Summary:

- It seems like the world was a different place the last time Amazon was at $88.

- Technicals indicate further short- to medium-term pain.

- A 50% fall is tempting, but does not make Amazon stock a buy right away.

- Multiple compression is real and no company is exempt from it.

4kodiak/iStock Unreleased via Getty Images

Amazon.com, Inc. (NASDAQ:AMZN) has had so much happening for it in the past 4 years, both good and bad, that it is hard to believe that the stock is now back to where it was around March 2019.

In this fast-paced World, March 2019 appears so far in the past that:

- Jeff Bezos held three titles that he no longer holds: CEO of Amazon, a married man, and the world’s richest person.

- Amazon had less than 50% of its current headcount.

- (Moving away from Amazon) the word “COVID” would have elicited nothing but a blank stare from people.

- The 45th President of United States still had almost two full years left in the Oval Office.

- Tom Brady was still with the New England Patriots.

- Roger Federer and Serena Williams were still not just competing but seriously contending for top titles in the World of Tennis

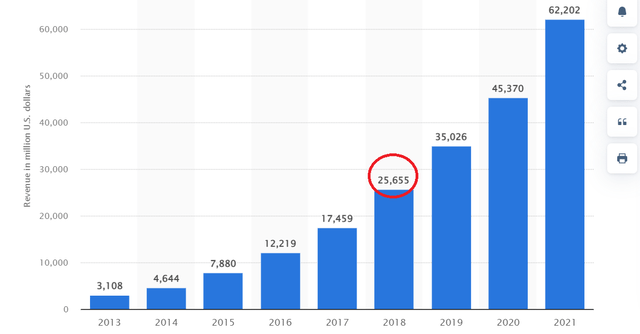

- Or, more to the point, Amazon Web Services’ (“AWS”) annual revenue was at $25 B, which is about one third of the current level. It makes one wonder how the revenue and in-turn the high margin profits generated by the company’s most profitable unit ended up being for nothing as far as the stock price is concerned.

AWS Revenue (www.statista.com)

Before moving away from this section, it is important to note that not even the COVID lows of March 2020 (red circle below) saw Amazon at $88. Bear in mind, that was before the market realized stay-at-home companies like Amazon would benefit from COVID. Hence, the March 2019 time frame indicated by the blue circle was meaningfully the last time Amazon traded at this level.

AMZN Chart (Google Finance)

How do things look for Amazon from here?

With that post-mortem out of the way, how do things look for Amazon here on? Let’s find out.

Worsening Technicals

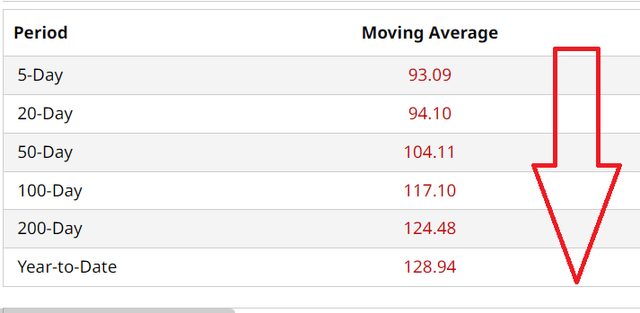

Things don’t appear any better from the technical standpoint, as the recent selloff has pushed the stock below all the commonly used moving averages, with each of the 5-, 20-, 50-, 100-, and 200- Day averages progressively lower in that order. Most importantly, the all-important 200-Day moving average is 40% away. All these suggest more short- to medium-term selling pressure as the stock continues making lower lows progressively with no end in sight.

AMZN Moving Averages (Barchart.Com)

Holiday Lift?

Although Amazon reported it had its biggest Black Friday weekend sales ever, the company did not release any specific sales numbers, and we need to wait for those till the quarterly results are announced. With the cost of goods and business in general running high, it won’t be a surprise if the record sales added precious little to the bottom line. Bear in mind that Amazon has already guided to a light holiday quarter. I suspect that the overall online Black Friday sales being up only 2.3% year-over-year is going to make a dent in Amazon’s quarterly fortunes.

