Summary:

- Amazon’s e-commerce business showed a surprise profit, demonstrating its ability to generate profits whenever it chooses to.

- The company’s fulfillment network is a competitive advantage, capable of delivering packages at incredible speeds.

- Management believes weakness in AWS has reached a bottom, with generative AI and a macro recovery expected to drive strong long-term growth.

- I explain why AMZN stock remains undervalued after stripping out heavy reinvestment in the business.

Phillip Faraone/Getty Images Entertainment

Amazon (NASDAQ:AMZN) is finally getting the love it deserves. Ironically, the catalyst did not come from its cloud computing AWS segment, which historically has garnered the bulk of analyst attention. Instead, it came from its e-commerce business, where the company showed a surprise profit – and effectively showed Wall Street that it could generate profits whenever it chooses to. AMZN continues to further increase the competitive advantages of its fulfillment network, capable of delivering packages at unfathomable speeds. Management is of the view that weakness in AWS has reached a bottom, with generative AI and an eventual macro recovery giving way to strong growth over the long term. As usual, I discuss the moving parts to understand why AMZN remains deeply undervalued – I reiterate my strong buy rating.

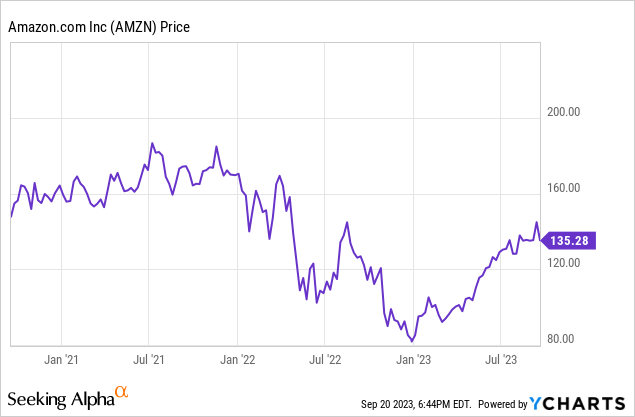

AMZN Stock Price

For much of the year, AMZN had lagged mega-cap tech peers amidst the broader rally in the tech sector, largely due to macro pressures in both its e-commerce and AWS segments. The stock is now starting to catch up.

I last covered AMZN in June where I named it a top pick for the rest of the year. The company continues to execute and I expect a shift in sentiment to lead to solid upside ahead.

