Summary:

- AWS’s robust growth, especially in AI and cloud services, strengthens Amazon’s revenue and positions it as a leader in cloud infrastructure.

- Amazon has significantly improved its operational efficiency across segments, particularly in North America, where it achieved margin expansion alongside revenue growth.

- Collaborations with Intel for U.S.-based AI chip manufacturing and with the Middle Eastern tech giant e& are boosting Amazon’s AI capabilities and expanding AWS’ footprint in key regions.

- Amazon’s high-margin AWS growth, improved profitability in retail and advertising, and robust cash flow position it as a strong investment with multi-segment growth potential.

Userba011d64_201

Written by Mark Daniels

Investment Thesis

After Amazon’s (NASDAQ:AMZN) Q3 2024 financial results and strategic initiatives, I believe the company presents an exceptionally compelling investment opportunity. The foundation of my thesis rests on two transformative pillars that I see driving substantial value creation in the coming years.

The first pillar is AWS’s accelerating growth trajectory, which has shown remarkable momentum over the past three quarters. Looking at the numbers, AWS revenue has grown from $23.06 billion in Q3 2023 to $27.45 billion in Q3 2024. What I find particularly significant is that this growth has remained steady at 19% for two consecutive quarters even as AWS has reached a substantial $110 billion annualized revenue run rate, with margins reaching an all-time high. Management attributes this to three key factors: accelerating top-line demand, rigorous cost control efforts and a 200-basis-point benefit from extended server useful life, by which AWS is saving approximately $900 million per quarter. While the server life extension contributed to the margin improvement, I believe the underlying operational efficiency gains are sustainable and reflect AWS’s growing scale advantages.

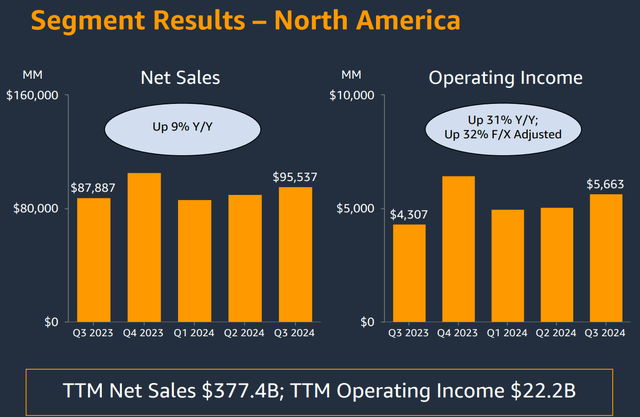

The second pillar of my thesis is around Amazon’s broad based operational efficiency improvements. The North America segment has transformed its profitability profile with operating income increasing from $4.31 billion to $5.7 billion YoY, representing a 32% growth rate.

I see several other catalysts that could drive further upside. The company’s AI initiatives in AWS are growing at a triple-digit rate and are expanding three times faster at this stage than AWS did in its early days. The recent strategic partnerships such as collaboration with Intel for AI chip manufacturing and the expansion into new markets like Malaysia and Middle-East provide additional growth vectors.

The combination of AWS’s sustained growth improving margins across all segments, and multiple emerging catalysts creates what, I believe, is a compelling investment case.

AWS Leading The AI Infrastructure Revolution

I believe AWS has reached an inflection point in its evolution as a cloud infrastructure provider. The segment has achieved an impressive $110 billion annualized revenue run rate, with Q3 revenue reaching $27.45 billion. What makes this growth trajectory particularly remarkable is its acceleration over four consecutive quarters, demonstrating strong momentum even at this massive scale.

