Summary:

- Amazon is focusing on AI applications in product recommendations, fraud detection, warehouse automation, and customer service, with plans to bring ChatGPT-style product search to its web store.

- The company’s growth outlook has increased 60%, with sales, earnings, and cash flow growth expected to be explosive in the coming years, partly due to AI-driven margin expansion.

- Amazon remains a strong long-term investment in the AI sector, offering a potential 160% upside by 2025 if it grows as expected and returns to fair value.

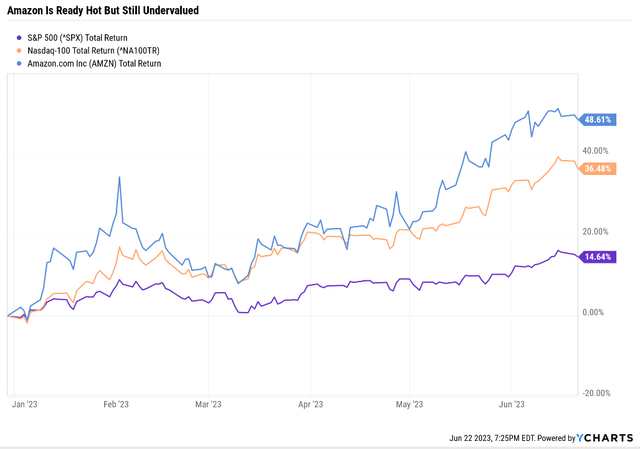

- Amazon is up 50% YTD but remains one of the best AI blue-chips you can buy.

- What if AI is overhyped? Well you still own Amazon don’t you?

Deagreez

This article was published on Dividend Kings on Thursday, June 22nd

—————————————————————————————

This is part 4 of an eight-part series on investing in AI, the future of everything. The series will be completed in September.

- 11 Billion Reasons To Buy Nvidia, And 2.2 Trillion Reasons To Sell

- 1.3 Trillion Reasons Microsoft Is A Must-Own World-Beater AI Dividend Blue Chip.

- Google Vs. Meta: One Could Dominate The Future Of Everything

————————————————————————————-

Today we’re talking about Amazon (NASDAQ:AMZN) and why it’s one of my top long-term Artificial Intelligence recommendations for the coming decade.

Bottom Line Up Front: Amazon’s Growth Outlook Has Popped Due To AI

You might be wondering what could cause me to do another Amazon update when earnings haven’t come out.

What has changed that could justify another non-dividend stock article?

- Amazon growth consensus 2 months ago: 27.2%

- Today: 43.2%

The range of growth estimates is from 16% (Oppenheimer) to 56.2% (Deutsche Bank).

Now whenever you see such a large jump in growth estimates, you should be skeptical for a company already so large.

AI is potentially world-economy changing, but can it really drive a 60% faster growth rate at Amazon?

To answer that, let’s first look at Amazon’s AI potential.

Then we’ll look at two measures of medium-term growth estimates in Amazon’s fundamentals to see how realistic that growth boost might be.

Amazon’s AI Plans

Amazon is using artificial intelligence in a variety of ways, including:

- Product recommendations: Amazon uses AI to recommend products to customers based on their past purchase history, browsing activity, and other factors. This helps customers find the products they are looking for more easily and helps Amazon increase sales.

- Fraud detection: Amazon uses AI to detect fraudulent transactions. This helps Amazon protect its customers from fraud, and it also helps Amazon prevent financial losses.

- Warehouse automation: Amazon is using AI to automate its warehouses. This helps Amazon improve efficiency and accuracy, and it also helps Amazon reduce costs.

- Customer service: Amazon is using AI to provide customer service. This helps Amazon provide customers with faster and more accurate service, and it also helps Amazon reduce costs.

Amazon is also investing in AI research and exploring new ways to use AI in its business. For example, Amazon is working on using AI to develop new products, improve its advertising platform, and personalize its shopping experience for customers.