AMZN Stock Key Metrics

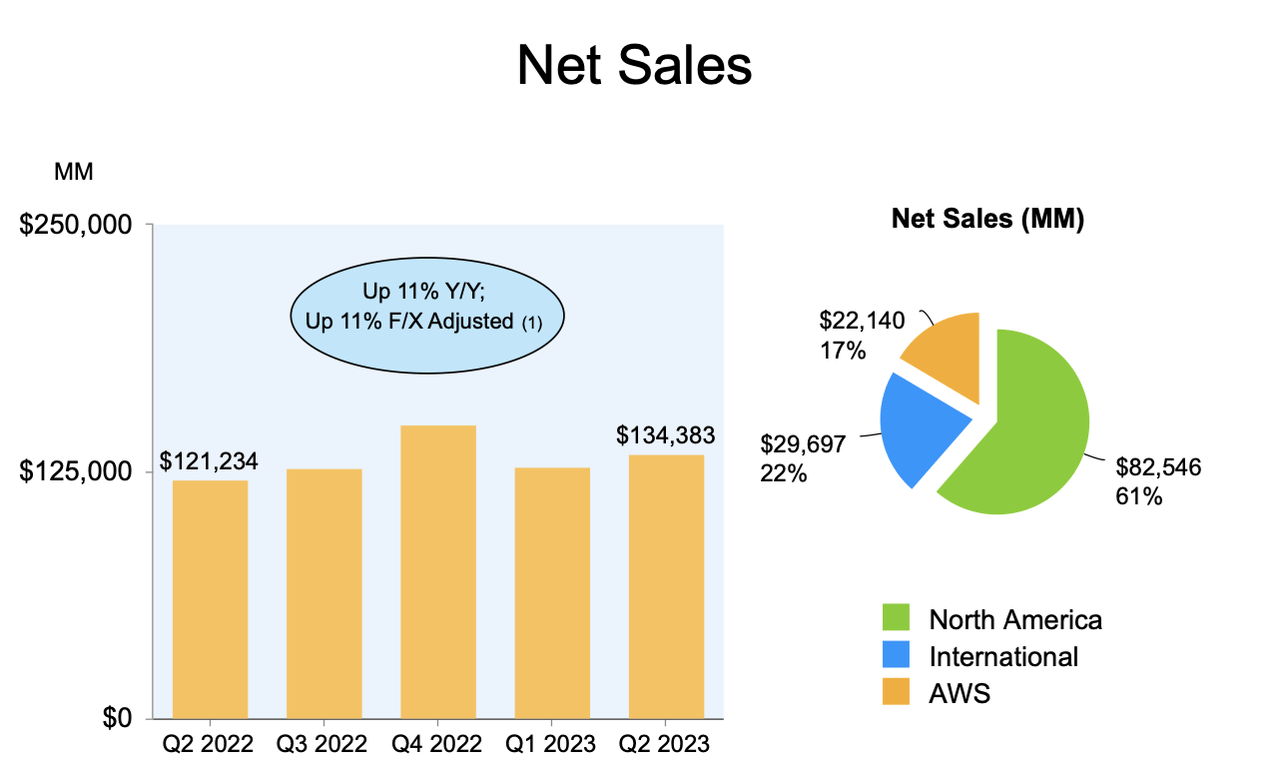

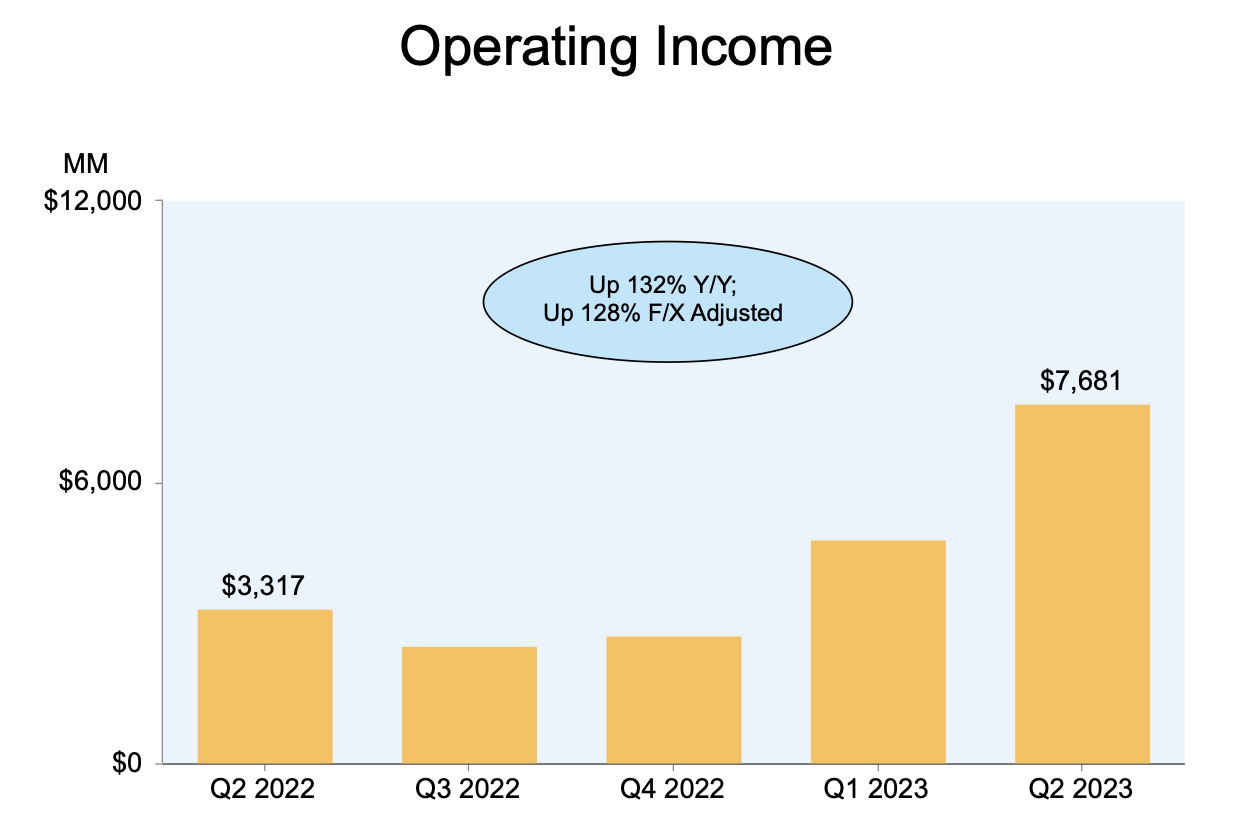

Heading into this most recent quarter, management had guided for up to 10% revenue growth to $133 billion and operating income of between $2 billion and $5.5 billion. Revenues end up growing 11% YOY to $134.4 billion.

The operating income beat was even bigger, coming in at $7.7 billion. The magnitude was not as important as where the beat came from.

2023 Q2 Presentation

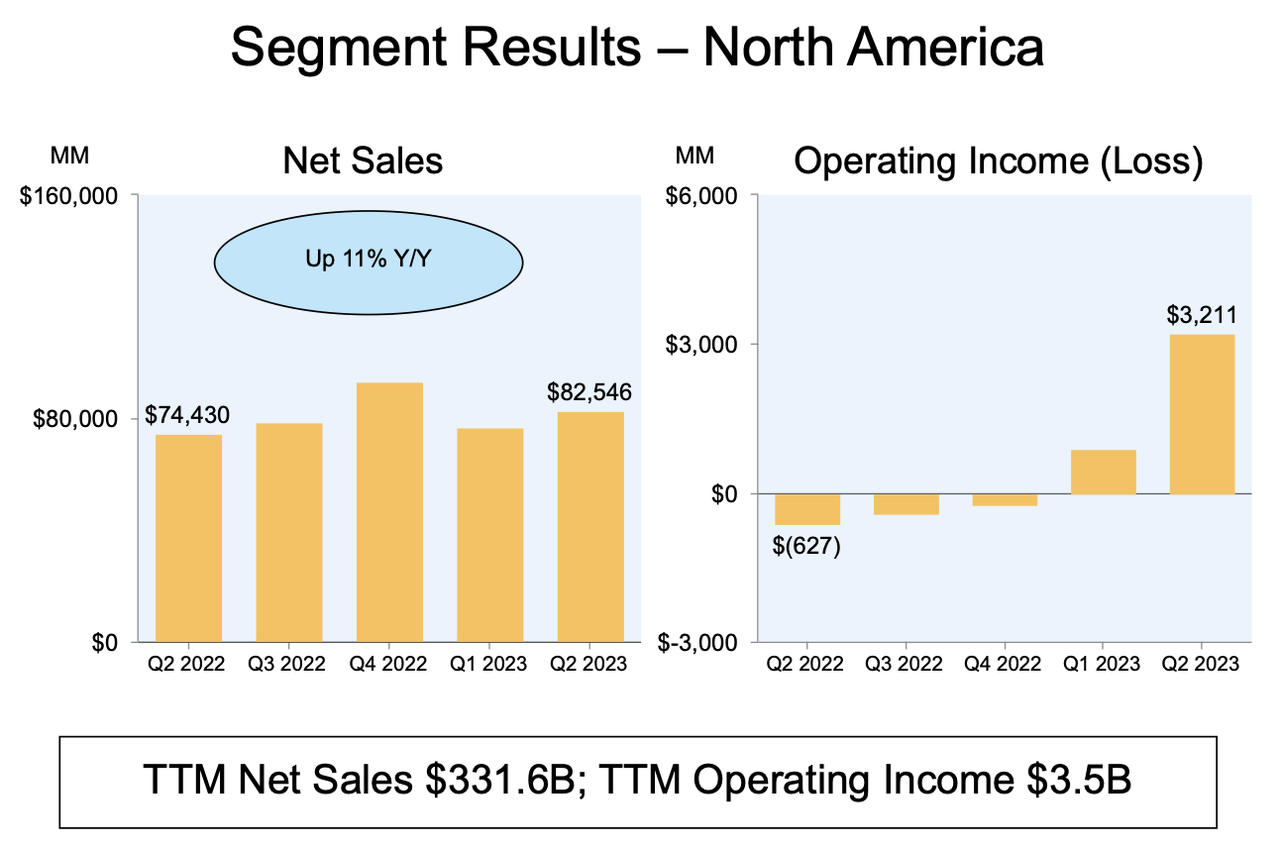

The main driver of the profit beat was continued execution on boosting margins in the North America (e-commerce) segment. Margins in this segment bottomed in the first quarter of 2022, but have seen 5 consecutive quarters of sequential gains.