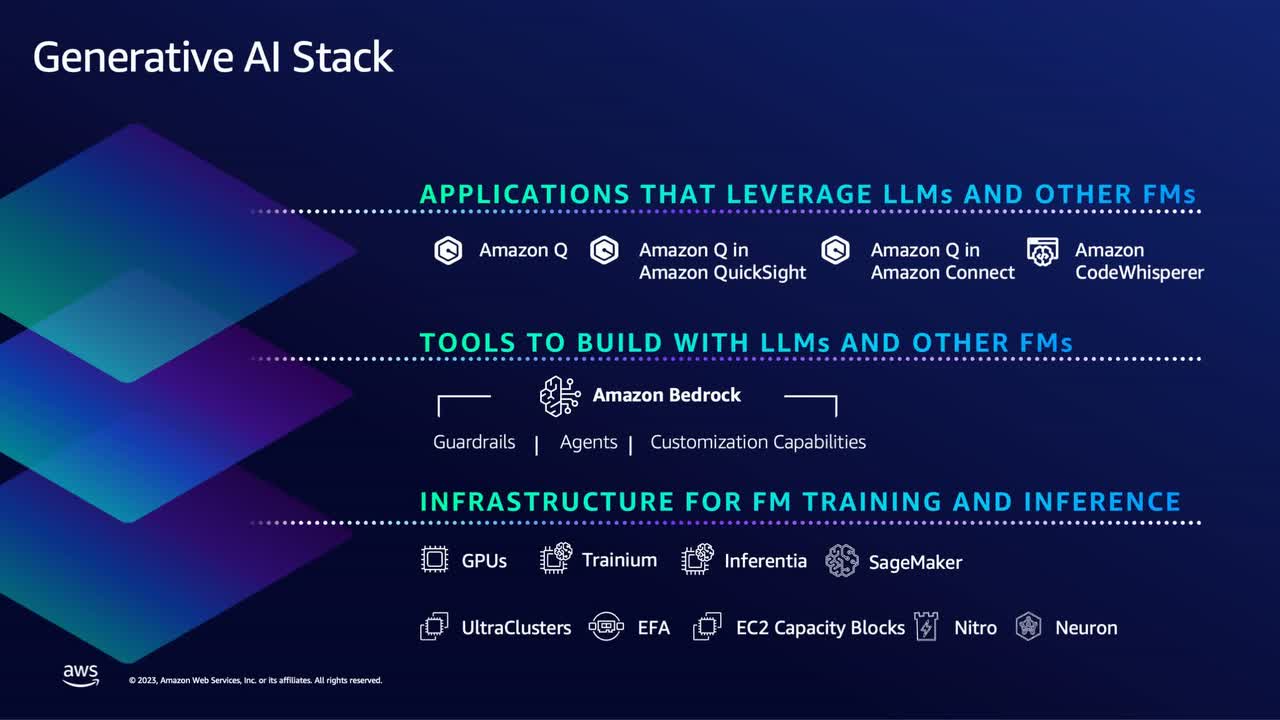

The most compelling aspect of AWS’s performance lies in its AI infrastructure business, which has emerged as a significant growth engine. According to management’s commentary, AWS’s AI related services have already reached a multi-billion dollar revenue run rate and are growing at triple-digit percentages YoY. To put this growth in perspective, management revealed that the AI business is expanding more than three times faster at its current stage than AWS itself did during its early growth phase, a remarkable achievement considering AWS’s historically rapid growth trajectory.

The development of custom silicon through AWS’s Trainium and Inferentia chips further strengthens this competitive advantage. The launch of Trainium2, AWS’s second-generation AI training chip, has captured significant customer interest, prompting multiple rounds of increased production orders from manufacturing partners.

Over the last 18 months, the company has released nearly twice as many machine learning and generative AI features as other leading cloud providers combined. The recent additions to Amazon Bedrock including Anthropic’s Claude 3.5 Sonnet, Meta’s Llama 3.2, and Mistral’s Large 2 models, this expansive model selection combined with Bedrock’s unique capabilities in model evaluation, guardrails and orchestration has driven significant customer traction.

The financial impact of these initiatives is reflected in AWS’s impressive margin performance. Operating income for the segment reached $10.4 billion in Q3, representing a 50% YoY increase and an operating margin of 38%. While approximately 200 basis points of this margin improvement came from extended server useful life, the underlying operational efficiency gains speak to AWS’s ability to manage its massive infrastructure at scale. As CEO Andy Jassy explained during the earnings call, AWS operates 35 regions with approximately 130 availability zones and thousands of SKUs, making it a comprehensive infrastructure that requires sophisticated capacity management.

