Summary:

- Revenue growth is mostly steady; the favorable growth outlook in AWS is balanced a bit by lower growth acceleration in ecommerce due to a weaker consumer environment.

- Amazon posted a rare EBIT margin guidance disappointment for Q3 FY24. However, an easing of global container freight rates and internal initiatives to lower cost of sales are margin levers.

- After a strong period of earnings-driven growth, I believe structural margin growth can lead to multiple expansion in the stock.

- The technical pullback I was waiting for on Amazon has come in, which, I think, makes this an ideal moment for buys.

Joe Raedle

Performance Assessment

In my last article on Amazon (NASDAQ:AMZN) (NEOE:AMZN:CA), I had a bullish slant but stopped short of rating the stock a ‘Buy’ due to a small correction in the technical action of the stock vs the S&P 500 (SPY) (SPX). Since then, the stock has slightly underperformed the market index:

Performance since Author’s Last Article on Amazon (Seeking Alpha, Author’s Last Article on Amazon)

Looking at these results, I believe my ‘Neutral/Hold’ stance was appropriate.

Q2 FY24 Thesis Update

After reviewing the latest quarterly results, I am changing my stance to a ‘Buy’ as I note the following:

- Revenue growth is mostly steady

- Margin guidance disappoints, but the outlook may fare better

- Multiple expansion is still on the cards

- Technical signals are favorable

Revenue growth is mostly steady

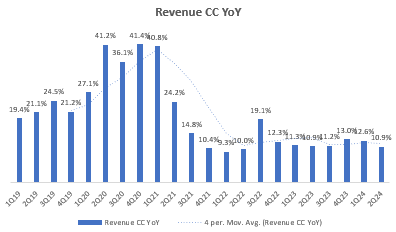

Overall revenue growth on a constant currency (CC) basis has been steady in the early double-digits YoY:

Revenue CC YoY (Company Filings, Author’s Analysis)

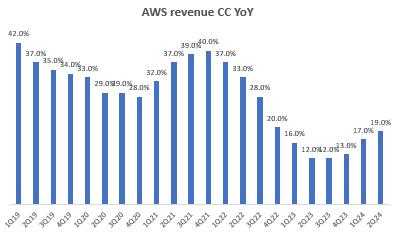

As expected in my earlier note, AWS (18% of total revenues but 64% of total EBIT) is experiencing a growth revival as CC YoY growth is accelerating for the past 4 quarters:

AWS revenue CC YoY (Company Filings, Author’s Analysis)

Management commentary was consistent from last quarter in noting that enterprises are increasing focus on new AWS projects after completing up cost optimization programs.

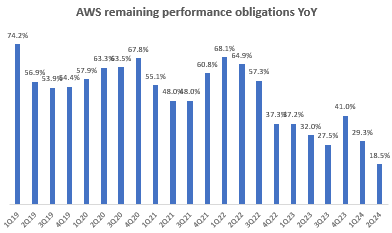

AWS remaining performance obligations YoY (Company Filings, Author’s Analysis)

From an outlook perspective too, the future looks promising as the remaining performance obligations (RPO) – a backlog indicator of future revenues – is still growing at nearly 20%. Although the acceleration of growth is slowing down, I still view this as a positive as growth is still there at levels similar to the current AWS YoY run rate.

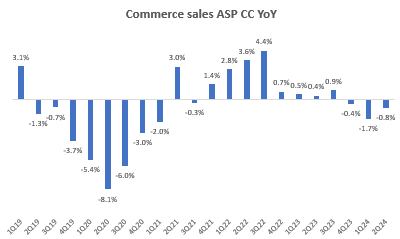

Amazon’s 1P and 3P e-commerce marketplaces (65% of revenues) are also seeing steady growth overall at around 10% CC YoY. Looking at the breakup of this, the average sales prices (ASP) have been ticking down on a CC YoY basis:

Commerce sales ASP CC YoY (Company Filings, Author’s Analysis)

As management noted:

Second, we’re seeing lower average selling prices, or ASPs, right now because customers continue to trade down on price when they can.

– CEO Andrew Jassy in the Q2 FY24 earnings call

I believe this is indicative of a bit of a weaker consumer spending environment.

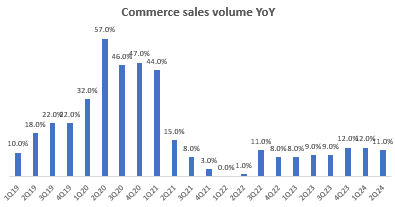

Sales volume, on the other hand, is chugging along well at 11-12%:

Commerce sales volume YoY (Company Filings, Author’s Analysis)

In terms of the purchasing trends, the narrative is a bit mixed compared to what was seen in the ASP data since more expensive durable good items were called out to show relatively more strength, albeit still lower than in more vibrant economic times:

More discretionary higher ticket items like computers or electronics or TVs are growing faster for us than what we see elsewhere in the industry but more slowly than we see in a more robust economy

