Summary:

- After more than a year of cost initiatives, Amazon’s North America segment operating margins reached levels not seen since 2019 largely driven from its regionalization efforts.

- The company continues to provide strong value proposition to customers, even in the current macroeconomic environment, by enabling them to save more through deals and coupons.

- While AWS continues to see cost optimizations, new workloads are increasing as a result of increased demand from generative AI and management commented AWS revenue growth is stabilizing.

- AWS has a three-layer strategy for generative AI, positioning itself as a long-term partner in the AI industry.

HJBC

Amazon’s (NASDAQ:AMZN) Q2’23 quarter was one of the best in a long while. In this article, I will analyze the quarter in depth and show you where the opportunities are for the company in the future.

Inflection in operating income to come

While we saw North America retail margins reach 3.9%, which is essentially its margin levels achieved back in 2019, I am of the view that we will continue to see efficiency improvements across the delivery network drive continued margin expansion, along with strength in the advertising business, which is high-margin and continued reducing of operating expenses.

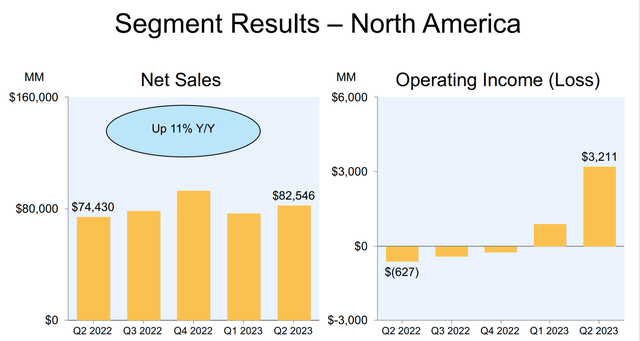

North America operating income rebounded very strongly in the second quarter of 2023. Operating margins of the North America segment bottomed in the first quarter of 2022, and we have seen five consecutive quarters of improvement, with operating margins reaching 3.9% in the second quarter of 2023. As a result, over the past five quarters, operating margin improved by an impressive 620 basis points.

Also bear in mind that this operating margin for the North America segment of 3.9% compares to the market consensus of just 1.8%. which illustrates the huge beat in operating margin for the segment in the quarter.

The largest contribution to the improvement in the operating margin is due to the improvements it has made over the past few quarters in the cost to serve, driving down fulfillment and shipping costs.

North America segment operating income (Amazon)

In my view, we are actually seeing the start of the inflection from the initiatives done to improve the cost to serve and there’s likely more efficiency improvements to emerge in the next few quarters.

Amazon’s regionalization strategy is the main contributor to the improved margins in the North America retail segment as it has resulted in faster delivery speeds and better inventory placement, resulting in lower overall costs for the company. With the transition to eight separate regions serving smaller geographic areas rather than just one national network, this has resulted in 20% reduction in touches, 19% reduction in travel distance, and more than 50% of Prime member orders arrived either on the same day or next day in the 60 largest US metro areas.

In particular, CEO Andy Jassy said that “while we are pleased with the progress we have made, we see more opportunity to drive improved cost efficiencies going forward”, leaving me positive that we are only just starting to see the effects of the cost initiatives implemented in the past few quarters.

I have covered Amazon for some time now, and their resolution to improve the customer experience for the long-term has paid strong dividends in the long run as customers remain happy and stayed with Amazon. The fact that Amazon continues to improve the customer experience today despite it being the market leader tells me that Amazon will continue to be the market leader for a long time.

Amazon’s value proposition shines in current environment

With the current macroeconomic environment being rather uncertain and difficult, consumer demand has been a key concern for Amazon.

However, in the quarter, Amazon showed that it continued to provide strong value for customers in the current environment.

This is because Amazon is focused on delivering cost savings to its customers through the best deals that enable customers to save more.

In the second quarter of 2023, Amazon provided customers with 144% more deals and coupons than they did in the prior year. This highlights that Amazon continues to focus on providing a strong value proposition to customers.

In addition, Prime Day was a successful one for Amazon this year as the company offered more deals than in previous years, with a very wide range of products being available on Amazon. The key thing is that more than 375 million products were bought globally and this helped Amazon’s customers save more than $2.5 billion in total from Prime Day alone.