AWS Collaboration With Intel For U.S. Based AI Chip Manufacturing

A key highlight of Amazon’s recent financials is its capital expenditure, particularly in property and equipment, which jumped to $17.6 billion. Much of this investment is tied to Amazon’s push into AI and cloud services. Unlike the pre-pandemic period when much of the capital was spent on logistics, these investments are now focused on building AI optimized data centers and expanding AWS infrastructure.

A major catalyst driving Amazon’s AWS division forward is its expanded strategic collaboration with Intel (INTC) which aims to develop next-generation AI chips and bolster U.S. based semiconductor manufacturing. This partnership was announced in September 2024 represents a significant multi-year, multi-billion-dollar commitment from both companies to advance the performance of AI applications and cloud infrastructure.

As part of this expanded collaboration, Intel will manufacture custom AI fabric chips on Intel’s advanced 18A process node and a custom Xeon 6 chip on Intel 3 specifically for AWS. This new development builds on the companies’ long-standing relationship dating back to 2006 when Intel chips powered Amazon’s first EC2 instance. According to Pat Gelsinger, CEO of Intel, this expanded collaboration will “unleash innovation across our shared ecosystem” by providing the computing power needed to run the most demanding AI workloads efficiently.

This collaboration emphasizes a broader geopolitical and economic advantage for Amazon and Intel by supporting U.S. based semiconductor manufacturing. Both companies are investing heavily in Ohio where Intel is building out its next-generation chip manufacturing facilities and Amazon is expanding its data center operations with a planned $7.8 billion investment.

AWS Expands in Asia with New Infrastructure Region in Malaysia

Another significant milestone in AWS’s global expansion is the launch of its Asia Pacific Malaysia Region. AWS’s $6.2 billion (MYR 29.2 billion) investment in Malaysia through 2038 is not only a major financial commitment but also a key driver for the region’s digital transformation. The launch of the new AWS region in Malaysia is particularly noteworthy, as it offers customers from startups to large enterprises and government organizations greater flexibility in running workloads and securely storing data. The new AWS region is forecast to add approximately $12.1 billion (MYR 57.3 billion) to Malaysia’s GDP by 2038, underscoring the critical role cloud infrastructure plays in driving economic growth.

AWS’s expansion in Malaysia also brings tangible benefits to a diverse range of customers. Prominent organizations like Bursa Malaysia, CelcomDigi, and Petroliam Nasional Berhad are already utilizing AWS’s broad suite of technologies to innovate and optimize their operations. As the cloud adoption wave continues to gain momentum, I expect AWS’s local customer base to grow significantly, positioning the company for strong revenue growth in this region.

Partnership with e& and Expansion in the Middle East

One of the most exciting recent developments for AWS is its strategic partnership with e&, a leading technology group that serves over 175 million subscribers across 34 countries. This $1 billion-plus agreement announced in October 2024, Amazon’s aggressive expansion into the Middle East market, strengthens AWS’s role as the premier cloud provider in the region. Through this collaboration, AWS and e& will deliver core cloud services such as storage, computing, networking, cybersecurity and artificial intelligence solutions across sectors like healthcare, finance, and oil and gas.

The timing of this agreement could not be better. According to PwC, nearly 70% of Middle East companies plan to migrate most of their operations to the cloud over the next two years. Additionally, a report by Telecom Advisory Services estimates that public cloud adoption will unlock $733 billion in economic value by 2033 across the Middle East and North Africa. AWS, with its first-mover advantage and deep expertise in cloud infrastructure, is perfectly positioned to benefit from this monumental shift.

In my opinion, this partnership not only boosts AWS’s footprint in a fast-growing region but also aligns with Amazon’s broader AI strategy. Amazon Bedrock AWS’s generative AI platform will play a crucial role in enabling companies in the Middle East to build and scale AI applications, improving operational efficiency and customer experiences. In the coming years, I expect this partnership to drive both revenue and margin expansion for AWS, contributing significantly to Amazon’s overall profitability.