Of course, ChatGPT has taken the world by storm. And Bard has been amazing some users with its incredible grasp of complex moral issues. In fact, someone on Reddit has started a Church of Bard!

An accurate estimate of ChatGPT users by April 2023 is 100 million to 173 million. This range is based on estimates from Similarweb and other website analytics companies. It is also based on ChatGPT’s 100 million monthly active users in January 2023. – Bard

ChatGPT is being used by around 135 million people per month, possibly more, with about 2 billion visits to OpenAI’s site to check it out.

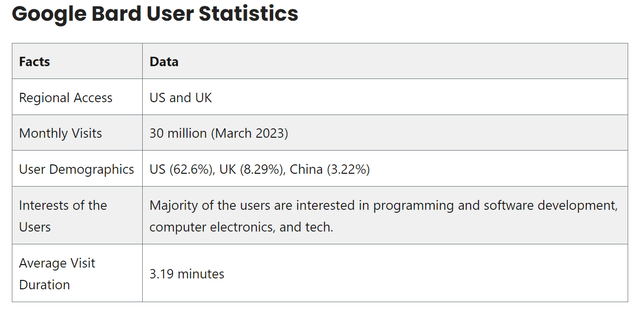

How about Bard?

Bard is in Beta and, within one month, had 30 million monthly visits in a very limited rollout in the US and UK.

So does Amazon have any plans for a large language model chatbot like ChatGPT or Bard? Something that could boost consumer engagement in its already sticky ecosystem?

Amazon.com Inc. plans to bring ChatGPT-style product search to its web store, rivaling efforts by Microsoft Corp. and Google to weave generative artificial intelligence into their search engines…

Generative AI uses vast quantities of data to assemble large language models that can help create text or images following a prompt. Amazon Chief Executive Officer Andy Jassy said on an earnings call last month that the technology “presents a remarkable opportunity to transform virtually every customer experience.” – Bloomberg

Amazon doesn’t plan to go toe-to-toe with Bing, Bard, and ChatGPT.

Amazon Web Services, the company’s cloud-computing unit, in April announced a set of services that rely on advances in generative AI. They have yet to be widely released. Meanwhile, the company is hoping to use similar technology to improve its Alexa voice assistant, Insider reported. Amazon is also building a team to use artificial intelligence tools to create photos and videos for advertising campaigns, the Information reported this month. – Bloomberg

In a few weeks, I’ll show just how profitable chatbot technology can be, but right now, I want to focus on Amazon’s best AI opportunity, Amazon Web Services.

The e-commerce giant’s Amazon Web Services unit on Thursday announced two of its own large-language models (LMM), one designed to generate text, and another that could help power web search personalization, among other things. – Bloomberg

Amazon wants its two LMMs to be enterprise products because that’s where Amazon makes almost all of its profit.

Basically, Amazon’s plan is to harness its mountain of consumer data to create business-focused AIs rather than the consumer-focused ones we’ve been playing with.

This will make it much easier to monetize because Amazon’s focus is on e-commerce. It is trying to build the ultimate sales machine.

ChatGPT is a wonderful research tool, and Bard? Well, Bard tries really hard, and their personality is wonderful. Bing? Well, Bing is limited, thanks to the infamous NYT interview that embarrassed Microsoft, and they have since restricted Bing to pretty much nothing but search.

- Bing can’t talk about its programming limitations

- or politics

- religion

- morality

- its opinions

- sentience

Bing Chat is now basically no better than Bing.

- Microsoft owns 33% of OpenAI, and thus ChatGPT 4+ is the gold standard of Generative AI Research and content creation tools

The bottom line on Amazon AI

- enterprise focused

- sticking to its knitting (no public chatbot) – other than on its site to search for stuff to buy

- Generative AI focused on helping directly sell

- the easiest path to monetization

Ok, that’s great but can AI really boost Amazon’s growth outlook by 60% to 43%.

