Summary:

- Amazon and Tesla are the only remaining companies in the Magnificent Seven group that do not give dividends or buybacks.

- Amazon is unlikely to start rewarding investors unlike other tech companies, as it can still use the cash flow in many new growth opportunities.

- Amazon is investing heavily in building better logistics, which will give the company a long-term edge in e-commerce and also increase the attraction of its subscription business.

- Amazon is also investing in many other segments, including streaming, cloud, autonomous cars, and international expansion, which should give the stock a better growth trajectory compared to investment in dividends and buybacks.

- In the end, it is unlikely that Jeff Bezos is interested in short-term capital return programs, and he would rather see investment in long-term projects.

Daria Nipot

Many tech companies have in recent quarters announced major capital returns programs. Some of these announcements have helped the stock sentiment. Investors were hoping that Amazon’s (NASDAQ:AMZN) (NEOE:AMZN:CA) management would also announce some kind of dividend or buyback program in recent earnings, but they were left disappointed. Now, only Amazon and Tesla (TSLA) are the companies within Magnificent Seven group, which do not give dividends or buybacks. This certainly puts pressure on Amazon’s management. However, there are valid reasons why the management might not start a big capital returns program. In a previous article published in November 2023, “Amazon: Fear of saturated market is overhyped” it was mentioned that Amazon is able to deliver good growth in key segments like subscriptions despite having a big revenue base. This growth has been possible due to massive capital investments in logistics, streaming, international expansion and more.

Amazon is investing massively in a number of segments which are very capital intensive. It is building a massive logistics network that requires billions of dollars in investment every year. Last year, it spent a whopping $19 billion on streaming video segment. Amazon is also spending heavily to expand its international presence.

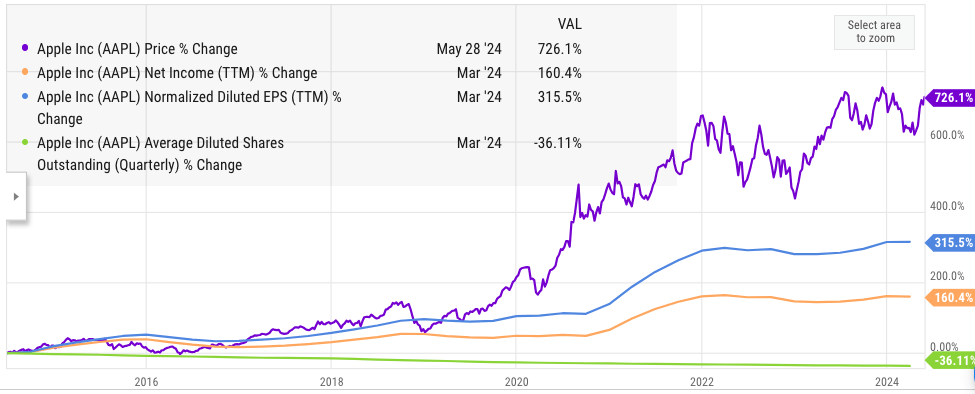

Some of the tech companies have been rewarded for their capital returns program. One of the best examples is Apple (AAPL) which has seen its net income increase by 150% in the last ten years. During the same time, its EPS has increased by over 300% due to stock buybacks and the stock price has jumped by 700%. Apple has been able to reduce its outstanding stock by over 40% since starting buybacks.

However, the end result will rest with the management and specifically Jeff Bezos. It is unlikely that Jeff Bezos might be interested in short-term capital returns program and would rather want Amazon to focus on investments that deliver long-term gains. We have seen this philosophy in the company since its inception. Hence, it is likely that investors hoping for dividends and buybacks could be disappointed.

Only two giants left

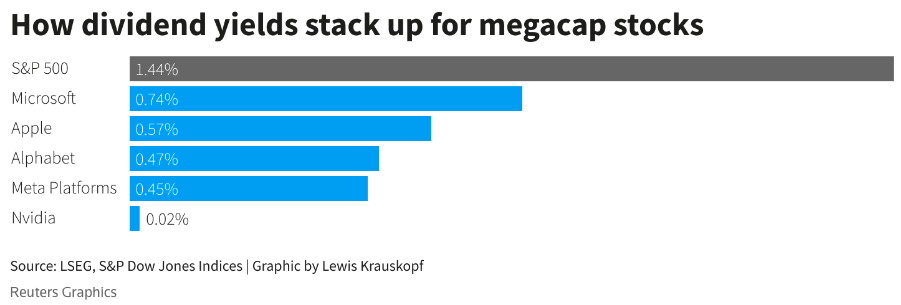

Alphabet (GOOG) recently started paying dividends, which was taken positively by Wall Street. Meta (META) started paying dividends in February. Amazon and Tesla are now the only two companies within the Magnificent Seven who are resisting the calls to start dividends and buybacks program. While the tech giants have invested massive amounts in their dividends, they still fall short of the average S&P 500 dividend yield of 1.44%.

