Summary:

- Wall Street was previously worried about the lack of profitability in e-commerce operations.

- Amazon returned North American margins nearly back to pre-pandemic highs and greatly reduced the International loss.

- AWS revenue growth remains muted but operating margins are expanding and management sees signs of a bottom.

- I am raising my estimates and reiterating my strong buy rating.

Alex Wong/Getty Images News

Amazon (NASDAQ:AMZN) entered 2023 with sentiment as low as ever. Wall Street appeared to be of the view that the e-commerce operations were structurally unprofitable amidst rising inflation. AWS was seeing revenue growth decelerate alongside margin contraction. But the company has executed strongly against such a negative backdrop, managing to post resilient top-line growth while boosting profit margins almost “at will.” AMZN has shown that it can show higher profitability when it wants to, and by how much it wants to, regardless of the tough macro environment. The strong results make it plausible that the stock undergoes a gradual re-rating as Wall Street grows more confident in the long-term trajectory of this growth story. I reiterate my strong buy rating as the stock continues to offer attractive valuations for a set of businesses with high barriers to entry.

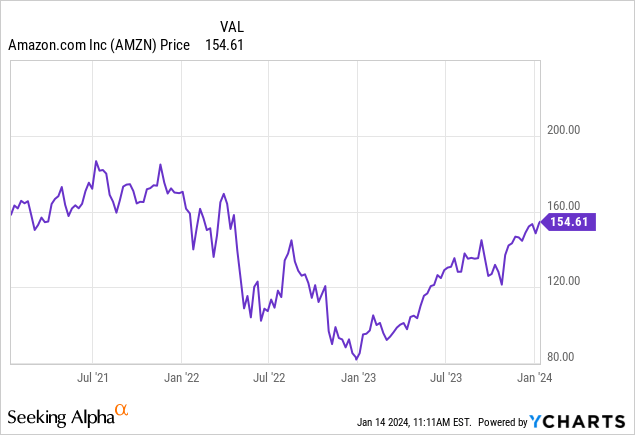

AMZN Stock Price

AMZN is far from the most profitable in the sector, but the stock has held up better than the vast majority of peers as the company has shown surprising strength in a tough environment.

I last covered the stock in September where I explained why the crown jewel arguably wasn’t AWS – Wall Street had previously been too pessimistic about the future of the e-commerce business. The company has continued to deliver strong results in both e-commerce and cloud operations, and investors are taking notice.

AMZN Stock Key Metrics

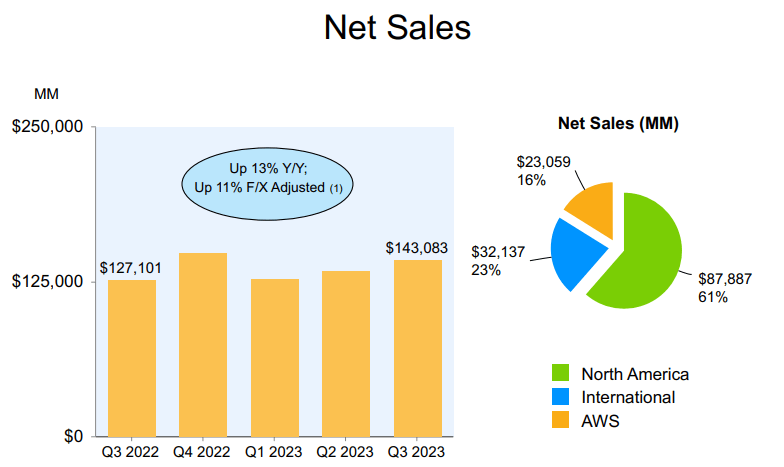

In its most recent quarter, AMZN delivered 13% YoY revenue growth to $143.083 billion, at the high end of guidance.

2023 Q2 Presentation

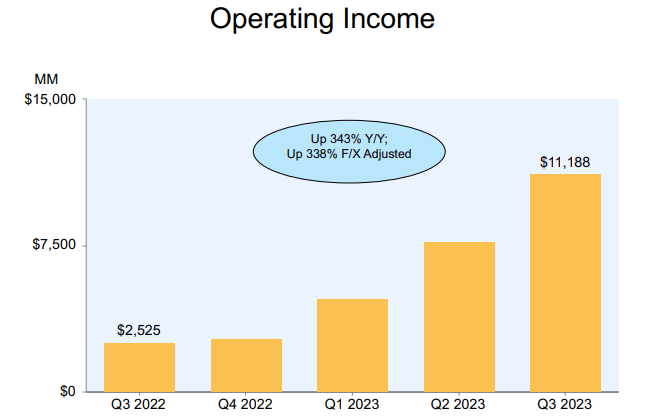

As has been common in the tech sector, the real source of outperformance came on the profitability side. AMZN delivered 343% YoY operating income growth to $11.2 billion, smashing guidance for operating income between $5.5 billion and $8.5 billion.

