Summary:

- Amazon’s AWS is well-positioned to capitalize on the AI revolution and is ahead of Microsoft Azure in a key area.

- While investors have been worried about cloud customers’ cost optimization efforts over the past year, Amazon has been savvily turning this into long-term growth opportunities for AWS.

- Though AWS also faces notable risks that investors should consider.

Noah Berger

Most investors are well aware of the fact that cloud providers will be one of the earliest beneficiaries of the AI revolution, as businesses worldwide seek to build their own AI models and applications, requiring immense cloud computing resources. The investment community expected Microsoft Azure and Google Cloud to lead the era of AI transformation, with Amazon’s AWS seen as a laggard that could lose market share to its smaller rivals. Though last quarter, Amazon proved that it is well-positioned to fight back. AWS has various strengths to leverage, and investors should certainly not eliminate the industry leader from the AI race. Nexus is upgrading the stock to a ‘buy’.

In our previous article covering the AWS segment, we discussed Amazon’s key strength, which is the fact that it offers its own chips, and how it could face challenges in inducing greater adoption of these chips. In the recent earnings report and analyst call, Amazon revealed the progress it is making in encouraging cloud customers to use its own chips, as well as the growth in new workloads it is experiencing amid the generative AI revolution. The promising growth prospects of Amazon’s main profit source have induced Nexus to upgrade the stock to a ‘buy’.

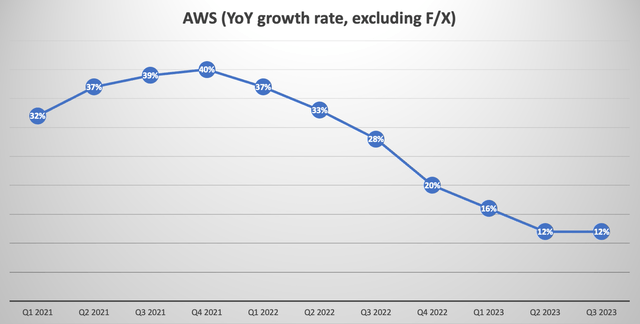

In Q3 2023, AWS’s year-over-year revenue growth rate seemed to have stabilized at 12%, as growth in new AI-related workloads was offset by continued cost optimization by customers.

Nexus, data from company filings

For investors who are new to the cloud industry, cost optimization essentially refers to when customers review their usage of cloud services and find ways to run workloads more cost efficiently. The dire macro backdrop over the past year has encouraged cloud customers across the industry to use their existing cloud computing resources more cost effectively. This means fewer new workloads being started on the cloud platforms, leading to slower revenue growth for cloud providers over the past several quarters.

That being said, cloud providers often tend to lean into customers’ cost optimization efforts. In other words, they help businesses find ways to use existing resources more cost efficiently, in the interest of developing stronger, longer-term customer relationships.

While executives on earnings calls often say that they are leaning into customers’ cost optimization initiatives to contextualize the slower cloud growth rates, on the last Amazon earnings call, executives actually highlighted certain strategies they are using to turn customers’ cost optimization efforts into longer-term revenue growth opportunities for AWS.

Firstly, Amazon is encouraging AWS customers to use cloud services that are powered by its own chips, as opposed to third-party chips from the likes of Intel and AMD.

Amazon offers its own CPU chip called Graviton, which integrates better with Amazon’s data center servers and software designs, compared to off-the-shelf chips from AMD or Intel. The more seamless integration within its data centers allows Amazon to reap cost efficiencies that can be passed onto cloud customers. On the Q3 2023 Amazon earnings call, CEO Andy Jassy proclaimed that:

A very significant portion of the optimization are customers taking advantage of enhanced price performance capabilities in AWS and making use of it. So for example, if you look at the growth of customers using EC2 instances that are Graviton based which is our custom chip that we built for generalized CPUs, the number of people and the percentage of instances launched their Graviton base as opposed to Intel or AMD base is very substantially higher than it was before. And one of the things that customers love about Graviton is that it provides 40% better price performance than the other leading x86 processors. So you see a lot of growth in Graviton.”

Now you might ask, what are instances? In simple terms, cloud computing instances are virtual servers that are hosted in data centers, and are usually accessed by customers through remote desktop connections. Instances can be used to run various forms of workloads, such as hosting websites, running machine learning algorithms to analyze large datasets, or even creating development and testing environments for new applications.