Operational Excellence Driving Margin Expansion

What impresses me most about Amazon’s Q3 results is the significant improvement in operational efficiency across all segments. The company reported operating income of $17.4 billion, up 56% YoY, marking their highest quarterly operating income ever. Here’s why I believe this operational excellence is sustainable:

This substantial improvement wasn’t driven by a single factor or segment, but rather reflects fundamental enhancements in how Amazon operates its entire business.

The North America segment’s transformation stands out as particularly impressive, with operating income reaching $5.7 billion, up from $4.3 billion in the prior year. The segment achieved an operating margin of 5.9% representing a 100 basis point improvement YoY. This margin expansion becomes even more noteworthy when considering it occurred while the segment grew revenue by 9% to $95.5 billion YoY. The simultaneous achievement of growth and margin expansion demonstrates the structural nature of these improvements.

The company has also undertaken a significant restructuring of its U.S. inbound network, implementing hundreds of changes and opening more than 15 new inbound buildings. These changes have yielded immediate results, with the company’s ability to spread inventory across fulfillment centers improving by 25% YoY. This enhanced inventory placement capability has direct implications for both cost efficiency and customer experience, allowing Amazon to compile shipments and deliver to customers more quickly while reducing transportation costs.

The expansion of same-day delivery capabilities represents another crucial element of Amazon’s operational improvement. In Q3, over 40 million customers received free same-day delivery, marking a 25% increase from the previous year. What makes this metric particularly significant from an operational perspective is that same-day delivery facilities represent one of Amazon’s lowest-cost delivery methods. This creates a virtuous cycle where faster delivery drives increased customer satisfaction and higher order frequency, while simultaneously lowering per-order delivery costs.

Perhaps the most forward-looking aspect of Amazon’s operational improvements comes from their investments in next-generation robotics and automation. The launch of their 12th-generation fulfillment center design in Shreveport, Louisiana, represents a step-change in fulfillment efficiency. This facility incorporates Amazon’s newest robotics innovations across the entire fulfillment process, from stowing and picking to packing and shipping. Early results show a 25% reduction in fulfillment processing time and a projected 25% improvement in cost to serve during peak periods. Importantly, management emphasized that despite having more extensive automation and robotics capabilities than retail peers, they believe they’re still in the early stages of their automation journey.

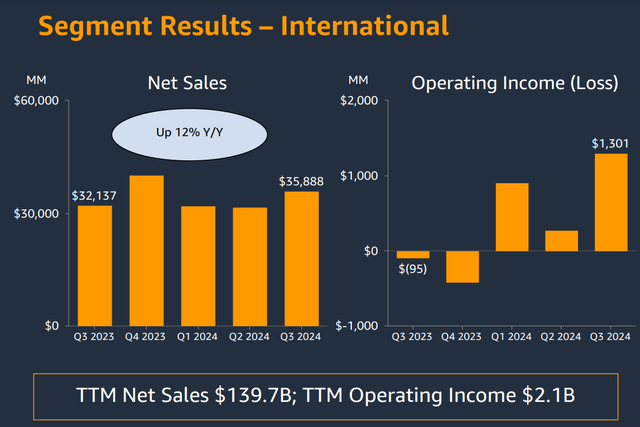

The international segment’s turnaround provides equally compelling evidence of Amazon’s operational excellence. The segment transformed from a $95 million operating loss in Q3 2023 to a $1.3 billion operating profit in Q3 2024, marking an improvement of $1.4 billion YoY. This represents the seventh consecutive quarter of YoY operating margin improvement, with margins reaching 3.6%, up 390 basis points from the previous year. The segment’s revenue grew 12% to $35.9 billion, demonstrating that margin expansion isn’t coming at the expense of growth.

The company’s increasing use of AI in its robotics network combined with recent hiring from a strong robotics AI organization suggests potential for additional automation gains. The ongoing rollout of same-day delivery facilities and continued optimization of the inbound network should provide additional efficiency improvements. Furthermore, the company’s ability to serve lower ASP items economically opens up new market opportunities while maintaining profitability.

