Summary:

- Amazon.com, Inc.’s shares are down 50% in the last year, but there’s reason to believe the stock is bottoming out.

- Short interest in Amazon declined by a significant 16.6% in the last cycle, indicating that the bears are leaving.

- This is an opportune time for investors with a multi-year time horizon to accumulate Amazon’s shares while they’re still discounted.

georgeclerk

Amazon.com, Inc. (NASDAQ:AMZN) shares are down nearly 50% in the last year, and the stock may have finally hit rock bottom. Latest data reveals that short interest in the e-commerce giant dropped considerably (16.6%) in last reporting cycle. This indicates rapid short unwinding and suggests that market participants perceive Amazon’s shares to be attractively valued at current levels, with limited downside potential from here onwards. This should reassure existing Amazon shareholders that the downtrend may finally be over and encourage long-term investors to accumulate AMZN shares while they’re still discounted.

Declining Short Interest

For the uninitiated, short interest is basically the total number of short positions that are open and are yet to be covered. A sharp rise in the metric indicates rapid buildup of short positions as, perhaps, market participants perceive a given stock to be due for correction. Conversely, a sharp decline in the metric indicates rapid short unwinding as, perhaps, market participants feel the stock is undervalued or fairly valued, with limited downside potential in store. So, the short interest data provides us a glimpse into the Street’s ever-evolving sentiment pertaining to any given stock.

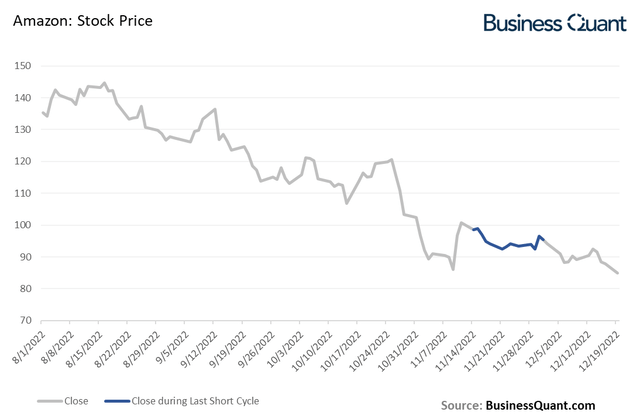

As far as Amazon is concerned, its short interest amounted to 67.7 million shares at the end of the last reporting cycle. To put things in perspective, this figure is down 16.6% sequentially and down 39.7% from the highs created in past June. This is a clear indication that market participants actively closed their short positions in Amazon of late.

Also, for the record, short interest data is reported in bi-monthly cycles. The data being referenced here is from the cycle ending November 30, which was disseminated only last week, which means the data is still fresh and relevant to our discussion here.

But having said that, what’s interesting here is that Amazon’s short interest declined when its stock price was nosediving. This suggests that short-side market participants chit their price targets, booked profits, and moved their capital to other, more lucrative, opportunities. In other words, Amazon stock may have hit its rock bottom. Otherwise, if Amazon still had ample downside potential, these speculators would’ve held on to their positions and probably also intensified shorting activity to profit from the stock’s continued downside. But that clearly did not happen and shorting activity subsided instead.

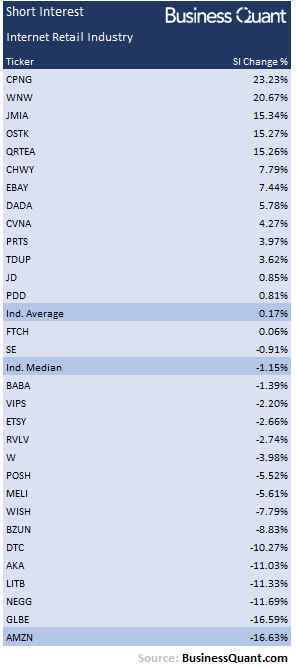

Next, I wanted to look at industry comparables to confirm my thesis and to also get a sense of how Amazon is stacked in the industry. After all, if short interest declined for most other e-commerce stocks, then Amazon wouldn’t stand out and our discussion would end right here. So, I pulled the short interest data for 30 other similar stocks that are also classified in the Internet retail industry, those listed on U.S. bourses and having a market capitalization of over $100 million.