So the fact that AWS customers are increasingly using instances that are based on Amazon’s Graviton CPUs as opposed to Intel/AMD chips is a very positive form of optimization. Amazon is essentially able to charge lower prices for running workloads on its own chips than it would be charging for instances powered by AMD/Intel chips. Now because instances are being sold at cheaper rates, it leads to slower top-line revenue growth rates for AWS. Though this form of slower revenue growth can be acceptable from a shareholder’s perspective considering that greater use of Graviton chips offers long-term benefits for AWS.

Producing its own chips grants Amazon the ability to innovate unique new features and capabilities that may not be possible with off-the-shelf chips, which are relatively more generic in nature. This can enable Amazon to improve the value proposition of its cloud services and differentiate from competitors. If Amazon can prove to deliver better functionalities and superior price performance through its Graviton CPUs, this could lead to further adoption of Graviton-based instances across AWS’s customer base, enabling Amazon to keep customers attached to the AWS ecosystem.

As customers increasingly use Graviton-based instances, it also encourages more and more third-party developers to build software applications specifically for Amazon’s CPUs. The market has gained a strong appreciation of how important it is to have a flourishing software ecosystem around a company’s chips in order to thrive in the semiconductor industry, given Nvidia’s success with the CUDA software platform.

Similarly, as third-party developers build software applications around Amazon’s chips, it further expands the functionalities of the Graviton CPUs, which in turn attracts even more customers to adopt Amazon’s in-house chips, inducing a virtuous network effect for AWS, and bolstering Amazon’s ability to encourage customers to migrate from AMD/Intel chips to Amazon’s own silicon. Again, this keeps customers increasingly knotted to the AWS ecosystem, conducive to recurring revenue growth for Amazon shareholders.

Moreover, as AWS customers increasingly adopt Amazon’s chips, it also reduces the need for Amazon to purchase silicon from third-party suppliers like AMD and Intel, which should be conducive to greater cost savings and improving profit margins for AWS.

Furthermore, CEO Andy Jassy also highlighted another way that Amazon is turning customers’ cost optimization efforts into an opportunity on the earnings call:

You also see a lot of customers who are moving from the hourly on demand rates for significant portions of their workloads to 1- to 3-year commitments which we call savings plans.”

Essentially, AWS is offering cheaper rates to cloud customers that commit to longer-term contracts. Amazon is succeeding at locking customers in over longer time periods. Such longer-term commitments can be leveraged to cross-sell more AWS solutions to these customers, particularly new generative AI solutions, further augmenting revenue growth prospects for Amazon investors.

Amazon’s approach to leaning into customers’ cost optimization needs is encouraging from an investor’s perspective, and positions AWS well for generative-AI related growth.

On the last earnings call, the CEO proclaimed the new workloads coming onto AWS:

we’re seeing the pace and volume of closed deals pick up and we’re encouraged by the strong last couple of months of new deals signed. For perspective, we signed several new deals in September with an effective date in October … the collection of which is higher than our total reported deal volume for all of Q3.

Some are kind of first really big deals from customers. Some of them are very large expansions of existing agreements where they’ve gone from call it, 20% of their workloads to 50% of their workloads moving to AWS in the cloud.”

It is these remarks that gave investors reasons to be optimistic about AWS’s generative AI-related growth opportunities. The fact that cloud customers are increasingly running workloads on AWS proves that Amazon is not out of the AI race, and in fact could be a force to be reckoned with.

Similar to how AWS produces its own Graviton CPUs, it also produces its own AI chips for training and inferencing AI models, conveniently named Trainium and Inferentia. Just like Graviton, these chips are deeply integrated with Amazon’s other data center hardware and software systems, allowing for cost efficiencies and enhanced performance capabilities. On the earnings call, Jassy talked up adoption of its own AI chips among AI start-ups:

Recently, we announced that leading LLM [Large Language Model] maker Anthropic chose AWS as its primary cloud provider and will use Trainium and Inferentia to build, train and deploy its future LLMs. As part of this partnership, AWS and Anthropic will collaborate on the future development of Trainium and Inferentia technology. We believe this collaboration will be helpful in continuing to accelerate the price performance advantages that Trainium and Inferentia deliver for customers.

