Summary:

- Amazon stock dropped 10% post-earnings due to a revenue miss and soft retail sales, indicating potential economic weakness affecting consumer spending.

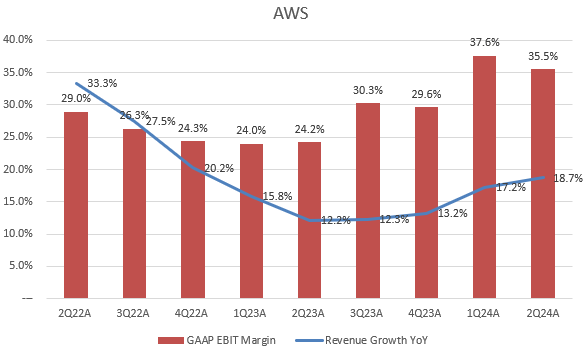

- Amazon’s AWS remains robust, showing continued revenue growth acceleration and strong YoY operating margin improvement.

- The management indicated that most of the company’s cost optimization efforts have been completed, supporting its operating margin while SG&A costs stabilized.

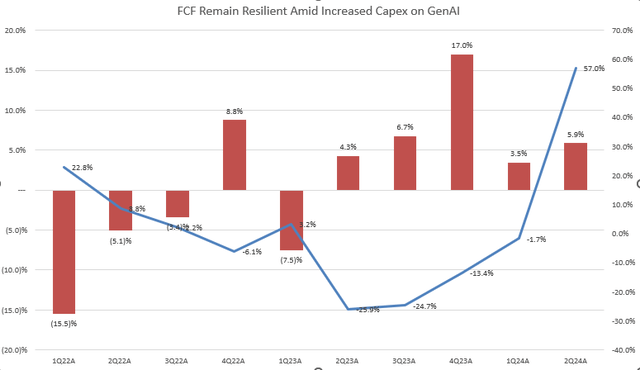

- The company grew 57% YoY in capex in Q2 and expects higher capital investments in 2H FY2024, supporting its GenAI innovation and AWS’s strong growth trajectory.

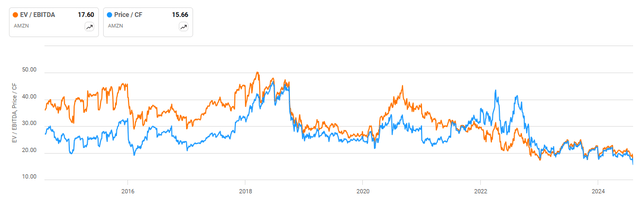

- After the recent stock selloff, AMZN’s EV/EBITDA TTM and P/OCF TTM reached new lows over the 10-year horizon, with its non-GAAP P/E TTM at 25x, indicating a reset in expectations.

hapabapa

Investment Thesis

Amazon.com, Inc. (NASDAQ:AMZN) stock dropped nearly 10% following the 2Q FY2024 earnings results due to a revenue miss and a soft net sales outlook. North America retail sales are showing signs of slowing growth, indicating potential weakness in consumer spending, as evidenced by a series of weak economic data released last week that triggered a big selloff in the stock market. However, AMZN’s cloud business remains resilient, with AWS showing further growth acceleration due to efficient GenAI monetization. The company plans to increase capital investments in AI infrastructure, indicating higher capex in 2H FY2024.

In my previous coverage, I downgraded the stock from “buy” to “hold” on July 2nd, as I believed earnings growth driven by a significant reduction in operating expenses was “inorganic.” Since then, the stock has fallen 18%, significantly underperforming the S&P 500 Index (SP500) by 13% over the past month. However, AMZN’s 2Q results showed a sequential increase in SG&A expense while beating GAAP EPS estimates. Additionally, it’s encouraging to see AWS revenue growth continuing to accelerate, supported by a higher capex outlook. Therefore, I have upgraded the stock to “buy” now following the recent selloff, as its valuation multiple has largely reset expectations.

Slowdown in Retail Sales Indicates Potential Economic Weakness?

The company model

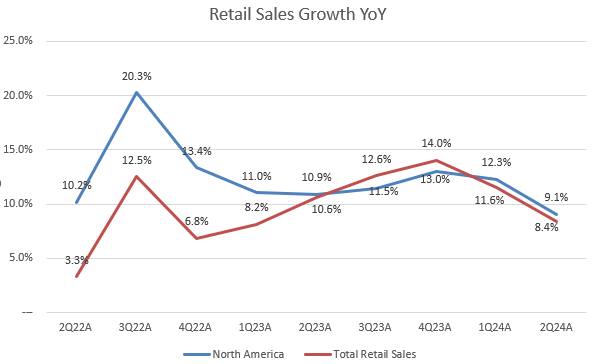

AMZN’s core retail sales have been softening over the past two quarters, significantly contributing to a slowdown in the total revenue growth. We can see the growth of 2Q North America retail sales dropped below the 10% threshold for the first time since 1Q FY2022. I believe the recent selloff can be attributed to negative sentiment among investors who are concerned about growth headwinds in its retail business due to a potential economic slowdown, as evidenced by lower consumer spending and higher unemployment rates. In the 2Q FY2024 earnings call, the management mentioned that “consumers are being careful with their spend, trading down, looking for lower ASP products, looking for deals” They continue to see signs of this trend in 3Q FY2024.