But far from a one-trick pony

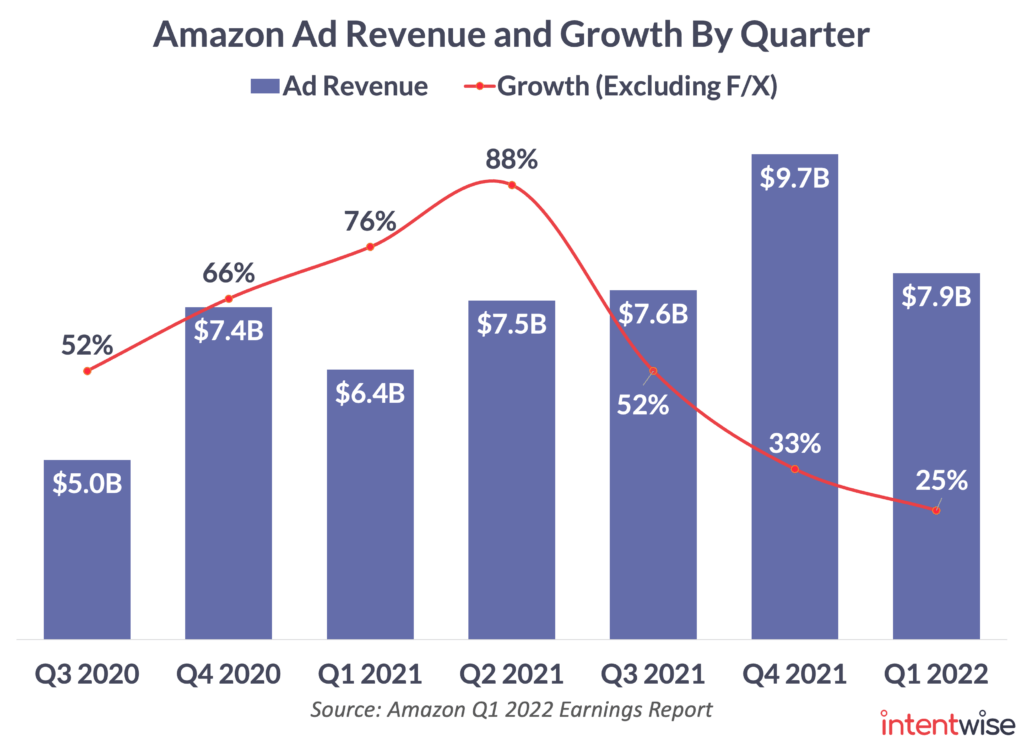

All right, let’s not get too negative. There is no denying that the slowdown in AWS is concerning. But it is to be expected as the wave of new and existing businesses moving to the Cloud during the peak of COVID was never going to continue. But, Amazon has always been willing to spend profits from one wing of its business to nurture another. Without this mindset, there would not be an AWS today. However, the company seems to have finally accepted it is not exempt from the laws of the economy, as evidenced by the announcement that as many as 20,000 people may be laid off. While the entire world was focusing primarily on AWS and to an extent the e-commerce business (mainly due to its failings), Amazon has quietly built up its next growth driver, as ads brought in a significant $31 B in revenue in 2021.

AMZN Ad Growth (www.intentwise.com)

P/E Compression – this time might be different

Long-term Amazon holders like to point out that Amazon has almost always been exempt from the traditional valuation metrics. Although the price to earnings ratio was always high, it was fairly clear in the past that Amazon continued investing to nurture other business units (like AWS).

AMZN PE (Seekingalpha.com)

