Summary:

- We maintain our buy rating on Amazon stock.

- 3Q23 results and outlook confirm that ad spend is rebounding.

- AWS revenue is also stabilizing as customer cost optimization eased.

- We think Amazon is uniquely positioned through its revamped fulfillment network of reduced cost to serve and faster delivery to reaccelerate top-line growth into the higher double-digit range.

- We still expect the stock to outperform the peer group in 2024.

zodebala/E+ via Getty Images

We remain buy-rated on Amazon (NASDAQ:AMZN) heading into 2024. 3Q23 results and outlook confirm our belief that Amazon is uniquely positioned for top-line reacceleration into 2024 based on three factors: ad spend rebounding, cost optimization easing, and its revamped fulfillment network. Our bullish sentiment is driven by our belief that management’s focus on restructuring its fulfillment network this year will pay off in higher ad revenue than the peer group as ad firms reaccelerate spend and flock to Amazon for heightened visibility. We see ad revenue driving top-line growth in 2024 and expect the next leg of growth to come from AWS after revenue stabilized this quarter.

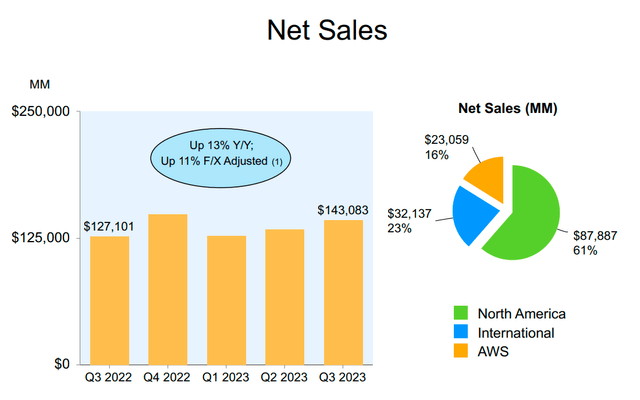

This quarter, the company reported revenue of $143.1B, up 12.6% Y/Y, beating by $1.54B and EPS of $0.94; management guides for net sales of $160-$167B next quarter versus consensus of $167.04B, representing a 7-12% Y/Y growth and operating income of $7-$11B compared to $2.7B in 4Q22. Our investment thesis regarding Amazon’s resilience to macro headwinds has played out, and now we’re seeing a transition to the next leg of growth and recommend investors buy in.

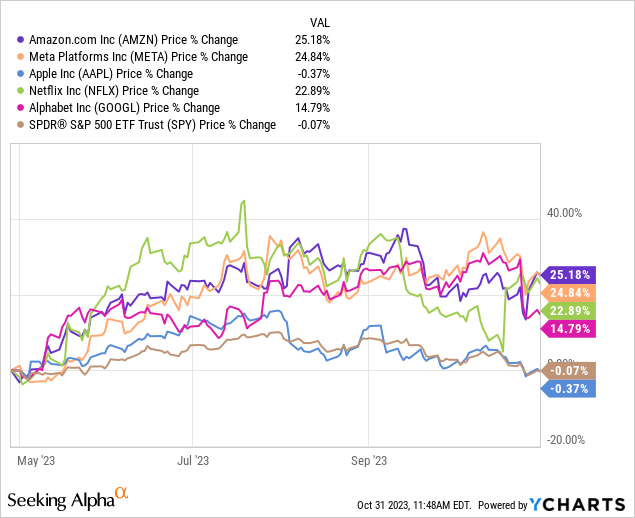

The stock is up roughly 25% over the past six months, outperforming the S&P 500 by 25% and the peer group, including Meta Platforms (META), Apple (AAPL), Netflix (NFLX), and Alphabet (GOOGL).

The following outlines Amazon’s stock against the FAANG group over the past six months.

YCharts

Ad spend rebounds, and cost optimization eases

While we expect the improving ad spend to benefit the entire peer group, we think Amazon harbors a competitive advantage here. 3Q23 results confirm that the ad spend rebound is playing out earlier than expected; this quarter, ad revenue surged 26% Y/Y, outpacing ad growth among the peer group with Alphabet ad growth at 9% Y/Y, Meta at 23% and Snapchat (SNAP) at a low 5%. We think the higher ad revenue is supported by more traction on the e-commerce side of the business, despite macro uncertainty.

We’re seeing stable net sales growth from the North America segment, up 11% this quarter to $87.9B, similar to 2Q23. We’re more optimistic about North America sales, accounting for 61% of total sales, after the Fed announced it’d be holding its benchmark rate at around 5.4%; while this is the highest level in 22 years and still leaves room for future hikes if inflation pressures reaccelerate, we think this a positive sign of macro recovery. The company’s international segment saw accelerated growth this quarter, up 16% to $32.1B from 10% growth last quarter to $29.7B. We’re still cautious about the possibility of macro headwinds spilling into 1H24, but we remain bullish on Amazon as we think management’s revamped fulfillment network, which reduced cost to serve and delivery time to support resilience in 2024 if macro uncertainty persists.

The following outlines Amazon’s net sales in 3Q23.