You’ve Heard The Hype, Now The Facts

| Metric | 2022 Growth | 2023 Growth Consensus (Recession) | 2024 Growth Consensus |

2025 Growth Consensus |

| Sales | 11% | 8% | 11% | 12% |

| EPS | -108% | 685% | 70% | 38% |

| Operating Cash Flow | 2% | 56% | 32% | 23% |

| Free Cash Flow | -16% | 228% | 76% | 61% |

| EBITDA | -18% | 124% | 19% | 21% |

| EBIT (operating income) | -45% | 65% | 57% | 41% |

(Source: FAST Graphs, FactSet)

Amazon’s earnings and cash flow growth are expected to be explosive.

However, it’s possible that the 2023 growth explosion coming off a terrible 2022 is skewing these numbers higher. However, that doesn’t explain why the growth outlook has soared 60% in the last few weeks.

So let’s check the compound annual growth forecast from 2022 to 2028.

| Year | Sales | Free Cash Flow | EBITDA | EBIT (Operating Income) | Net Income |

| 2022 | $513,983 | -$11,569 | $73,583 | $12,249 | -$2,722 |

| 2023 | $559,868 | $18,550 | $84,343 | $22,249 | $16,758 |

| 2024 | $626,791 | $36,972 | $102,495 | $35,040 | $27,940 |

| 2025 | $704,111 | $58,636 | $122,590 | $50,647 | $41,376 |

| 2026 | $786,454 | $86,984 | $156,359 | $70,823 | $57,152 |

| 2027 | $869,081 | $105,638 | $180,947 | $84,829 | $69,233 |

| 2028 | $977,738 | $130,250 | $210,003 | $108,884 | $89,331 |

| Annualized Growth 2022-2028 | 11.31% | 47.67% | 19.10% | 43.93% | 39.75% |

| Cumulative 2023-2028 | $3,964,175 | $437,030 | $856,737 | $372,472 | $301,790 |

(Source: FAST Graphs, FactSet)

Suddenly 43% growth doesn’t seem so crazy.

Amazon Is A Margin Story

| Year | FCF Margin | EBITDA Margin | EBIT (Operating) Margin | Net Margin |

| 2022 | -2.3% | 14.3% | 2.4% | -0.5% |

| 2023 | 3.3% | 15.1% | 4.0% | 3.0% |

| 2024 | 5.9% | 16.4% | 5.6% | 4.5% |

| 2025 | 8.3% | 17.4% | 7.2% | 5.9% |

| 2026 | 11.1% | 19.9% | 9.0% | 7.3% |

| 2027 | 12.2% | 20.8% | 9.8% | 8.0% |

| 2028 | 13.3% | 21.5% | 11.1% | 9.1% |

| Annualized Growth 2022-2028 | 32.09% | 6.99% | 29.30% | 25.01% |

(Source: FAST Graphs, FactSet)

Most companies would kill to have sales growth rates as strong as Amazon’s expected margin expansion in the coming years.

I wouldn’t necessarily attribute AI to explain this margin expansion and explosive cash flow.

I’ve seen one tech giant already monetizing AI, and I will talk about that in the coming weeks.

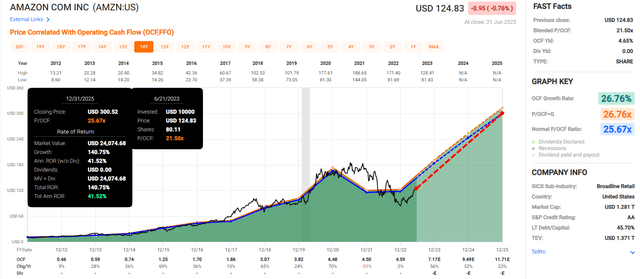

Amazon: Still Cheap After A Monster Run

Amazon has been on fire! But it started from a 60% discount to fair value and remains a bargain.

| Metric | Historical Fair Value Multiples (14-Years) | 2022 | 2023 | 2024 | 2025 | 2026 |