We are also seeing success with generative AI start-ups like Perplexity.ai who chose to go all in with AWS, including running future models in Trainium and Inferentia.”

The fact that more start-ups are using AWS’s Trainium and Inferentia is already encouraging from the perspective that it is again conducive to the build-out of software ecosystems and subsequent network effects, and reduces reliance on expensive Nvidia GPUs that allow for cost savings over the long term. On the other hand, competitors Microsoft Azure and OpenAI are currently still heavily reliant on Nvidia’s AI chips.

Anthropic is one of the hottest AI start-ups right now and is a key rival to OpenAI. It is promising to see Anthropic work together with Amazon to further advance the capabilities of the Trainium and Inferentia chips for generative AI purposes. It’s an essential move for AWS to catch up in the AI race.

Note that given the tight relationship between Microsoft and OpenAI, it wouldn’t be surprising if they came out with their own AI chips as well at some point. Nonetheless, it’s safe to say that Amazon is already well ahead of Microsoft on this front.

Keep in mind also that because AWS has been the largest cloud provider for so many years, it consequently also boasts the largest partner ecosystem. The partner ecosystem includes ‘Technology partners’ which develop software/ hardware solutions that integrate specifically with AWS. It also includes ‘Consulting and systems integration’ partners which help cloud customers design, implement, and manage their IT systems, through which customers often learn about and deploy AWS services.

The point is, the AWS partner ecosystem includes various types of partners that have all invested a lot of time, money and resources into building business solutions around the top cloud provider in the world. So it is very likely that they will continue deploying resources into AWS amid the generative AI revolution in order to continue reaping the fruits of their investments in AWS.

More specifically, as Amazon strives to expand the generative AI-related capabilities of AWS, its partners will also be developing generative AI-driven solutions around AWS, enabling Amazon to stay competitive. Now investors should certainly not underestimate Microsoft Azure and Google Cloud’s ability to grow their own partner ecosystem through the promise of generative AI-leadership. Though the fact that AWS already boasts the largest partner ecosystem is a key competitive advantage to help it protect its market share in the AI race.

Risks to AWS’ growth prospects

Productivity apps: AWS’ top rivals, Microsoft and Google, both offer their own suites of productivity apps, namely Microsoft Office 365 and Google Workspace. They have also introduced generative AI-powered assistants, Microsoft Copilot and Google’s Duet AI, that aid users in completing tasks much more easily and are expected to make these productivity apps very sticky. Moreover, the two rivals could leverage the convenience and stickiness of these AI assistants to upsell customers towards their enterprise cloud solutions, enabling them to take market share.

Competitors moving aggressively to take market share: Earlier this week, OpenAI introduced a more advanced LLM model, GPT-4 Turbo, which “has a 128k context window so it can fit the equivalent of more than 300 pages of text in a single prompt”. For comparison, Anthropic’s Claude 2 (a key LLM model offered through AWS) has a context window of 100k. The superior processing capacity of the GPT-4 Turbo could help Microsoft Azure attract more customers and catch up to AWS in terms of market share.

Now that being said, the race to offer the most superior AI models will be ongoing, as the tech giants continuously offer new, advanced models to cater to various customer needs. One size does not fit all, and there are various other factors that can determine a cloud customer’s choice of AI model. Nonetheless, investors should not underestimate competitors’ ability to take market share through AI model advancements.

Is Amazon stock a buy?

The growth rate of AWS seems to have bottomed at 12% and is expected to re-accelerate as the tech giant is strongly positioned to capitalize on the generative AI revolution. For context, the total addressable market for the cloud industry is projected to grow at a compounded annual growth rate of 14.1% between 2023 and 2030, to $1.5 trillion.

On the earnings call, Amazon CFO Brian Olsavsky shared:

My perspective is that the cloud is still in the early stages. If you think about 90% plus of the global IT spend being on-premises, where I think that equation is going to flip in 10 years”

The shift from on-premises computing to cloud computing is certainly a key growth catalyst for the industry as organisations across the globe seek to reap the full benefits of generative AI through cloud-based services.

That being said, rival Microsoft Azure has already struck savvy deals with smaller competitors Oracle and SAP to enable their ‘on-premises’ customers to migrate to Azure, as CEO Satya Nadella proclaimed on Microsoft’s Q2 2024 earnings call:

We are the only other cloud provider to run Oracle’s database services, making it simpler for customers to migrate their on-prem Oracle databases to our cloud.

