Summary:

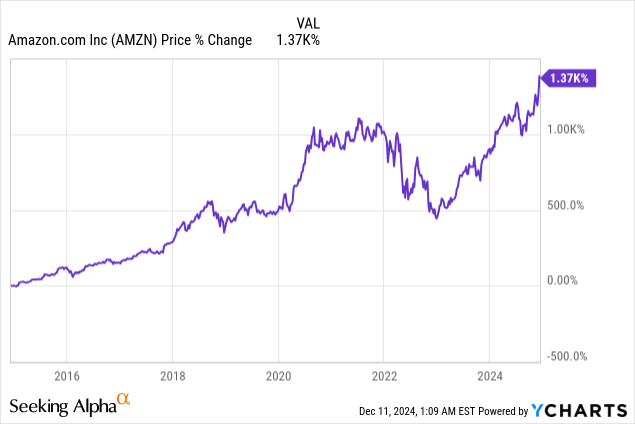

- Amazon’s shares just hit a new all-time high, driven by optimism about the U.S. economy and strong e-Commerce performance.

- I rate Amazon a strong buy due to robust growth in both Cloud and e-Commerce, with significant operating income potential.

- Black Friday was a big success for Amazon and with inflation moderating, the shopping season could yield record results for the e-Commerce segment.

- Amazon’s valuation is high at a forward P/E ratio of 37X, but its dominance in e-Commerce and Cloud justifies the premium.

- The biggest risk is Amazon’s high valuation, but strong Cloud profitability and growth in e-Commerce mitigate this risk, supporting a positive outlook.

4kodiak/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN)(NEOE:AMZN:CA) has reached a new all-time high lately on strong optimism about the U.S. economy following the win of President Trump as well as broadly falling inflation. Amazon, as a major e-Commerce platform, is obviously set to benefit from increasing business and consumer confidence. The company is also likely going to see a record fourth-quarter which is typically a great quarter for e-Commerce businesses due to the inclusion of the Christmas shopping season. With operating income in the e-Commerce business growing even more quickly than in the fast-growing Amazon Web Services unit, I believe Amazon has considerable potential to surprise to the upside in the fourth-quarter.

Previous rating

I rated shares of Amazon a strong buy in my last work in November — Road To $325 — because the company delivered double-digit top line growth as well as a very impressive operating income up-lift. While Cloud took the lead in terms of revenue growth (+19% Y/Y in Q3’24), I believe it is e-Commerce that could be the shining element for Amazon going forward. With the shopping season in full swing, I believe Amazon is set for a record fourth-quarter in its e-Commerce business, with moderating inflation providing consumer spending support. Given sustained e-Commerce tailwinds, I am also raising my fair value estimate for Amazon.

Amazon’s e-Commerce business is one fire

Amazon’s shares are currently the most expensive in the big tech group, although companies like Meta Platforms (META) have out-performed Amazon on a percentage-basis this year. Amazon is nonetheless trading at record highs, not only because of its prospects for a strong shopping season, but also because the company has other highly valuable businesses included in its operating portfolio, including Amazon Web Services, the #1 ranked public service Cloud infrastructure, and the company is now running a sizable digital advertising business as well.

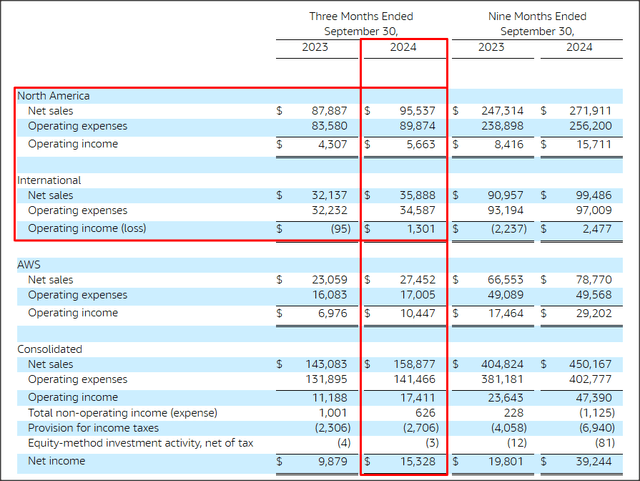

However, e-Commerce and Cloud are the two most significant businesses within Amazon’s portfolio and they generated a total of $158.9B in quarterly revenue in the third-quarter and $17.4B in operating income.

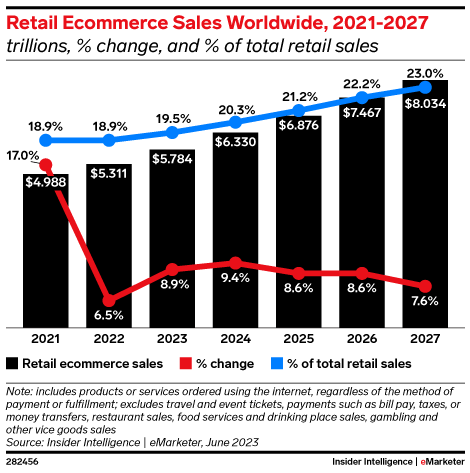

Amazon is set to benefit from growing confidence in the U.S. economy. As the largest e-Commerce platform in the U.S., Amazon will benefit from growing e-Commerce spending during the holiday season, which could potentially lead to a record quarter for the e-Commerce firm. According to eMarketer, global e-Commerce sales are set to rise to $8.0T by the end of FY 2027 which implies that between FY 2023 and FY 2027 the market is going to expand at an annual average growth rate of 9%.

