Summary:

- Amazon is by far leading in one of the most promising technological industries, including cloud computing and e-commerce.

- Recent developments position AWS well to solidify its dominance in the global cloud infrastructure industry.

- According to my analysis, the stock is substantially undervalued.

Joe Raedle

Investment thesis

My previous bullish thesis about Amazon (NASDAQ:AMZN) aged well, as the stock outperformed the S&P 500 since mid-September. A lot happened over the last three months, and today, I want to share with readers my view on how the recent developments will likely affect the company’s future prospects. I think that the company is well-positioned to sustain its market leadership in the hot cloud computing industry, given strong strategic moves in this domain, including vast investments in in-house infrastructure as well as the strategic partnership with one of the leading generative artificial intelligence [AI] platforms, Anthropic. Prospects for the core e-commerce business are also bright as the management works on the improvements both from the customers’ and merchants’ sides. Furthermore, my valuation analysis suggests that AMZN is substantially undervalued, making it a compelling investment opportunity. All in all, I reiterate my “Strong Buy” rating for Amazon.

Recent developments

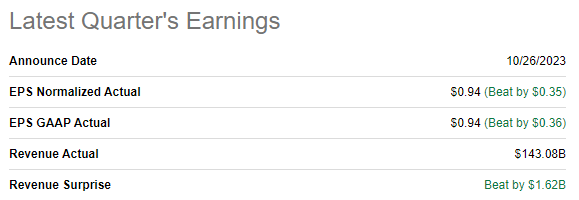

I will not dig into deep details regarding the company’s latest quarterly earnings release, which took place in late October. I will just highlight that AMZN delivered a solid beat against consensus estimates, and the topline grew by 12.6% on a YoY basis, which looks impressive given the uncertain macro environment.

Seeking Alpha

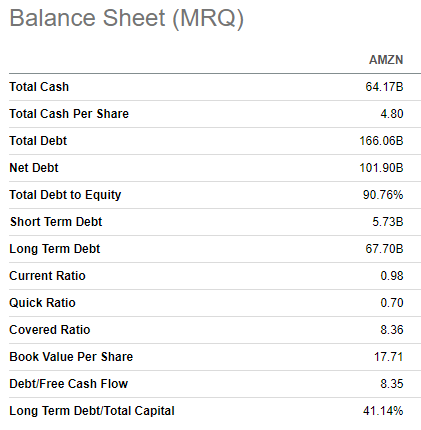

AMZN delivered a solid operating margin expansion, to 7.8%, which enabled the company to substantially improve its free cash flow [FCF]. The company generated almost $13 billion FCF in Q3, which enabled it to solidify its fortress financial position. The company’s $64 billion cash pile makes it well-positioned to continue investing in R&D and strategic acquisitions to fuel further revenue growth.

Seeking Alpha

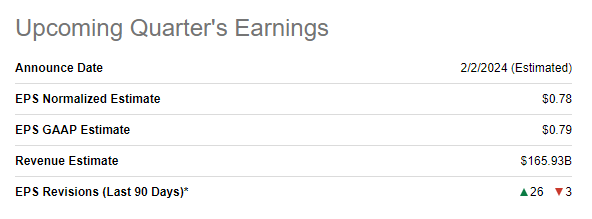

There were 26 upward EPS consensus revisions over the last 90 days, which is a bullish sign. In Q4, consensus estimates project revenue at $166 billion, indicating an 11.4% YoY growth. The expected adjusted EPS of $0.78 will be significantly stronger YoY, given last year’s massive headwinds and the recording of the investment in Rivian Automotive (RIVN) in 2022. I also look with optimism on Amazon’s Q4 earnings, given the record Thanksgiving spending online. Overall, according to statista.com, the 2023 holiday season U.S. online spending is expected to demonstrate an 11% YoY growth, which means Amazon is well-positioned to deliver robust Q4 financial performance. The next earnings release date is scheduled for February 2, 2024.

