Summary:

- The company is aggressively improving its cost structure and reducing costs in a bid to improve operating margins and income for 2023 amidst macro uncertainties.

- Amazon announced that it will be carrying out a second round of headcount reductions, this time involving around 9,000 more employees.

- This is on top of the first round of headcount reductions that involved about 27,000 employees.

- The two headcount reductions will result in a total incremental annual cost savings of $6 billion to $7 billion.

- This cost savings from headcount reductions amount to roughly 19% to 22% of its 2022 operating income.

HJBC

In my previous article on Amazon (NASDAQ:AMZN), I highlighted the progress the company has made in efficiency improvements and streamlining of costs. I recently shared with members of Outperforming the Market that I am looking to enter a position in Amazon based on the Buy alert I sent out as well as the reasons for buying the stock.

In this article, I aim to share more about my growing optimism for Amazon. Management continued to be aggressively streamlining costs in 2023 as the company announced its second round of layoffs and this article aims to highlight the progress management has made in improving the cost structure of the business.

Investment thesis

I think that there is no doubt that Amazon remains an attractive long-term investment. The company remains very well positioned across sectors with strong tailwinds like e-commerce, online advertising and cloud computing.

The near-term narrative may be more challenging for Amazon as a result of cost headwinds affecting margins.

That said, having covered Amazon through its journey of cost reductions and efficiency improvements, I do think that the company is realizing significant cost savings from its recent efforts to make its cost structure leaner. With the efficiency improvements made for its businesses, I think that Amazon will emerge from this a much more profitable organization than before. The improvements in operating efficiency and operating income were evident in recent quarters and will continue to show in the coming quarters as the cost saving initiatives in the past few quarters materialize. Lastly, I do think that the cost optimizations we see in AWS are a short-term pain for its long-term gain as the entire sector is experiencing this right now given the current uncertain macro backdrop.

Second round of layoffs

Amazon announced that it will be carrying out a second round of headcount reductions, this time involving around 9,000 more employees.

Based on the announcement, Amazon stated that this round of employee reduction will come from its cloud computing business AWS, human resources, advertising and Twitch livestreaming businesses. The CEO of Twitch did publicly state that 400 employees will be cut from this second round of headcount reductions as a result of the downturn in the economy as well as Twitch’s user and revenue growth being slower than expected.

This decision to cut its headcount for a second time came after its second phase of Amazon’s annual budgeting process. The key consideration here is undoubtedly to further streamline costs. Some factors that were taken into account include the economic situation and macro uncertainty surrounding its business.

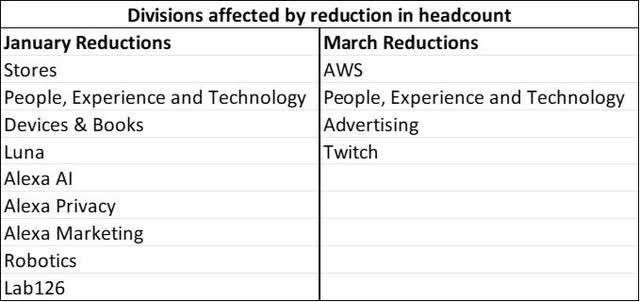

As can be seen below, we can see which divisions were primarily affected by Amazon’s reductions in headcount in January and March respectively.

Divisions affected by headcount reductions (Author generated)

I think that one of Amazon’s 2023 goals is to emerge as a leaner organization while still investing for the longer-term. This has resulted in a difficult decision to reduce its workforce further, but Amazon CEO Jassy remained positive about the future of the business:

I remain very optimistic about the future and the myriad of opportunities we have, both in our largest businesses, Stores and AWS, and our newer customer experiences and businesses in which we’re investing.

I think that there was a huge hiring spree by Amazon during the pandemic period when Amazon’s business was booming as a result of the pandemic tailwinds.

However, we are now in a very different economic and macro landscape. The Federal Reserve is committed to reducing inflation by hiking rates while the regional banking saga has resulted in lower confidence in the financial system.

Overall, the macro backdrop has become more uncertain, and the economic landscape looks bleak. As a result, the right thing for management to do is really to use the levers that it can pull to improve the cost structure of the company and to improve efficiencies so that in the long-term, the business will continue to grow sustainably.

Incremental annual operating expense savings

As this round of layoffs involves around 9,000 positions, this involves around 3% of the total corporate workforce in Amazon. Assuming around $250,000 in incremental savings per employee, this will result in $2.25 billion in annualized operating expense savings for Amazon as a result of this second round of layoffs. Given that the second round of job cuts involves the AWS team, I think that this incremental cost savings could actually be higher than the $2.25 billion estimated.

Blended impact of the second round of job cuts

I think that the second round of job cuts involves Amazon’s faster growing and higher margin businesses like AWS and advertising businesses. What this could imply is that management may be more cautious about these opportunities in the near-term given the macro uncertainties and economic situation.

As a result of headcount reductions in these businesses, I think that this round of headcount cut could imply some near-term caution on these higher margin and faster growing businesses as a result of the weaker macro backdrop. I think that management is attempting to take a proactive and prudent approach to these businesses to think of the longer-term opportunity of the overall business.

Total cost savings from headcount reductions

When looking at the total headcount reduction from the January and March reductions, the company reduced headcount by 18,000 in January and with the additional 9,000 employees to be laid off in the March round, the total headcount reduction is at 27,000.

This amounts to around 8% of Amazon’s total corporate headcount.

Again, assuming around $250,000 in annualized cost savings per employee, the 27,000-headcount reduction will mean around $6 billion to $7 billion total annualized cost savings from both headcount reduction exercises.

Given that Amazon had operating income of around $32 billion in 2022, this annualized cost savings of $6 billion to $7 billion amounts to 19% to 22% of its 2022 operating income.

Risks

Uncertain macro backdrop

Much of Amazon’s business is vulnerable to changes in the macroeconomic environment. At the end of the day, if the macro backdrop weakens, Amazon’s e-commerce business will see weaker consumer demand as a result of poorer consumer sentiment and its cloud computing business may weaken further as a result of businesses holding back on their spending or due to continued cost optimizations. As a result, a weaker macro backdrop is certainly a downside risk for Amazon.

Competition

With Amazon cutting its headcount to improve on its cost structure, while it may bring incremental cost savings and bring efficiency improvements, it may ultimately lead to competitors being able to catch up or compete meaningfully with Amazon. That said, given the current uncertain macro backdrop, I do not think it is likely that competitors will ramp up competitive pressures given the weakness in the e-commerce and cloud computing market we have seen recently. That said, Amazon remains under pressure from competitors in its cloud computing business like Microsoft (MSFT) and Google (GOOG), while competitors in its e-commerce business like Walmart (WMT) or eBay (EBAY) may ramp up pressure in the sector.

Conclusion

Amazon is certainly taking significant actions in the headcount reductions front to become a leaner company over time.

Given the accelerated pace of hiring as a result of the pandemic, I do think that there have been some inefficiencies within the organization and improvements in cost structure that will be better for the organization in the longer run.

These incremental cost savings will ensure that the company is investing sustainably in the long-term potential of the business while ensuring that the cost structure of the business remains strong given that the macro uncertainties may impact Amazon’s top-line in the near-term.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 41% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!