12-Month Forward Fair Value |

| Operating Cash Flow | 25.67 | $117.83 | $184.05 | $243.61 | $305.99 | $356.81 | |

| Average | $117.83 | $184.05 | $243.61 | $305.99 | $356.81 | $212.69 | |

| Current Price | $128.24 | ||||||

|

Discount To Fair Value |

-8.84% | 30.32% | 47.36% | 58.09% | 64.06% | 39.70% | |

| Upside To Fair Value | -8.12% | 43.52% | 89.96% | 138.60% | 178.24% | 65.85% | |

| 2023 OCF | 2024 OCF | 2023 Weighted OCF | 2024 Weighted OCF | 12-Month Forward OCF | 12-Month Average Fair Value Forward P/OCF | Current Forward P/OCF |

Current Forward Cash-Adjusted PE |

| $7.17 | $9.49 | $3.72 | $4.56 | $8.29 | 25.7 | 15.5 | 15.3 |

AMZN is trading at 15X cash flow, which is a terrific bargain for a company growing cash flow at almost 50% per year.

AMZN is up 50% this year yet still offers a 160% upside by 2025 if it grows as expected and returns to fair value.

Bottom Line: Amazon Is One Of My Favorite AI Stocks For The Long Term

Here’s the truth about AI.

There is a lot of hype right now. It doesn’t take a genius to see that.

So what’s the smart way to invest in what is currently hype but could be one of the most profound inventions in human history in the long-term?

If you want to own the future, you need to own AI stocks.

But that doesn’t mean chasing whatever red hot ticker last slapped “AI” on its name.

It means buying the companies most likely to prosper, thrive, and possibly even dominate the ultimate growth driver of the future.

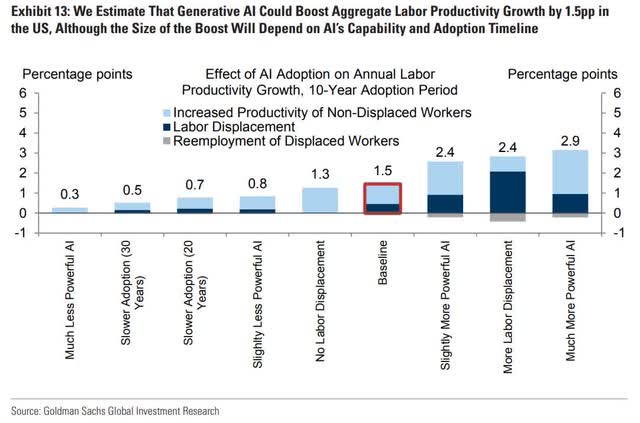

AI could help solve the US deficit problem all on its own if Goldman’s base-case productivity boost is correct.

It could usher in the start of the next great industrial revolution.

The changes coming in the next 10, 20, and 30 years will likely shake the financial earth with their significance.

But what if I’m wrong?

Invert, Always invert. – Charlie Munger

What if AI is just another passing hype fad like crypto, SPACs, 3D printers, and the Internet of Things?

Well, if you are buying the world’s leading cloud computing giants, Microsoft, Alphabet, and Amazon, you are going to sleep well at night because you still own three of the greatest companies in history.

Is Amazon a leader in AI right now? Not for public-facing products, no.

They are focusing mostly on bringing productivity tools to AWS enterprise customers.

They are sticking to their knitting and focusing on being a better sales platform.

That might not be sexy, but it’s definitely smart.

AWS is the #1 cloud platform on Earth.

It has the most enterprise customers.

It has the most enterprise data to train AIs on.

Which means it is likely to maintain an edge in data analytics.

When the true rise of AI arrives, when it starts showing up in economic data, Amazon’s AI advantage, focused on maximizing sales for companies, could make investors a fortune.

But in case I’m wrong, all I can offer you is a 42% undervalued AA-rated Ultra SWAN that’s growing its free cash flow at close to 50%.

All I can offer is a potential 160% upside in the next 2.5 years, about 6X that of the S&P.

If you want to invest in AI? Don’t go chasing the mania or be one of the “greater fools.”

And Amazon is one of the best hyper-growth Ultra SWANs you can buy today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my $2.5 million family hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.