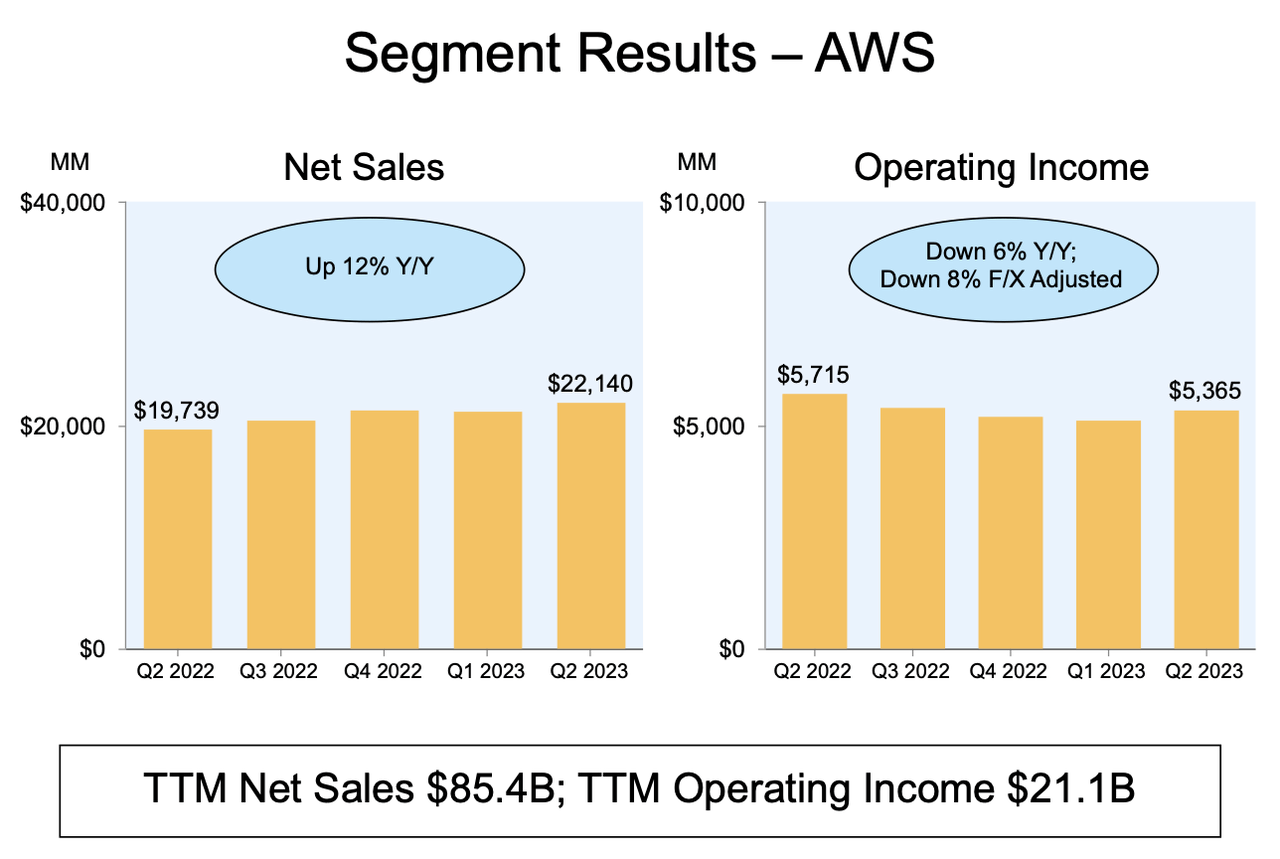

AWS ended up growing revenues at 12% YOY – better than feared – though operating income declined YOY.