– CEO Andrew Jassy in the Q2 FY24 earnings call

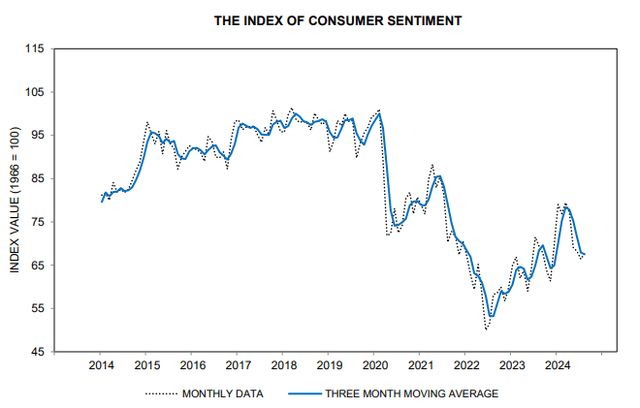

Overall, I believe this points to some consumer weakness. Looking at the University of Michigan Consumer Sentiment Index trends, we see recent falls in the index value:

University of Michigan Consumer Sentiment Index (University of Michigan)

I find the monthly frequency of data in this indicator useful for informing next quarters’ expectations. Now that we are almost 2 months into Q3 FY23, my expectations for the next quarterly e-commerce marketplace results are a little bit on the cautious side for Amazon.

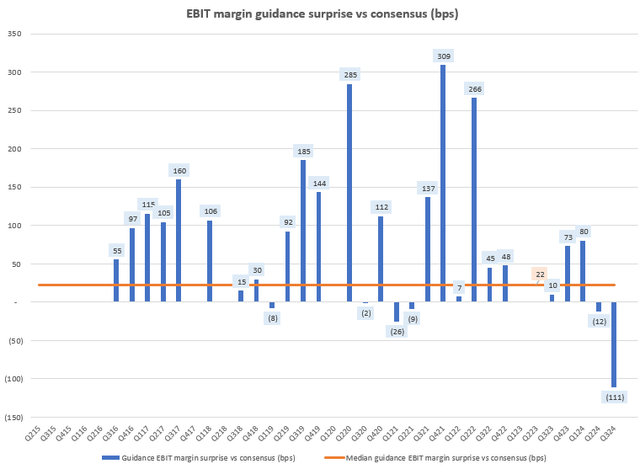

Margin guidance disappointments but the outlook may be better

Amazon’s EBIT margin guidance for Q3 FY24 displayed a rare material miss vs consensus expectations of 111bps:

EBIT Margin Guidance vs Consensus (bps) (Capital IQ, Author’s Analysis)

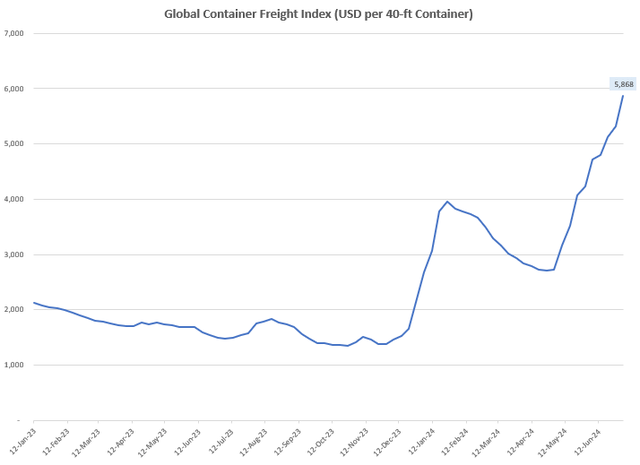

I believe higher container freight rates are one of the key headwinds here:

Global Container Freight Index (USD per 40-ft Container) (Drewry, Author’s Analysis)

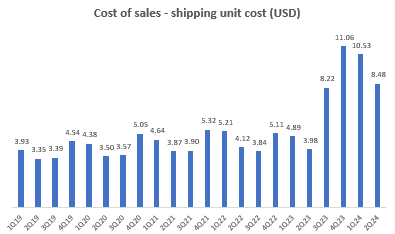

This has led to a corresponding rise in Amazon’s unit shipping costs in recent quarters:

Cost of sales – unit shipping cost (USD) (Company Filings, Author’s Analysis)

That said, I believe the outlook is rosier as industry experts such as Niels Rasmussen from the Baltic and International Maritime Council (BIMCO) believe that freight rates would weaken in H2 FY24 and beyond:

Looking ahead, we expect freight rates and time charter rates to follow the predicted supply/balance development, ie begin to weaken during the 2nd half of 2024 and weaken further during 2025.

– Niels Rasmussen from BIMCO

In addition to this margin lever, Amazon’s management is working on other internal ways to reduce cost of sales over the medium to longer term:

…we remain focused on lowering our cost to serve. We have a number of opportunities to further reduce costs, including expanding our use of automation and robotics, further building out our same-day facility network and regionalizing our inbound network.

– CEO Andrew Jassy in the Q2 FY24 earnings call

Hence, despite the margin guidance miss, I have an optimistic outlook on Amazon’s margins.

