Summary:

- Amazon’s stock might have dropped following its Q1 2024 results, but it has more than recovered since, as there’s much to like about the numbers.

- A good operating margin was a notable positive in the report, though there’s reason for some concern about it.

- Rising competition from the likes of Temu and a softening US consumer market can put downward pressure on revenues, while ongoing labor challenges can increase costs.

- For now, however, it’s expected that the company’s numbers will continue to be positive for the stock. These, along with its forward P/E indicate further upside ahead for Amazon.

AdrianHancu

The stock market did not respond positively to e-commerce marketplace giant Amazon.com Inc.’s (NASDAQ:AMZN) first quarter (Q1 2024) results, with a 3.3% price drop on the day they were released. But in the weeks that have followed, the stock has not just recovered, but it’s also slightly up since then (see chart below).

Price Chart (Source: Seeking Alpha)

A look at its quarterly figures reveals that there were indeed positives in the Q1 2024 report, which justify the price rise since, with the biggest highlight being the robust operating income figure. At $15.3 billion, it was a notable 27.5% higher than the top end of Amazon’s guidance range and a huge 53% higher than the midpoint of the range. Commensurately, the operating margin rose to 10.7%, up from 6.4% for the full year 2023.

Yet, it’s exactly the operating margin that’s now of some concern to me as there can be downward pressure on revenue growth at hand and upward pressure on costs. In the next section, I discuss these very challenges for Amazon, followed by the still multiple positives for it to determine which way the balance is tilted for the stock.

The challenges

Amazon’s potential challenges stem from massive e-commerce business as opposed to the cloud computing arm, AWS, which accounted for less than 20% of the revenues as of the latest quarter. This alone indicates why it’s essential to consider three of the following challenges:

#1. Temu’s price edge

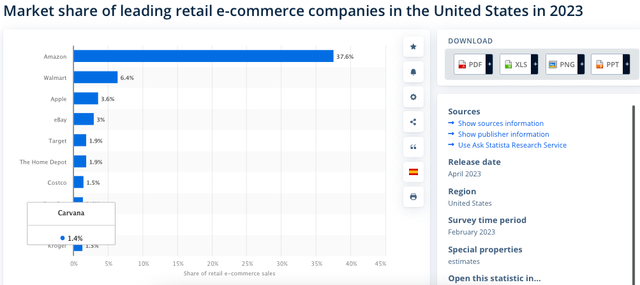

Much of Amazon’s e-commerce business is from its North American market. This is also mirrored in its share of 38% in the US retail e-commerce market (see chart below), towering over its competitors.

However, the competition might be about to heat up. Specifically, China’s PDD Holdings Inc. (PDD) owned Temu is one to watch out for. The company appears committed to living up to its tagline of “Shop like a billionaire”, with dirt-cheap prices that have the potential to give Amazon a run for its money.

Its marketing has certainly worked in the US market, with Temu becoming one of the most downloaded apps after its advertisements appeared during the Super Bowl earlier this year.

There’s some solace to be taken in the fact that it’s still minuscule compared to Amazon. PDD’s total revenues, which include the company’s China-based e-retailer Pinduoduo, were at just 6% of Amazon’s in 2023. I would keep a watch on its numbers though, considering that by Q1 2024, the ratio of PDD’s revenue to Amazon’s had risen to 8.3%.

With low prices being Temu’s unique selling point, it follows that for Amazon to stay competitive, there can be price pressure on it too. Unless of course, PDD decides to deemphasize the US market, which is possible after TikTok had run-ins with the law in the market recently. However things develop, this can be a matter of concern to Amazon and worth watching.