Seeking Alpha

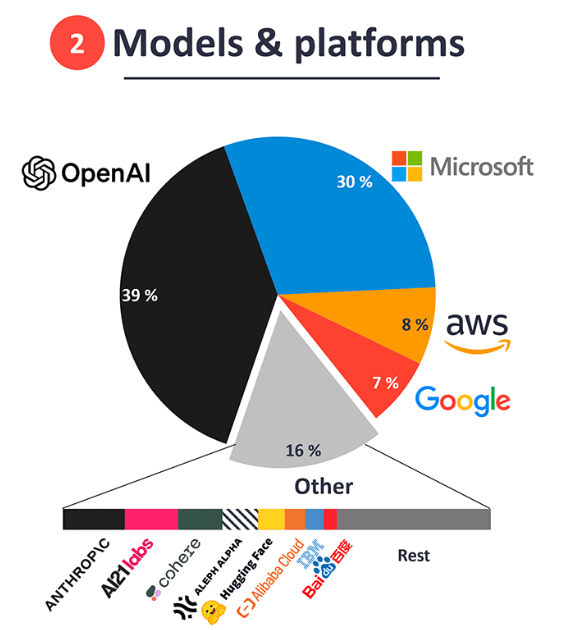

As I have mentioned earlier, the company’s strong financial position provides vast opportunities for shareholders to invest in long-term value. That said, the $4 billion investment in Anthropic, the AI developer, looks like a sound move for AWS to keep up with the major cloud competitors, Microsoft (MSFT) and Google (GOOG). I am optimistic about this acquisition because the generative AI capabilities are a crucial next step for cloud computing technologies. The fact that Amazon now partners with one of the leading generative AI platforms will highly likely add value to the company from a technological perspective. According to Bloomberg, the generative AI industry is forecasted to become a $1.3 trillion market by 2032. Given the fact that AWS has a massive 32% share in the global cloud computing industry, the company has massive growth potential in the generative AI field. Solid exposure to the emerging AI domain made AMZN one of the top picks for 2024 from Needham and Citi.

IoT Analytics

Apart from strategic investments, Amazon also invests heavily in-house. The company continues investing heavily in its AWS infrastructure to sustain its cloud market leadership. Recent news suggests that around $18 billion will be invested in its Canadian infrastructure over the next 15 years. The expanded infrastructure will improve the quality of service delivered to AWS Canada customers. Overall, the company also plans to expand its AWS infrastructure to southeastern Asia as well.

Let us also not forget about the core business, which generates the lion’s part of total sales, the e-commerce. Amazon’s leadership in the U.S. e-commerce industry is intact, and I see several positive developments here. The management continues to experiment with variations of Amazon Prime to add more value to its customers. From the merchants’ perspective, Amazon also has a new set of initiatives to attract more Chinese merchants. The move looks sound given the fact that China is by far the world’s largest exporter, and more Chinese merchants will highly likely drive Amazon’s gross merchandise value. This will ultimately lead to Amazon’s financial performance improvement.

Apart from working hard on unlocking new potential for revenue growth, the management is also disciplined about the cost side of the profitability equation. The company already laid off thousands of employees early this year, and this process continues. About a month ago, Amazon cut “several hundred” jobs in its Alexa division, which means the management is still seeking for efficiencies. It is also crucial to understand that the positive effect of mass 2023 layoffs was not yet recorded in full this year, as the company offered generous severance packages to laid-off employees. However, in 2024, the effect of severance costs will likely be much lower as the pace of layoffs naturally decelerates. This will also help profitability in the next fiscal year.

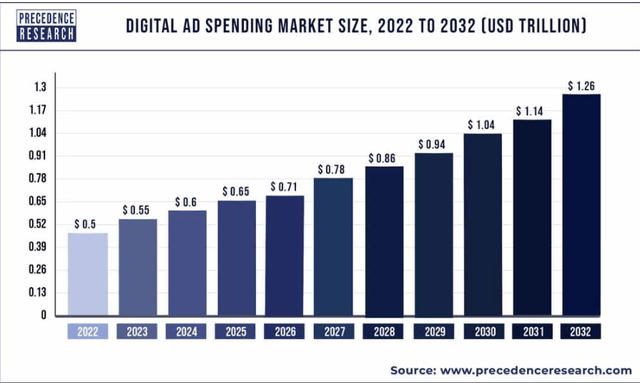

Last but not least, the recent important news regarding the expected 2024 digital advertising trends is also favorable for Amazon. According to Dentsu, global digital advertising spending is expected to grow by 6.5% in 2024, representing an overall 59% of the total spend. While Amazon’s revenue from digital ads is still insignificant compared to the total sales, this is one of the company’s fastest-growing revenue streams, and a solid tailwind behind its value will also likely add value to shareholders. It is also important to understand that the growth in the digital advertising industry is secular and is expected to accelerate in the years beyond 2024. The industry is expected to compound at 9.7% annually, which is also a solid secular tailwind for Amazon.