2023 Q2 Presentation

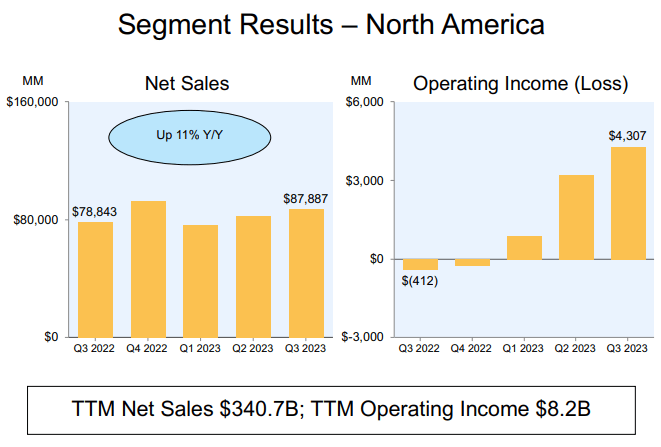

AMZN delivered the bulk of the earnings surprise due to strong showings in its e-commerce operations. AMZN delivered yet another profitable of strong quarterly profits in North America, with sales rising 11% YoY but operating profits flipping from negative $412 million to positive $4.3 billion.

2023 Q2 Presentation

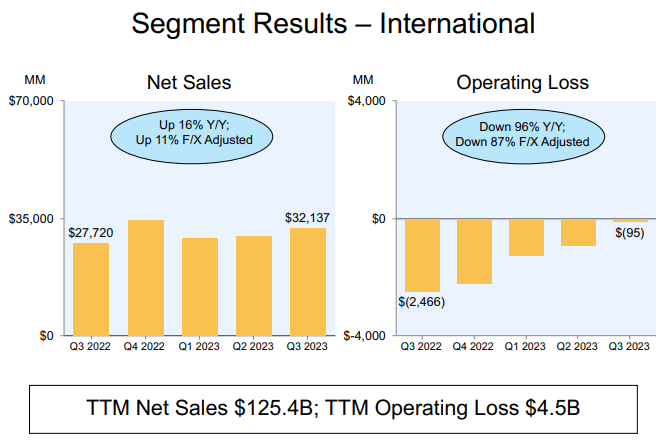

Even in the international e-commerce operations, AMZN was able to narrow its operating loss from $2.5 billion to just $95 million.

2023 Q2 Presentation

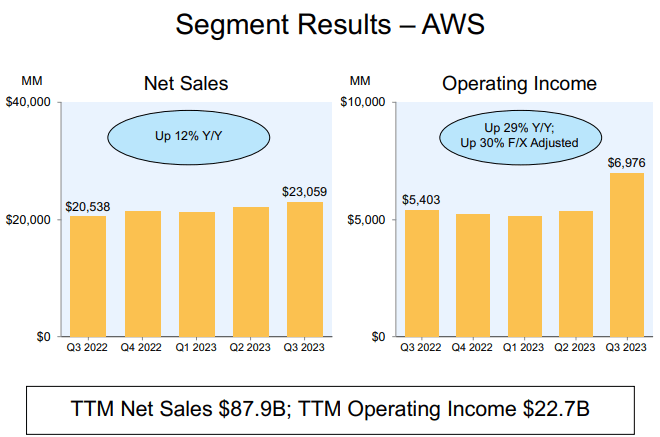

While AWS revenue growth remains muted at 12%, the company executed on operating leverage, with operating margin rising 400 bps to 30.2%.

2023 Q2 Presentation

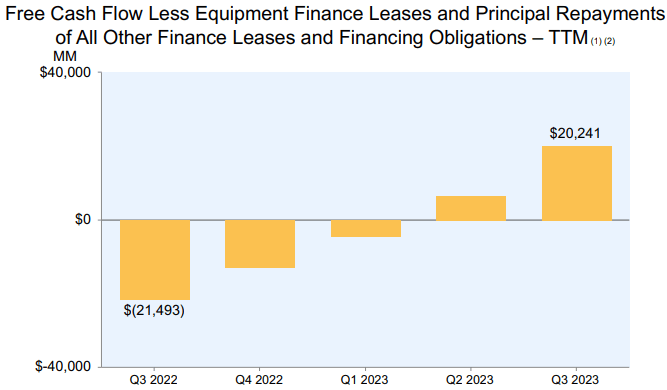

The strong results on profitability also helped drive free cash flow sharply higher. On a twelve-month basis, AMZN generated $20.2 billion in free cash flow. Compare that with the $21.5 billion cash flow burn generated on the trailing twelve months in the prior year.