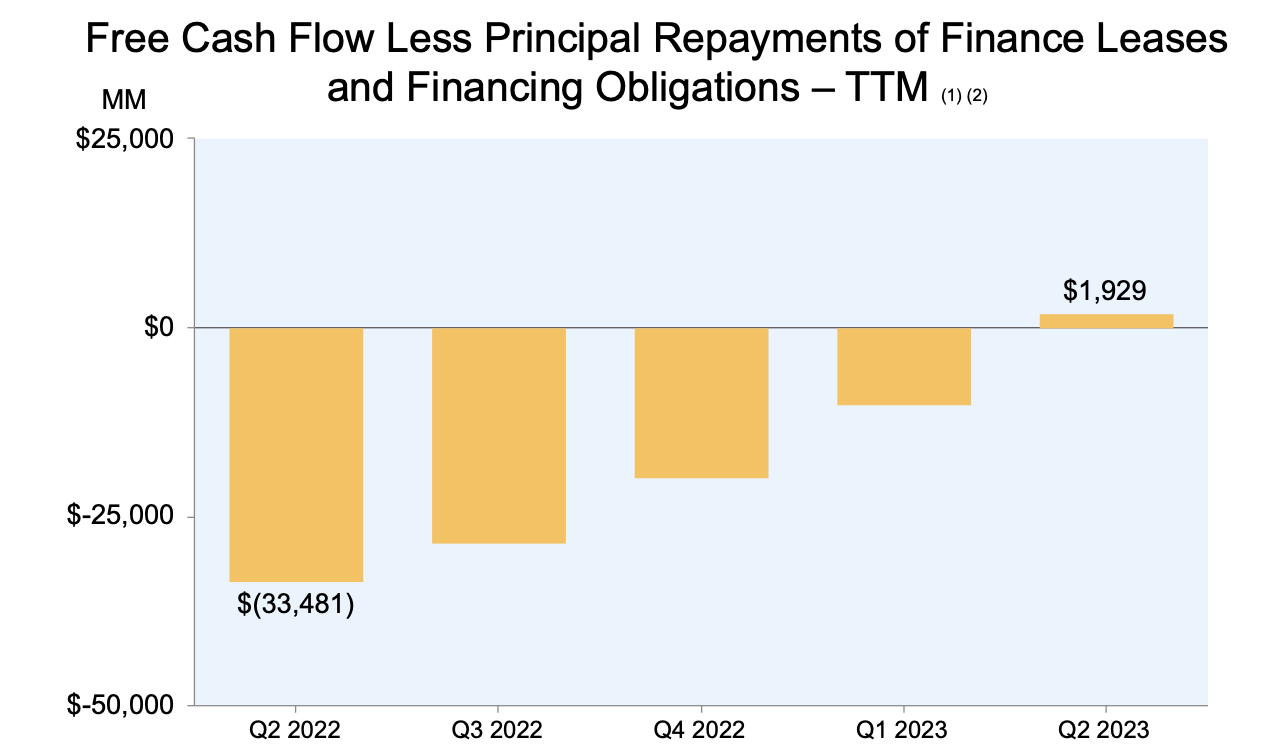

The strong recovery in this and recent quarters has enabled AMZN to finally post positive free cash flow generation on a trailing twelve months basis.

2023 Q2 Presentation

AMZN ended the quarter with $63.9 billion of cash versus $63.1 billion of debt, representing a strong balance sheet especially considering that this is a business that arguably should be able to support ample amounts of leverage in the long term.

On the conference call, management credited their margin gains in North America as being due to their transition of 1 central national network to “a series of 8 separate regions serving smaller geographic areas.” The idea is that each region has its own “broad selection of inventory,” helping the company deliver products faster and cheaper to customers. Management estimates that regionalization has led to a 20% reduction in touches per package and a 1,000 bps increase in deliveries fulfilled within a region.

Management noted that faster delivery is not just an investment in futility, despite what Wall Street may seem to believe. They noted that customers make purchases “meaningfully” more often when presented with faster delivery promises and are more likely to stick around for future purchases as well. An impressive datapoint – AMZN was able to deliver over 1.8 billion units to U.S. prime members the same or next day, which was nearly 4x the amount in 2019. AMZN was already fast in 2019, but the pandemic has made them even faster.