Particularly, I want to highlight McDonald’s (MCD) 2Q earnings results. The growth trajectory of McDonald’s store sales can provide insights into underlying consumer spending behavior. The company reported -1% YoY growth on its global comparable sales and -0.7% YoY growth on U.S. comparable sales. MCD experienced a sales decline for the first time since the 2020 pandemic outbreak. I believe this sales decline indicates a potential slowdown in consumer spending, which implies a growth slowdown in Amazon’s retail business in the coming quarters.

Despite a strong growth in AWS, AMZN expected its net sales in 3Q FY2024 to be in a range of $154.0 billion and $158.5 billion, below the market consensus. Considering the midpoint of the revenue guidance, this implied a further growth slowdown to 9.5% YoY, down from 10.2% YoY in 2Q FY2024.

2Q Retail Sales Margin Is Still Resilient

The company model

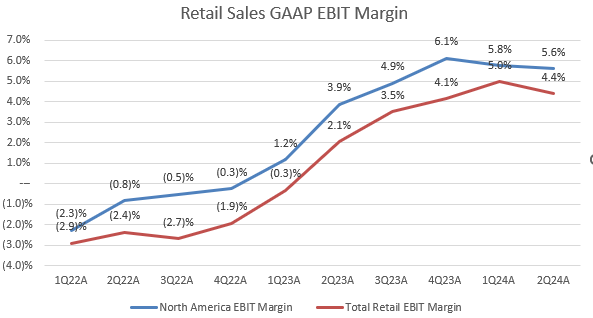

Despite slowdown in retail revenue, its EBIT margin is still resilient in 2Q FY2024 compared to 2Q FY2023. As shown in the chart, Amazon’s US retail EBIT margin came in at 5.6%, only 20 bps decrease sequentially. During the earnings call, management explained that this was largely due to increased Q2 spending in certain investment areas. At the company level, AMZN’s EBIT margin was 9.9%, slightly down from 10.7% in 1Q FY2024. They also indicated that most of the company’s cost optimization efforts have been completed, making a further year-over-year decline in SG&A less likely. I’m optimistic about AMZN’s margin outlook, as automation and robotics will continue to improve operating efficiency.

Strong AWS Growth Driven by Higher Capital Investments

The company model

Although AMZN has experienced softness in its retail business, its AWS segment is still robust. AWS revenue growth accelerated to 18.7% YoY in Q2 FY2024, up from 17.2% YoY in the previous quarter. The management indicated that AWS has launched more than twice as many machine learning and GenAI features than all the other major cloud providers combined in the past 18 months. They saw more companies leveraging into the power of GenAI and migrating more workloads to the cloud. Meanwhile, AWS’s operating margin showed strong expansion, increasing by 11.3% YoY.

In addition, the company significantly increased capex in 2Q FY2024, growing 57% YoY. In 2H FY2024, the management expects total capex to exceed the $30.5 billion spent in 1H. Most of the capital investments will support AWS infrastructure, driven by strong demand for GenAI workloads. Despite a significant increase in capex in 2Q, Amazon still expanded its FCF margin by 240 bps QoQ. During the earnings call, an analyst asked about the sustainability of AWS’s current growth trajectory.

CEO Andy Jassy discussed a potential growth opportunity through cloud migration from traditional on-premises setups. He mentioned that of “the $105 billion revenue run rate business, about 90% of global IT spending is still on-premises.” Therefore, I believe AMZN’s elevated capex will continue to power strong growth in AWS, eventually enhancing its overall profitability.

Valuation

Due to the recent market selloff, the stock was down almost 20% from the July high. This led to a multiple contraction in its valuation. As we can see from the chart, both EV/EBITDA TTM and P/OCF TTM have reached new lows on their 10-year horizon. Meanwhile, its P/E multiple has also largely come down. Considering its non-GAAP EPS TTM with stock-based compensation, AMZN’s adjusted P/E TTM is 25x. Given the company’s guidance, we can expect its forward P/E to be even lower. Therefore, I think the company’s lofty valuation has largely been reset, and I believe it’s time to be bullish on the stock.

Conclusion

In sum, AMZN’s recent Q2 earnings report triggered a 10% selloff due to a softness in its retail business amidst broader economic uncertainties affecting consumer spending. During the following days, the stock experienced a further decline due to a broad market pullback. Although its retail business may be impacted by a cyclical weakness, AWS is experiencing accelerated revenue growth and margin expansion, driven by increased capex in AI infrastructure and a focus on the cloud migration from on-premises.

With valuation multiples approaching appealing levels, the stock’s current level has reset expectations, which presents a buying opportunity. Therefore, I am upgrading the stock to a “buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.