These operational improvements have also led to strong cash flow generation, with operating cash flow increasing 57% to $112.7 billion for the trailing twelve months. Free cash flow improved to $47.7 billion, up from $21.4 billion in the prior year period, demonstrating the financial impact of these operational enhancements.

Valuation Analysis

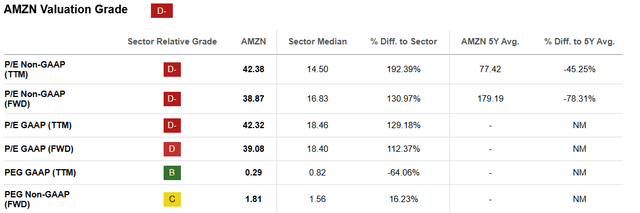

I believe the company presents compelling value despite its seemingly premium valuation multiples. Trading at a forward P/E Non-GAAP of approximately 39.87x, the stock might appear expensive at first glance. However, I think that this multiple understates the company’s earnings growth potential and the structural improvements across its business segments.

This needs to be viewed in the context of Amazon’s historical valuation; the current multiple is actually 78.31% below its 5-year average forward P/E Non-GAAP of 179.19x. This dramatic compression in Amazon’s trading multiple, despite improving fundamentals, suggests a potential disconnect and undervaluation.

Thanks to AWS’s exceptional performance and growth trajectory, the segment delivered $10.4 billion in operating income in Q3 2024, achieving an industry leading operating margin of 38%. This represents a substantial increase from $7.0 billion in the prior year, demonstrating powerful operating leverage as revenue scales. The margin expansion story becomes even more compelling when examining the segment’s evolution over time. The sustainability of these margins is supported by management’s sophisticated approach to capacity management across their 35 regions and 130 availability zones, which helps optimize infrastructure utilization.

Looking at AWS’s AI initiatives, specifically the segment’s multi-billion dollar AI business, given the higher margins typically associated with AI workloads and the segment’s demonstrated ability to scale efficiently, I expect this to drive substantial earnings growth in coming years.

The retail business’s margin expansion provides another key pillar of my valuation thesis. The North America segment consecutive quarter of YoY margin improvement, suggesting structural rather than cyclical improvements. The international segment’s transformation is even more dramatic, swinging from a $95 million operating loss to a $1.3 billion profit YoY with margins reaching 3.6%.

Amazon’s advertising business represents another significant value driver that, I believe, isn’t fully appreciated in current valuation metrics. The segment grew 19% YoY to $14.3 billion in Q3, building on an increasingly large base. With advertising revenue now running at an annual rate exceeding $50 billion and representing approximately 9% of total revenue, this high-margin revenue stream materially impacts overall profitability. The upcoming introduction of ads in Prime Video and the expansion of AI-powered advertising tools suggest substantial runway for further growth.

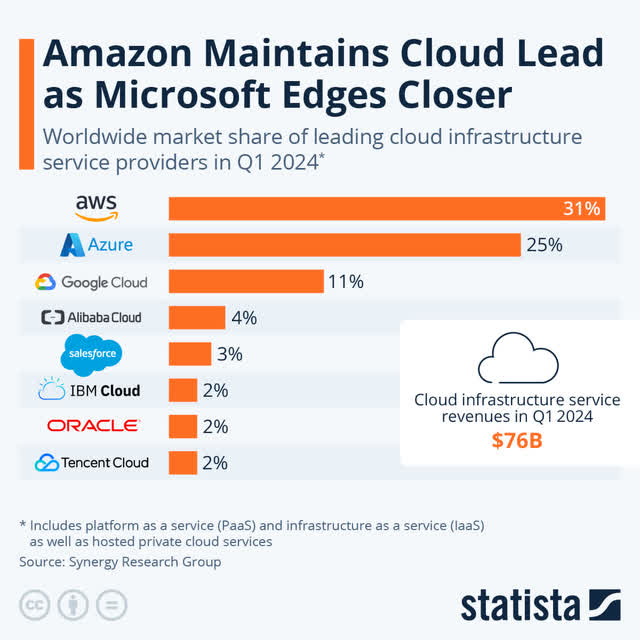

When comparing Amazon’s valuation to peers, it’s important to consider the unique combination of growth and scale across its businesses. In cloud infrastructure, AWS maintains clear leadership with the largest market share of 31%. In e-commerce, despite its size, Amazon still represents only about 1% of the global retail market, suggesting substantial room for expansion. The advertising business’s growth rate matches or exceeds many advertising companies while benefiting from Amazon’s unique first-party data advantages.

