Summary:

- Amazon is still firmly positioned to benefit from secular shifts regarding the rapid penetration of e-commerce and cloud solutions, which are Amazon’s major revenue streams.

- Near-term headwinds are strong but they are highly likely to be temporary, and the company’s financial position is strong enough to weather the storm.

- My valuation analysis suggests the stock is still massively undervalued.

David McNew

Investment thesis

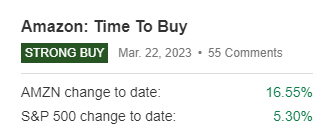

My investment thesis about Amazon (NASDAQ:AMZN), which I shared two months ago, aged well. The stock significantly outperformed the market, which you can see below.

Seeking Alpha

A lot happened during these two months, so I would like to update my thesis and incorporate changes in consensus estimates into my valuation analysis. The macro-environment also changed, becoming much more rigid during the last couple of months, but even considering current headwinds, the stock is still significantly undervalued. Also, the company continues capturing favorable secular trends of e-commerce and rapid cloud technologies adoption, so the stock is still a strong buy.

Recent developments

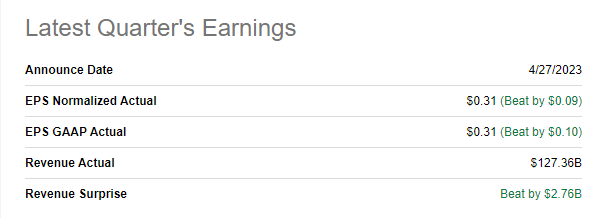

The company reported its latest earnings on April 27, beating consensus estimates in revenue and EPS. Revenue increased about 9% on a YoY basis, which I believe is a vital sign given the challenging macro environment.

Seeking Alpha

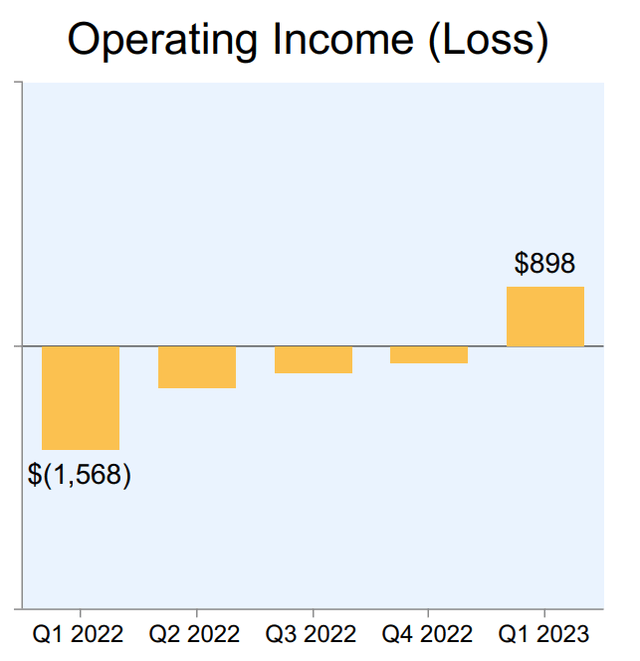

The retail-only operating loss was $343 million for 1Q23, compared to $2.85 billion a year earlier in 1Q22. I consider significantly improving operating results in the retail business as a sign that the management is being proactive in addressing the challenging environment, especially given the inflation, which is still way higher than we got used to. The strength in the retail segment was mainly thanks to North America. Retail revenue generated in North America was $76.8 billion, which comprises 60% of total sales, indicating an increase of 11% year-over-year. North American retail generated an operating profit of $898 million, vs. a year-earlier loss of $1.57 billion. International retail revenue was almost flat, with the increase almost diminished by unfavorable foreign exchange movements. You can see below how North American retail has been improving steadily quarter over quarter since the start of 2022.

Amazon’s latest earnings presentation

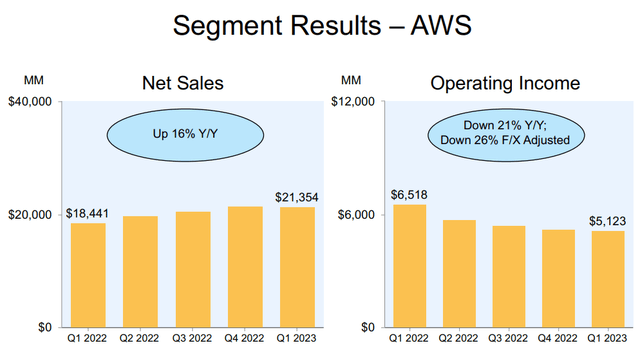

Now let me turn to the jewel in Amazon’s crown, the Amazon Web Services [AWS] cloud segment. The segment remains highly profitable, though growth rates and operating profitability are currently below peaks. AWS revenue increased 16% on a YoY basis and was about flat sequentially. The operating margin shrank substantially compared to a year ago.

Amazon’s latest earnings presentation

I consider decelerating the revenue growth of AWS to be natural as the segment scales up. The operating margin is under pressure given temporary macro headwinds, which can last over the next several quarters, but they are not secular. Moreover, AWS, as a leader, is well-positioned to capture growth from new technology development, like AI. The company joined the AI race, introducing new AI features to AWS. A month ago, the company introduced its generative AI tool called Bedrock. It is difficult to assess at the moment how will generative AI tools increase the earnings potential of AWS. Still, Amazon’s management aims to bite a significant part of the generative AI market, which is expected to grow at a staggering 35% CAGR up to FY 2030. Thus, I believe that Amazon is firmly positioned to return to its impressive growth and profitability trajectory thanks to new opportunities unlocked by new technologies like generative AI.