BusinessQuant.com

Interestingly, there was no clear bullish or bearish trend prevalent within the industry — half the stocks saw a short interest buildup whereas the other half saw short interest declines. But what really stands out is the fact that short interest in Amazon declined the most in our study group. This suggests that market participants were neutral on the Internet retail industry but they made sure to wind their short positions in Amazon in particular. This confirms my thesis that the Street is forecasting little to no downside in Amazon’s shares from their current levels.

But this leads us to the next question now – why is the Street cutting back on their short positions on Amazon in the first place?

Reasons to be Bullish

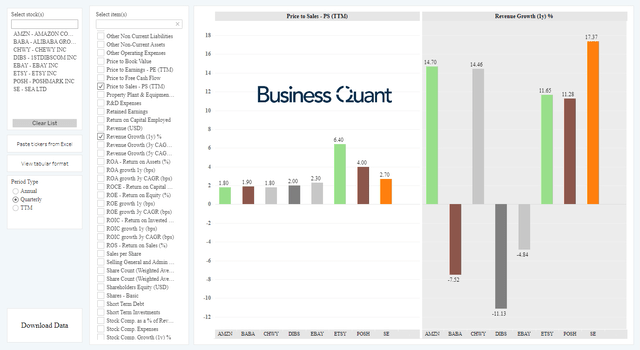

For starters, Amazon’s shares are down 50% in the last year alone and its shares are now trading at just 1.8-times the company’s trailing twelve-month sales. Note in the chart below how many of the other prominent names in the internet retail industry are trading at relatively higher Price-to-Sales (or P/S) multiples and/or have a relatively lower pace of revenue growth. So, the recent correction in Amazon’s stock price makes it an attractive buy for investors with a multi-year time horizon. This, in my opinion, is one of the major reasons why short-side market participants wound up their positions in the e-commerce giant.

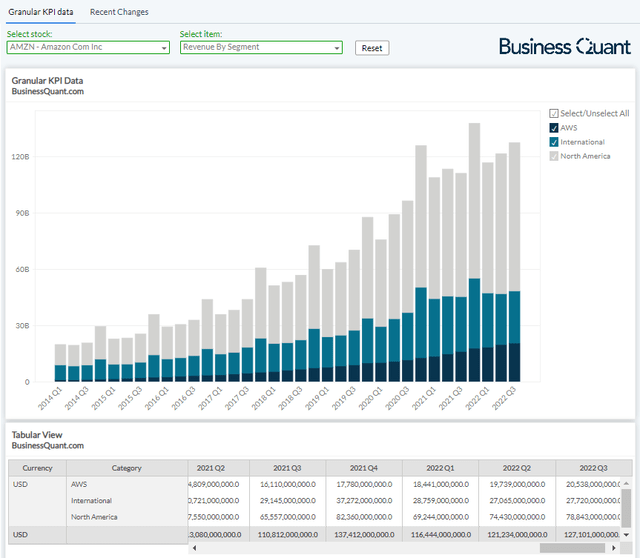

Secondly, e-commerce businesses across the globe have been hammered down by the recessionary environment and the cutback in consumer discretionary spending. Meanwhile, Amazon has remained unhinged and has continued to grow its revenue on a sequential as well as on a year-over-year basis during Q3. This presents the possibility that, perhaps, consumers are classifying their spending on Amazon’s platforms as essential rather than discretionary. If that’s the case, then the company might be able to ride out the challenging macroeconomic environment with ease whilst also grow its top line along the way.

But don’t take my word for it.

A consensus of 35 analysts reveals that Amazon’s revenue is estimated to grow 8.6% in FY22 and 10.5% in FY23. So, while the calls for global recession in 2023 are growing each day, analysts are bullish on Amazon’s growth prospects and are estimating its growth to accelerate instead. This is a commendable feat and an enviable position to be in, especially when businesses are going bust due to tough macroeconomic conditions. I contend that this is another major reason why short-side market participants have wound up their positions in Amazon. They’ll be better off targeting companies that are experiencing financial deterioration which, eventually, will lead to a meaningful decline in their stock prices.

Final Thoughts

The takeaway here is that Amazon’s saw one of the most active short unwinding in the Internet retail industry of late. This suggests that bears perceive AMZN stock to be fairly or undervalued at current levels, with limited downside potential left in store from here onwards.

Amazon stock is trading at an attractive P/S multiple, and the business, overall, is expected to continue growing well in FY23. This means that shorts have a good reason to avoid Amazon altogether and maybe target other stocks instead. This should encourage investors with a long-term time horizon to accumulate Amazon’s shares while they’re still discounted, before they likely start to rally. Good Luck!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.