Reuters

Figure: Dividend yield of major tech companies. Source: Reuters

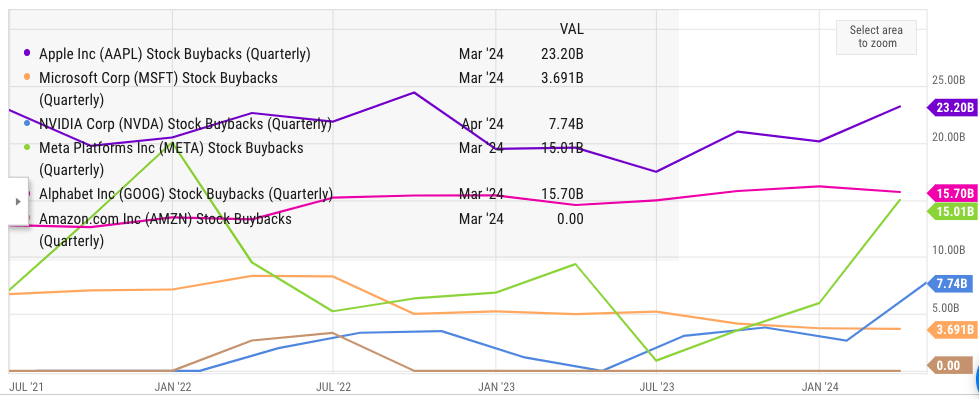

In terms of buybacks, the investment has been bigger, with billions of dollars invested every quarter.

YCharts

Figure: Comparison of stock buybacks in the last few quarters. Source: YCharts

These capital returns programs have been quite successful in a few cases. One of the best examples is Apple, which has invested over half a trillion dollars in buybacks and dividends over the last ten years. Apple’s net income has increased by 160% in the last ten years. However, due to a 40% reduction in outstanding stock, the EPS has jumped by 315% while its stock price has increased by over 700% due to a higher valuation multiple.

YCharts

Figure: Apple’s trajectory of net income, stock price growth. Source: YCharts

Amazon also undertook a short-term buyback program, but the scale of buyback was quite low to make any dent in the outstanding shares.

Amazon has many investment opportunities, unlike other tech giants

One of the key reasons why Amazon will be hesitant in putting huge cash flow in buybacks and dividends is because it can invest this resource in other high-growth options. This is not possible for many tech giants. As an example, over the last decade, Apple did not have many capital-intensive projects which it could invest prudently. Meta is already investing heavily in Reality Labs and besides this segment, there are very few other initiatives that would require a big investment.

However, Amazon is investing heavily in logistics, which will give it a big competitive edge over the next few years within the e-commerce segment. It is also investing in international regions like South Asia and Europe, which will give the company a massive growth runway. It recently announced over $16 billion in investment in Spain and has earlier mentioned that it would invest $26 billion in India by 2030.

One of the biggest investments by Amazon has been in streaming video. It spent a staggering $18.9 billion on content in 2023. This was a 14% YoY growth from the year earlier. At the current growth rate, the streaming budget could reach $50 billion by 2030. This would easily overshadow the investment of most streaming platforms. Amazon gains a massive edge by investing in streaming, as it improves the flywheel effect for its subscription business.

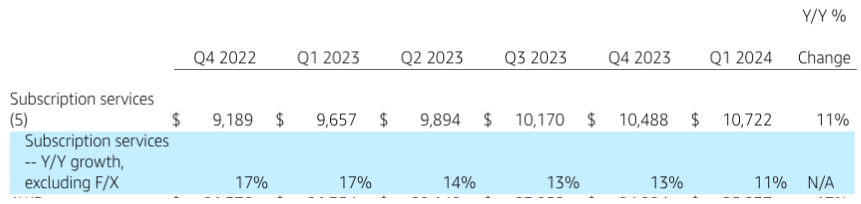

Amazon Filings

Figure: Growth in Amazon’s subscription business. Source: Amazon Filings

The subscription revenue touches $40 billion annually and is still showing good double-digit growth.

We will likely see a similar investment scale in other segments by Amazon, which makes it difficult to reserve a massive cash pile for buybacks or dividends.