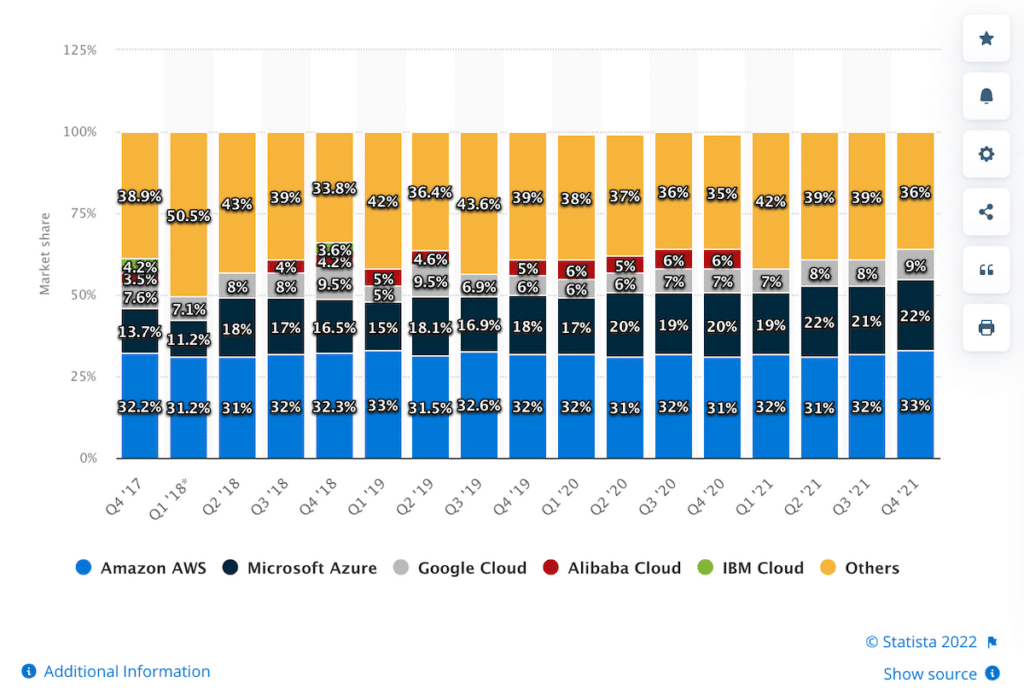

True, in the past, looking away from valuation served the longs well. But the past may not be prologue in the world of investing, which is strictly forward looking. As the number of competitors and the strength of existing competitors increase, it’d be a massive challenge for the incumbents (AWS) to even maintain their share, much less to continue growing at the same pace. Although ads are strong right now, just ask Meta Platforms (META) and Google (GOOG, GOOGL) about the downside of an ad reliant revenue stream.

Cloud Market Share (kinsta.com)

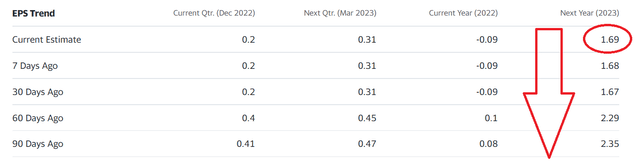

To round off this section about valuation, 2023 EPS estimates have fallen nearly 30% in the last 3 months. Even if the current 2023 estimate of $1.69 per share is met, Amazon is trading at a forward multiple of 52. That is extremely hard to justify in the current market that is punishing even the best of earnings.

Conclusion

I am not an Amazon bear. In fact, far from one, as I am long. However, this time it appears different. P/E compression was always real, but Amazon was exempt from it due to a variety of factors including but not limited to having a founder-CEO at the helm, a once-in-a-life time product (AWS), and the general Zero Interest Rate Policy (ZIRP).

SA contributor Albert Lin had an interesting article recently suggesting AWS was worth $60 and the ad business was worth $20. That makes sense, but at the current price, it makes the rest of the business worth about $8 per share while it is evidently clear they are actually negative. Hence, given the technical weakness and worsening fears about inflation and rate hikes, I am leaning towards the $70 level as written in this article. That would represent a forward multiple of about 40, which is still a bit rich, but when you factor in the expected annual earnings growth rate of 26%, the price/earnings-to-Growth (PEG) is a reasonable 1.50.

However, the key word for Amazon may very well be patience. As shown by the 200-Day moving average being 40% away from the current price, Amazon stock is undergoing a reset period. And resets don’t happen overnight or even in months. Given the weakness on display, wait for a lower entry point in the $70s and reward yourself long term, as Amazon will continue leveraging its Prime ecosystem, which is the key differentiating factor allowing it to market and distribute any product it sells at a competitive advantage.

Disclosure: I/we have a beneficial long position in the shares of AMZN, META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.