3Q23 Amazon earnings presentation

Shifting to AWS, we think the cost optimization weighing on cloud spend in 2023 is beginning to ease; AWS reported 12% Y/Y growth this quarter to $23.1B. We now expect to see new signings accelerate, driven by cloud migration and gen A.I. demand. We understand investor concern over AWS’s slower growth compared to Microsoft’s (MSFT) Azure revenue growth of 29% this quarter and Google Cloud at 22%. Still, we’re not too concerned as we think AWS growth Y/Y is stabilizing and expect to see a more material rebound in cloud spending in 2024. Last quarter, AWS sales grew 12% to $22.1B and 16% to $21.4B a quarter prior. Still, we think the largest factor impacting investor confidence in the stock into 2024 is AWS’ slower growth rate compared to the competition.

AWS is among the top cloud providers, alongside Microsoft, Google, Alibaba (BABA), and IBM (IBM); public cloud foundational services generated a total revenue of $169B last year, with AWS accounting for 40.5% of the foundational cloud services market. We think AWS’ growth rate this quarter incited specific concerns over the company losing market share; we don’t think this is the case. Instead, we think AWS revenue reacceleration will be driven by companies transitioning to the cloud deploying net new workloads; Gartner expects worldwide IT spending to grow 8% next year compared to 2023, with data center spend estimated to grow 9.5% versus 4.7% in 2023 due to speed-up digital transformation after a limited cloud capex in 2023.

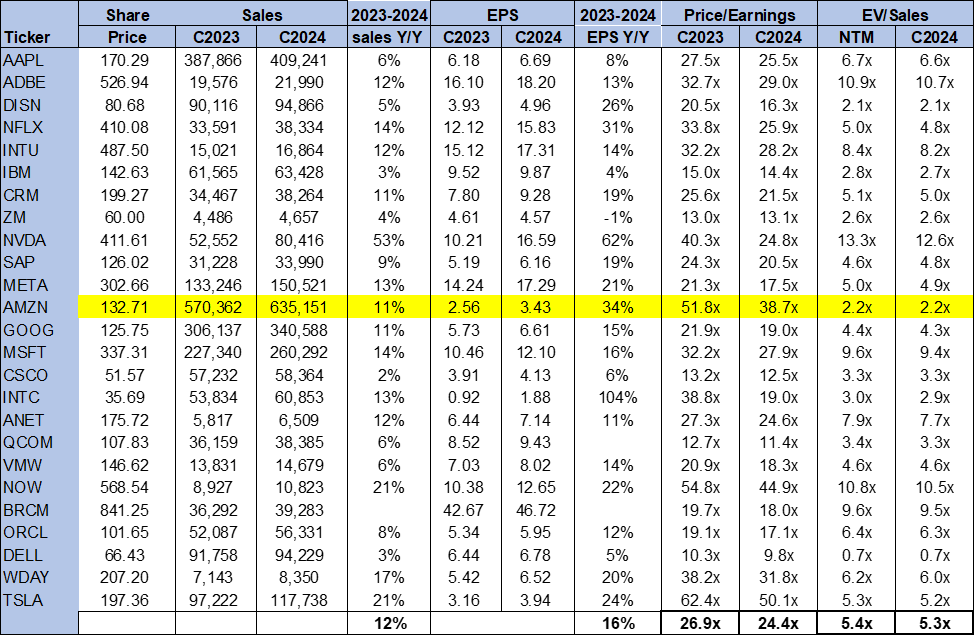

Valuation

The stock is trading below the peer group average. The stock is trading at 2.2x EV/C2024 Sales versus the peer group average of 5.3x. On a P/E basis, the stock is trading at 38.7x C2024 EPS $3.43 compared to the peer group average of 24.4x. We think the stock is fairly valued at current levels, considering the slower-than-expected AWS growth this quarter offset by better-than-expected ad revenue. We see more upside ahead for Amazon as we now think our previous post-pandemic concerns have played out and recommend investors explore entry points into the stock at current levels.

The following chart outlines Amazon’s valuation against the peer group average.

TSP

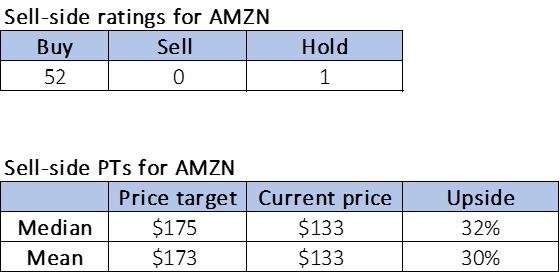

Word on Wall Street

Wall Street shares our bullish sentiment on the stock. Of the 53 analysts covering the stock, 52 are buy-rated, and the remaining are hold-rated. We think Amazon is uniquely positioned for more upside in 2024, and Wall Street sees it. The stock is currently priced at $133 per share. The median sell-side price-target target is $175 while the mean is $173, with a potential upside of 30-32%.

The following charts outline the sell-side ratings and price-targets for Amazon.

TSP

What to do with the stock

We continue to be buy-rated on Amazon. We see more upside driven by ad revenue and cloud spend stabilization into 2024. We think the reduced costs and operational efficiencies will continue to support top-line growth into the higher double-digit range. We still expect the stock to outperform the peer group in 2024 and recommend investors explore attractive entry points into the stock at current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.