2023 Q2 Presentation

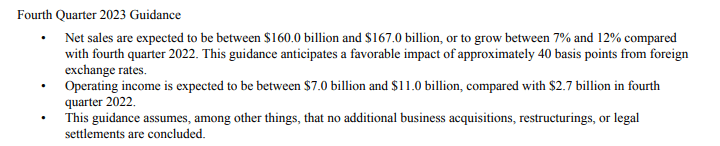

AMZN ended the quarter with $64 billion of cash versus $61.1 billion of debt, representing a strong balance sheet. Looking forward, management has guided for up to 12% YoY revenue growth to $167 billion with up to $11 billion in operating income. Consensus estimates call for $166 billion in revenue and $0.78 in EPS.

2023 Q3 Release

On the conference call, management credited their gains in e-commerce profitability to their move “from a single national fulfillment network in the U.S. to 8 distinct regions.” That has culminated in faster shipments and lower costs of service – don’t ask me how that’s possible. The company noted that the third quarter Prime Day was its biggest ever with 375 million items purchased worldwide. I suspect that direct profitability from Prime Day may be closer to neutral given that AMZN may be discounting its first-party items as well, but the event may help to increase customer loyalty as well as drive new Prime memberships.

Investors may have been hoping for a quicker recovery in AWS revenue growth rates. Management noted that cost optimization headwinds remain present, but they see evidence of inflection with more and more customers transitioning ” to deploying net new workloads.” Management highlighted promising deal volume as evidence, noting that several new deals signed in September that didn’t show up in this past quarter will end up having collections higher than the total deal volume of the quarter. Management noted that while cost optimization headwinds will likely persist for some time, they are of the view that “the relatively low-hanging fruit on optimization has happened in 2023.”

Is AMZN Stock A Buy, Sell, or Hold?

AMZN has never looked cheap on a price to earnings basis. Consensus estimates have the company growing earnings very rapidly over the coming years.

The key with AMZN is that the company has historically invested aggressively in growth, which has meant that it has ramped up operating expenses in order to reduce taxable income. This has enabled it to rapidly grow its revenue base without paying much taxes or showing much profit. It is hard to find anyone who does not believe in the high barriers to entry for the e-commerce segment. AMZN has built a wide advantage in logistics infrastructure, enabling it to deliver shipments much faster on a more consistent basis than any other peer. I am of the view that AMZN can drive strong profit margins in e-commerce if it wants to when it wants to. The company is already showing signs of a commitment to profitability, recently announcing layoffs at its Twitch and Audible divisions.

That ability was on full display in the past quarter with North American profitability jumping to a 4.9% operating margin. In the prior quarter, management had stated confidence in their ability to drive North American margins back to pre-pandemic highs – that mark puts it right under the 5.2% margin shown in the 2018 full-year. I had previously assumed 5% long-term net margins for the e-commerce segment, but am now of the view that I was being too conservative. Based on 7% long-term net margins and 25x earnings multiple, I value the e-commerce operations at $815 billion. I continue to see AWS returning to at least 18% revenue growth. Based on my assumptions of 40% long-term net margins and a 2x price-to-earnings growth ratio (‘PEG ratio’), I see AWS being worth $1.3 trillion. Adding these up, we arrive at $2.1 trillion in value or a stock price of $196 per share.

What are the key risks? The most obvious barrier to e-commerce profitability is inflation, but I view such headwinds as being near-term issues as the company can drive increasing benefits from scale indefinitely over the long term. Instead, regulatory risk looms large. It is unclear if governments will act on the e-commerce segment in a way that impairs the long-term profitability of the business. For example, the company might be forced to alter its first-party operations in a way that makes it less competitive with other vendors. As for AWS, it is admittedly unsettling to see competitor Microsoft (MSFT) post 26% YoY growth rates in Azure versus the 12% posted by AWS last quarter. While I am of the view that generative AI will benefit all of the cloud titans, there is the risk that it ends up being a winner “takes most market” with MSFT being the winner. Finally, I note that relative to other mega-cap tech names, AMZN is not generating as much cash flow relative to its market cap. The company is not aggressively buying back stock and does not appear to have the financial resources to do so even if it wanted to. That means that the stock might have less downside support and thus show more volatility in market downturns.

I reiterate my strong buy rating for AMZN stock, as its resilient fundamental results in this tough macro environment justify premium valuations over the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!