Valuation update

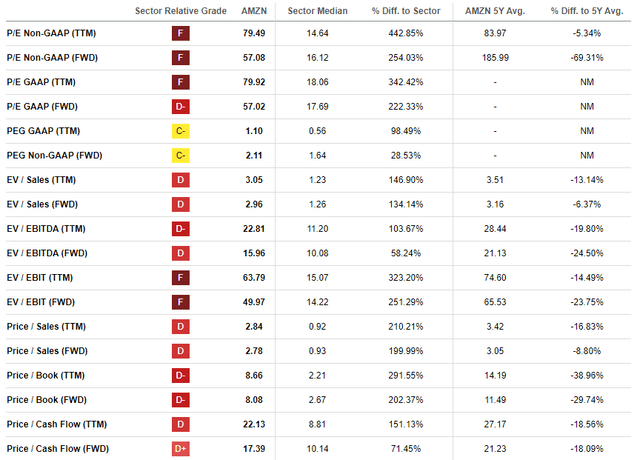

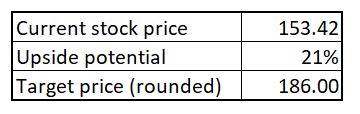

AMZN rallied by 78% year-to-date, significantly outperforming the broader U.S. stock market. Given the company’s unmatched scale and market position, AMZN’s valuation ratios are substantially higher than the sector median across the board. Therefore, It is better to compare AMZN with its historical valuation averages. The current valuation ratios are notably lower than the last five years’ averages, indicating undervaluation.

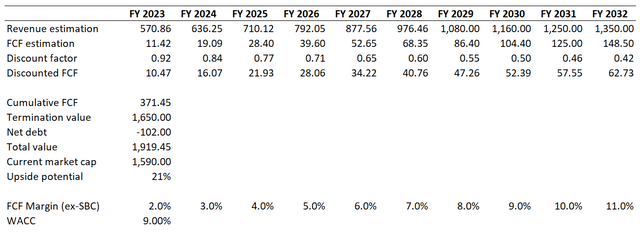

I want to proceed with the discounted cash flow [DCF] simulation. The last time I simulated DCF for AMZN, I used a 10% discount rate. Today, I want to use a less conservative 9% WACC, given the Fed’s announcement that rate cuts will start in 2024. Moreover, the 9% discount rate is within the range recommended by valueinvesting.io and I am comfortable with it. I use a TTM 2% FCF ex-SBC margin and expect a one percentage point yearly expansion as the business continues to scale up. Revenue consensus estimates project a 10% CAGR for the next decade, which I consider fairly conservative given AMZN’s firm exposure to major global technological trends.

According to my simulation, the business’ fair value is $1.9 trillion, which is around 21% higher than the current market cap. That said, the valuation is very attractive, and my target price is $186 per share.

Author’s calculations

Risks update

There are just a few trading days left in 2023; the year has been very robust for Amazon stock, with a notable upward trajectory. As the rally goes on, the risk of a pullback caused by profit-taking increases as well. Investors, having enjoyed significant gains this year, may be tempted to realize their profits. This increases the risk of near-term volatility, and potential investors should be aware of this.

It seems that the U.S. economy is on its path to a soft landing as the fight against inflation did not cause notable adverse trends in the labor markets, as unemployment rates are near all-time lows. However, in my opinion, the recession is still not off the table. The decrease in interest rates might cause a new spike in economic activity, which will drive the demand for oil and lead to energy commodities price increases. High oil prices will highly likely add inflationary pressures, which might force the Fed to pause rate cuts. And it will not be good news for growth investors.

Bottom line

To conclude, Amazon is still a “Strong Buy”. The valuation looks extremely attractive for such a well-rounded company with leading exposure to major secular technological trends like cloud computing, AI, and e-commerce. I am optimistic about the recent developments as they included several sound strategic and tactical moves, which will highly likely build value for shareholders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.