Management reiterated expectations for North American margins to return to pre-Covid levels, but also expressed hopes to even surpass those targets. AMZN has entered more than 10 countries over the past 6 years but management notes that it took 9 years to reach profitability in the United States. While the international segment is still not yet profitable, I expect AMZN to scale over time.

Regarding AWS, management noted that while optimization trends have continued, they are seeing more customers begin focusing on innovation and bringing new workloads. Management noted that AWS revenue growth “stabilized” in the quarter, saying that their customers are “mostly” optimized, but notably did not give explicit guidance for the third quarter and onwards. That said, management emphasized their conviction in the long term cloud opportunity, noting that generative AI should provide tailwinds for years to come.

I did notice management changing their tone about AWS on the call, attempting to get analysts to focus on the large $88 billion revenue run rate of AWS instead of the growth rate. That commentary was reminiscent of CEO Tim Cook’s own commentary about Apple (AAPL) many years ago when AAPL saw its hyper-growth moderate. While I continue to expect AWS to deliver solid double-digit growth for the foreseeable future, I also highlight the possibility that AWS (and the e-commerce segment for that matter) are eventually rewarded with the premium multiples that they deserve.

It is worth noting that AMZN also brought their Amazon Clinic nationwide just prior to the quarter’s release, a reminder that AMZN may be able to use its favorable reputation to penetrate more and more of the broader economy.

Is AMZN Stock A Buy, Sell, or Hold?

AMZN has perennially looked overvalued on the basis of PE ratios.

But this is a case where one must be careful to avoid punishing AMZN for being “too good.” I should clarify that. Typically it is a good thing (rather a very good thing) for a company to be able to invest capital at high rates of return. In AMZN’s case, it is able to invest lots of capital at high rates of return – so much so that it eats into present-day profitability. Given that AMZN has been able to achieve such dominance in e-commerce on account of its deep investment in its fulfillment network, investors in theory should be hoping for as little profits as possible due to the implication of greater capital being invested – an ironic point. In order to avoid penalizing AMZN for choosing to invest aggressively in its long term growth ambitions, I choose to value the stock based on long term margin assumptions. Based on a 5% long term net margin assumption in e-commerce and a 25x earnings multiple, I value the e-commerce operations at $565 billion. Based on a return to 18% revenue growth at AWS, 40% long term net margins and a 2x price to earnings growth ratio (‘PEG ratio’), I see this unit being valued at $1.2 trillion. Together, that implies a valuation of $172 per share, implying solid multiple expansion upside potential to go with the ongoing annual growth.

What are the key risks? Competition remains an important risk. It would be catastrophic if retailers like Walmart (WMT) or Target (TGT) are able to effectively take market share from AMZN in spite of not having the same investment in fulfillment. A large part of the investment thesis depends on AMZN’s large investment in e-commerce eventually yielding high return on investment. My personal anecdotal view is that this is unlikely given that AMZN has historically done a better job in pleasing the consumer than retail peers – I have noticed that Amazon.com is my family’s default stop for online purchases.

It is not clear if AWS will be a beneficiary of generative AI, or if this eventually proves to be a “winner takes most” market where someone like Microsoft (MSFT) ends up taking all the market share over time. I am doubtful of such a scenario given that, again, AMZN heavily invests in growth and innovation and is unlikely to be “out-innovated” by peers, at least to the extent that it is unable to compete in cloud computing as it has in the past. In particular, I am most excited for how generative AI and AI in general may help AMZN extract greater operational efficiencies at both AWS and its e-commerce segments.

AMZN’s valuation relies heavily on long term margin assumptions, which are inherently subjective and may fluctuate based on sentiment. Amidst the tech crash, investor sentiment reached a low, with many investors seemingly writing off the e-commerce segment as a business incapable of profits. Investors should be prepared for significant volatility especially given AMZN’s exposure to macro conditions. I expect both the e-commerce and AWS businesses to eventually be rewarded with more resilient earnings multiples like those seen at Walmart or Apple, but it may be some time before the broader investor base catches on.

I reiterate my strong buy rating for the stock, as its heavy investment in e-commerce and AWS continue to further differentiate it from the competition.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!