And we are the cloud of choice for customers’ SAP workloads too. Companies like Brother Industries, Hanes, ZEISS, and ZF Group all run SAP on Azure.”

It is moves like these that are enabling Microsoft Azure, which grew by 28% (constant currency) last quarter, to catch up fast to AWS. Amazon will certainly need to step up its game to optimally capitalize on the enterprise shift from on-premises to cloud computing.

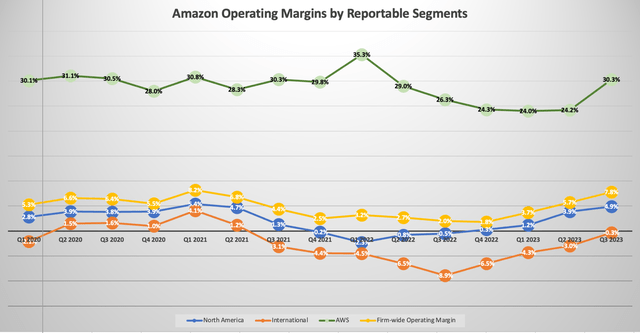

On a positive note, Amazon has been successful in achieving cost efficiencies in its cloud business, with the AWS operating margin expanding to 30.3% in Q3 2023.

Nexus, data from company filings

Though it is worth noting that this margin is considerably lower than Microsoft Azure’s operating margin of 48%. Nonetheless, Amazon remains well-positioned grow its profit margins going forward thanks to greater reliance on its own chips, as discussed earlier in the article.

Now while AWS is the company’s most important profit-driver, we must also consider the e-commerce side of the business to acknowledge Amazon stock as a whole.

Amazon has delivered remarkable profit margin expansion in its e-commerce business, particularly the North American segment where the operating margin expanded to 4.9% last quarter. The company’s initiative to regionalize its fulfilment infrastructure for faster and more cost-effective deliveries is proving to pay off, and profit growth is likely to continue given CEO Andy Jassy remarks on the last earnings call:

we know how important speed of delivery is to customer satisfaction and buying behavior. A good example is the significant growth we’re seeing in consumables and everyday essentials. When customers are getting items as quickly and conveniently as they are now from Amazon, they’re going to consider us more frequently for more of their shopping needs.

we have a long way before being out of ideas to improve cost and speed”

Jassy is truly proving his ability to deliver profitable growth, which should be supportive of bullish stock price performance going forward.

Although in a previous article, we also discussed how the generative AI revolution could pose risks to Amazon’s e-commerce business, such as the ease with which sellers can set up their own webstores through Shopify’s generative AI tools, as well as the conflict of interest as to whether Amazon will use its massive treasure of shopping data to grow the sales of its own private-labeled products, or third-party sellers’ products. These risks could undermine the future growth potential of Amazon’s e-commerce business.

Now in terms of valuation, Amazon stock currently trades at a forward PE multiple of 53.66x, which is significantly above the valuation multiples of its key cloud rivals, with Microsoft trading at 32.22x and Google trading at 23.05x.

Though Amazon stock has been trading at expensive forward PE multiples for a long time, with a 5-year average forward PE of almost 187x, given its high EPS growth rates.

Hence, a more prudent valuation metric to use would be the forward Price-Earnings-Growth [PEG] ratio, which offers better insights into how each stock is valued relative to its expected future growth rate.

Amazon currently trades at a forward PEG of 1.98, Microsoft trades at 2.35, and Google at 1.48.

A stock with a PEG of 1 would mean it is trading at fair value, though it’s safe to say that highly sought-after stocks rarely trade at fair value. A stock could be trading at a premium to its fair value for various reasons, such as investors having high confidence in a company’s growth potential due to the competitiveness of its products/ services, a solid moat, dominant market share position, or the strength of a company’s balance sheet.

It goes without saying that Amazon and Microsoft stocks trade at extreme premiums to their fair value, and are likely to continue trading at these premium valuations given their dominant market positions in their respective industries, as well as their promising growth potential through generative AI. Hence despite Amazon’s expensive valuation, Nexus is upgrading the stock to a ‘buy’ given its earnings growth prospects via generative AI.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, SHOP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.