As a result, I think that we are seeing that in an uncertain macroeconomic environment, while consumer demand may be faltering in other parts of the market, we continue to see strong consumer demand as Amazon brings the best deals to customers and enable them to stretch their dollar.

AWS has finally shifted to stabilization

In my opinion, this is huge for Amazon and AWS as the main market concern for AWS is the deceleration in growth of the segment.

However, this was what CEO Andy Jassy said about the AWS segment:

And while customers have continued to optimize during the second quarter, we’ve started seeing more customers shift their focus towards driving innovation and bringing new workloads to the cloud.

As a result, we’ve seen AWS’ revenue growth rate stabilize during Q2 where we reported 12% year-over-year growth.

The comment does include the fact that customers continue to optimize in the second quarter, but to me, the positives are that customers are starting to bring new workloads to the cloud as their focus turns to innovation once again, and that we are seeing AWS revenue growth stabilize.

However, given that AWS revenue growth in the second quarter was two percentage points higher than the market consensus expectations, I think we are indeed starting to see that AWS business stabilize in the near-term as a result of the growth in cloud demand from generative AI, as I will mentioned below.

I have been saying that the weakness in AWS is actually an excellent opportunity for investors given that the market is pricing in so much negative sentiment around the deceleration of growth in the segment when the fact is that it is a broad-based cloud industry phenomenon and that there is no fundamental change in the AWS story.

Generative AI strategy coming together

In addition, I think that CEO Andy Jassy’s pitch for AWS being the long-term partner of choice in generative AI was a very good one. In particular, I think that this was a great pitch because it is the first time Amazon communicated its generative AI strategy well to the market.

In particular, Amazon has a three-layer approach to its generative AI strategy.

In the bottom layer, this is essentially the compute that is required by customers to train their foundational models and for them to be able to make inferences and predictions.

Amazon finds that at this bottom layer, there is an opportunity to be seized as Nvidia (NVDA) is the only viable option currently in the market and as a result, supply has been the limiting factor.

The opportunity for AWS here is that it has spent the last few years working on its own custom AI chips, Trainium and Inferentia chips. These two chips continue to be improved and have a strong price performance characteristic that makes them appealing and CEO Andy Jassy was “optimistic” that many model training and inference work in the future will be running on AWS Trainium and Inferentia chips.

In the middle layer, AWS’s opportunity is to provide large language models as a service. This is because customers do not want to spend large amounts of time and resources to develop these models, and this is where the AWS managed service comes into play. This managed service is Amazon Bedrock and it includes Titan, Amazon’s very own large language models.

Lastly, the top layer will include the applications that run on top of these large language models. One of the opportunities that AWS is tackling in generative AI is to develop an AI-powered coding companion, which is calls Amazon CodeWhisperer. There are many other generative AI applications being worked on in AWS and I am sure we will see more such applications emerge for other use cases in the future.

In my opinion, Amazon is definitely well positioned for the generative AI opportunity given its largest customer base that stores their data with AWS. Along with that, AWS is focused on all three layers of the generative AI opportunity as mentioned above and has the widest range of services in AWS for its customers.

At the end of the day, AWS is bringing its customer first value that we first saw it apply to e-commerce into its cloud business, which I think will result in long-term outperformance as customers stick with AWS.

Valuation

My 1-year price target for Amazon is based on 18x 2024 EV/EBITDA. 18x EV/EBITDA is justified given Amazon’s leading position in AWS and retail segments.

As such, I reiterate my 1-year price target of $169.

Conclusion

Amazon’s second quarter results showed the markets that the works that it has started from more than one year ago is finally bearing fruit.

Operating margins in North America segment has reached levels of 2019, way ahead of consensus, and likely to continue to expand as management continues to drive efficiency improvements in the business.

On the other hand, we are starting to see the AWS business stabilize even though cloud spend optimizations are continuing, given the increase in new workloads as a result of the demand from generative AI.

Amazon’s value proposition continues to shine in a difficult macroeconomic environment as consumers look to save and go for more deals. As a result, we are seeing Amazon delivering on its promise and bring more deals to customers, as evident from the successful Prime Day the company had.

Lastly, I think management has communicated its three-layer generative AI strategy to the markets which looks compelling to me. That said, I think we are in the very early stages here, and in the words of CEO Andy Jassy, “we are a few steps into a marathon”. The long-term opportunity is huge, and Amazon is well positioned to take advantage of this.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 97% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!