Risk to the above thesis

Amazon has favored long-term investment instead of rewarding investors with buybacks or dividends. But these investments need to very prudent, else it can hurt the ability to improve margins. Amazon has invested $19 billion in streaming video in 2023. This is a massive amount, but the management would need to closely watch the returns on this investment. In 2023, Amazon invested $250 million in Citadel, a spy-themed TV show. The ratings for this show have been quite poor and even Amazon’s CEO has mentioned that they would need to closely monitor the expenses in future.

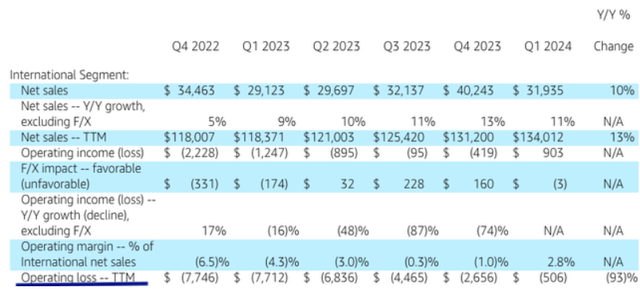

Similarly, Amazon’s international expansion requires massive investment, but this can cause huge losses if they are not done efficiently. Back in the last quarter of 2022, Amazon was reporting trailing twelve months operating loss of $7.4 billion from international operations. The company has since reined expenses and reduced the ttm losses to $0.5 billion.

Figure: Slow improvement in operating loss of international operation in last few quarters. Source: Amazon Filings

It would be important to gauge the future income and FCF trajectory of the company. Any big losses similar to 2022 could cause a bearish sentiment towards the stock. On the other hand, if the company invests in new segments like advertising, it can boost the overall margins rapidly.

Final decision will be with the management

The final decision about cash return programs depends largely on the outlook of the top management. For a long time, Warren Buffett did not believe in using buybacks. Only recently has he changed his views. In the case of Amazon, Jeff Bezos will likely have a last call on whether a major cash returns program should be started by the company. Since its inception, Amazon has focused heavily on reinvesting its profits and increasing its footprint in new segments. It is highly unlikely that this will change substantially until Bezos has a major control of Amazon.

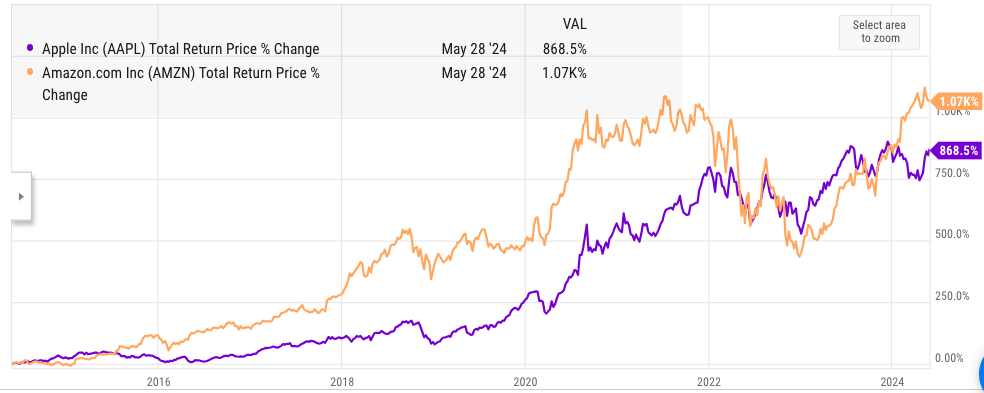

YCharts

Figure: Comparison of Amazon and Apple’s total return. Source: YCharts

Apple has invested over half a trillion in buybacks and dividends over the last ten years. However, Amazon stock has been able to show good returns during this period without using Apple’s strategy. At the same time, the forward revenue growth estimate of Amazon is much better than Apple, which is facing a slowdown in key business segments.

Long-term investors could gain from better stock price growth as the company shows stronger revenue growth and higher margins due to economies of scale.

Investors hoping for a short-term bump by the announcement of buybacks or dividends might be disappointed. Both Amazon and Tesla have shown that they are willing to invest massively in building their respective business, and it is unlikely we will see a big change in this strategy.

Investor Takeaway

There were high hopes from Amazon’s management that they would follow other tech peers and announce a major capital returns program that will benefit investors. However, this has not happened in the recent quarter. It is highly unlikely that Amazon will follow other tech giants by giving dividends and buybacks. The company has ample options to use its cash pile to improve several key segments. Amazon is investing heavily in logistics, international operations, streaming video, cloud, and several other growth areas. This should likely give a better return for Amazon’s cash, instead of investing in dividends or buybacks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.