#2. Softening US market

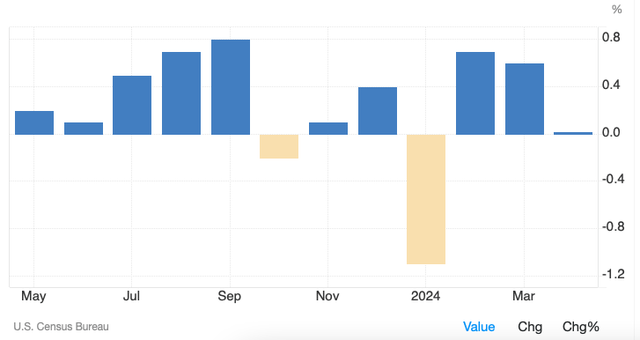

This is even more so as the US market slows down. In Q1 2024, the economy grew by just 1.3% quarter-on-quarter (QoQ) after the figure was revised downwards by 0.3 percentage points from the initial reading due to weaker than earlier estimated consumer spending. Weakness in consumer expenditure is further backed by underwhelming trends in US retail sales, with flat month-on-month figures in April (see chart below).

This may well show up in Amazon’s revenue numbers too. The company’s 12.5% year-on-year (YoY) growth in Q1, might have been ahead of analysts’ full year projections on Seeking Alpha at 11.1%, the same might not be the case in Q2 2024. Amazon projects a 10.9% increase at best in the quarter, which isn’t bad at all, but it is a small softening from both the Q1 figures and the 2024 full year forecast.

Retail Sales, Monthly, MoM (Source: Trading Economics)

#3. Rising labor costs

Additionally, there’s still upward pressure on the company’s labor costs. When I wrote about Amazon in February, the UK’s workforce was particularly discontent. Even though the wage increase in response to it was only a small fraction of the company’s total operating income, the company’s operating losses from its international e-commerce business have widened. At $1.25 billion, the figure expanded by 38.5% YoY and was up by a much bigger 3.1x sequentially.

Further, even the other e-commerce segment, North America, saw an operating margin of 5.7%, which to be fair, was a significant improvement over the 1.2% rise seen in Q1 2023, but is still much lower than the overall operating margin of 10.7%. The overall margin was actually supported by the highly lucrative AWS, which might have only 17.5% revenue contribution as of the latest quarter, but it contributed to 61.5% of the operating income.

Positive as this is for now, the risk of a drag on margins from the e-commerce segment can’t be ignored. This is particularly as Amazon’s own forecasts for Q2 2024, put the operating margin at 9.7% at best if revenue comes in at the lowest point of guidance and the operating profit at the highest.

Moreover, the pressure from labor is unlikely to die down anytime soon either. Recently, the company’s labor union at the Staten Island warehouse partnered with the International Brotherhood of Teamsters, which is the biggest labor union in America, which can provide it with greater support.

The positives

Daunting as the challenges might appear, there’s much to like about the stock as well. All the four reasons why Amazon remains a buy for 2024, that I had discussed the last time around, still stand.

Specifically, here are the developments since that go in the stock’s favour:

- If the operating margin for Q1 2024 is anything to go by, there’s more likely to be margin expansion in 2024 than not. Rising labor costs should be monitored, but so far they haven’t dented the company’s profits. In fact, Amazon’s operating expenses, which include the cost of sales, rose by just 4.4% YoY in the quarter compared to a 7.2% increase in the full year 2023.

- Revenue growth may well continue to support the margins as well. Amazon expects 9% growth at the midpoint of its forecast range in Q2 2024, which is a relatively small growth slowdown compared to last quarter. Even as there are concerns on account of both a softening US market and rising competition from the likes of Temu, clearly, the company doesn’t expect a big dent in growth going forward. In fact, analysts’ estimates are even more bullish on growth in Q2 2024, with a forecast of 10.6%.

- Even with a price rise of 8% since I last checked on the stock, my estimate of the forward price-to-earnings (P/E) ratio looks slightly improved. This is because it now reflects updated assumptions for revenue growth and operating margin as seen in Q1 2024. The forward P/E is now at 41.3x, down from 41.7x in February. It’s also lower than the 46.7x figure for the past five years.

What next?

The key takeaway here is that despite likely margin pressures on the company’s commerce segment going forward, the overall picture still looks fine, with at least a 10% upside to the stock for the remainder of the year.

Amazon has a real winning ticket in AWS as far as profits go, even as the bigger part of its business is e-commerce. As a result, while it’s true that it can be impacted by rising competition and labor costs, AWS can still save the day with regard to earnings. And that’s really what determines the stock’s attractiveness from a market valuation perspective. I’m retaining a Buy rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—