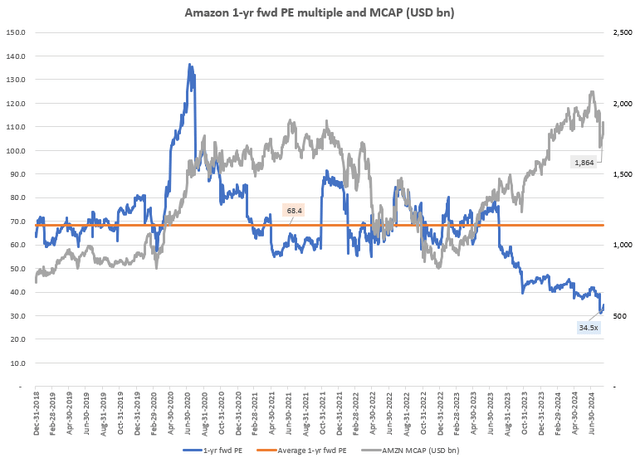

Multiple expansion is still on the cards

In my last note on Amazon, I shared my view that there is scope for multiple expansion to follow the strong last twelve months of earnings-led growth. This has not yet happened, since the 1-yr fwd PE multiple of 34.5x has still not meaningfully appreciated more than the market capitalization, which currently stands at $1.86 billion:

Amazon 1-yr fwd PE and MCAP (USD bn) (Capital IQ, Author’s Analysis)

However, I still believe multiple expansion is on the cards, driven by structural margin increases arising from lower cost of sales, enabled by AI and robotics.

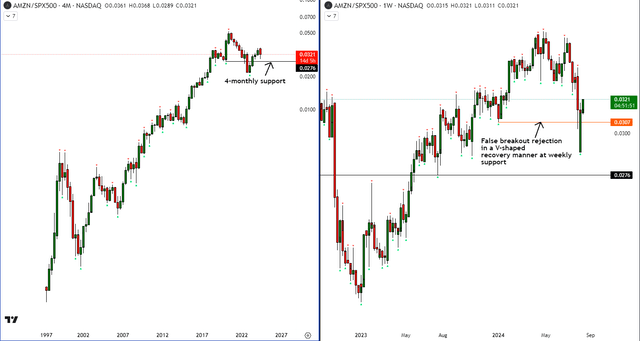

Technical signals are favorable

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of AMZN vs SPX 500

Until now, the main thing that was holding me back from a ‘Buy’ on Amazon was the relative technicals. But now, the correction I was awaiting has come in, posting a sharp V-shaped rejection from the weekly support level, all in the vicinity of a higher time frame 4-monthly support level:

AMZN vs SPX 500 Technical Analysis (TradingView, Author’s Analysis)

I believe this increases the chances of a push-up in the relative chart of AMZN vs the S&P 500, thus opening up the opportunity for outperformance.

Key Monitorable

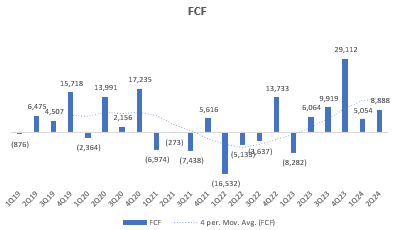

As indicated last time, I believe FCF numbers are a key monitorable as Amazon is looking to balance FCF yield for investors with the need to invest in AWS infrastructure to support higher workload demand, particularly in AI applications.

FCF (USD mn) (Company Filings, Author’s Analysis)

So far, FCF is trending along at an average of $10 billion per quarter, which, I believe, is a healthy positive level to sustain. Investors may be pleased to see the consistency of positive FCF for the last 5 quarters; something which has not happened before.

That said, H2 FY24 is expected to see a higher level of capex than the $30.5 billion incurred in H1 FY24:

Looking ahead to the rest of 2024, we expect capital investments to be higher in the second half of the year. The majority of the spend will be to support the growing need for AWS infrastructure as we continue to see strong demand in both generative AI and our non-generative AI workloads.

– CFO Brian Olsavsky in the Q2 FY24 earnings call

I am keeping an eye on what this means for FCF generation going ahead.

Takeaway & Positioning

Previously, I leaned bullish on Amazon but did not have sufficient alignment of fundamental and technical factors to rate it a ‘Buy’. However, now after Q2 FY24 results, I believe that alignment is present:

I believe revenues are steadily growing on the whole; the strong growth outlook in AWS is offset a little bit by a weaker consumer spending environment holding back a growth acceleration in the e-commerce marketplace business. On the margins front, I view the miss on EBIT margin guidance as an opportunity, since I believe easing global container freight rates and internal initiatives to reduce cost of sales are levers for margin expansion in H2 FY24. I expect some of these margin levers to lead to a structural margin increase, which makes for a case of multiple expansion in the stock to provide an upside to the valuation multiples. Finally, the technical correction I had been waiting for has now arrived. Hence, I am rating the stock a ‘Buy’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.