Amazon

According to Adobe Analytics, Black Friday shoppers spent almost $11B on shopping deals, showing a 10% Y/Y growth rate. Amazon, as the largest e-Commerce platform, likely was a huge beneficiary of this sales boost as well, although the company has not released any specific Black Friday sales numbers. Amazon, however, stated that it saw record sales and a record number of items sold, and that independent sellers accounted for 60% of all Black Friday sales. Amazon has guided for $181.5B-188.5B in revenues in Q4’24, implying 7-11% top line growth Y/Y, and the company could easily surpass this guidance range, in my opinion, when considering the favorable economic backdrop.

While Cloud is the fastest growing segment for Amazon in terms of revenue, e-Commerce continues to dominate the business mix: e-Commerce represented 83% of total consolidated revenue for Amazon in the third-quarter. In the last nine-months period, e-Commerce generated $371.4B in revenues, or 83% of all sales. In terms of operating income, the picture is more slated in favor of Amazon Web Services: AWS represented 60% of all operating income in Q3’24 and 62% in the first nine months of the year. The increasing percentage is due to Amazon Web Services adding a lot of new customers to the AWS platform, but its operating income gains on a percentage basis are weaker than those made in e-Commerce… which is why I believe investors may be underestimating the company’s e-Commerce potential going forward.

Amazon Web Services’ grew its operating income 50% Y/Y in the last quarter, compared to a growth rate of 65% Y/Y in e-Commerce. This growth is due to favorable development in terms of inflation (which is moderating) and robust growth in the U.S. economy that leads to a positive climate for consumer spending. In my opinion, Amazon is set to benefit more from a robust economic backdrop in its e-Commerce business than in Amazon Web Services, which is more dependent on the corporate sector.

Amazon may be cheap given its potential…

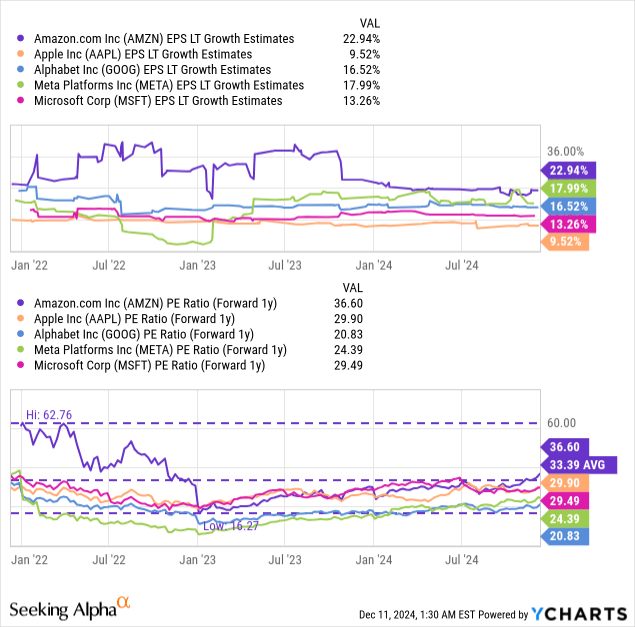

Amazon’s shares are currently valued at a price-to-earnings ratio — on a forward FY 2025 basis — of 36.6X which makes Amazon by far the most expensive big tech company you can invest in. While hares are the most expensive in the big tech industry group, they continue to have revaluation potential, in my opinion.

The big tech industry group — which includes Amazon, Apple (AAPL), Meta Platforms, Alphabet (GOOG) and Microsoft (MSFT) — has an average forward price-to-earnings ratio of 28.2X — meaning Amazon is about 30% more expensive than the average big tech company. I also said in the past that I see Google representing top value for investors given its low valuation, which is in part related to the government trying to break the company up over its search monopoly, which has created a ton of negative investor sentiment. I recently recommended investors to buy the ‘DOJ dip’ which so far has worked out very well.

In my last work on Amazon, I stated that I saw a fair value of $325 per-share for Amazon. However, with the e-Commerce segment set to have a very strong quarter in Q4 and investors being optimistic heading into FY 2025, I believe Amazon could even achieve a higher valuation in the next twelve months.

My last calculation was based off of a 20% long term EPS growth rate and a 35X forward P/E ratio. However, with both e-Commerce and Amazon Web Services doing really well for Amazon right now, I believe the company could grow its EPS even faster. Assuming that the company could grow its EPS at 25% annually, shares of Amazon could have a fair value in the neighborhood of $352 per-share (also assuming a 35X P/E ratio). This would mark an increase of $27 per-share compared to my previous fair value estimate. I am raising my estimate compared to my last estimate mainly because of a strong Black Friday shopping event as well as a boost to consumer sentiment after the election of President Donald Trump.

Risks with Amazon

Amazon’s business execution looks solid as the company continues to expand rapidly in both e-Commerce and Cloud, with e-Commerce leading the company’s operating income growth. Shares of Amazon are highly valued based off of earnings (relative to other big tech stocks), which may represent a higher than average risk for investors. However, Amazon is exceptionally profitable and seeing a surge in operating income growth. What would change my opinion on Amazon is if the company were to see a weak shopping season (unlikely) or a decline in its operating income growth in e-Commerce (also unlikely).

Final thoughts

Amazon is a well-run e-Commerce and Cloud company and I believe Amazon is set for a record fourth-quarter in terms of revenue and operating income growth due to a strong holiday season and moderating inflation, which is set to free cash up cash for consumers. Much of this cash, so my prediction, will end up on the Amazon shopping platform and could lead to a boost of the company’s e-Commerce division. Amazon’s e-Commerce operating income growth has recently out-performed operating income growth in Amazon Web Services, which could make e-Commerce the ultimate driver of stronger growth in Amazon’s portfolio going forward. While shares just reached a record high and are clearly not cheap, there are very good reasons to maintain a strong buy rating for the company even at record highs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOG, AAPL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.