The combination of AWS’s AI-driven growth, retail margin expansion and advertising business scaling should drive substantial earnings growth over the next several years. The company’s demonstrated ability to improve profitability while maintaining growth across all segments suggests these improvements are sustainable and likely to compound over time.

While the current forward P/E of 39.87x might appear expensive relative to the broader market, I believe it fails to capture the company’s multiple growth vectors and margin expansion potential. The combination of high margin AWS growth improving retail profitability, and scaling of the advertising business creates a compelling case for earnings growth that could drive significant shareholder value creation even from current levels.

Risks and Challenges

While I maintain a bullish outlook on Amazon’s long-term prospects, there are some concerns that deserve particular attention, given Amazon’s current scale and the rapidly evolving competitive landscape in key growth areas.

The most immediate challenge facing Amazon is the dramatic increase in capital intensity across its businesses. In Q3 2024, the company’s capital expenditure reached $22.6 billion, a substantial increase from $12.48 billion in the same quarter last year. Management has guided for total capital expenditure of approximately $75 billion in 2024, marking a significant step-up in investment intensity. To put this in perspective, capital intensity as a percentage of sales has nearly tripled from historical levels of 5-6% in 2018-19 to 14.2% in Q3 2024.

The majority of this increased capital expenditure is directed toward technology infrastructure, primarily supporting AWS and, particularly, its AI initiatives. While management characterizes the AI opportunity as “once-in-a-lifetime” and potentially transformative, the cash flow dynamics of these investments warrant careful consideration. As explained during the earnings call, the AWS business model requires upfront capital investment in data centers, networking gear, and hardware before customer usage can generate revenue. This dynamic is particularly pronounced in AI infrastructure, where the accelerators and chips are significantly more expensive than traditional CPU hardware.

Though management emphasizes that many of these assets have long useful lives with data centers, for instance, being productive for 20–30 years, the near-term impact on free cash flow and returns on invested capital would be affected by it. The company’s operating cash flow has grown 57% to $112.7 billion for the trailing twelve months, but the increased capital intensity could pressure free cash flow metrics if revenue growth doesn’t materialize as expected.

On the retail front, emerging competitive threats pose additional challenges. Chinese e-commerce platforms such as Shein, Temu, AliExpress, and TikTok Shop have been gaining market share globally by offering ultra-low prices and free shipping for cross-border purchases. Notably, Shein has become the third-largest online fashion retailer in the US trailing only Amazon and Walmart, and is expected to surpass Amazon in this category in 2024. These platforms’ ability to operate with lower margins while maintaining aggressive growth could pressure Amazon’s retail margins.

Summing Up

I believe Amazon represents a compelling investment opportunity at current levels. The combination of AWS’s AI-driven growth, improving operational efficiency and multiple profit growth levers creates a powerful foundation for long-term value creation. The company’s demonstrated ability to execute on both technological innovation and operational optimization gives me confidence in their ability to maintain this momentum.

The Q3 results and management’s forward-looking commentary suggest that Amazon is well-positioned to capitalize on the generative AI opportunity while continuing to improve its core retail operations. While the increased capital intensity bears watching, I believe these investments will drive strong returns over time, particularly in AWS’s AI infrastructure business.

Investors looking for exposure to a tech giant with a diversified business model and strong growth potential should seriously consider adding Amazon to their portfolios before the earnings announcement. With AWS continuing to grow and the company making smart investments in future technologies, I expect Amazon’s stock to perform well in both the short and long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.