learning, along with their entire suite of tools that were available to AI developers long before this AI rally, has seemingly not been addressed much in the investment landscape. All of Amazon AWS’ tools, from preparing, building to training and deploying ML models, make it, in our view, one of the most overlooked AI plays out there today. We expect the growth in AI cloud can bring AWS back to their base growth rate of 20-30% CAGR.

With the enormous upcoming growth in machine learning, customers will be able to get a lot more done with AWS’s training and inference chips at a significantly lower cost. We’re not close to being done innovating here, and this long-term investment should prove fruitful for both customers and AWS. AWS is still in the early stages of its evolution, and has a chance for unusual growth in the next decade. (Amazon Letter to Shareholders)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.