What I also consider very positive is the double-digit growth in sales from third-party merchants, which grew 16% YoY but declined 19% sequentially compared to the holiday quarter of 2022. Sales at physical stores increased 7% YoY and both Whole Foods and Amazon stores generated higher foot traffic, which is a very good sign amid soft macro environment.

The company’s cash flow during Q1 2023 was still negative, but the company continues to invest heavily the future growth, and the balance sheet with more than $60 billion outstanding cash balance as of the reporting date allows the company to invest in new projects.

Overall, I believe that the company is successful in navigating the challenging macro environment and decelerating growth pace in AWS is a temporary pain, given the opportunities which were unlocked by the release of generative AI capabilities. AWS’s large customer base gives a substantial advantage to Amazon in monetizing the secular shift to AI solutions.

Valuation update

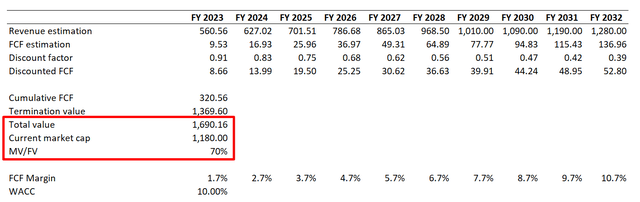

I use the same discounted cash flow [DCF] approach as I did initially. I consider the 10% WACC I used initially to be still reasonable. I changed the consensus earnings estimates, which were revised slightly. Given AWS’s current harsh environment and decelerating growth, I use a much more conservative FCF margin than before. Amazon’s TTM FCF margin is currently at 1.7%, so I use it for FY 2023 and expect it to expand by one percentage point per year.

As you can see from the above calculations, the fair value of Amazon’s business equals approximately $1.7 trillion, much higher than the current market cap. It indicates massive undervaluation and is a very bullish sign.

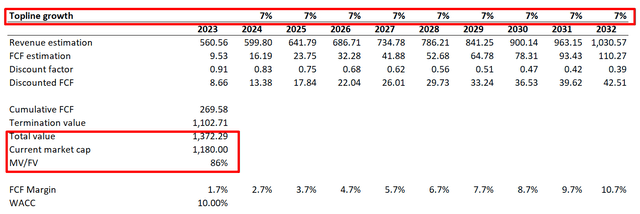

Consensus estimates project Amazon’s topline to increase at approximately 8.6% CAGR. I would like to simulate a more conservative topline growth scenario where revenue increases by 7% yearly. I need it to understand how the fair business value will look if the long-term growth trajectory is downward and all other assumptions remain unchanged.

Even if Amazon delivers substantially modest revenue growth, the stock is still attractively valued with double digits margin of safety.

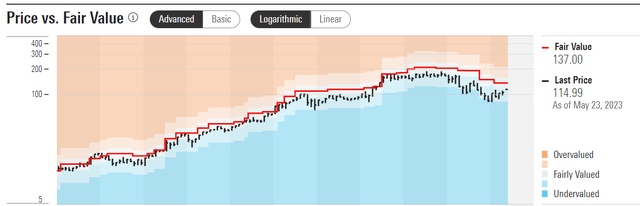

To add more conviction, let me also share the opinion of Morningstar regarding AMZN’s fair stock price. They project a fair share price of $137, about 20% higher than current levels. In the below chart, you can see how, historically did actual share price of AMZN followed Morningstar’s fair value estimate.

Overall, I believe the stock is very attractively valued with substantial upside potential. Please note that the 1.7% FCF margin I used for FY2023 estimations is a massively conservative assumption.

Risks update

The macro-environment has become more challenging since my last article about Amazon went live. The significant risk now is the decelerating U.S. economy which adversely affects almost all businesses on the Earth. Companies cut back on spending due to high-interest rates, and even giant cloud providers’ customers do so. Besides cloud business, Amazon’s core e-commerce business also significantly depends on the broader economy’s health, especially regarding consumer spending metrics. The looming credit crunch also does not add optimism neither to e-commerce customers, nor to corporate AWS customers, On the other hand, despite being severe, I consider macro headwinds as temporary and not secular. Moreover, the company has a solid balance sheet to weather temporary storms, even if they last for several quarters in a row.

Last but not least, as we have seen in the latest quarterly cash flow statement, capital expenditures are still immense and were higher than cash generated from operations. It is obvious that Amazon has a massive outstanding cash balance, and there is almost no risk that the company will run out of cash to finance growth. The point here is that the cost of mistakes is very high when you execute expensive capital projects. Those long-term bets must pay out to make shareholders happy, and the company must perform exceptional management of these massive projects. When expectations are high, there is also an elevated risk of underperforming.

Bottom line

Overall, I reiterate my “Strong Buy” opinion about Amazon stock. Despite significantly outperforming S&P500 and Nasdaq indexes year-to-date, the stock is still very attractively valued. The current environment is harsh, but the company’s financial position is a fortress, and future growth prospects are very bright. And most important, the current stock price is a gift for long-term investors, according to my valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.